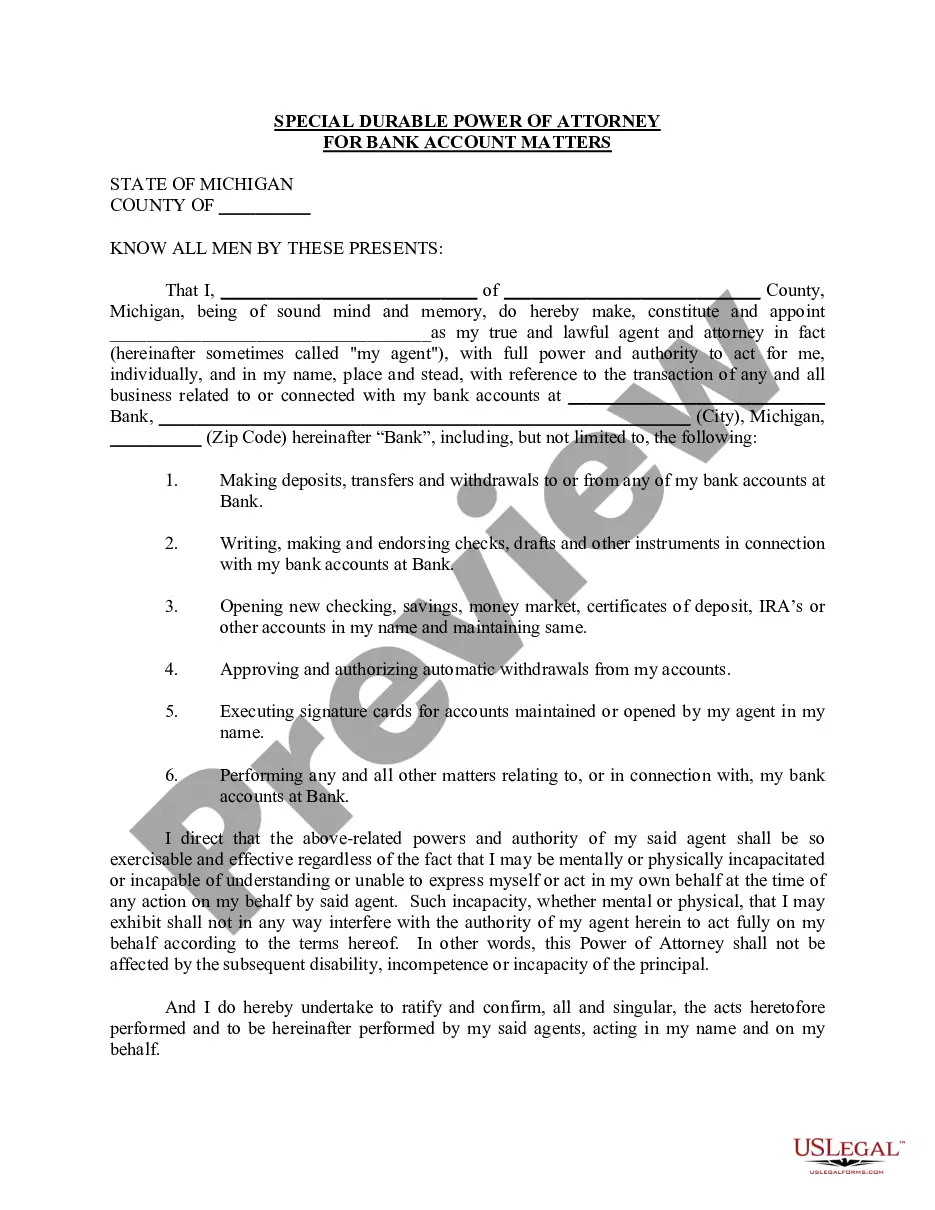

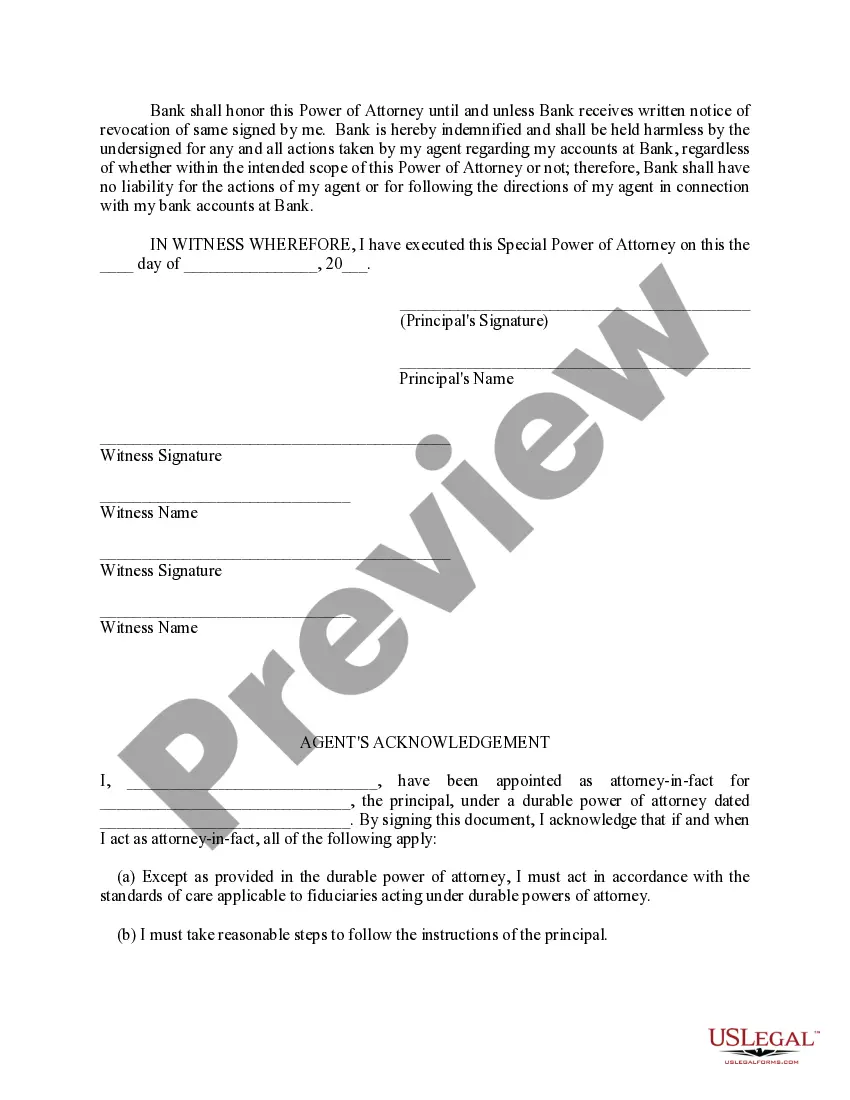

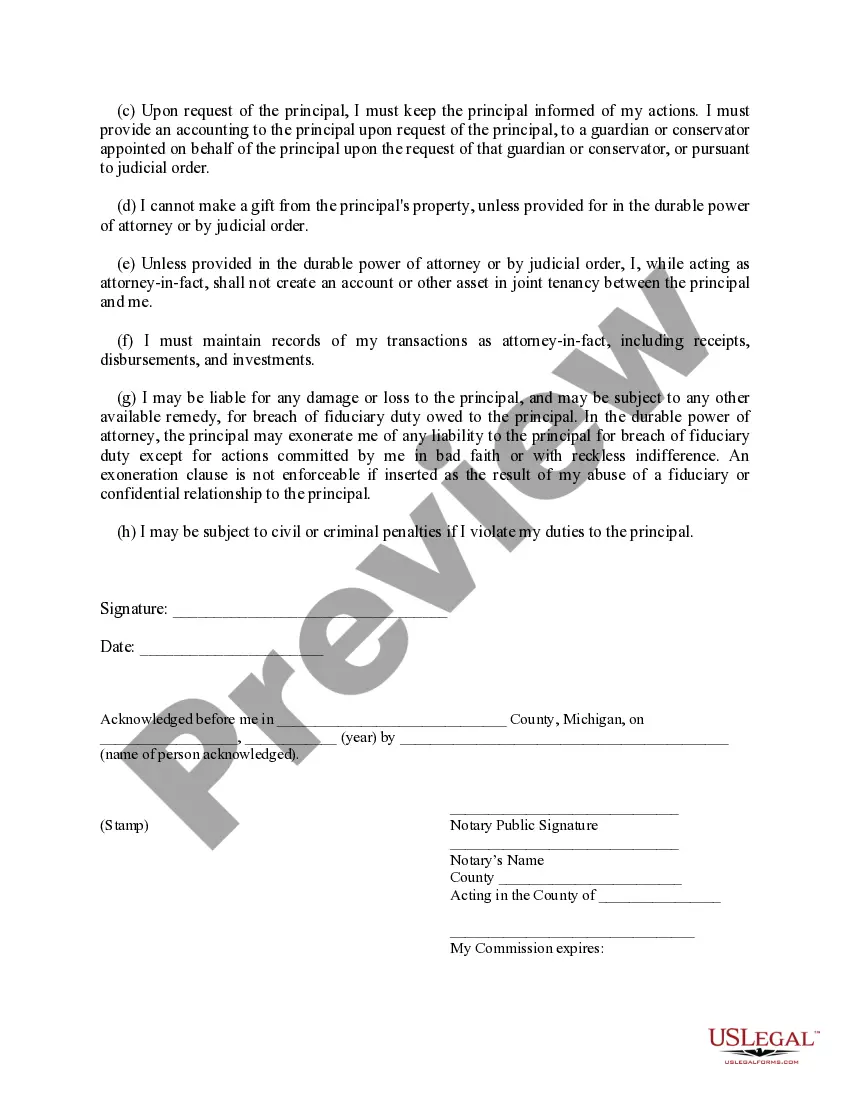

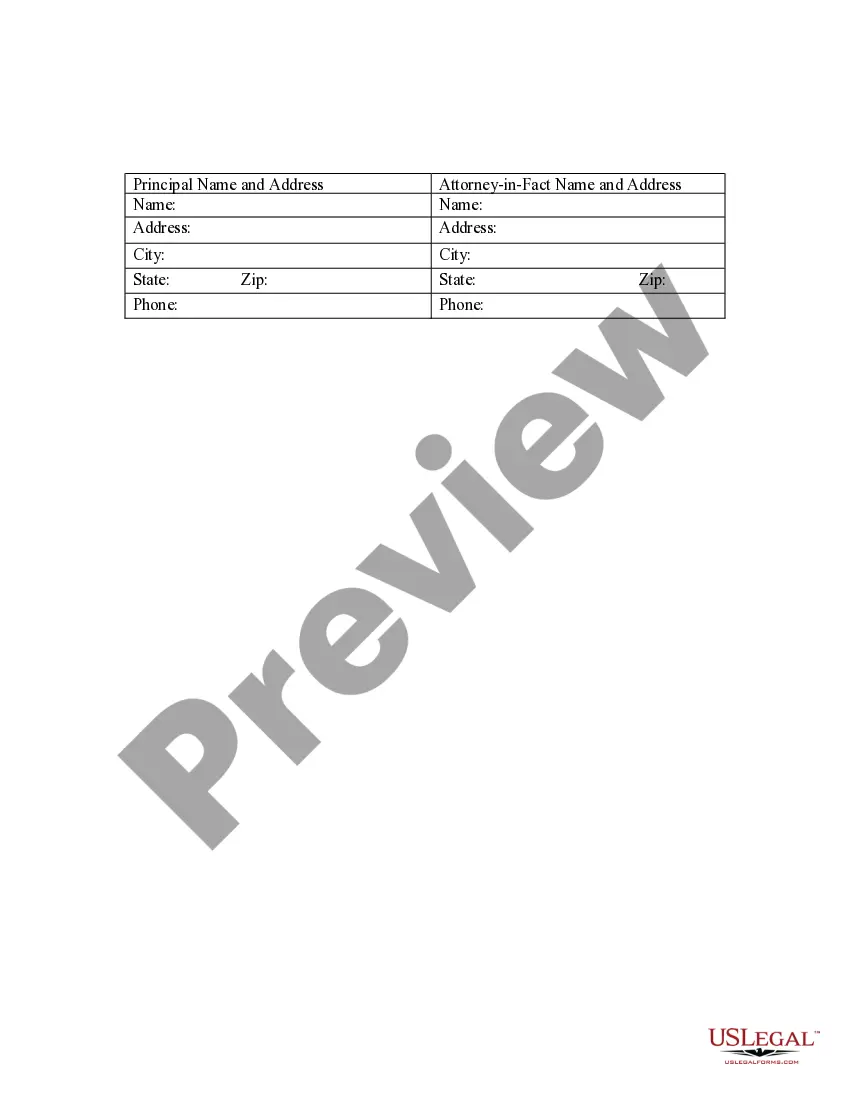

Lansing, Michigan Special Durable Power of Attorney for Bank Account Matters is a legal document that grants a designated individual or attorney-in-fact the authority to manage specific bank account matters on behalf of an individual residing in Lansing, Michigan. This specialized power of attorney is crucial for maintaining control over financial matters when an individual is unable to handle them due to various circumstances, such as illness, disability, or being out of the country. This specific type of power of attorney focuses only on bank account matters, enabling the attorney-in-fact to make decisions regarding the management, access, and handling of the principal's bank accounts. These decisions may include, but are not limited