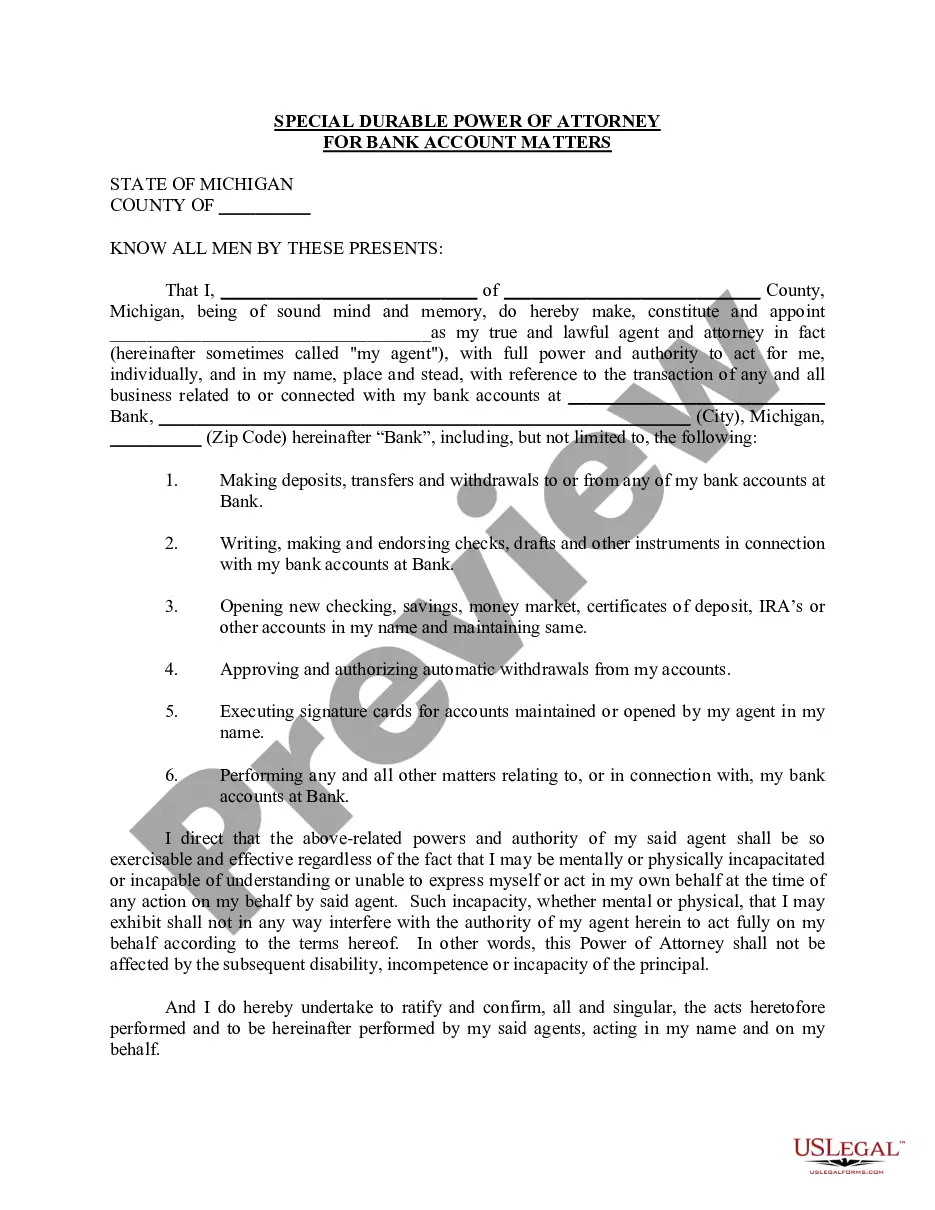

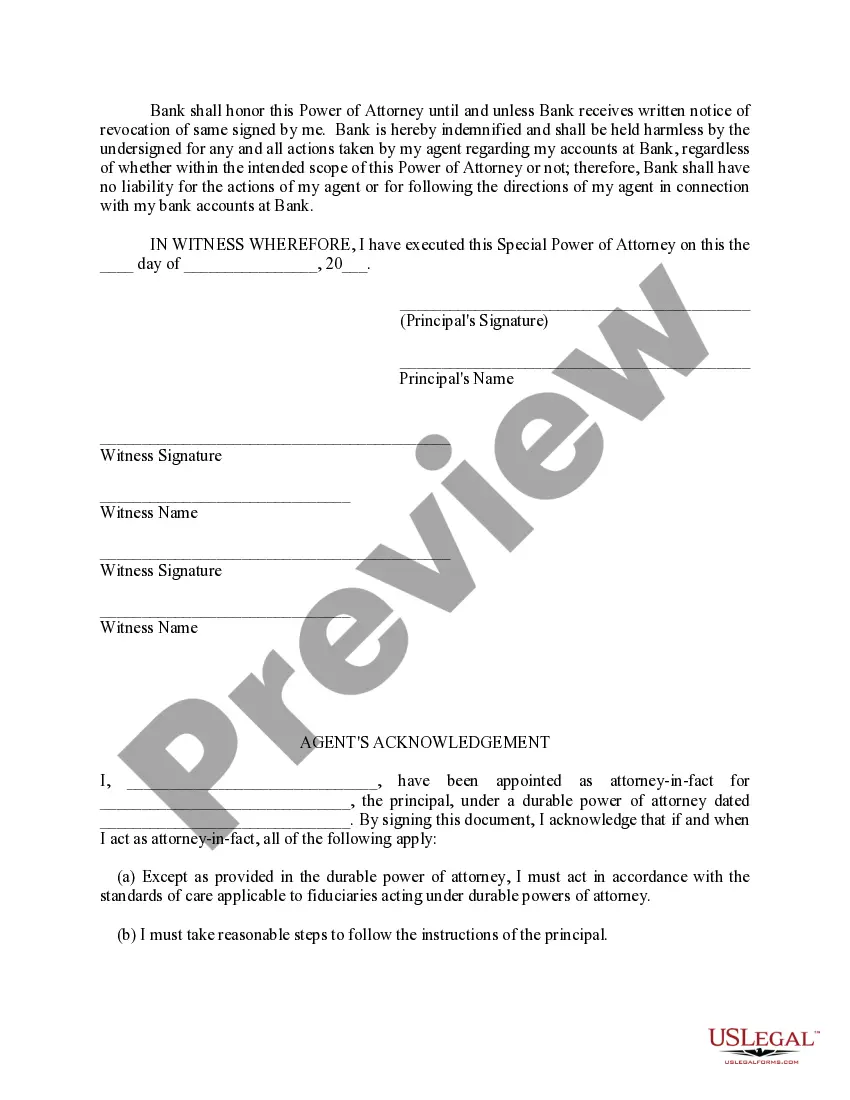

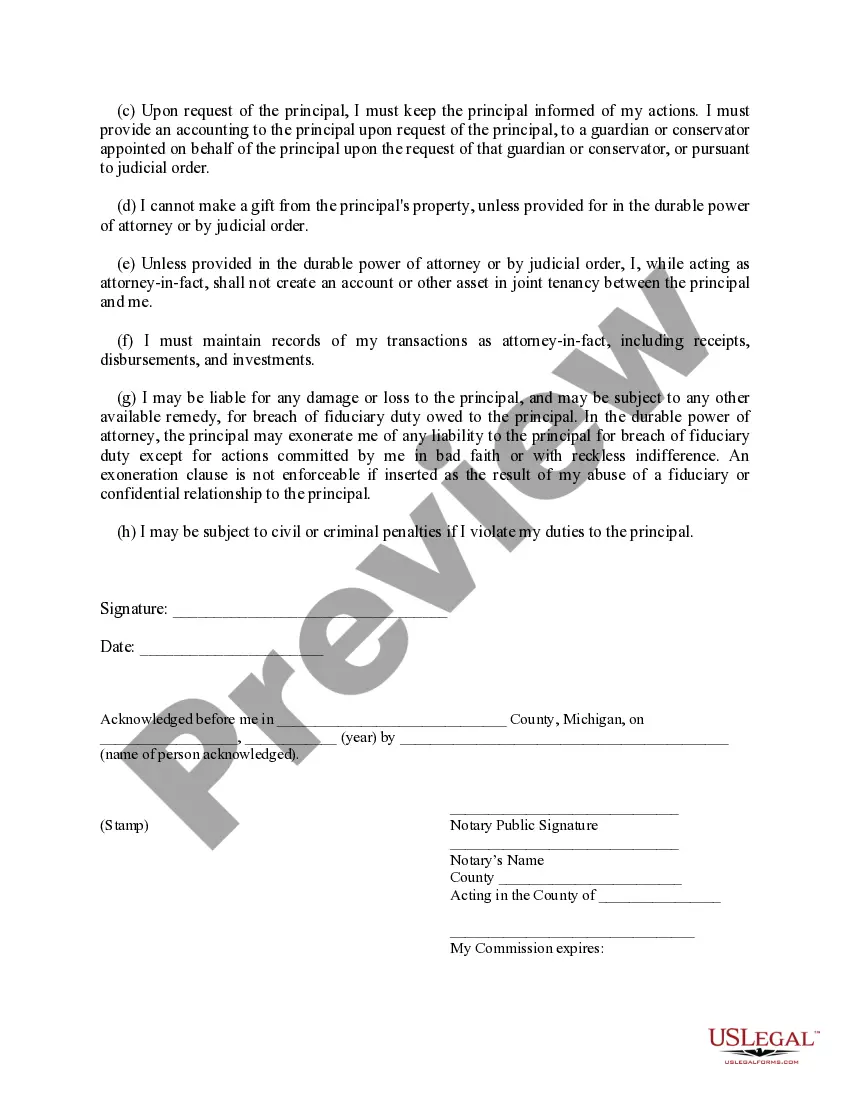

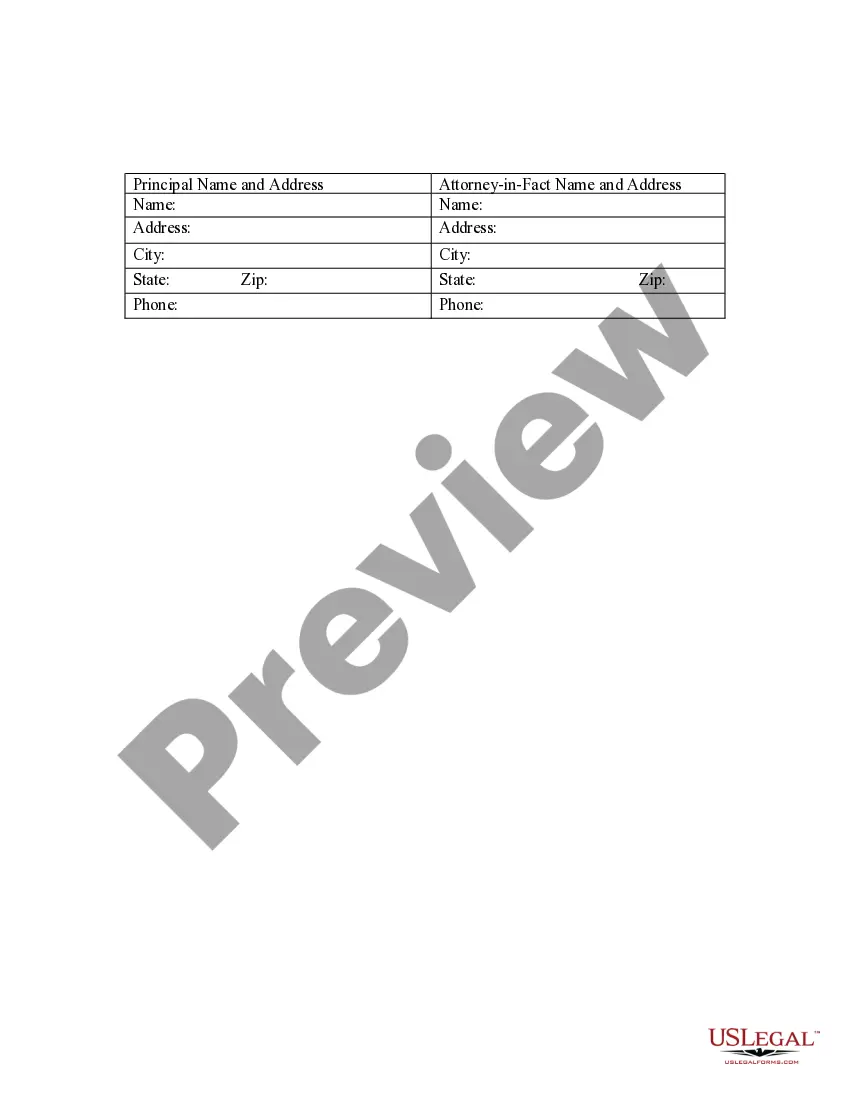

A Detroit Michigan Special Durable Power of Attorney for Bank Account Matters is a legal document that authorizes a designated individual, known as the agent, to handle specific banking transactions and matters on behalf of the principal. This type of power of attorney is specifically designed to grant the agent the authority to manage the principal's bank accounts and make decisions related to them. Keywords: Detroit Michigan, special durable power of attorney, bank account matters, legal document, agent, principal, banking transactions, authority, manage bank accounts, decision-making. There may be different types or variations of this Special Durable Power of Attorney for Bank Account Matters, depending on the specific requirements or preferences of the principal. These variations could include: 1. General Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney grants the agent broad authority to manage and handle all banking transactions and matters related to the principal's bank accounts. It covers a wide range of financial decisions and actions. 