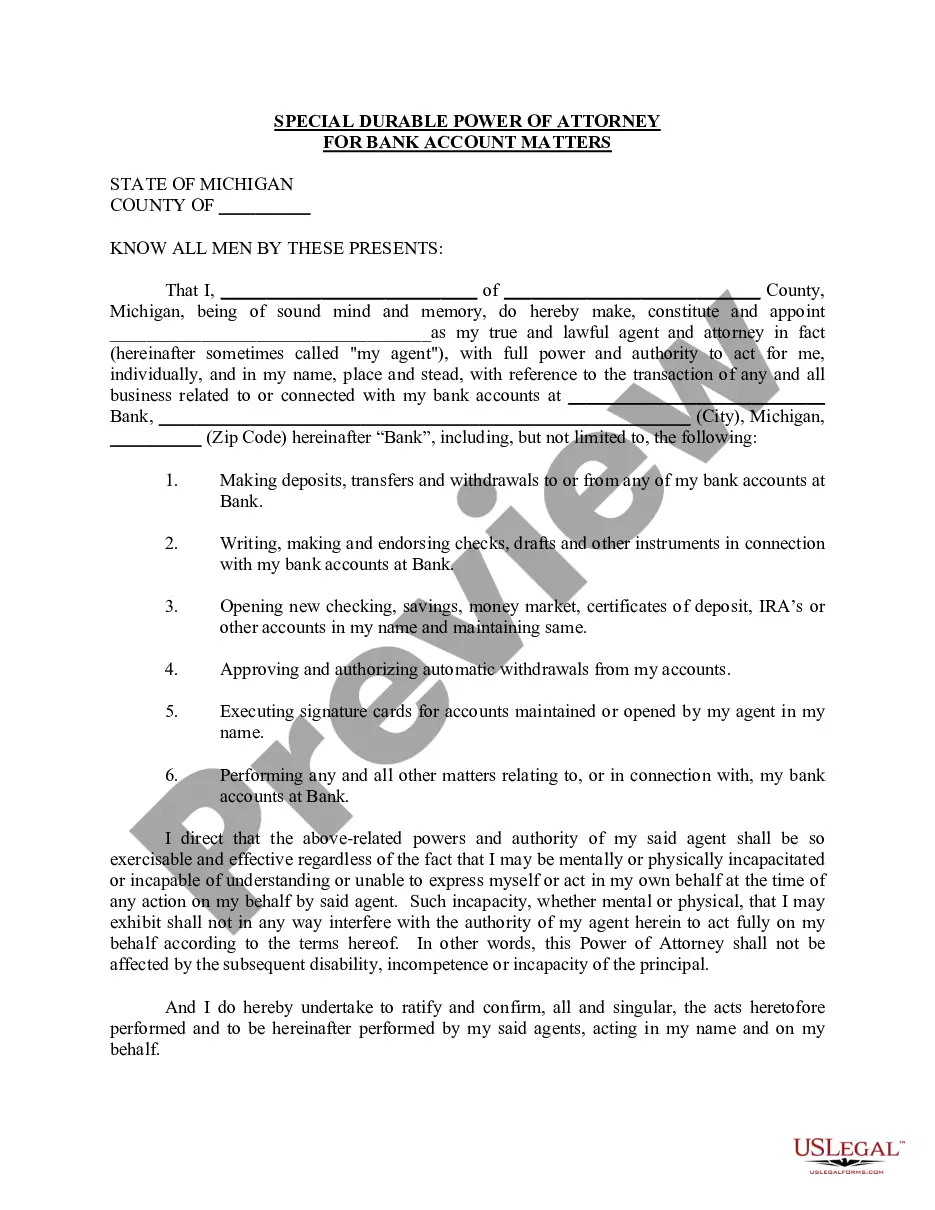

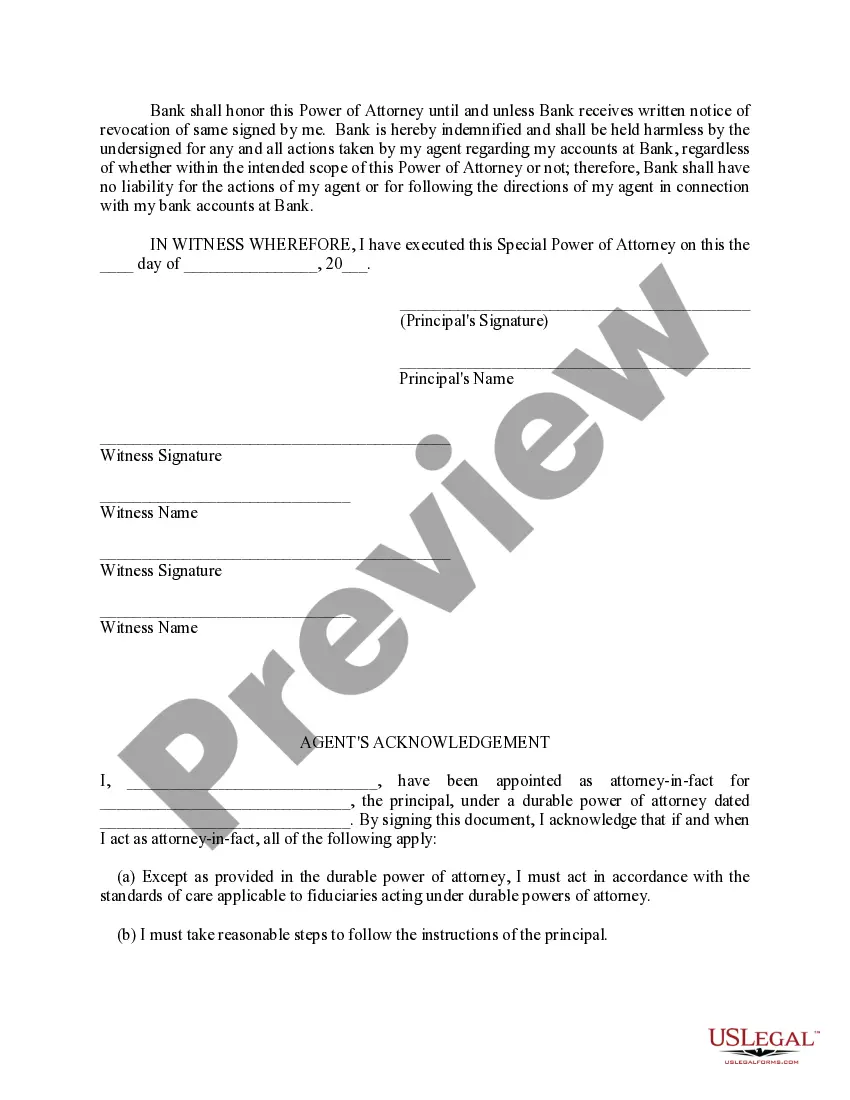

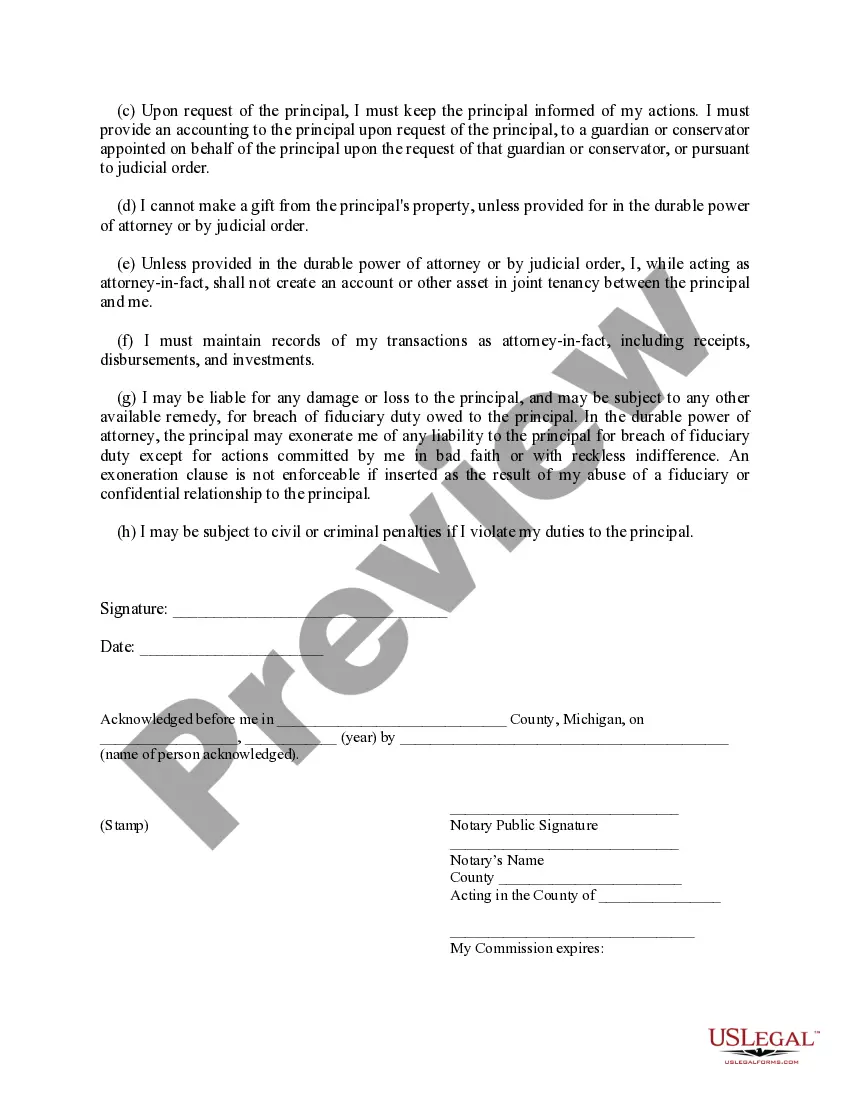

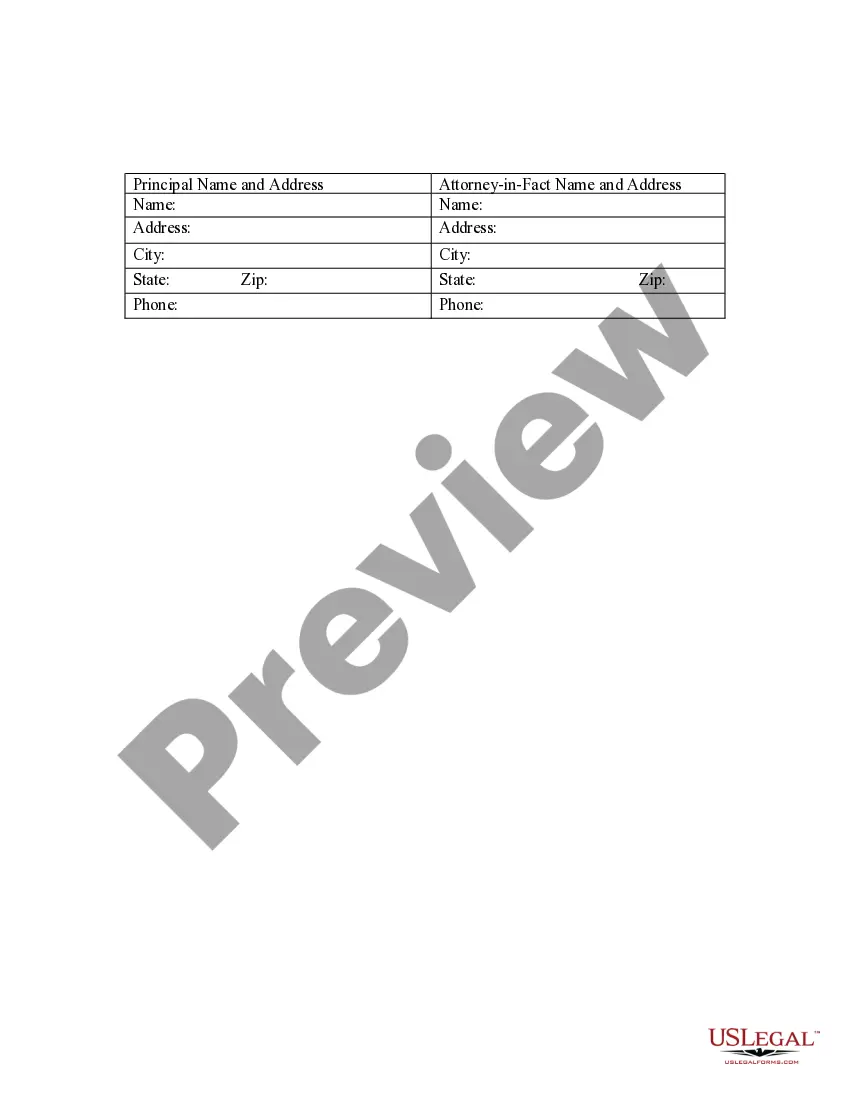

Oakland Michigan Special Durable Power of Attorney for Bank Account Matters is a legally binding document that grants specific powers to an appointed individual (known as the agent or attorney-in-fact) to handle bank account-related matters on behalf of the principal (the person granting the power). This type of power of attorney is designed to be durable, meaning it remains in effect even if the principal becomes incapacitated or mentally incompetent. The Oakland Michigan Special Durable Power of Attorney for Bank Account Matters enables the agent to perform various actions concerning the principal's bank accounts, such as making deposits and withdrawals, managing funds, paying bills, transferring funds, opening or closing accounts, initiating wire transfers, and executing other financial transactions related to the principal's bank accounts. By executing this Special Durable Power of Attorney, the principal can appoint a trusted individual to act on their behalf, ensuring that their bank accounts are managed efficiently, even if they are unable to do so themselves due to illness, injury, or absence. In Oakland Michigan, there are various types of Special Durable Power of