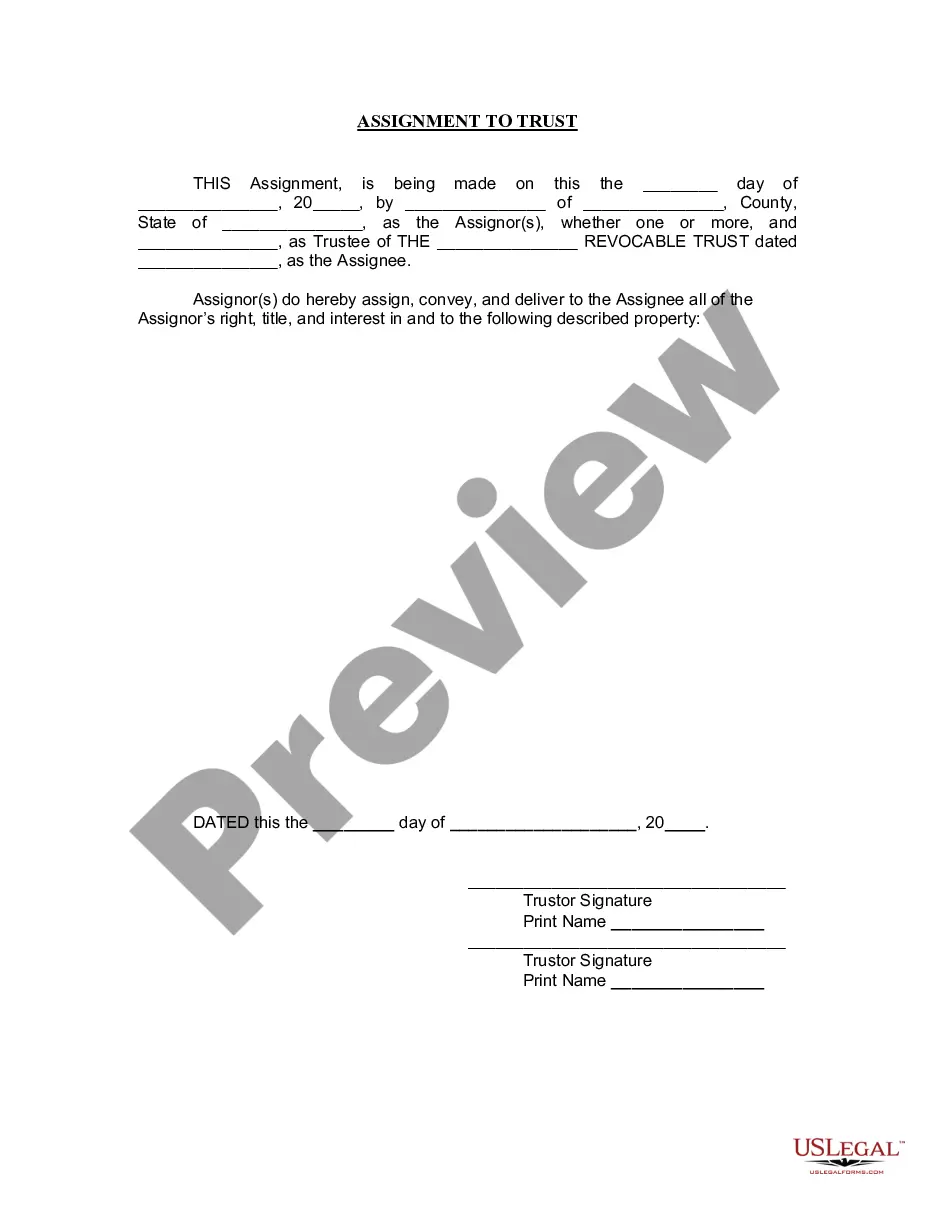

Ann Arbor Michigan Assignment to Living Trust

Description

How to fill out Michigan Assignment To Living Trust?

