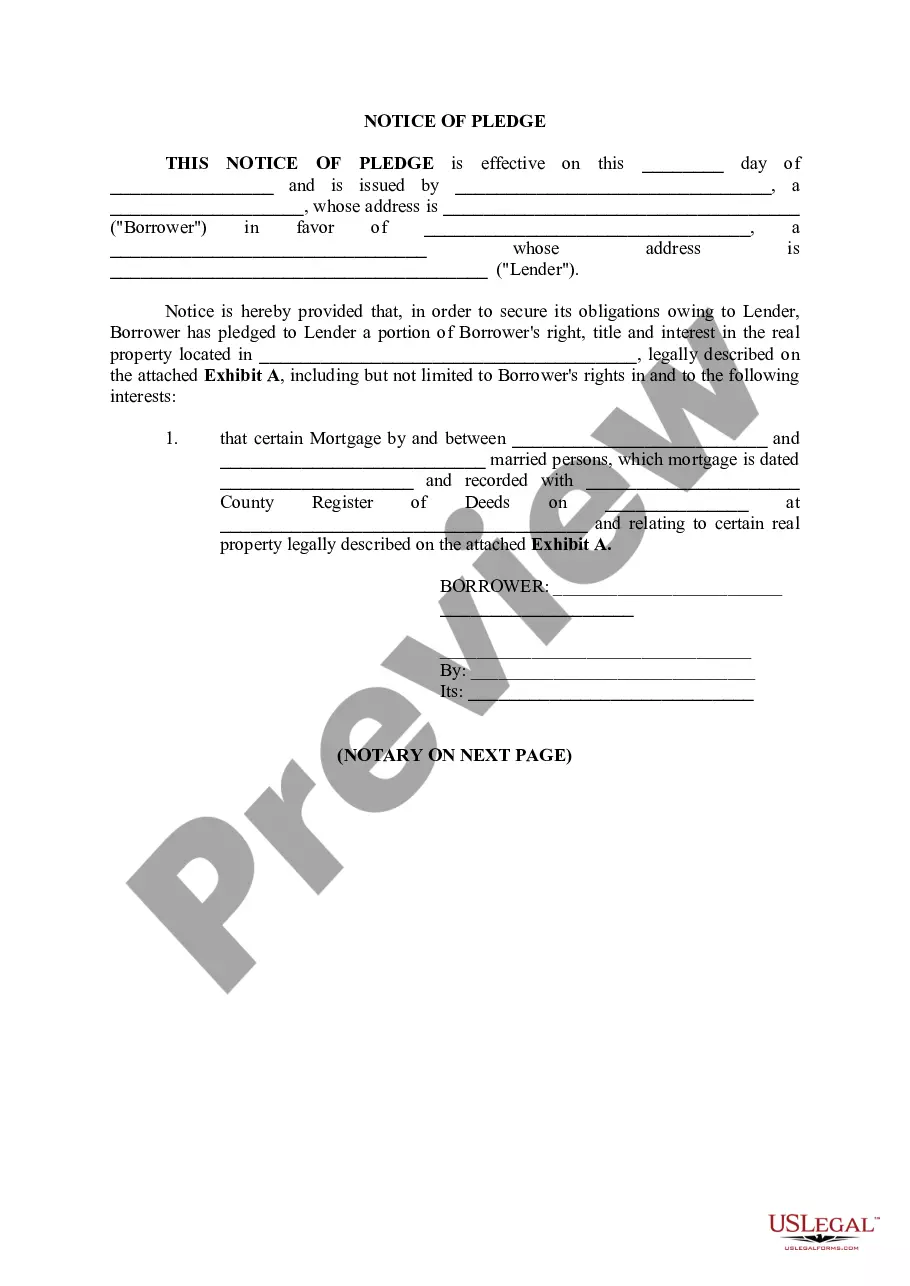

Title: Understanding Wayne Michigan Notice of Pledge to Secure and Its Types Introduction: The Wayne Michigan Notice of Pledge to Secure is a legal document that outlines the terms and conditions agreed upon by a debtor and a creditor in securing a loan or debt. It serves as a commitment to pledge assets as collateral to ensure repayment of the debt. This article will provide a detailed description of the Notice of Pledge to Secure and shed light on its different types. 1. Definition and Purpose: The Wayne Michigan Notice of Pledge to Secure is a legal instrument used to establish collateral as security for a loan or debt. It formally acknowledges the pledge of assets by the debtor to the creditor, providing a sense of reassurance to the creditor and confidence in repayment. 2. Key Components: a. Debtor & Creditor Information: The notice includes the names, addresses, and contact details of both the debtor and the creditor involved in the agreement. b. Asset Description: It specifies the assets being pledged as collateral, such as real estate, vehicles, stocks, or any other valuable property. c. Terms & Conditions: The notice outlines the terms of the pledge, including the loan amount, interest rate, repayment schedule, and consequences of default. d. Signatures: Both the debtor and the creditor must sign the notice to make it legally binding and valid. 3. Types of Wayne Michigan Notice of Pledge to Secure: a. Real Estate Pledge: This type of notice is used when real estate property is pledged as collateral, whether it be land, a residential or commercial building, or any other immovable assets. b. Personal Property Pledge: When items such as vehicles, equipment, jewelry, or valuable collectibles are offered as collateral, the Personal Property Pledge notice is utilized. c. Stock Pledge: In cases where shares of stocks are being pledged as security, a Stock Pledge notice is employed. This type of pledge is commonly used for business loans or investment purposes. Conclusion: The Wayne Michigan Notice of Pledge to Secure is a crucial legal document defining the agreement between debtors and creditors regarding the use of collateral to secure the repayment of loans or debts. It provides certainty and protection for both parties involved. Understanding the types of notice available, such as Real Estate Pledge, Personal Property Pledge, and Stock Pledge, helps ensure that the specific collateral is properly identified and accounted for within the agreement.

Wayne Michigan Notice of Pledge to Secure

Category:

State:

Michigan

County:

Wayne

Control #:

MI-LR127T

Format:

Word;

Rich Text

Instant download

Description

A pledge that the Lender will convey some right, title and interest in property to secure its obligations to the Lender.