2. Limited Special Durable Power of Attorney for Bank Account Matters: This variation restricts the agent's authority to specific banking transactions or matters as defined by the principal. It limits the agent's power to a particular scope of actions, such as the ability to deposit or withdraw funds from specific accounts. 3. Conditional Special Durable Power of Attorney for Bank Account Matters: In this type, the agent's authority is contingent upon certain conditions being met. For example, the power of attorney might specify that the agent's authority can only be exercised in the event of the principal's incapacity or absence. 4. Springing Special Durable Power of Attorney for Bank Account Matters: This type only becomes effective when a specific triggering event occurs, such as the principal's incapacitation, illness, or absence. Until the triggering event happens, the agent does not have any authority. It is important to consult with an attorney familiar with Detroit Michigan laws to ensure that a Special Durable Power of Attorney for Bank Account Matters complies with the specific legal requirements of the state. The legal document should clearly outline the agent's authority, limitations, and any conditions or triggers that apply. Additionally, the power of attorney should be properly executed, notarized, and filed with the appropriate financial institutions to ensure its validity and acceptance by banks or other financial institutions.

Detroit Michigan Special Durable Power of Attorney for Bank Account Matters

Description

How to fill out Detroit Michigan Special Durable Power Of Attorney For Bank Account Matters?

If you are searching for a relevant form template, it’s difficult to find a more convenient platform than the US Legal Forms site – probably the most extensive libraries on the internet. With this library, you can get a huge number of templates for company and individual purposes by categories and states, or key phrases. Using our advanced search function, finding the most recent Detroit Michigan Special Durable Power of Attorney for Bank Account Matters is as easy as 1-2-3. Moreover, the relevance of each record is confirmed by a group of skilled lawyers that regularly check the templates on our platform and revise them in accordance with the most recent state and county laws.

If you already know about our platform and have a registered account, all you need to get the Detroit Michigan Special Durable Power of Attorney for Bank Account Matters is to log in to your user profile and click the Download button.

If you make use of US Legal Forms for the first time, just follow the instructions below:

- Make sure you have chosen the sample you require. Read its explanation and use the Preview option to explore its content. If it doesn’t meet your needs, utilize the Search option at the top of the screen to discover the appropriate document.

- Affirm your decision. Select the Buy now button. Next, pick your preferred pricing plan and provide credentials to sign up for an account.

- Process the transaction. Utilize your bank card or PayPal account to complete the registration procedure.

- Receive the template. Pick the format and download it to your system.

- Make changes. Fill out, edit, print, and sign the acquired Detroit Michigan Special Durable Power of Attorney for Bank Account Matters.

Each and every template you add to your user profile does not have an expiry date and is yours permanently. You can easily access them via the My Forms menu, so if you need to get an additional version for modifying or creating a hard copy, feel free to return and download it once more anytime.

Take advantage of the US Legal Forms extensive library to get access to the Detroit Michigan Special Durable Power of Attorney for Bank Account Matters you were looking for and a huge number of other professional and state-specific samples on a single platform!