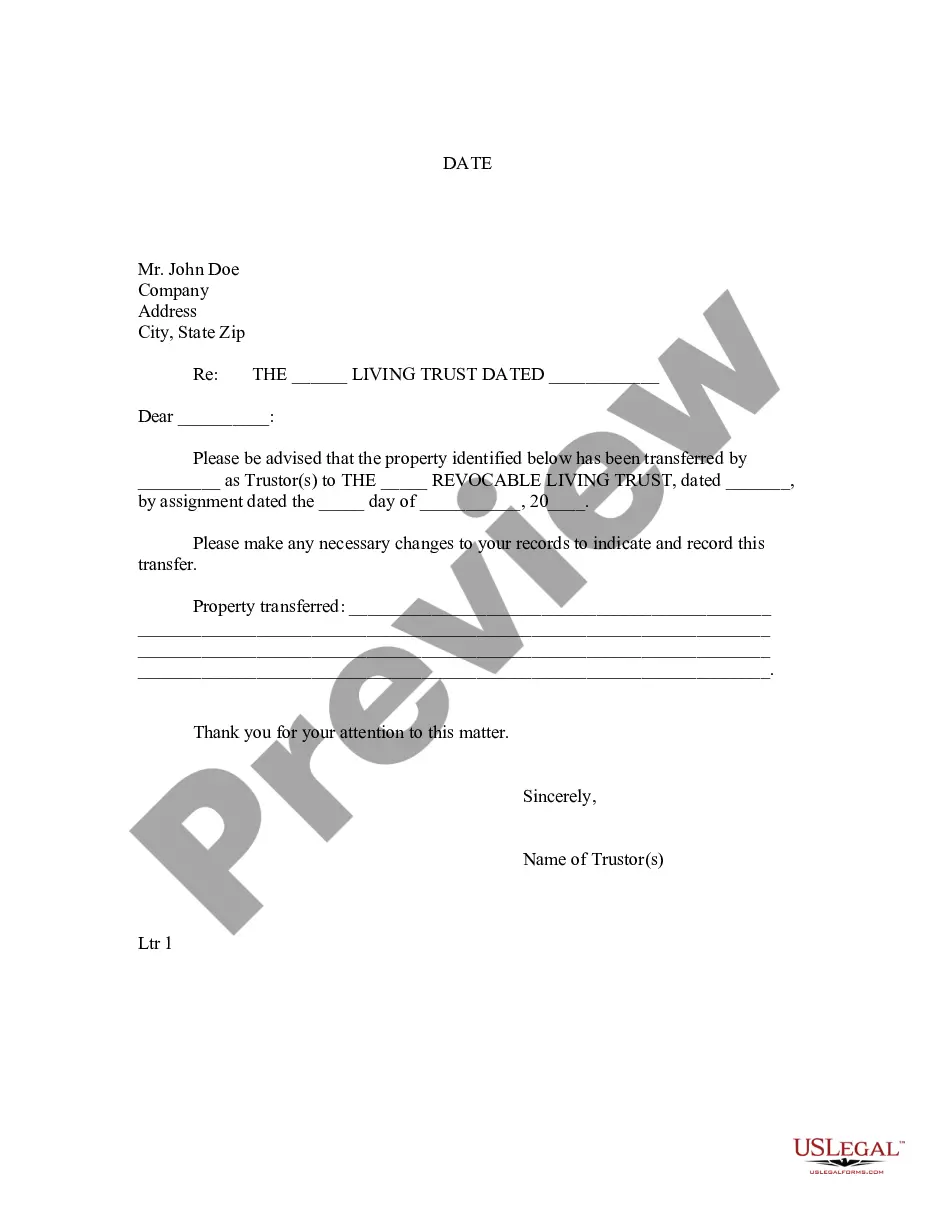

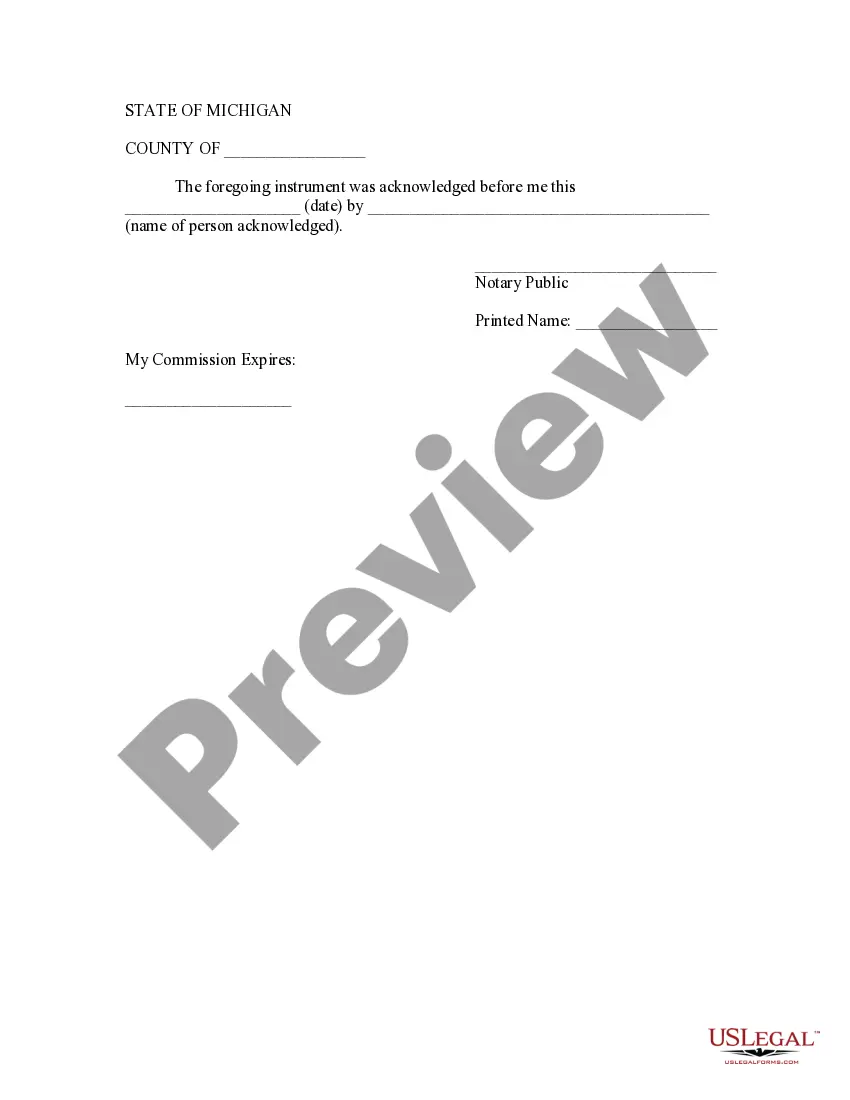

Lansing, Michigan is a vibrant city known for its rich history, beautiful parks, and thriving community. If you find yourself in a situation where you need to notify a lien holder of a trust, it's essential to understand the proper protocol and utilize the correct form. In Lansing, Michigan, there are different types of letters to lien holders to notify them of trust, including the Notice of Trust Agreement, Notice of Living Trust, and Notice of Testamentary Trust. Let's delve into the details of each type to help you understand which one is most relevant for your particular situation. 1. Notice of Trust Agreement: The Notice of Trust Agreement is used when notifying a lien holder about a trust that has been established through a specific agreement. This type of letter provides the lien holder with essential information, such as the trust's name, the date it was established, and the parties involved. It should also include the lien holder's account details, the trust's taxpayer identification number, and any other relevant information regarding the trust's assets or beneficiaries. 2. Notice of Living Trust: If you have created a living trust, which takes effect during your lifetime, you may need to notify a lien holder about its existence. The Notice of Living Trust outlines the basic details of the trust, including the name, date of creation, and the names of the trustee(s) and beneficiaries. Additionally, it should mention that the trust is revocable or irrevocable to inform the lien holder of the trust's nature. 3. Notice of Testamentary Trust: A Testamentary Trust is established upon the death of the settler and is commonly included within a will. Should you need to inform a lien holder of this type of trust in Lansing, Michigan, you will need to send a Notice of Testamentary Trust. This letter must provide the lien holder with information about the trust, such as the name, date of the settler's death, and the probate court overseeing the administration of the estate. No matter which type of Lansing, Michigan Letter to Lien holder to Notify of Trust you need, it's crucial to double-check the specific requirements of the lien holder and consult with legal professionals to ensure accuracy and compliance with local regulations. By following the appropriate procedures and utilizing the correct form, you can effectively notify the lien holder while safeguarding the trust's integrity.

