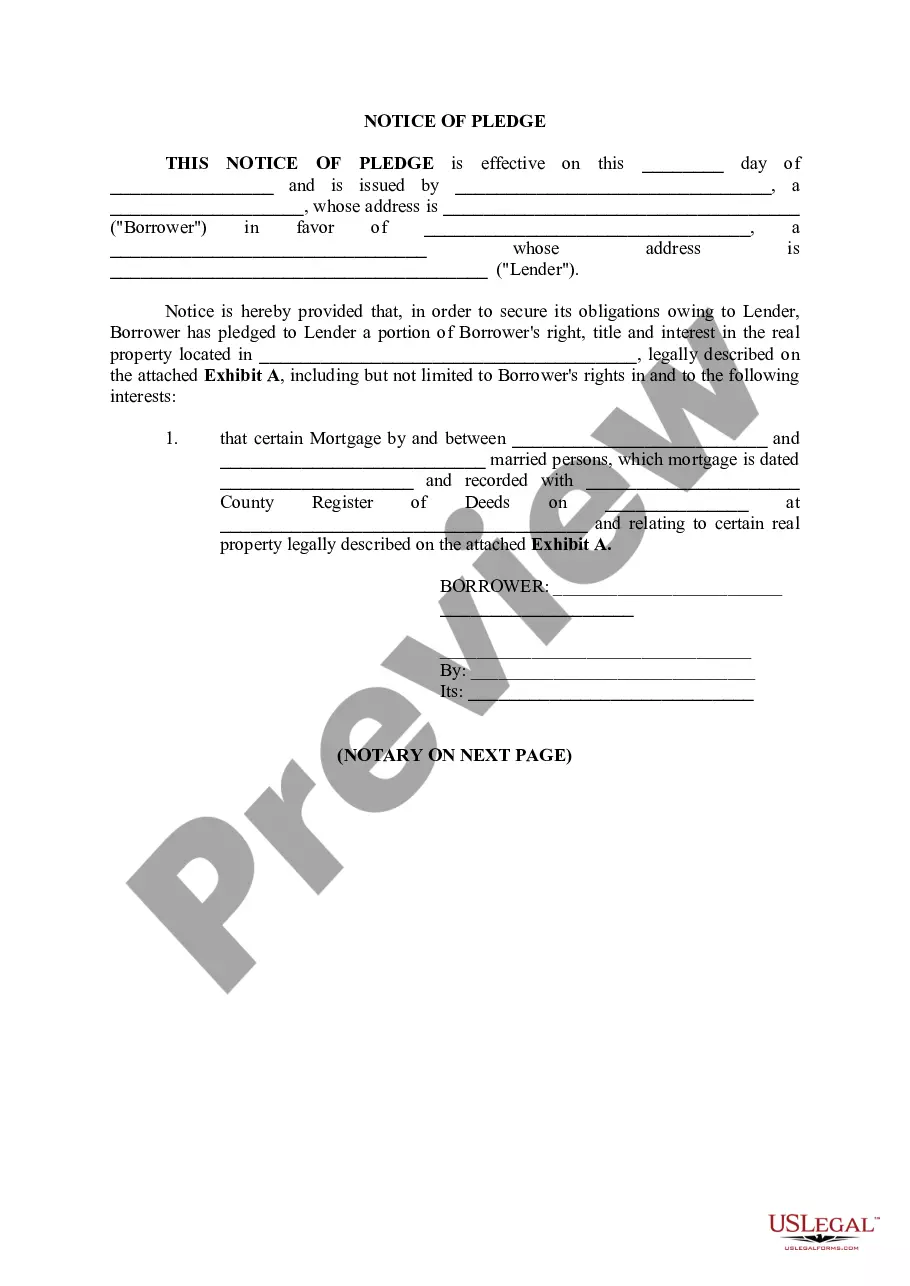

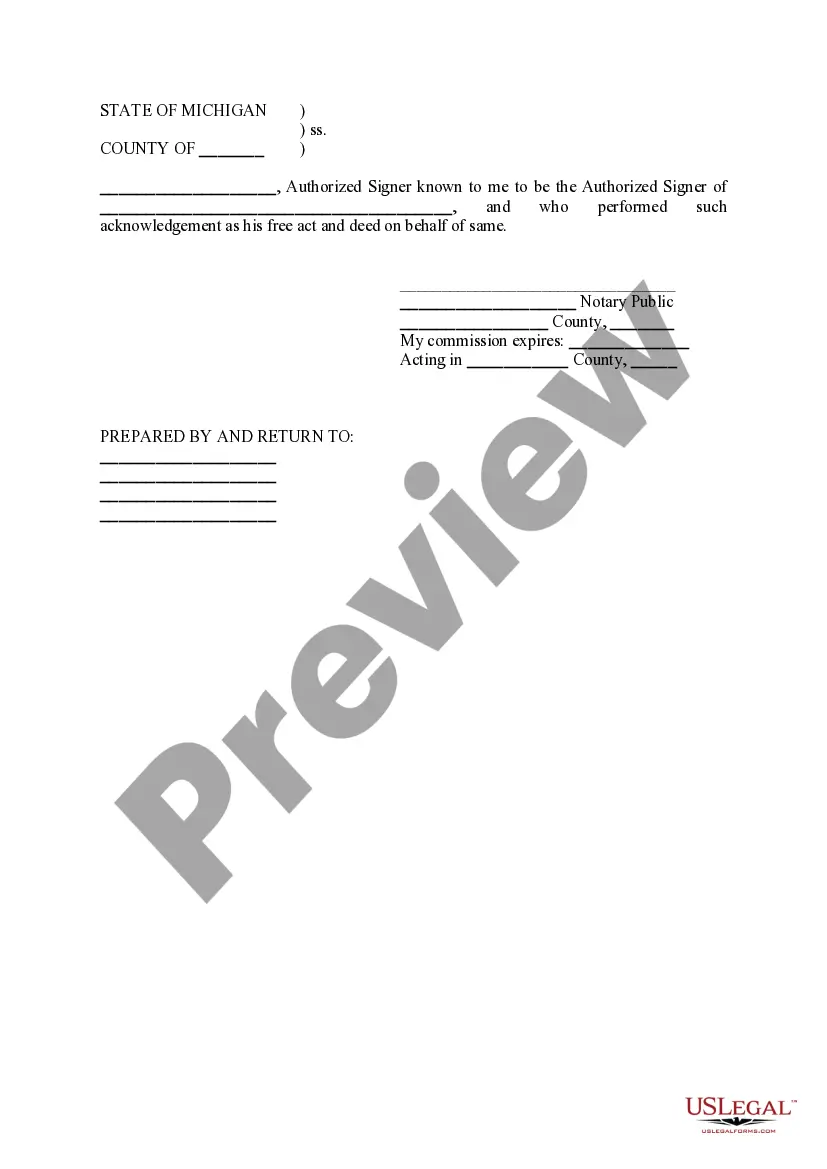

The Grand Rapids Michigan Notice of Pledge to Secure is a legal document that outlines an agreement between a borrower and a lender in the Grand Rapids, Michigan area. This notice identifies the property or asset that is being pledged as security for a loan or debt. Keywords: Grand Rapids Michigan, Notice of Pledge to Secure, legal document, borrower, lender, agreement, property, asset, security, loan, debt. There are several types of Grand Rapids Michigan Notice of Pledge to Secure that can be used depending on the circumstances: 1. Real Estate Pledge: This type of notice is used when a borrower pledges their property, such as a house or land, as security for a loan. The document will typically include a detailed description of the property, its location, and any specific terms and conditions related to the pledge. 2. Personal Property Pledge: In cases where a borrower pledges personal assets, such as vehicles, equipment, or valuable items, this type of Notice of Pledge to Secure is utilized. The document will specify the details of the assets being pledged and any additional terms regarding their maintenance or insurance requirements. 3. Financial Securities Pledge: When a borrower pledges financial securities, such as stocks, bonds, or mutual funds, as collateral for a loan or debt, this notice comes into play. It outlines the specific securities being pledged, their current value, and any applicable transfer or sale restrictions. 