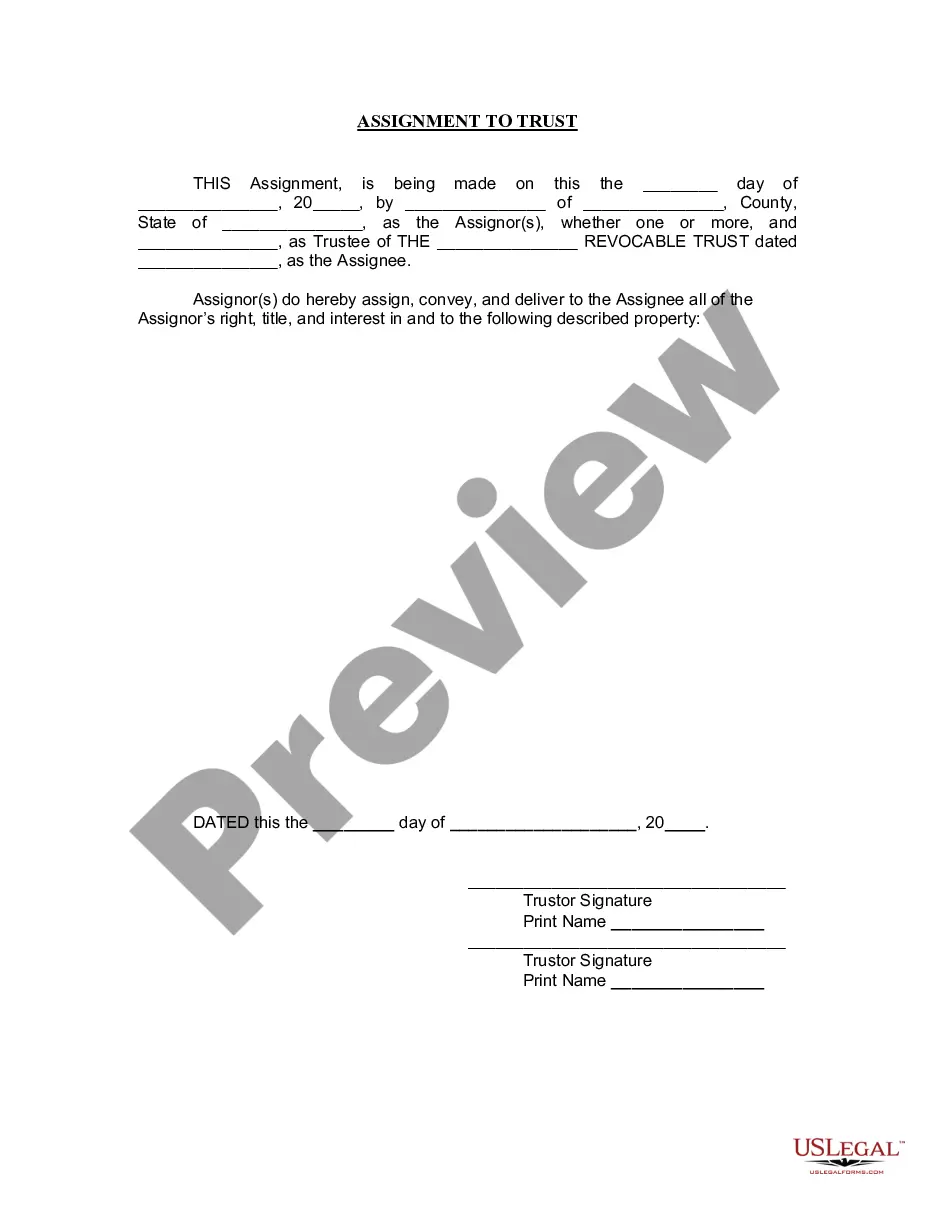

Detroit Michigan Assignment to Living Trust refers to a legal process whereby a person's assets or property located in Detroit, Michigan are transferred to a living trust. This type of assignment is primarily done to ensure a smooth transfer of assets to beneficiaries, avoid the probate process, and potentially reduce estate taxes upon the individual's death. A living trust is a legal document that holds the assets of an individual during their lifetime and specifies how these assets should be managed and distributed after their death. By creating a living trust, the individual becomes the granter, who designates a trustee to manage the trust, and beneficiaries who will receive the trust's assets. There are several types of Detroit Michigan Assignment to Living Trust, including revocable and irrevocable living trusts. A revocable living trust allows the granter to modify or revoke the trust during their lifetime. It offers flexibility and control as the granter can also act as the trustee and manage the assets within the trust. An irrevocable living trust, on the other hand, cannot be modified or revoked without the consent of the beneficiaries. This type of trust offers potential tax benefits and protects assets from creditors. Another type is the testamentary living trust, also known as a pour-over trust, which is created within a person's will and becomes effective upon their death. This trust allows assets to be transferred from the probate estate to the trust, ensuring they are managed and distributed according to the individual's wishes. The process of creating a Detroit Michigan Assignment to Living Trust involves drafting a trust agreement that outlines the terms and conditions of the trust. This document typically includes details such as the identification of the granter, trustee, beneficiaries, assets being transferred to the trust, and instructions for managing and distributing those assets. The trust agreement must comply with Michigan state laws and be executed with the necessary legal formalities, such as being witnessed and notarized. To complete the assignment, the granter must transfer the ownership of their Detroit, Michigan assets to the trust. This may involve changing the titles of properties, updating beneficiary designations on financial accounts, and properly documenting the transfer of other assets like vehicles or businesses. It is important to consult with a qualified attorney specializing in estate planning and trust law in Detroit, Michigan to ensure the assignment to a living trust is executed correctly and in accordance with state laws. The attorney can provide guidance on the different types of living trusts available, advise on asset protection strategies, and assist in the proper implementation of the trust assignment.

Detroit Michigan Assignment to Living Trust

Description

How to fill out Detroit Michigan Assignment To Living Trust?

We always want to reduce or avoid legal damage when dealing with nuanced legal or financial matters. To accomplish this, we sign up for attorney solutions that, usually, are very expensive. However, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based collection of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without using services of an attorney. We provide access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Detroit Michigan Assignment to Living Trust or any other document quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it from within the My Forms tab.

The process is equally easy if you’re new to the website! You can register your account in a matter of minutes.

- Make sure to check if the Detroit Michigan Assignment to Living Trust adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Detroit Michigan Assignment to Living Trust is suitable for your case, you can choose the subscription option and proceed to payment.

- Then you can download the form in any suitable format.

For more than 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!