If you’ve previously utilized our service, Log In to your account and retrieve the Ann Arbor Michigan Assignment to Living Trust to your device by clicking the Download button. Ensure your subscription is active. Otherwise, renew it following your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have continuous access to all documents you have purchased: you can find it in your profile under the My documents section whenever you need to retrieve it again. Utilize the US Legal Forms service to swiftly find and download any template for your personal or business requirements!

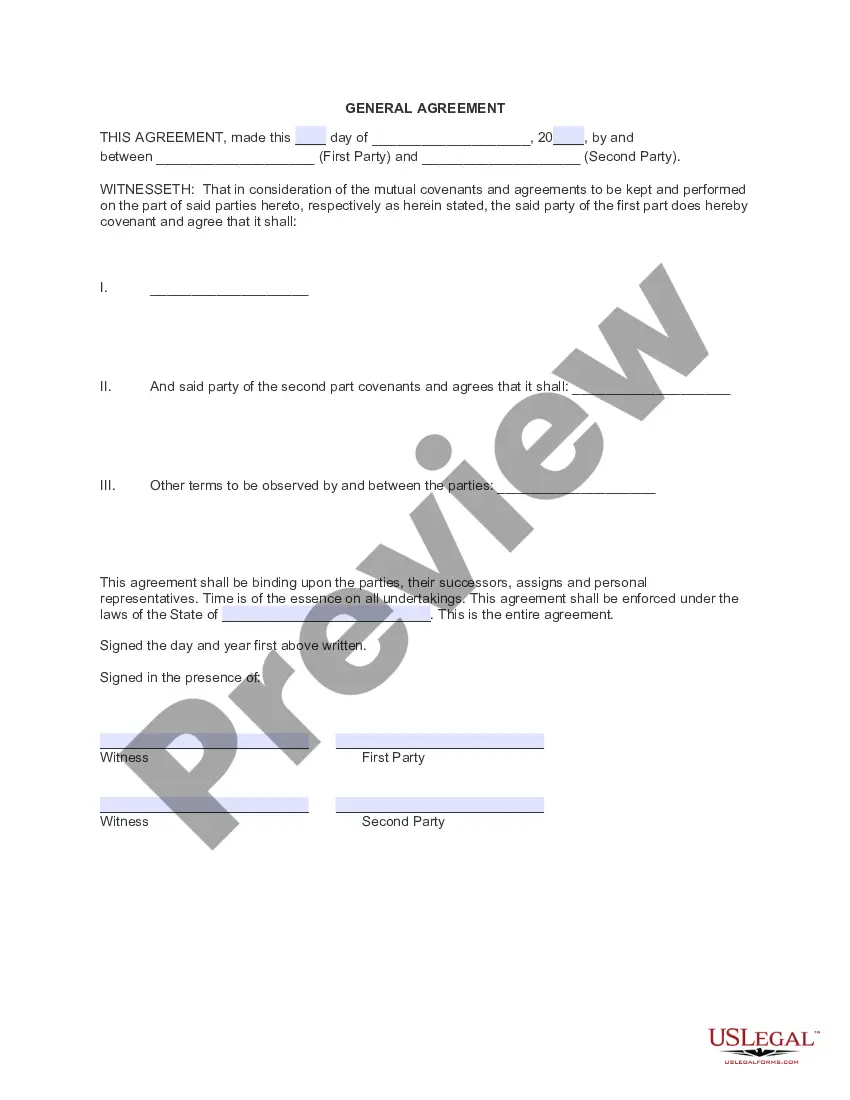

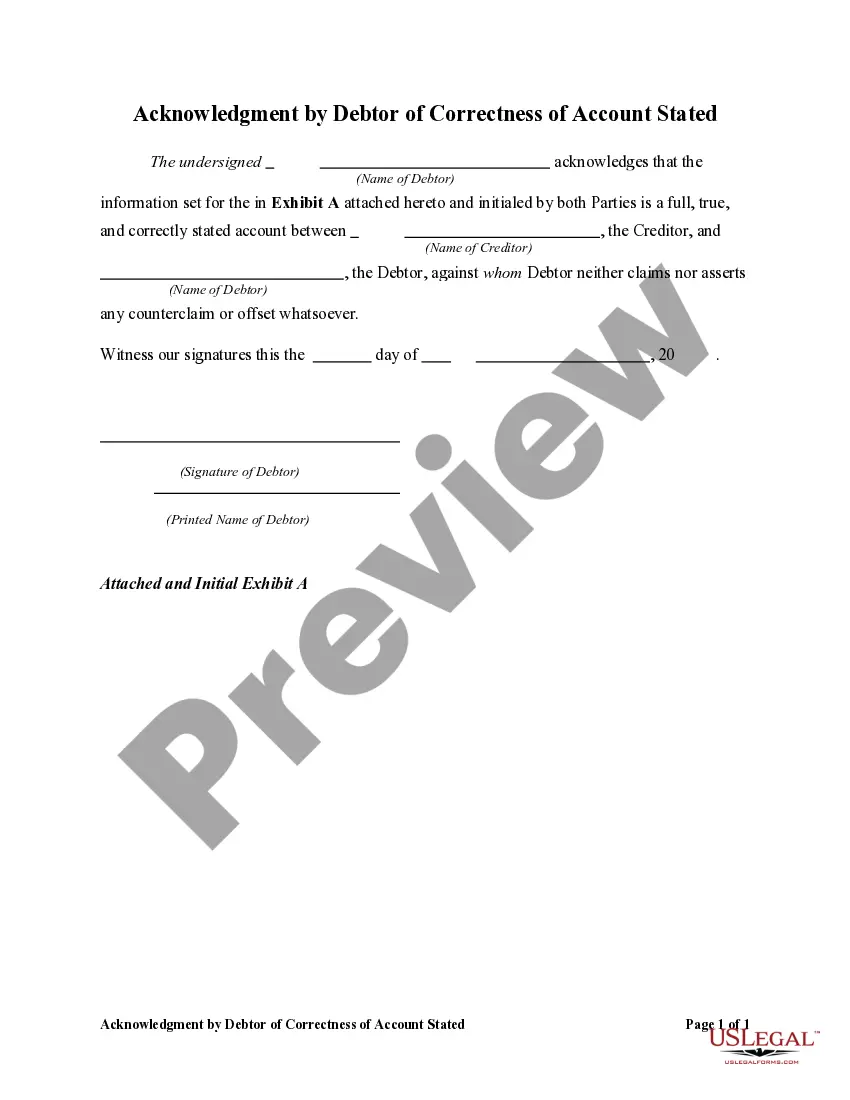

- Ensure you’ve located a suitable document. Review the description and use the Preview feature, if available, to ascertain if it fulfills your requirements. If it does not fit, utilize the Search tab above to discover the correct one.

- Buy the template. Click the Buy Now button and select a monthly or yearly subscription option.

- Establish an account and process a payment. Employ your credit card information or the PayPal method to finalize the transaction.

- Download your Ann Arbor Michigan Assignment to Living Trust. Choose the file format for your document and store it on your device.

- Complete your document. Print it or use online professional editors to fill it out and sign it digitally.

Form popularity

FAQ

In Michigan, a trust does not need to be filed with the court, including the Ann Arbor Michigan Assignment to Living Trust. Unlike a will, which requires probate, trusts usually provide more privacy and do not require court involvement upon creation. Always keep your trust documents secure and accessible for those who may need them later. For detailed guidance on setting up your trust, uslegalforms can be a helpful resource.

Yes, you can amend your trust by yourself in the context of an Ann Arbor Michigan Assignment to Living Trust. You typically need to create a formal amendment document, which specifies the changes to your existing trust. It is smart to follow state laws to ensure your amendments are valid. However, for added peace of mind, you might consider using resources from uslegalforms to guide you through the process.

