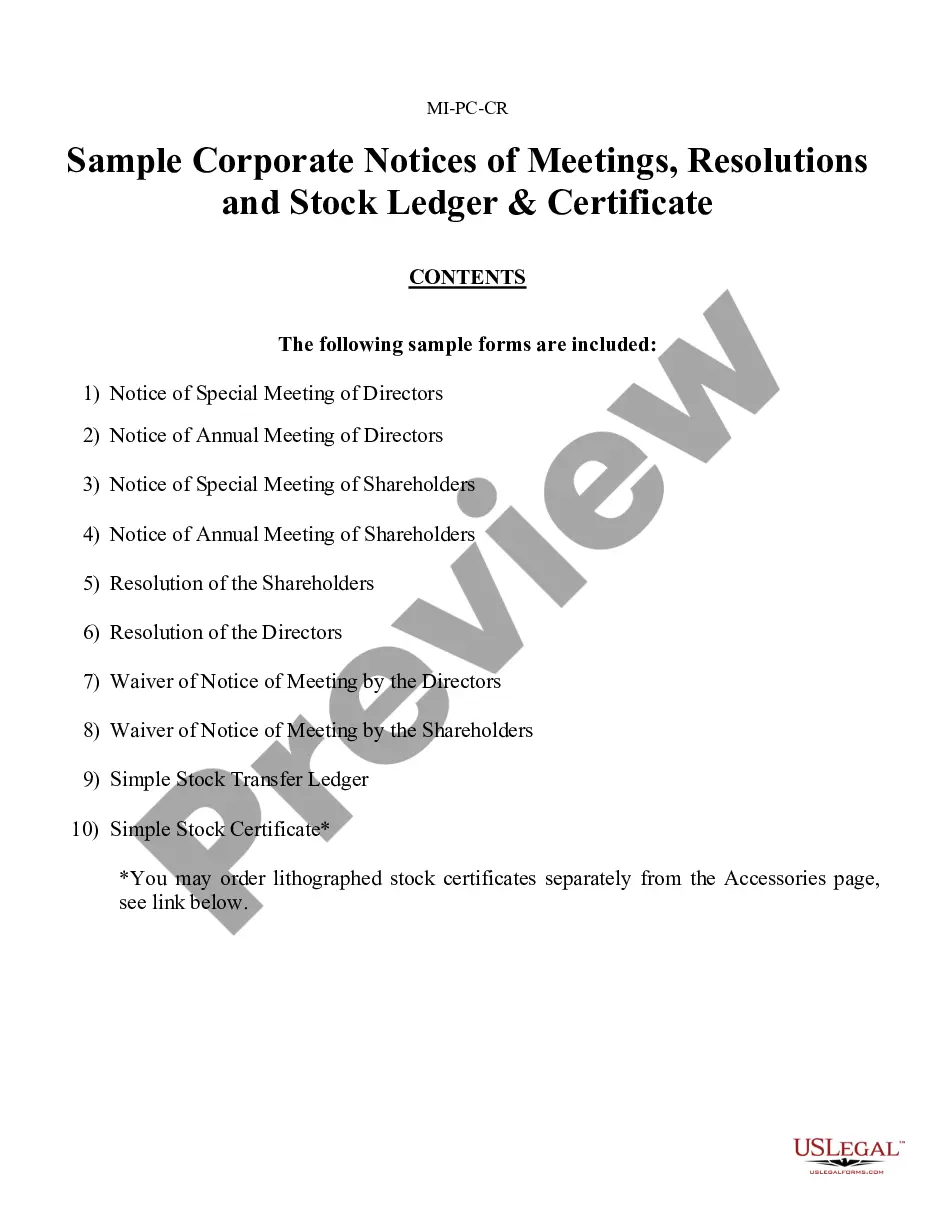

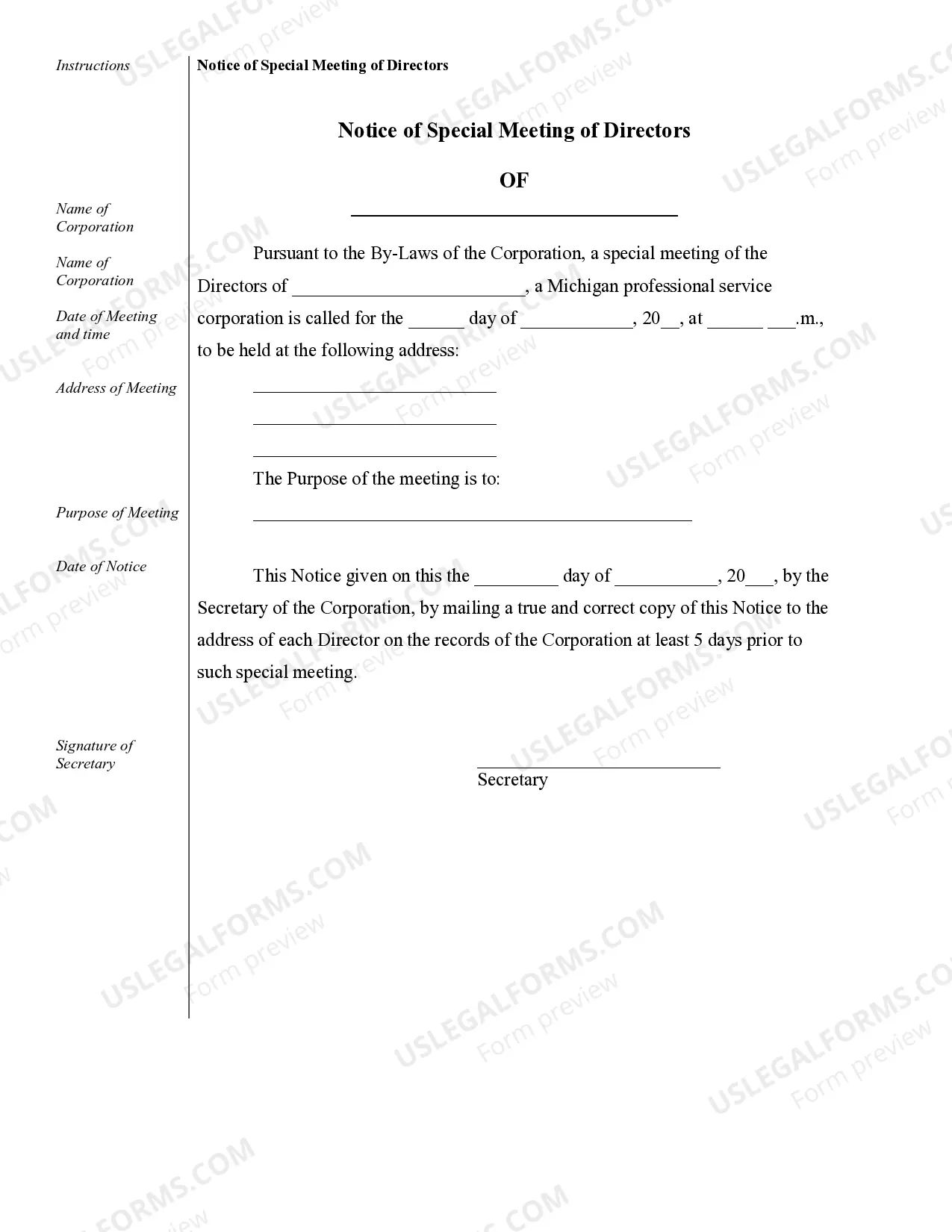

