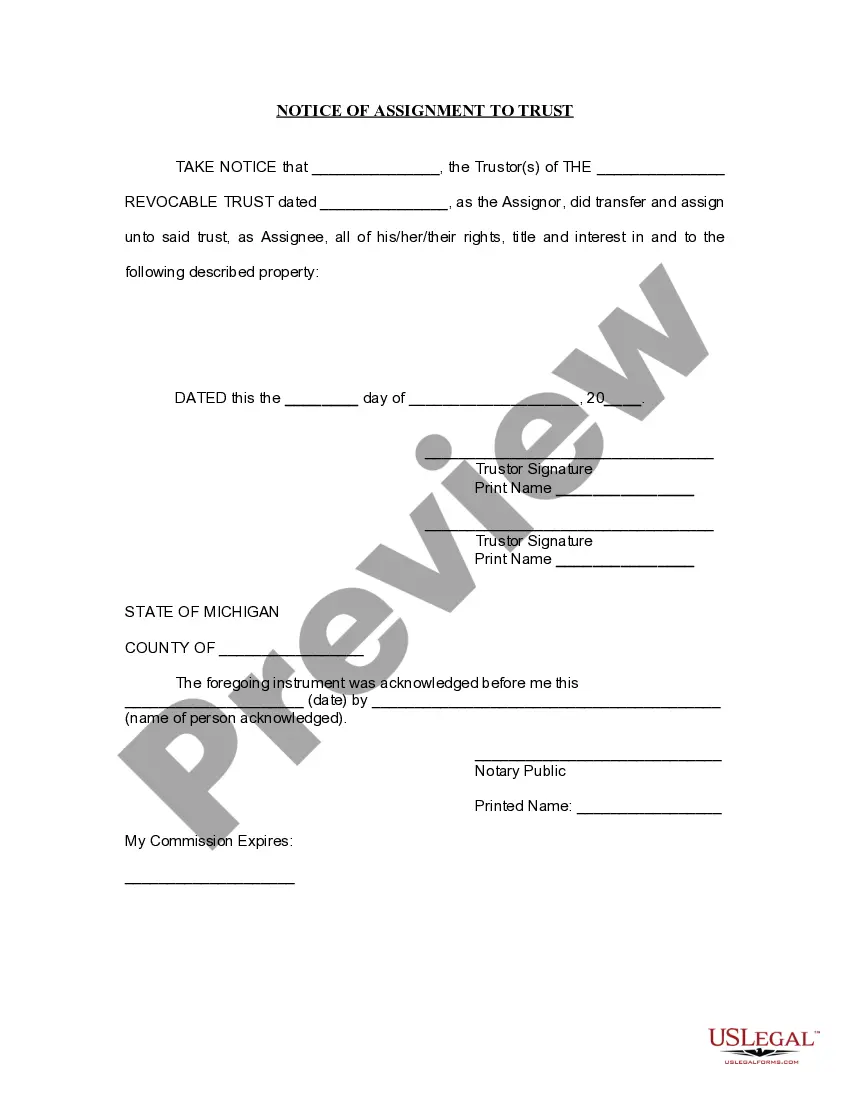

Oakland Michigan Notice of Assignment to Living Trust is an essential legal document that outlines the transfer of assets to a living trust within Oakland County, Michigan. This legal notice serves to inform interested parties, such as financial institutions, creditors, and other relevant entities, that the individual's assets have been transferred to a trust for management and distribution purposes. A Notice of Assignment to Living Trust is typically used to ensure the smooth transfer of assets to a living trust during the granter's lifetime. It also provides details regarding the date of the assignment, the name and contact information of the trustee(s), and any relevant instructions and conditions set forth by the granter. Some common types of Oakland Michigan Notice of Assignment to Living Trust may include: 1. Oakland Michigan Notice of Assignment to Revocable Living Trust: This type of notice involves the transfer of assets to a revocable living trust, which allows the granter to modify or revoke the trust during their lifetime. 2. Oakland Michigan Notice of Assignment to Irrevocable Living Trust: In this case, the assets are assigned to an irrevocable living trust, which cannot be modified or revoked without the consent of the beneficiaries. 3. Oakland Michigan Notice of Assignment to Testamentary Living Trust: This notice pertains to the transfer of assets to a living trust that is established through a will and becomes effective upon the granter's death. 4. Oakland Michigan Notice of Assignment of Real Estate to Living Trust: If the assets being transferred are specifically real estate properties located within Oakland County, this notice is used to inform interested parties about the assignment of such properties to a living trust. Overall, an Oakland Michigan Notice of Assignment to Living Trust is a crucial legal tool that ensures the proper administration and distribution of assets, offers protection against probate, and maintains privacy for the granter and their beneficiaries. It is recommended to consult with an experienced estate planning attorney to draft and execute this notice accurately and in compliance with state laws and regulations.

Oakland Michigan Notice of Assignment to Living Trust

Description

How to fill out Oakland Michigan Notice Of Assignment To Living Trust?

Do you need a trustworthy and inexpensive legal forms supplier to buy the Oakland Michigan Notice of Assignment to Living Trust? US Legal Forms is your go-to choice.

Whether you require a simple agreement to set rules for cohabitating with your partner or a package of documents to advance your separation or divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and frameworked in accordance with the requirements of separate state and county.

To download the form, you need to log in account, find the needed form, and click the Download button next to it. Please remember that you can download your previously purchased form templates at any time from the My Forms tab.

Is the first time you visit our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Oakland Michigan Notice of Assignment to Living Trust conforms to the regulations of your state and local area.

- Read the form’s description (if available) to learn who and what the form is good for.

- Start the search over in case the form isn’t good for your specific situation.

Now you can register your account. Then pick the subscription plan and proceed to payment. As soon as the payment is completed, download the Oakland Michigan Notice of Assignment to Living Trust in any available format. You can return to the website at any time and redownload the form without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about wasting hours researching legal paperwork online for good.