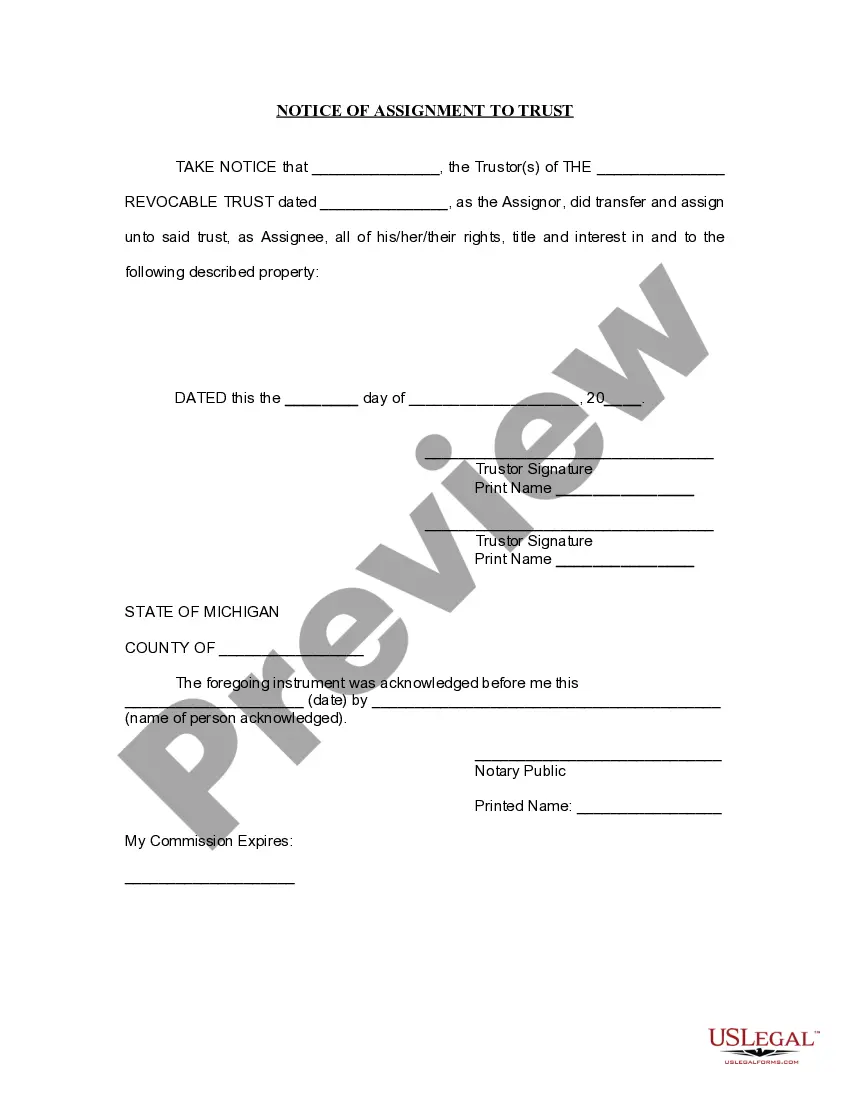

A Wayne Michigan Notice of Assignment to Living Trust is a legal document that signifies the transfer of assets from an individual to their living trust. This document ensures that the property and other assets effectively become part of the trust and are managed according to the granter's wishes. It is essential for individuals who have established a living trust to properly execute the Notice of Assignment to ensure the assets are successfully included in the trust. The Notice of Assignment to Living Trust is specifically tailored to comply with Wayne County, Michigan, laws and regulations. This document serves as a public record, informing interested parties about the transfer of assets to the trust. By providing a clear and detailed notice, individuals can avoid potential disputes or claims regarding the ownership of the assets. There are several types of Wayne Michigan Notice of Assignment to Living Trust, each customizable to meet the specific requirements and circumstances of the granter. Some common variations include: 1. Real Estate Assignment: This notice encompasses the transfer of real estate properties, such as residential homes, commercial buildings, or vacant land, into a living trust. It ensures that the trustee has legal authority over these properties and can effectively manage them on behalf of the beneficiaries. 2. Financial Assets Assignment: This type of notice focuses on the transfer of financial assets, including bank accounts, stocks, bonds, mutual funds, and other investment instruments, to the living trust. It ensures that these assets are accurately accounted for and administered by the trustee. 3. Personal Property Assignment: This notice deals with the transfer of personal property items, such as vehicles, jewelry, artwork, furniture, and other valuable possessions, to the living trust. It ensures that these items are properly titled in the trust's name and distributed according to the granter's instructions. 4. Business Interests Assignment: For individuals who own a business or have ownership interests in a company, this notice enables the transfer of business assets, shares, or ownership stakes into the living trust. It ensures that the trust has legal control over these assets, allowing for seamless management or potential succession planning. When executing a Wayne Michigan Notice of Assignment to Living Trust, it is crucial to consult with an experienced attorney knowledgeable about estate planning and local laws to ensure compliance. This document represents a significant step in effectively managing and protecting assets and should be crafted carefully to reflect the intended transfer while addressing any specific legal considerations.

Wayne Michigan Notice of Assignment to Living Trust

Description

How to fill out Wayne Michigan Notice Of Assignment To Living Trust?

Take advantage of the US Legal Forms and get instant access to any form you need. Our helpful website with a huge number of templates makes it easy to find and obtain almost any document sample you require. You are able to download, complete, and sign the Wayne Michigan Notice of Assignment to Living Trust in a few minutes instead of surfing the Net for many hours trying to find a proper template.

Using our library is a superb way to increase the safety of your record submissions. Our experienced attorneys on a regular basis review all the documents to ensure that the forms are appropriate for a particular region and compliant with new acts and polices.

How do you obtain the Wayne Michigan Notice of Assignment to Living Trust? If you already have a subscription, just log in to the account. The Download option will appear on all the samples you view. Furthermore, you can get all the previously saved documents in the My Forms menu.

If you don’t have a profile yet, stick to the tips below:

- Find the form you require. Make certain that it is the template you were seeking: verify its name and description, and take take advantage of the Preview function if it is available. Otherwise, utilize the Search field to look for the needed one.

- Launch the downloading procedure. Click Buy Now and select the pricing plan you prefer. Then, create an account and pay for your order using a credit card or PayPal.

- Export the document. Pick the format to get the Wayne Michigan Notice of Assignment to Living Trust and revise and complete, or sign it for your needs.

US Legal Forms is among the most extensive and trustworthy template libraries on the internet. We are always happy to assist you in any legal case, even if it is just downloading the Wayne Michigan Notice of Assignment to Living Trust.

Feel free to take full advantage of our platform and make your document experience as straightforward as possible!