Ann Arbor Michigan Revocation of Living Trust

Description

How to fill out Michigan Revocation Of Living Trust?

Irrespective of societal or occupational standing, finalizing law-related documents is a regrettable requirement in today’s work environment.

Frequently, it’s nearly unfeasible for an individual lacking any legal training to create this kind of documentation from the ground up, primarily due to the intricate terminology and legal subtleties they encompass.

This is where US Legal Forms comes into play.

Confirm that the template you select is specific to your area, as the regulations of one state or region do not apply to another.

Review the document and read a concise summary (if available) of circumstances for which the paper can be utilized.

- Our service provides an extensive array of over 85,000 ready-to-use state-specific documents that are applicable for nearly any legal circumstance.

- US Legal Forms is also an excellent tool for associates or legal advisors looking to save time by using our DYI forms.

- Whether you need the Ann Arbor Michigan Revocation of Living Trust or any other documents suitable for your state or region, with US Legal Forms, everything is readily available.

- Here’s how you can obtain the Ann Arbor Michigan Revocation of Living Trust in moments using our reliable service.

- If you are currently a subscriber, you can go ahead and Log In to your account to access the appropriate document.

- However, if you are not acquainted with our platform, make sure to adhere to these steps prior to acquiring the Ann Arbor Michigan Revocation of Living Trust.

Form popularity

FAQ

The 5 year rule for trusts refers to a significant timeframe in which assets held in a trust may be subject to certain tax regulations or considerations. In the context of an Ann Arbor Michigan Revocation of Living Trust, this rule can impact how and when you revoke or change your trust. If you revoke your trust within five years of establishing it, certain tax consequences might arise, affecting your overall estate plan. Understanding these implications is crucial for effective estate planning, and platforms like US Legal Forms can assist you in navigating the complexities involved.

Michigan trusts are generally not required to be filed with the court. This allows for greater privacy and flexibility in managing your trust. However, if you anticipate changes or revocation in the future, knowing how to effectively manage the Ann Arbor Michigan Revocation of Living Trust will assist you in making those transitions easier.

In Michigan, a trust does not need to be filed with the court unless it is part of a court case. This means you can manage your trust privately without court intervention. However, understanding your rights and options regarding the Ann Arbor Michigan Revocation of Living Trust can help you navigate future changes more effectively.

No, you do not have to record a trust in Michigan. While recording is not required, it may be beneficial for certain types of trusts, particularly when dealing with real estate. Keeping trust documents organized and accessible aids in the Ann Arbor Michigan Revocation of Living Trust, ensuring a smoother process for any necessary updates.

To ensure a trust is valid in Michigan, it must meet specific criteria. First, the trust must be signed by the trustor, the person creating the trust. Additionally, the trust should clearly outline the assets included and the beneficiaries involved. This clarity helps in the Ann Arbor Michigan Revocation of Living Trust process, should you ever need to make changes.

