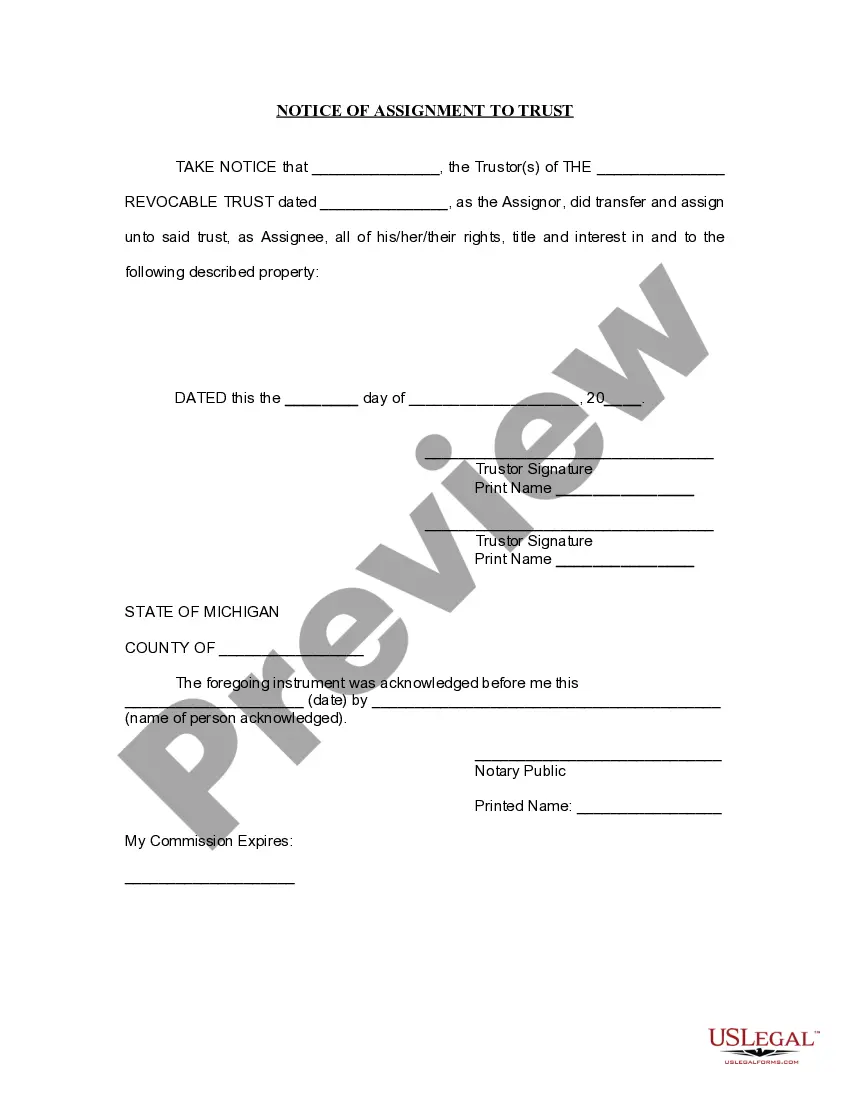

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

A Lansing Michigan Notice of Assignment to Living Trust is a legal document used to transfer the ownership of assets to a living trust based in Lansing, Michigan. It is an essential step in the estate planning process as it helps individuals ensure that their assets are properly managed and distributed according to their wishes. When creating a Lansing Michigan Notice of Assignment to Living Trust, individuals should include specific details such as the full legal name of the trust, the date of creation, and a comprehensive list of assets being assigned to the trust. This list may encompass real estate properties, bank accounts, investments, personal valuables, and any other valuable assets owned by the individual. By utilizing a Living Trust, individuals can avoid probate, a time-consuming and costly legal process. This process involves court supervision, which can be bypassed with a properly executed trust. Additionally, a Living Trust allows for greater privacy since it does not become a matter of public record like a will. There are different types of Lansing Michigan Notice of Assignment to Living Trust, each tailored to different circumstances. These may include: 1. Revocable Living Trust: This type of trust allows the individual to retain control over the assets and make changes or revoke the trust at any time during their lifetime. 2. Irrevocable Living Trust: In contrast to a revocable trust, an irrevocable trust cannot be modified or revoked without the consent of all involved parties. This type of trust is commonly used for tax planning purposes or to protect assets from creditors. 3. Testamentary Trust: Sometimes, individuals may choose to create a testamentary trust, which is established through a will and goes into effect after the individual's death. This type of trust can be a suitable option for individuals who want to maintain control over their assets until their passing. 4. Special Needs Trust: A special needs trust is designed to manage assets on behalf of an individual with disabilities. This trust aims to preserve the beneficiary's eligibility for government benefits while providing additional financial support for their specific needs. It is crucial to consult with an experienced estate planner or attorney when drafting a Lansing Michigan Notice of Assignment to Living Trust. They can provide expert guidance based on individual circumstances, ensuring the document complies with Michigan state laws, and accurately reflects the individual's wishes and intentions.