4. Intellectual Property Pledge: In situations where intellectual property rights, such as patents, copyrights, or trademarks, are being pledged as security, this type of notice is employed. It provides a thorough description of the intellectual property and any required registrations or licenses for the pledged assets. Regardless of the type, a Grand Rapids Michigan Notice of Pledge to Secure is vital in protecting the rights of both the borrower and the lender. It ensures that the pledged assets will be used as collateral for the loan or debt, thereby offering a form of security to the lender in case of default.

Grand Rapids Michigan Notice of Pledge to Secure

Description

How to fill out Grand Rapids Michigan Notice Of Pledge To Secure?

We always strive to reduce or avoid legal damage when dealing with nuanced legal or financial matters. To accomplish this, we apply for legal services that, as a rule, are extremely costly. Nevertheless, not all legal matters are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based library of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of using services of legal counsel. We offer access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Grand Rapids Michigan Notice of Pledge to Secure or any other document quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again in the My Forms tab.

The process is equally effortless if you’re new to the website! You can register your account within minutes.

- Make sure to check if the Grand Rapids Michigan Notice of Pledge to Secure adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the Grand Rapids Michigan Notice of Pledge to Secure is suitable for you, you can select the subscription option and make a payment.

- Then you can download the document in any available file format.

For over 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!