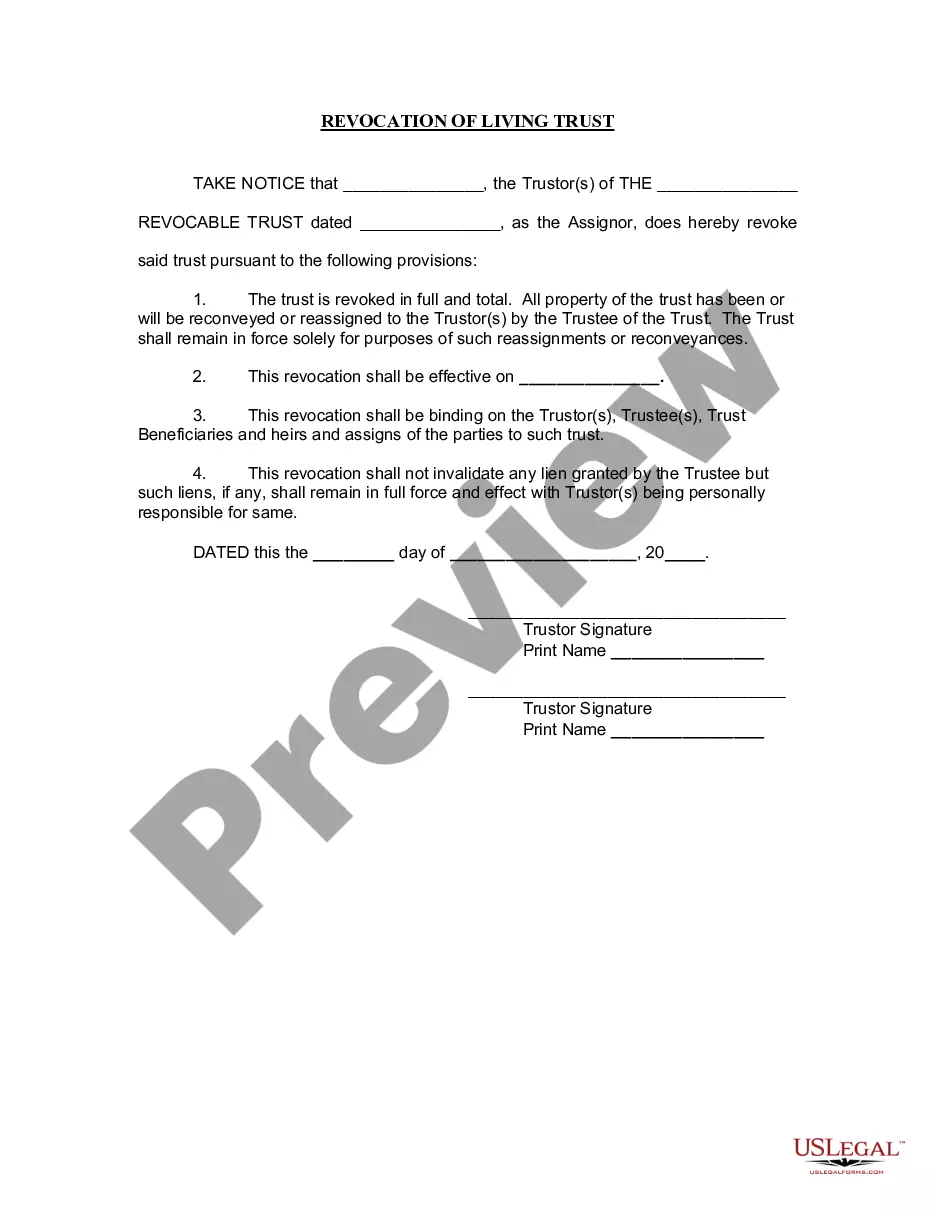

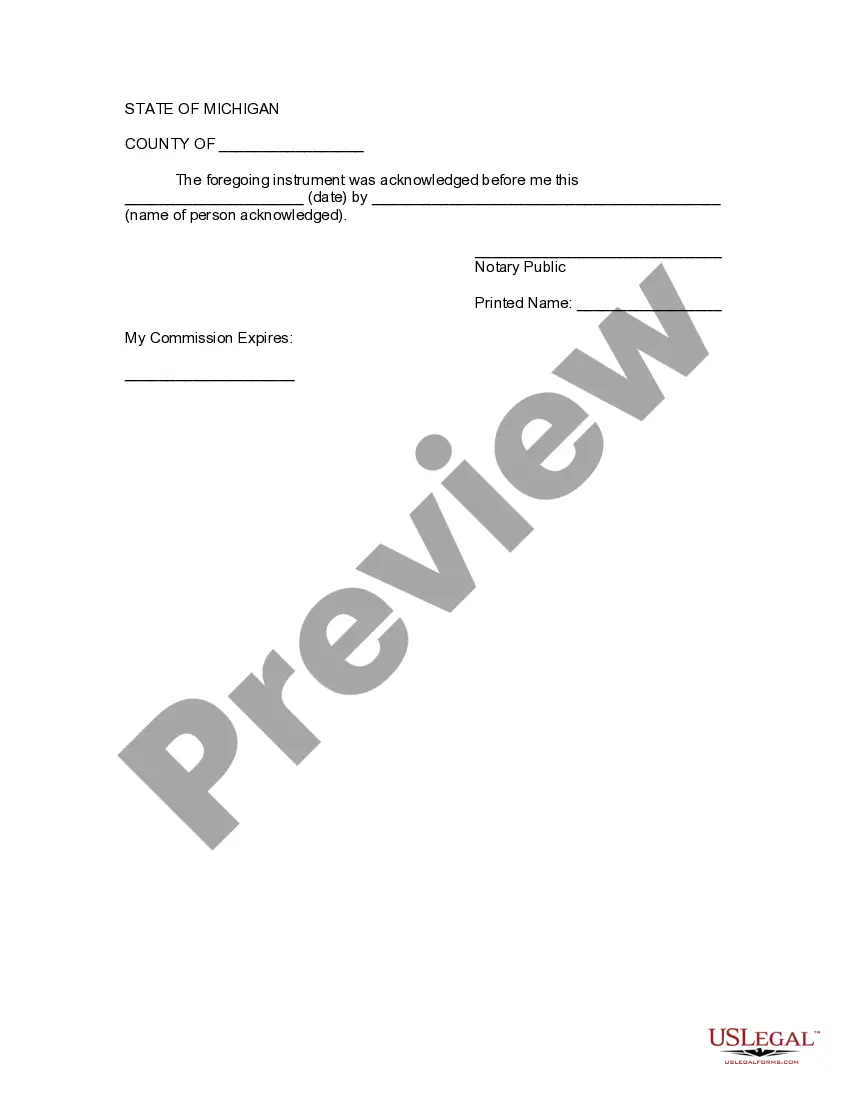

To revoke a revocable living trust, you should create a written revocation document that clearly states your intent to cancel the trust. Include all relevant information, such as the trust's name and your signature. Once completed, distribute copies to any involved parties, and secure your assets accordingly. Platforms like US Legal Forms can aid you in creating this document, making the process efficient and comprehensive.

Yes, you can amend a revocable trust without an attorney, although seeking legal advice is always wise. Making changes usually involves preparing an amendment document that specifies the modifications to the trust. When handling the Ann Arbor Michigan Revocation of Living Trust, ensure you follow the legal requirements carefully to preserve the trust's validity. US Legal Forms offers resources for those wishing to navigate this process independently.

To dissolve a revocable trust, you need a specific form known as a trust dissolution form. This document states your desire to end the trust and should include essential details such as the name of the trust and your signature. For those in Ann Arbor, Michigan, using a reliable service like US Legal Forms can provide you with proper templates, ensuring everything is filled out correctly and legally binding.

Yes, a revocable living trust does allow the grantor to revoke or dissolve the trust at any time during their lifetime. This flexibility is one of the key features of such trusts. By using the Ann Arbor Michigan Revocation of Living Trust, you maintain control over your assets. Remember, consult with a legal professional if you need guidance navigating this process.

A trust revocation declaration is a legal document that officially cancels a living trust. For instance, when you complete a document stating your intention to revoke your Ann Arbor Michigan Revocation of Living Trust, it should include the name of the trust, your signature, and a date. This declaration serves as clear evidence of your decision, allowing you to manage your assets as desired. Using platforms like US Legal Forms can help you find templates that make this process straightforward.