Ann Arbor, Michigan Letter to Lien holder to Notify of Trust provides crucial information to the lien holder about the establishment of trust in a property located in Ann Arbor, Michigan. This formal communication ensures that the lien holder is aware of the trust and acknowledges the trustee's authority and responsibility in handling the property. The letter serves as an official notice, promoting transparency and legal compliance in property ownership and management. Keywords: Ann Arbor, Michigan, letter, lien holder, trust, notify, property, trustee, authority, responsibility, transparency, legal compliance. Different types of Ann Arbor, Michigan Letter to Lien holder to Notify of Trust: 1. Ann Arbor, Michigan Letter to Lien holder — Notice of Trust Agreement: This type of letter notifies the lien holder of the existence of a trust agreement concerning the property in question. It outlines the key details of the trust agreement, including the trustee's name, contact information, and the property's legal description. The purpose is to keep the lien holder informed regarding the property's ownership and trust arrangements. 2. Ann Arbor, Michigan Letter to Lien holder — Trust Notice and Notification: This variant of the letter is meant to provide a comprehensive notification to the lien holder about the creation and purpose of the trust. It includes detailed information about the trust, such as its purpose, terms, and any relevant restrictions or instructions that may affect the property. This ensures the lien holder is fully aware of the trust's impact on the property and its rights. 3. Ann Arbor, Michigan Letter to Lien holder — Trustee Change Notice: This special type of letter is used to inform the lien holder of a change in the trustee handling the trust for the property in Ann Arbor, Michigan. It outlines the reasons for the trustee change, provides the new trustee's contact information, and seeks the lien holder's acknowledgment and confirmation of the change. This ensures a smooth transition and continued cooperation between the lien holder and the new trustee. Overall, Ann Arbor, Michigan Letter to Lien holder to Notify of Trust plays a vital role in maintaining a transparent and legally compliant relationship between the lien holder and the trustee. It facilitates effective communication and ensures all relevant parties are informed about the establishment, terms, and changes pertaining to the trust in the Ann Arbor, Michigan property.