Title: Understanding Wayne Michigan Notice of Pledge to Secure and Its Types Introduction: The Wayne Michigan Notice of Pledge to Secure is a legal document that outlines the terms and conditions agreed upon by a debtor and a creditor in securing a loan or debt. It serves as a commitment to pledge assets as collateral to ensure repayment of the debt. This article will provide a detailed description of the Notice of Pledge to Secure and shed light on its different types. 1. Definition and Purpose: The Wayne Michigan Notice of Pledge to Secure is a legal instrument used to establish collateral as security for a loan or debt. It formally acknowledges the pledge of assets by the debtor to the creditor, providing a sense of reassurance to the creditor and confidence in repayment. 2. Key Components: a. Debtor & Creditor Information: The notice includes the names, addresses, and contact details of both the debtor and the creditor involved in the agreement. b. Asset Description: It specifies the assets being pledged as collateral, such as real estate, vehicles, stocks, or any other valuable property. c. Terms & Conditions: The notice outlines the terms of the pledge, including the loan amount, interest rate, repayment schedule, and consequences of default. d. Signatures: Both the debtor and the creditor must sign the notice to make it legally binding and valid. 3. Types of Wayne Michigan Notice of Pledge to Secure: a. Real Estate Pledge: This type of notice is used when real estate property is pledged as collateral, whether it be land, a residential or commercial building, or any other immovable assets. b. Personal Property Pledge: When items such as vehicles, equipment, jewelry, or valuable collectibles are offered as collateral, the Personal Property Pledge notice is utilized. c. Stock Pledge: In cases where shares of stocks are being pledged as security, a Stock Pledge notice is employed. This type of pledge is commonly used for business loans or investment purposes. Conclusion: The Wayne Michigan Notice of Pledge to Secure is a crucial legal document defining the agreement between debtors and creditors regarding the use of collateral to secure the repayment of loans or debts. It provides certainty and protection for both parties involved. Understanding the types of notice available, such as Real Estate Pledge, Personal Property Pledge, and Stock Pledge, helps ensure that the specific collateral is properly identified and accounted for within the agreement.

Free preview

How to fill out Wayne Michigan Notice Of Pledge To Secure?

If you’ve already utilized our service before, log in to your account and save the Wayne Michigan Notice of Pledge to Secure on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your file:

- Ensure you’ve found an appropriate document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to obtain the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Wayne Michigan Notice of Pledge to Secure. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!