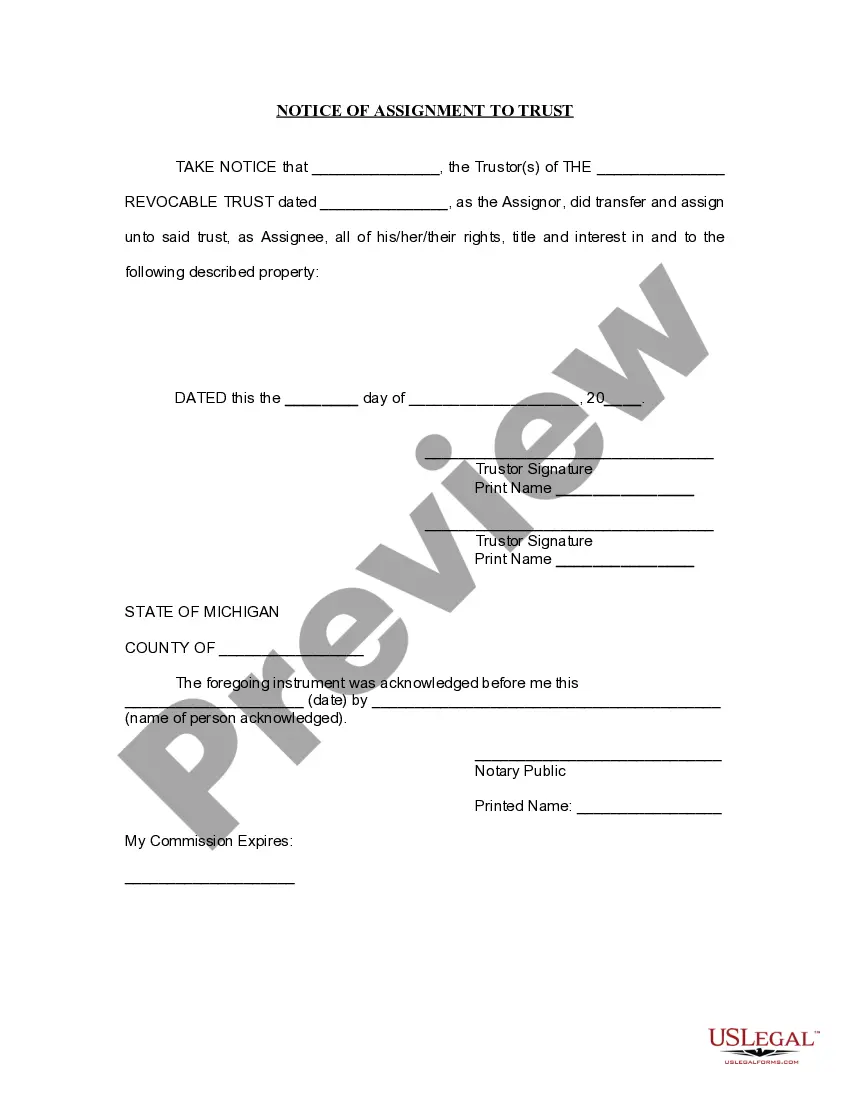

Grand Rapids Michigan Notice of Assignment to Living Trust: A Comprehensive Guide Keywords: Grand Rapids Michigan, Notice of Assignment, Living Trust, types Introduction: The Grand Rapids Michigan Notice of Assignment to Living Trust is a crucial document that allows individuals to transfer their assets into a living trust, ensuring efficient management and distribution of their estate while avoiding probate. Key Details: 1. Purpose: This legal document notifies all relevant parties (such as debtors, banks, and financial institutions) that the individual has assigned their assets to a living trust. 2. Importance: By assigning assets to a living trust, individuals can maintain control over their assets during their lifetime and designate beneficiaries to seamlessly inherit their estate after their passing. 3. Avoiding Probate: The primary advantage of utilizing a living trust notice is to bypass the complex and time-consuming probate process, allowing for a faster distribution of assets. 4. Property Types: The Grand Rapids Michigan Notice of Assignment to Living Trust pertains to various types of assets, including real estate, financial accounts, investments, personal belongings, and intellectual property rights. Types of Grand Rapids Michigan Notice of Assignment to Living Trust: 1. Real Estate Assignment: This notice specifically relates to the assignment of real estate properties, such as residential homes, land, commercial buildings, and rental properties, into the living trust. 2. Financial Account Assignment: This type of notice focuses on assigning bank accounts, brokerage accounts, retirement accounts, and other financial assets into the living trust. 3. Tangible Personal Property Assignment: This notice addresses the transfer of personal items with monetary value, such as jewelry, artwork, vehicles, collectibles, and furniture, into the living trust. 4. Intellectual Property Assignment: This specific notice pertains to the transfer of intellectual properties, such as copyrights, trademarks, patents, and royalties, into the living trust. 5. Business Interest Assignment: In cases where individuals own a business or shares in a company, this notice allows for the assignment of business interests into the living trust while ensuring business continuity and seamless succession. Importance of Customization: While the Grand Rapids Michigan Notice of Assignment to Living Trust follows a standardized format, it is essential to customize it according to the individual's unique circumstances and preferences. Working with an attorney experienced in estate planning is highly recommended ensuring the document accurately reflects the individual's wishes and the nature of their assets. Conclusion: The Grand Rapids Michigan Notice of Assignment to Living Trust is a powerful tool for individuals seeking to safeguard their assets, streamline estate transfers, and bypass probate in the state of Michigan. By customizing the notice to their specific circumstances and utilizing the correct type of trust assignment, individuals can ensure their assets are managed and distributed efficiently according to their wishes.

Grand Rapids Michigan Notice of Assignment to Living Trust

Description

How to fill out Grand Rapids Michigan Notice Of Assignment To Living Trust?

Do you need a reliable and inexpensive legal forms supplier to buy the Grand Rapids Michigan Notice of Assignment to Living Trust? US Legal Forms is your go-to choice.

Whether you need a basic arrangement to set regulations for cohabitating with your partner or a set of documents to advance your separation or divorce through the court, we got you covered. Our platform provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and framed in accordance with the requirements of specific state and area.

To download the document, you need to log in account, locate the required form, and click the Download button next to it. Please take into account that you can download your previously purchased form templates anytime from the My Forms tab.

Is the first time you visit our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Grand Rapids Michigan Notice of Assignment to Living Trust conforms to the regulations of your state and local area.

- Go through the form’s details (if available) to learn who and what the document is good for.

- Start the search over if the form isn’t good for your legal situation.

Now you can create your account. Then select the subscription option and proceed to payment. As soon as the payment is completed, download the Grand Rapids Michigan Notice of Assignment to Living Trust in any available file format. You can get back to the website when you need and redownload the document free of charge.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about wasting your valuable time researching legal paperwork online once and for all.