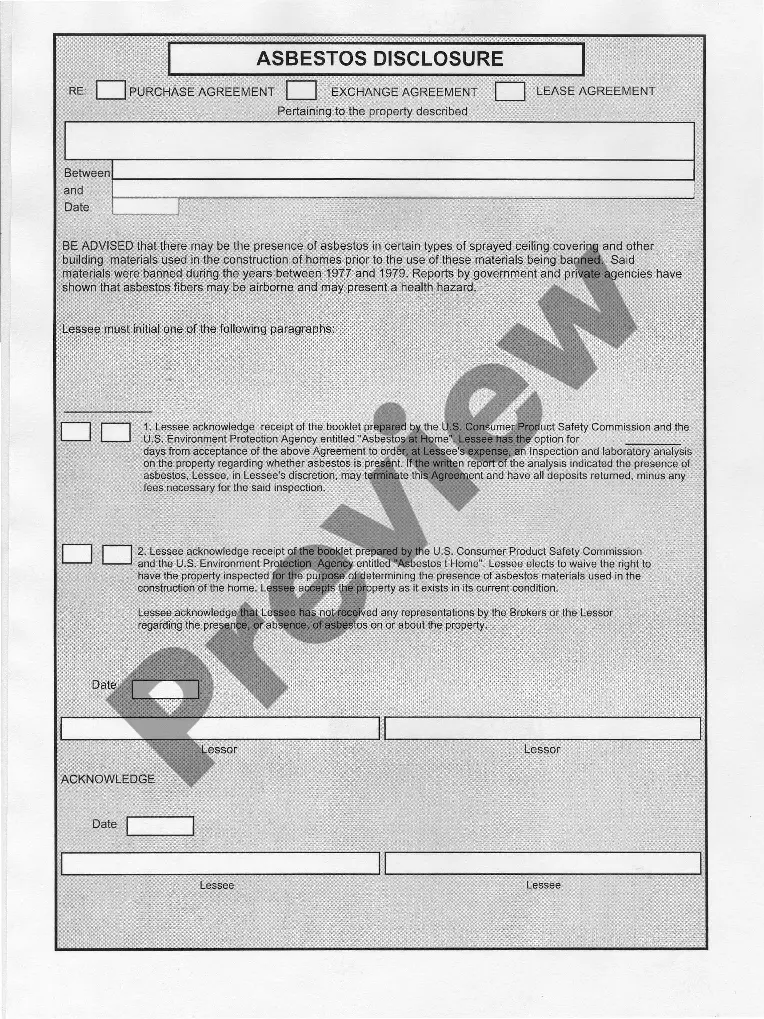

While trusts offer many advantages, they do have potential downfalls. One significant issue is that a trust may not provide the same protection from creditors as other estate planning tools. Furthermore, trusts require careful management, which can include regular updates and potential legal fees. To navigate these challenges related to the Ann Arbor Michigan Assignment to Living Trust effectively, you may consider consulting with a legal professional.

