This Order to Release Lien is an official document from the Michigan State Court Administration Office, and it complies with all applicable state and Federal codes and statutes. USLF updates all state and Federal forms as is required by state and Federal statutes and law.

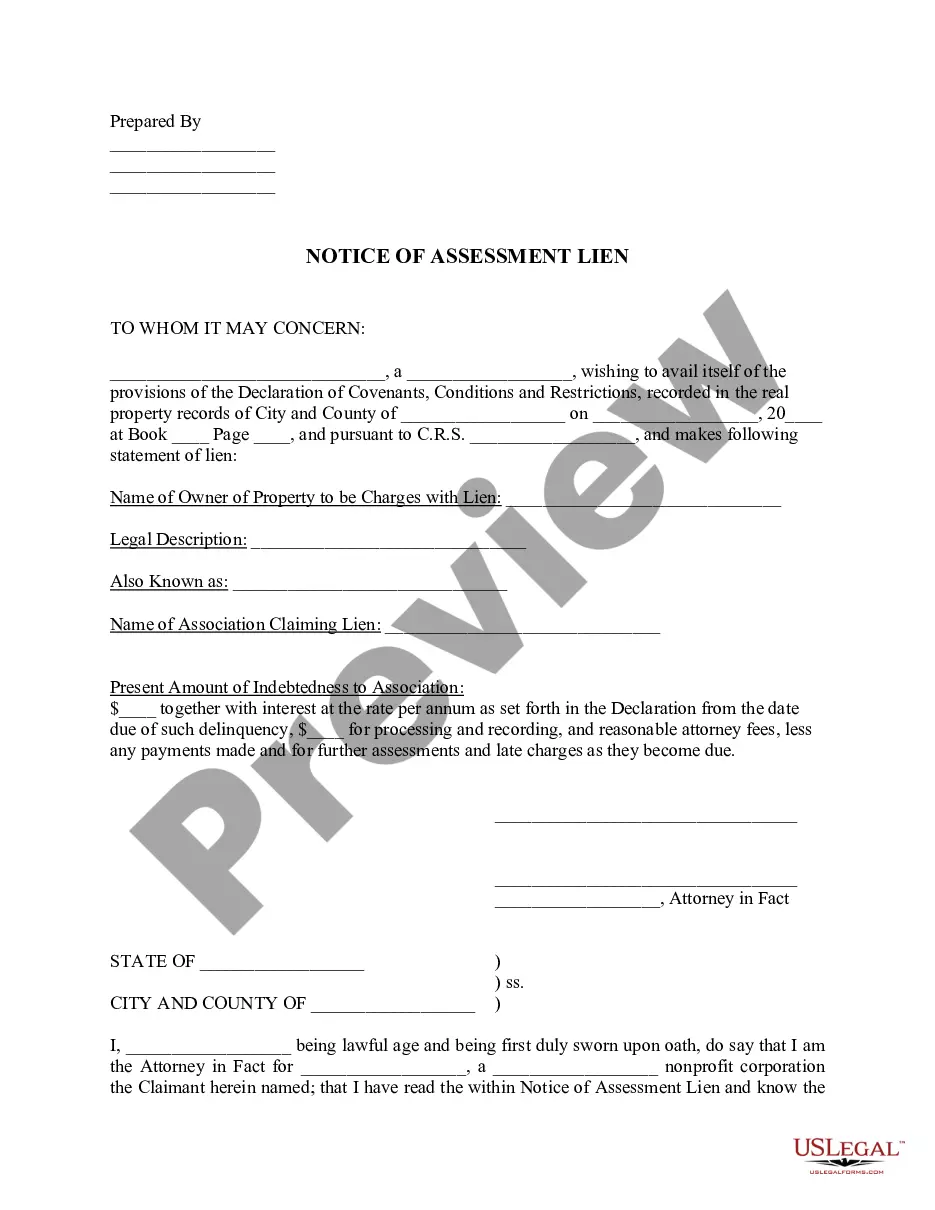

Keyword: Grand Rapids Michigan Orders releasing Lien Grand Rapids, Michigan is a city located in Kent County and is known for its vibrant culture, thriving art scene, and rich history. When it comes to legal matters, one common process that individuals and businesses may encounter is the Order to Release Lien. This legal document is essential for releasing a lien placed on a property or asset in Grand Rapids, Michigan. There are several types of Order to Release Lien that may be applicable in Grand Rapids, Michigan. These include: 1. Real Estate Liens: Real estate liens are a common type of lien placed on a property if the owner fails to fulfill a financial obligation. An Order to Release Real Estate Lien is required to remove such a lien from the property title. 2. Mechanics Liens: Mechanics liens are filed by contractors, subcontractors, or suppliers who have provided labor, materials, or services for a construction project but haven't been paid. An Order to Release Mechanics Lien can be obtained once the debt is settled, allowing the property owner to clear their title. 3. Tax Liens: Tax liens are imposed by governmental authorities when property taxes or other types of taxes remain unpaid. An Order to Release Tax Lien is necessary to release the lien and resolve any outstanding tax obligation. 4. Judgment Liens: Judgment liens are often placed on a property as a result of a court-ordered judgment. An Order to Release Judgment Lien can be obtained when the judgment has been satisfied, allowing the property owner to regain clear title. While the process for obtaining an Order to Release Lien in Grand Rapids, Michigan can vary based on the specific type of lien, generally, it involves the following steps: 1. Verification of Debt: The party seeking the release of the lien must verify that the debt or obligation has been fulfilled or settled. 2. Preparation of Documents: The necessary paperwork for the Order to Release Lien must be prepared, ensuring accuracy and compliance with legal requirements. 3. Filing with the Appropriate Authority: The completed Order to Release Lien is filed with the appropriate authority, such as the county recorder's office or the court, depending on the type of lien. 4. Payment of Associated Fees: Certain filing fees and related costs may need to be paid during the submission of the Order to Release Lien. 5. Review and Approval: The authority responsible for reviewing and approving the Order to Release Lien will evaluate the submitted documents and verify the satisfaction of the debt or obligation. 6. Notification of Release: Once approved, the party seeking the release of the lien will receive documentation confirming the release and satisfaction of the lien. In summary, an Order to Release Lien is a crucial legal process aimed at removing various types of liens placed on properties and assets in Grand Rapids, Michigan. Whether it's a real estate lien, mechanics lien, tax lien, or judgment lien, obtaining the appropriate Order to Release Lien is necessary to restore clear title and resolve any outstanding obligations.