Attorney for Bank Account Matters that may be named based on specific circumstances or requirements. Some examples are: 1. Limited Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney grants the agent limited authority, allowing them to perform only certain predetermined actions on behalf of the principal regarding their bank accounts. The powers and limitations are clearly specified within the document. 2. General Special Durable Power of Attorney for Bank Account Matters: A general power of attorney provides broader authority to the agent, enabling them to handle a wide range of bank account-related matters on behalf of the principal. This type can be suitable when the principal wants to grant extensive powers to the agent, allowing them to act comprehensively in managing their bank accounts. 3. Springing Special Durable Power of Attorney for Bank Account Matters: A springing power of attorney becomes effective only when a specific event specified in the document occurs, typically the incapacitation or mental incompetence of the principal. This type ensures that the agent's powers are not prematurely activated, providing a safeguard until the necessary conditions are met. It is important to consult with an attorney familiar with Oakland Michigan's laws and regulations to ensure the accuracy and legality of the Special Durable Power of Attorney for Bank Account Matters. Additionally, the principal should carefully consider whom they appoint as their agent, selecting someone they trust implicitly and who possesses the necessary skills to handle financial matters with integrity and competence.

Oakland Michigan Special Durable Power of Attorney for Bank Account Matters

Description

How to fill out Oakland Michigan Special Durable Power Of Attorney For Bank Account Matters?

If you are looking for a relevant form, it’s extremely hard to choose a better place than the US Legal Forms website – probably the most considerable libraries on the internet. Here you can find thousands of templates for company and individual purposes by categories and states, or keywords. Using our high-quality search option, discovering the newest Oakland Michigan Special Durable Power of Attorney for Bank Account Matters is as elementary as 1-2-3. Furthermore, the relevance of every file is confirmed by a group of professional attorneys that on a regular basis review the templates on our platform and revise them based on the newest state and county demands.

If you already know about our platform and have an account, all you should do to get the Oakland Michigan Special Durable Power of Attorney for Bank Account Matters is to log in to your user profile and click the Download option.

If you use US Legal Forms for the first time, just follow the guidelines listed below:

- Make sure you have opened the form you want. Read its explanation and utilize the Preview option (if available) to explore its content. If it doesn’t suit your needs, use the Search field near the top of the screen to discover the needed record.

- Confirm your decision. Choose the Buy now option. Following that, choose your preferred subscription plan and provide credentials to register an account.

- Process the financial transaction. Utilize your bank card or PayPal account to complete the registration procedure.

- Get the template. Choose the file format and save it to your system.

- Make adjustments. Fill out, revise, print, and sign the obtained Oakland Michigan Special Durable Power of Attorney for Bank Account Matters.

Every single template you add to your user profile has no expiry date and is yours permanently. It is possible to gain access to them using the My Forms menu, so if you need to receive an additional duplicate for editing or printing, feel free to come back and download it once more whenever you want.

Make use of the US Legal Forms extensive library to get access to the Oakland Michigan Special Durable Power of Attorney for Bank Account Matters you were seeking and thousands of other professional and state-specific templates on one website!