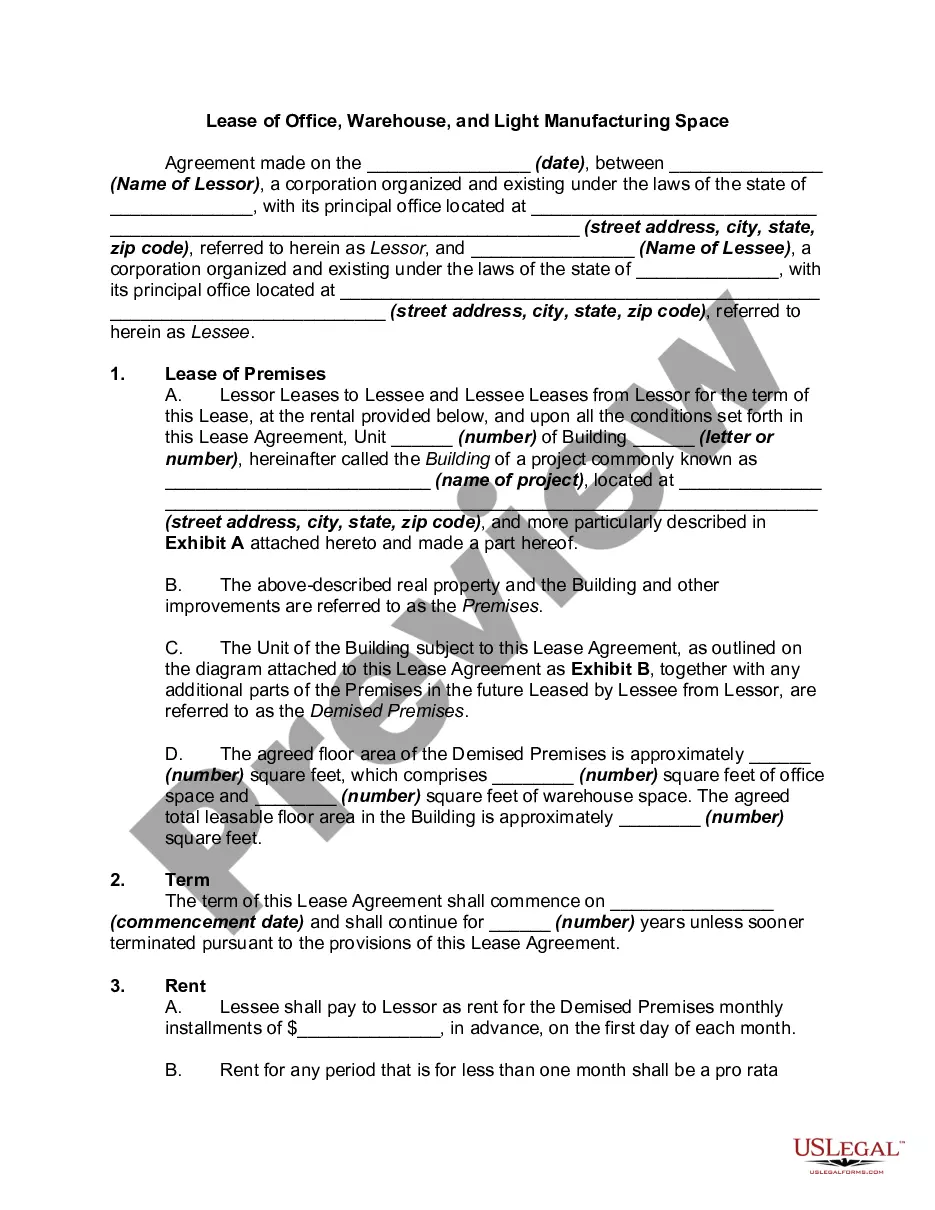

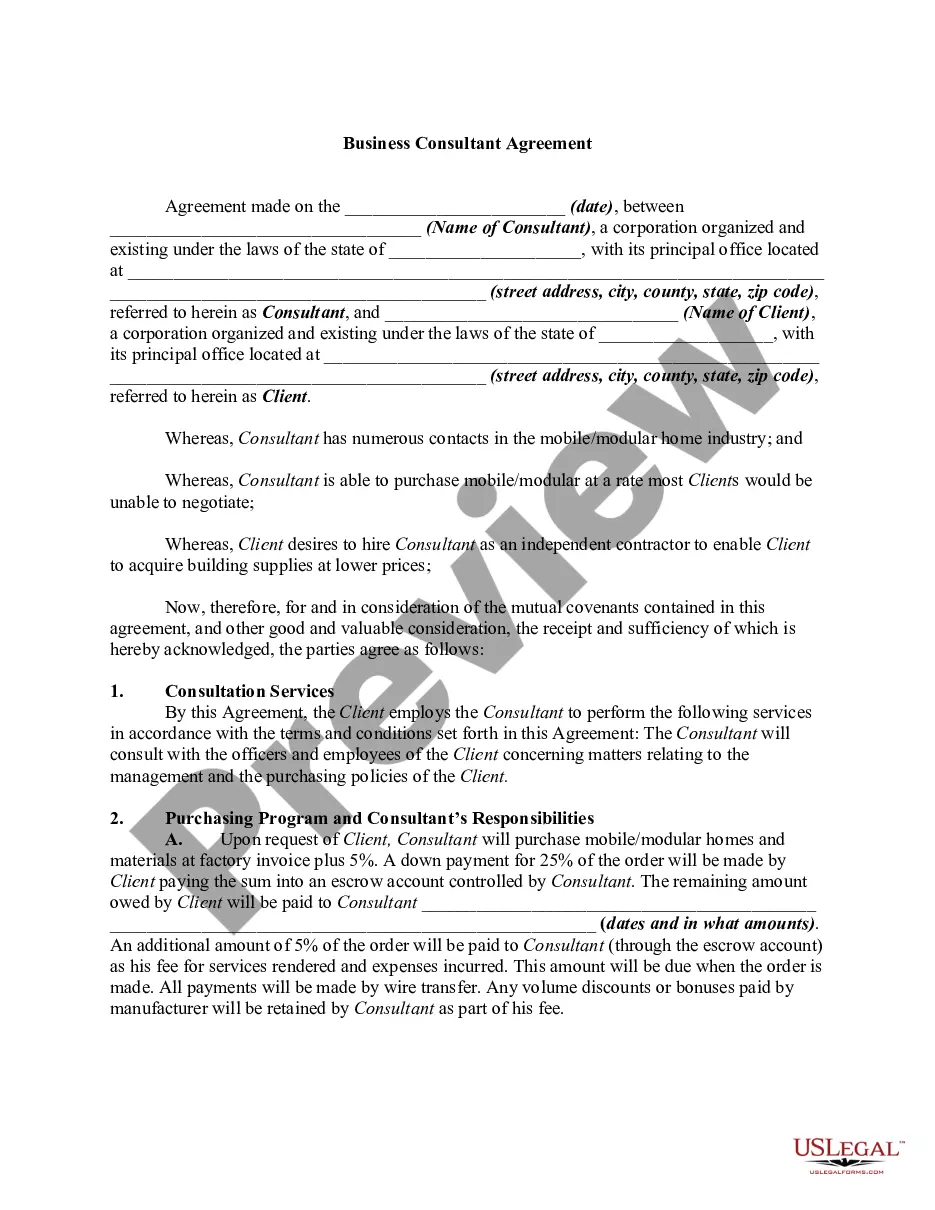

To transfer your property into a trust in Michigan, you typically start with drafting the trust document, which outlines the terms and conditions. Next, you must execute a deed that transfers ownership from you to the trust. This process can get complex, and using platforms like US Legal Forms can simplify the Ann Arbor Michigan Assignment to Living Trust process, offering templates and guidance every step of the way.

A living trust is not immune to drawbacks. For instance, if you do not transfer all your assets into the trust, those assets may not avoid probate upon your death. Similarly, some people find that ongoing management and updates of the living trust can feel burdensome. When establishing an Ann Arbor Michigan Assignment to Living Trust, understanding these factors helps ensure you make informed decisions.

One downside of placing assets in a trust is that it can incur upfront costs, such as legal fees for drafting the trust document. Additionally, transferring assets into the trust may involve paperwork and possible tax implications. When considering an Ann Arbor Michigan Assignment to Living Trust, it's essential to weigh the benefits against these costs.

One of the biggest mistakes parents make when setting up a trust fund is failing to fund the trust properly with their assets. This oversight can defeat the purpose of creating a trust, especially in cases like the Ann Arbor Michigan Assignment to Living Trust. It’s crucial to ensure that all intended assets are transferred into the trust to maximize its benefits. Transitioning assets correctly alleviates future challenges for beneficiaries.

Putting assets in a trust can offer benefits like avoiding probate and managing how assets are distributed. If your parents are considering the Ann Arbor Michigan Assignment to Living Trust, they should evaluate their financial situation, family dynamics, and long-term goals. Consulting with a legal professional can provide clarity on whether this option is suitable for their needs. Informed choices lead to effective estate planning.

Filling out a living trust requires gathering necessary information about your assets, beneficiaries, and the terms you want to include. Begin by contacting a trust attorney or using resources like US Legal Forms to ensure you understand the requirements specific to the Ann Arbor Michigan Assignment to Living Trust. Afterward, you can fill out the forms systematically and designate your property accordingly. This process helps outline your wishes and can provide peace of mind.