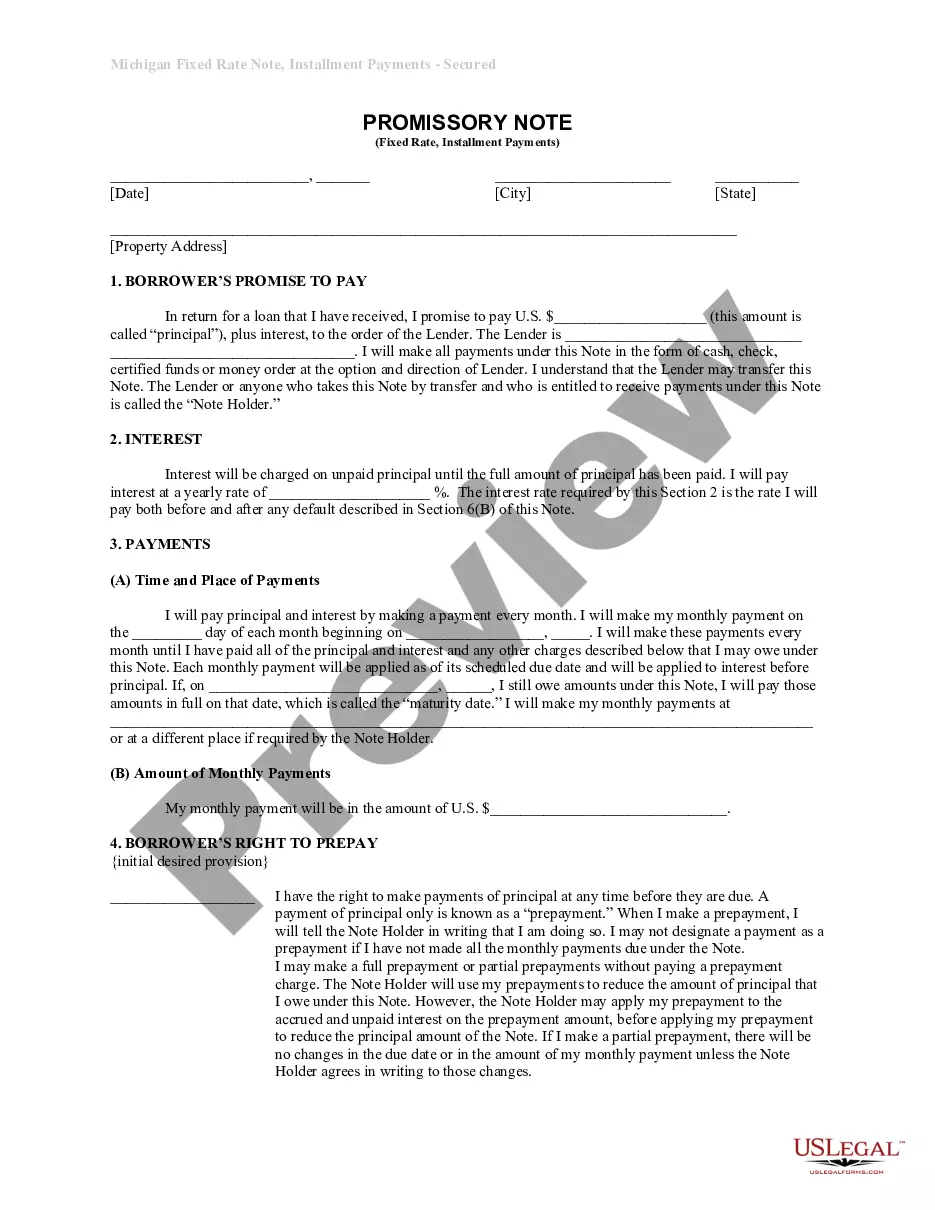

A Grand Rapids Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal agreement between a borrower and a lender, typically a financial institution or a private individual, regarding a loan for purchasing or refinancing residential real estate in Grand Rapids, Michigan. This type of promissory note outlines the terms and conditions of the loan, including the repayment schedule, interest rate, and the collateral offered as security, which is the residential property in Grand Rapids. The purpose of this note is to provide a detailed description of the specific terms and conditions related to the loan. It ensures that both parties understand their rights and obligations throughout the lending process. The key focus of the document is on the repayment schedule, fixed interest rate, and the property securing the loan. There are variations of the Grand Rapids Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate, tailored to meet different needs: 1. Purchase Loan Promissory Note: This type of note represents a loan taken by a borrower to purchase a residential property in Grand Rapids, Michigan. It specifies the loan amount, interest rate, repayment schedule, and the terms related to the transfer of ownership. 2. Refinance Loan Promissory Note: This note is used when a borrower wants to refinance their existing residential property in Grand Rapids, Michigan. It outlines the terms of the new loan, including the outstanding loan balance, interest rate, repayment schedule, and any conditions related to the refinancing process. 3. Home Equity Loan Promissory Note: In cases where homeowners in Grand Rapids, Michigan wants to tap into the equity of their residential property, this type of note is utilized. It determines the loan amount, fixed interest rate, repayment schedule, and provisions for securing the loan against the property's equity. In Grand Rapids, Michigan, a Promissory Note Secured by Residential Real Estate is an essential document that provides legal protection and clarity to both the borrower and lender. It ensures that all parties involved understand their rights and obligations throughout the loan repayment period.

