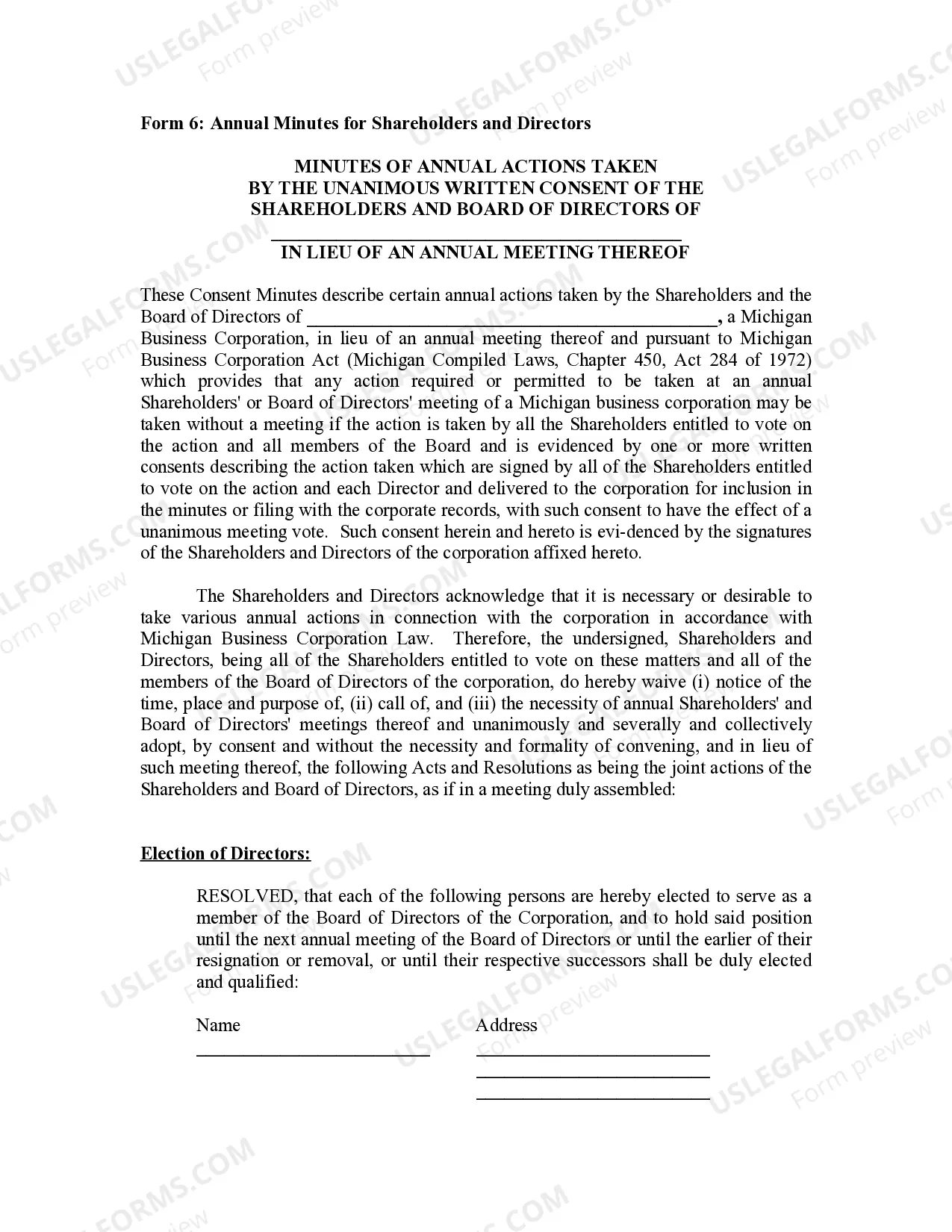

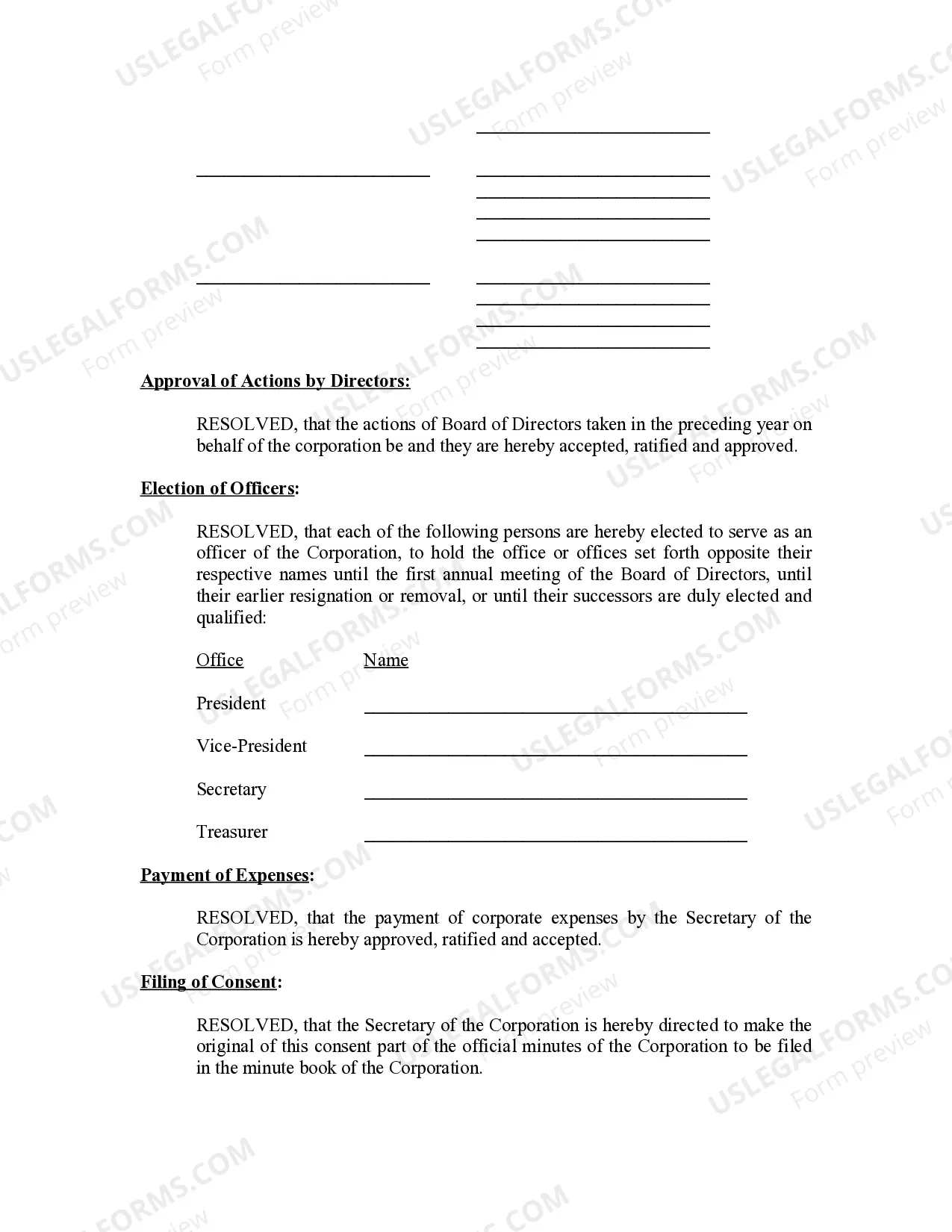

The Annual Minutes form is used to document any changes or other organizational activities of the Corporation during a given year.

Grand Rapids Annual Minutes, also known as the Grand Rapids City Council Annual Minutes, refer to the official records of the meetings held by the City Council of Grand Rapids, Michigan on a yearly basis. These minutes serve as a detailed account of the discussions, decisions, and actions taken during the city council meetings, highlighting the key issues and policies addressed by the council members. The Grand Rapids Annual Minutes provide comprehensive information about the city's governance, policy-making process, and legislative actions. They outline the items discussed in each meeting, including topics such as budget allocations, city zoning, infrastructure projects, public services, community development initiatives, public safety measures, and more. These minutes are vital in ensuring transparency, accountability, and public access to the decision-making process of the city council. The Grand Rapids Annual Minutes — Michigan are not categorized into different types but are organized chronologically, representing the entire range of issues and matters addressed by the council throughout the year. Each set of minutes covers a specific time period, such as "Grand Rapids Annual Minutes — 2020" or "Grand Rapids City Council Minutes — 2021," making it easier for individuals to locate specific records and track the city's progress over time. These minutes are crucial resources for various stakeholders, including city officials, city administrators, researchers, historians, journalists, and concerned citizens. They offer valuable insights into the prioritization of initiatives, changes in policies, and the decision-making process of the city council. Additionally, the minutes serve as a historical record, providing future generations with a comprehensive account of the city's development, challenges, and achievements in a specific year. By examining the Grand Rapids Annual Minutes — Michigan, citizens gain a deeper understanding of how their local government operates, allowing them to actively engage in civic affairs, contribute to public discussions, and hold their elected representatives accountable. The minutes can also serve as a tool for tracking the progress of specific projects and initiatives undertaken by the city council, empowering residents to stay informed and participate in the decision-making process. In summary, the Grand Rapids Annual Minutes — Michigan are a collection of official records documenting the meetings held by the Grand Rapids City Council on an annual basis. They provide a detailed account of the discussions, decisions, and actions taken during these meetings, shedding light on the city's governance, policies, and legislative actions. These minutes offer transparency, accountability, and public access to the city council's decision-making process, enabling citizens to actively engage in civic affairs and understand the development and progress of their local government.