Ann Arbor Michigan Letter to Lienholder to Notify of Trust

Description

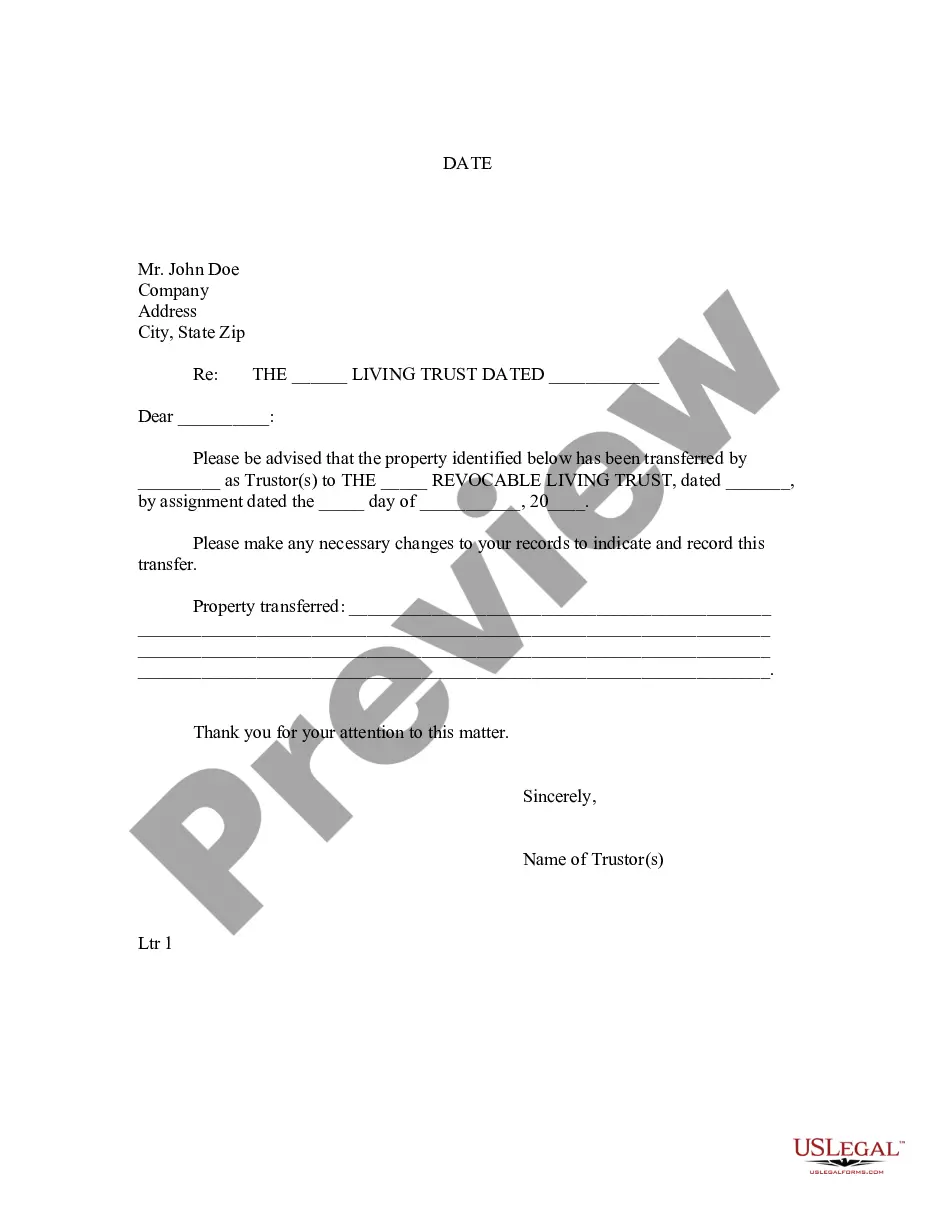

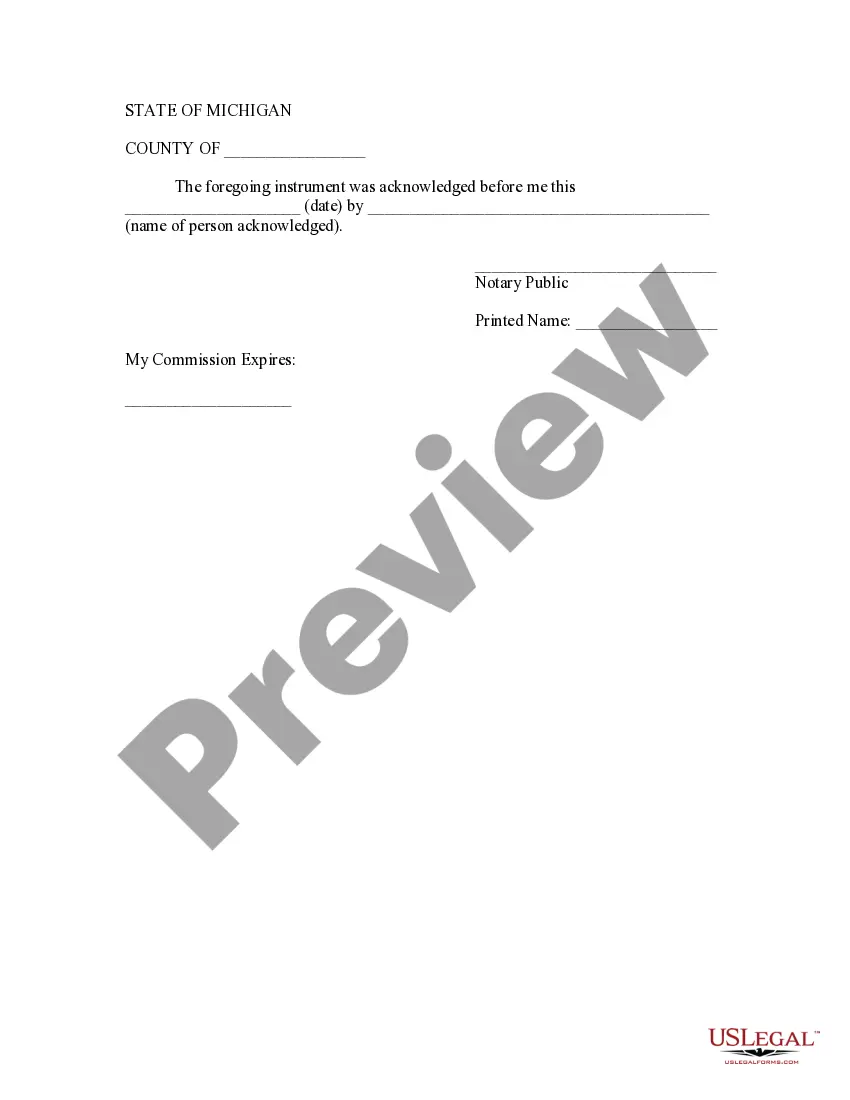

How to fill out Ann Arbor Michigan Letter To Lienholder To Notify Of Trust?

Utilize the US Legal Forms and gain instant access to any form template you require.

Our advantageous platform with a vast array of documents simplifies the process of locating and acquiring nearly any document sample you need.

You can save, complete, and authenticate the Ann Arbor Michigan Letter to Lienholder to Notify of Trust in just a few minutes rather than spending hours on the internet searching for a suitable template.

Using our collection is an excellent method to enhance the security of your document submissions.

If you haven’t created an account yet, follow these instructions.

Find the template you require. Ensure it is the correct template by checking its title and description, and utilize the Preview feature when available. Alternatively, use the Search field to find what you need.