Grand Rapids Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out Grand Rapids Michigan Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

If you have previously used our service, Log In to your account and save the Grand Rapids Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate on your device by clicking the Download button. Ensure your subscription is active. If not, renew it based on your payment arrangement.

If this is your initial engagement with our service, follow these straightforward steps to obtain your document.

You have uninterrupted access to all documents you have purchased: you can find them in your profile under the My documents section whenever you wish to reuse them. Utilize the US Legal Forms service to quickly find and save any template for your personal or professional requirements!

- Confirm that you have found the correct document. Review the description and use the Preview feature, if available, to verify if it satisfies your requirements. If it does not fit your needs, use the Search tab above to locate the appropriate one.

- Purchase the template. Hit the Buy Now button and choose a subscription plan, either monthly or yearly.

- Establish an account and make a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Acquire your Grand Rapids Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate. Choose the desired file format for your document and save it on your device.

- Fill out your sample. Print it or utilize professional online editors to complete and sign it digitally.

Form popularity

FAQ

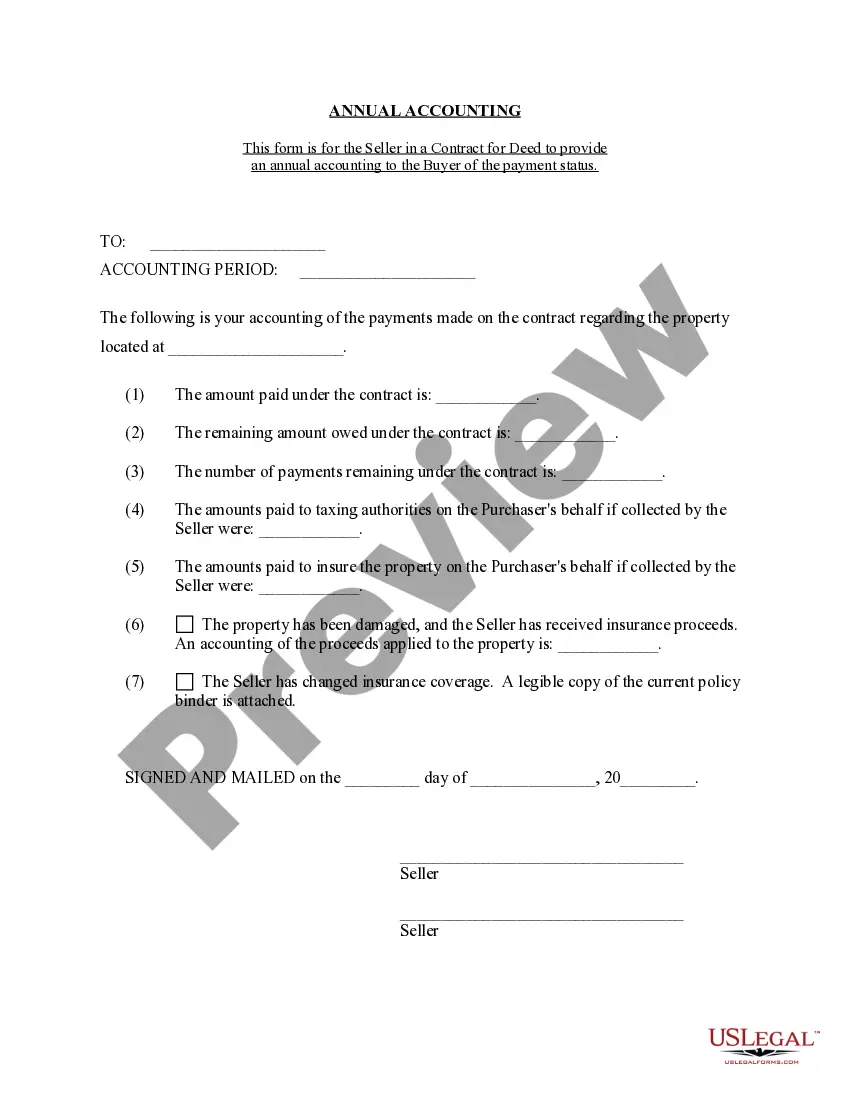

To set up a payment agreement, you first need to outline the terms clearly in writing. This includes the amount owed, payment schedule, and any penalties for late payments. When dealing with a Grand Rapids Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate, detailing these terms helps solidify the expectations between parties. Consider using the uslegalforms platform to easily create a comprehensive payment agreement template.

Setting up a payment plan with the state of Michigan requires contacting the appropriate state department. You will need to discuss your financial situation and propose a plan that outlines how you intend to make payments. When securing a Grand Rapids Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate, having a clear plan in writing can support your negotiations. Again, platforms like uslegalforms can provide the necessary documents to streamline this process.