to, depositing or withdrawing funds, transferring money between accounts, paying bills, and reconciling statements. There are variations of the Lansing, Michigan Special Durable Power of Attorney for Bank Account Matters that cater to different circumstances and needs. Some specific types include: 1. Medical Power of Attorney: This power of attorney grants the designated individual the authority to make medical decisions on behalf of the principal if they become incapacitated or unable to communicate their preferences. 2. Financial Power of Attorney: This type grants the designated individual the authority to manage the principal's entire financial portfolio, including investments, real estate transactions, and other financial assets, in addition to bank account matters. 3. Limited Power of Attorney: A limited power of attorney gives the designated individual the authority to perform specific actions on behalf of the principal, such as signing checks, making deposits, or handling a particular bank account matter, for a defined period. 4. Springing Power of Attorney: This power of attorney becomes effective only upon the occurrence of a specific event, such as the principal's incapacity or disability. It allows the attorney-in-fact to manage the designated bank account matters under the specified conditions. It is important to consult with an experienced attorney to ensure that the Lansing, Michigan Special Durable Power of Attorney for Bank Account Matters is drafted accurately and meets the specific requirements and intentions of the principal. This legal document plays a vital role in safeguarding an individual's financial interests and ensuring that their bank account matters are managed efficiently during challenging periods.

Lansing Michigan Special Durable Power of Attorney for Bank Account Matters

Description

How to fill out Lansing Michigan Special Durable Power Of Attorney For Bank Account Matters?

Getting verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Lansing Michigan Special Durable Power of Attorney for Bank Account Matters becomes as quick and easy as ABC.

For everyone already familiar with our service and has used it before, obtaining the Lansing Michigan Special Durable Power of Attorney for Bank Account Matters takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a couple of more steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make certain you’ve selected the correct one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, use the Search tab above to get the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Lansing Michigan Special Durable Power of Attorney for Bank Account Matters. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!