- Our knowledgeable legal experts frequently assess all the records to ensure that the templates are applicable for a specific area and comply with recent laws and regulations.

- How do you access the Ann Arbor Michigan Letter to Lienholder to Notify of Trust.

- If you already have an account, simply Log In to access the Download option which will be available for all the samples you view.

- You can also retrieve all previously saved records from the My documents menu.

Form popularity

FAQ

Settling an estate with a trust in Michigan can take several months to a year. Generally, it involves gathering and valuing assets, paying debts, and distributing the remaining assets to beneficiaries. Utilizing an Ann Arbor Michigan Letter to Lienholder to Notify of Trust can help clarify and expedite the process, especially if there are liens involved. For assistance, consider using the US Legal Forms platform, which offers resources to simplify the documentation and ensure compliance.

Certain assets, such as some retirement accounts like 401(k)s, cannot be directly held in a trust without consequences. Additionally, property with significant restrictions, like personal protections or certain government benefits, may not transfer smoothly into a trust. It's important to understand these limitations when considering a trust as part of your estate planning. An Ann Arbor Michigan Letter to Lienholder to Notify of Trust can help navigate these considerations, ensuring you're informed about what assets you can include.

Yes, a trust can hold title to real property in Michigan. This practice is common and can help in estate planning by managing how property is distributed after the owner’s death. Holding real estate in a trust can also provide certain tax benefits and protect the property from probate. For necessary communications, utilize an Ann Arbor Michigan Letter to Lienholder to Notify of Trust for clear documentation.

When a title is held in a trust, it indicates that the trust is the legal owner of the asset. The trustee manages the asset on behalf of the beneficiaries, ensuring that the asset is used according to the trust's terms. This arrangement can provide benefits such as asset protection and streamlined estate transfer. To notify parties involved, an Ann Arbor Michigan Letter to Lienholder to Notify of Trust is often advisable.

One disadvantage of placing property in a trust is the non-negligible costs associated with setting it up and maintaining it. Additionally, it requires proper management and legal follow-through to avoid complications. Some people may also have concerns about losing control over their property. If you are considering a trust, an Ann Arbor Michigan Letter to Lienholder to Notify of Trust can assist in clarifying asset ownership.

Yes, a trust can own a vehicle in Michigan. When a vehicle is titled in the name of the trust, it is treated as an asset of the trust. This ownership can help in estate planning and can simplify the transfer process upon the trust creator's passing. To ensure a smooth process, consider using an Ann Arbor Michigan Letter to Lienholder to Notify of Trust for proper documentation.

While placing property in a trust provides benefits like avoiding probate, there are potential disadvantages. You may face costs associated with creating and maintaining the trust, including legal fees and possible tax implications. Additionally, once the property is in a trust, you may have limited control over it, as the trust document dictates how it is managed. Consider using resources like US Legal Forms for guidance on matters involving the 'Ann Arbor Michigan Letter to Lienholder to Notify of Trust' to help mitigate these drawbacks.

Putting your property in a trust in Michigan involves several clear steps. First, draft a trust agreement that specifies how the property will be managed and who will benefit from it. Then, you should execute a deed to transfer ownership of the property into the trust, and make sure to record this with the appropriate local authority. Using an 'Ann Arbor Michigan Letter to Lienholder to Notify of Trust' can help inform lienholders about this important change.

To place your house in a trust in Michigan, first, you need to create a trust document. This document outlines the terms and beneficiaries of the trust. After that, you will transfer the title of your house into the trust, which may involve preparing a new deed and recording it with your local county office. For a smooth process, consider using the 'Ann Arbor Michigan Letter to Lienholder to Notify of Trust' when notifying relevant parties about the transfer.

To publish a notice to creditors in Michigan, you must first draft a notice that meets legal requirements. Then, publish this notice in a local newspaper for three consecutive weeks. Doing so helps inform potential creditors about the trust. An Ann Arbor Michigan Letter to Lienholder to Notify of Trust can streamline the process and ensure compliance with local laws.

Interesting Questions

More info

FOR THE FURTHER EDUCATIONAL BENEFITS OF CODE 905. The following form is intended for use in courtroom (or similar facility) at a hearing. This form is adapted for use by the Court Clerk(s) at the courthouse or other entity that has responsibility for the handling of applications for grants. Written documentation is not required. The form is the same used at the County Clerk's office, City Clerk's office, U.S. Attorney's offices, Probate court, etc., and should also be the form used by law enforcement agencies in accordance with court regulations. You need only fill in the required information on this form. The Judge's or Magistrates office, or equivalent entity at the courthouse will not have a need or the appropriate number of forms, so the form may be used at any location. The forms are the same used by police departments for the purpose of seizing property. If you need assistance, please contact the appropriate agency where you live and/or work.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.