Yes, you can make payment arrangements with the state of Michigan. These arrangements often involve structured payment plans to address taxes or fines. If you opt for a Grand Rapids Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate, you can outline these payments clearly. Utilizing the uslegalforms platform can assist you in formalizing these arrangements in a way that meets state requirements.

Creating a payment plan is straightforward. You start by determining the total amount you need to repay, and then you break it down into manageable installments. In the context of a Grand Rapids Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate, this plan outlines your monthly payment schedule, making it easier to manage your finances. Consider using uslegalforms platform for templates that can guide you in outlining your payment plan effectively.

To fill out a promissory demand note, start by including the borrower's and lender's names along with their addresses. Specify the amount borrowed, and since it is a demand note, indicate that repayment is required upon the lender's request. In the context of a Grand Rapids Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate, ensure that all security details regarding collateral are also included.

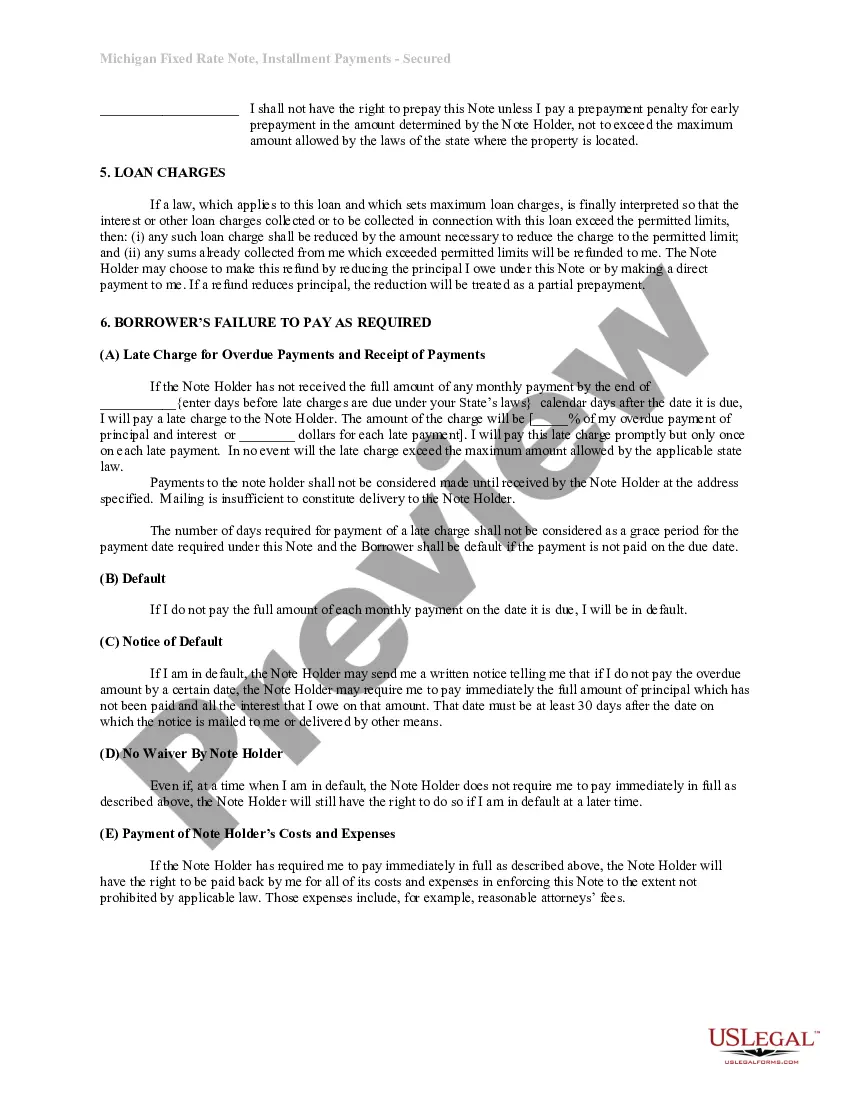

The rules for promissory notes typically include requirements about clarity and enforceability. For example, a Grand Rapids Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate must include the principal amount, interest rate, and repayment terms. Additionally, both parties must sign the note, ensuring mutual consent to the terms.

The promissory note policy outlines the guidelines and procedures for creating and managing promissory notes. For a Grand Rapids Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate, this policy ensures compliance with local laws and protects the interests of both borrowers and lenders. Following this policy helps prevent disputes down the line.

Yes, a promissory note is a legally binding document. This means that if one party fails to fulfill the terms of the Grand Rapids Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate, the other party can take legal action. It is essential to ensure that all terms are explicitly stated to avoid misunderstandings.

The promissory rule refers to the legal principle that governs the enforcement of promissory notes. It ensures that the terms agreed upon in a Grand Rapids Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate are honored by both the borrower and lender. This rule reinforces the importance of clear and fair communication in financial agreements.

Promissory notes can be considered a fixed-income investment depending on their structure. A Grand Rapids Michigan Installments Fixed Rate Promissory Note Secured by Residential Real Estate typically generates regular, predictable payments over time. This consistency can provide borrowers with peace of mind, while offering lenders a reliable return. Therefore, these notes create a stable financial arrangement that appeals to both parties.