Lansing Michigan Letter to Lienholder to Notify of Trust

Description

How to fill out Lansing Michigan Letter To Lienholder To Notify Of Trust?

Irrespective of social or occupational position, filling out legal documents is an unfortunate requirement in today's society.

Frequently, it’s nearly impossible for someone without any legal education to create these types of documents from scratch, primarily due to the complex language and legal intricacies they involve.

This is where US Legal Forms steps in to assist.

Review the document and glance through a brief summary (if available) of scenarios for which the paper can be utilized.

If the form you’ve chosen does not fulfill your needs, you can restart the search for the appropriate document.

- Our service offers an extensive collection of over 85,000 ready-to-use state-specific documents that cater to virtually any legal matter.

- US Legal Forms is also a superb resource for associates or legal advisors looking to enhance their time management by utilizing our DIY forms.

- Whether you need the Lansing Michigan Letter to Lienholder to Notify of Trust or another document suitable for your jurisdiction, with US Legal Forms, everything is readily available.

- To obtain the Lansing Michigan Letter to Lienholder to Notify of Trust swiftly using our reliable service, if you are already a subscriber, you can simply Log In to your account to download the correct form.

- If you are new to our platform, make sure to follow these steps before downloading the Lansing Michigan Letter to Lienholder to Notify of Trust.

- Ensure that the form you’ve located is relevant to your region, as the laws of one state may not apply to another.

Form popularity

FAQ

Yes, you can write your own trust in Michigan, as long as it complies with state laws. Begin by clearly stating your intentions and including essential details like the names of the beneficiaries and the assets involved. However, incorporating a Lansing Michigan Letter to Lienholder to Notify of Trust can provide clarity to those holding legal claims on your property. To avoid potential pitfalls, consider using services such as USLegalForms, which can guide you through the process.

To set up a trust in Michigan, you first need to choose the type of trust that fits your needs, such as a revocable or irrevocable trust. Next, you should draft a trust document that outlines the terms, beneficiaries, and responsibilities of the trustee. Using a Lansing Michigan Letter to Lienholder to Notify of Trust can help you inform lienholders about your trust arrangement. It's advisable to consult with a legal professional or utilize platforms like USLegalForms to ensure everything is correctly established.

Yes, beneficiaries in Michigan generally have the right to view the trust document. This right strengthens the transparency and accountability of the trustee's actions. By understanding the terms of the trust, beneficiaries can ensure their interests are protected. Should you need to communicate details about the trust, a Lansing Michigan Letter to Lienholder to Notify of Trust can facilitate this process effectively using resources from US Legal Forms.

In Michigan, a trustee typically must notify beneficiaries of the trust within a reasonable time after the trust becomes irrevocable. This time frame generally falls within a few months, depending on the specifics of the trust. By communicating promptly, the trustee ensures beneficiaries know their rights and interests. If you require assistance, you can create a Lansing Michigan Letter to Lienholder to Notify of Trust through US Legal Forms to streamline the notification process.

Trust income is generally taxable in Michigan unless specifically exempt. It is crucial to keep track of income sources to comply with tax regulations. Proper documentation, such as a Lansing Michigan Letter to Lienholder to Notify of Trust, can assist in managing these complexities.

Tax-exempt income for a trust typically includes certain interest income and qualified dividends. Understanding what qualifies can help maximize your trust's financial efficiency. A Lansing Michigan Letter to Lienholder to Notify of Trust can also clarify your intention regarding tax implications.

Certain types of income, such as gifts or inheritances, are not taxable in Michigan. Interest from specific municipal bonds may also be exempt. Knowing these exemptions can help when framing a Lansing Michigan Letter to Lienholder to Notify of Trust, clarifying your asset's tax situation.

To place your house in a trust in Michigan, you must execute a new deed transferring the house formally into the trust's name. This procedure may involve title searches and legal counsel. Always remember to inform relevant parties using a Lansing Michigan Letter to Lienholder to Notify of Trust.

Yes, Michigan does tax trust income under certain conditions. Be prepared to file taxes on income generated by trust assets. Properly notifying lienholders with a Lansing Michigan Letter to Lienholder to Notify of Trust can also help clarify your financial situation.

A Michigan trust return must be filed by any trust that generates taxable income. Understanding your filing obligations helps maintain compliance. You may assist this process by providing a Lansing Michigan Letter to Lienholder to Notify of Trust, keeping everyone informed.