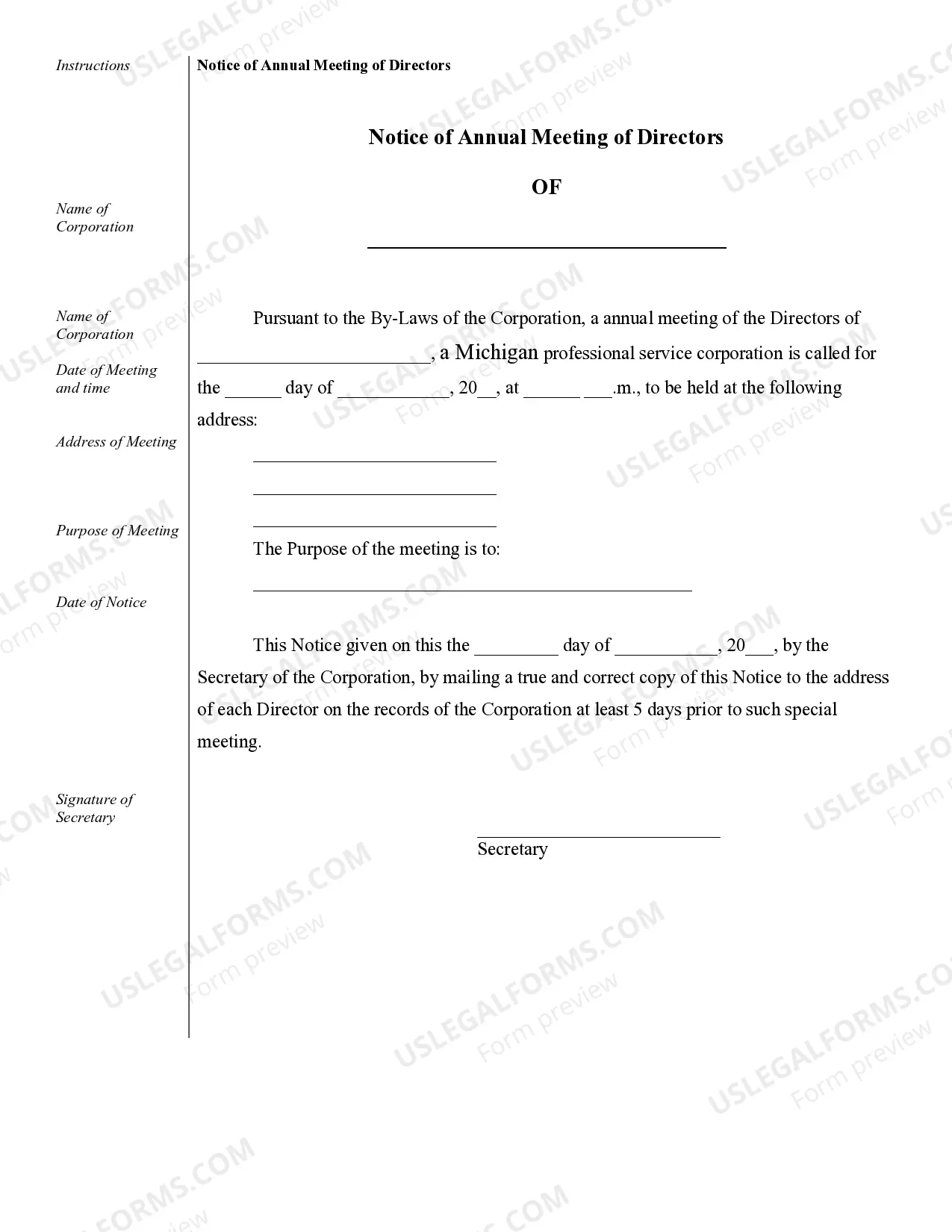

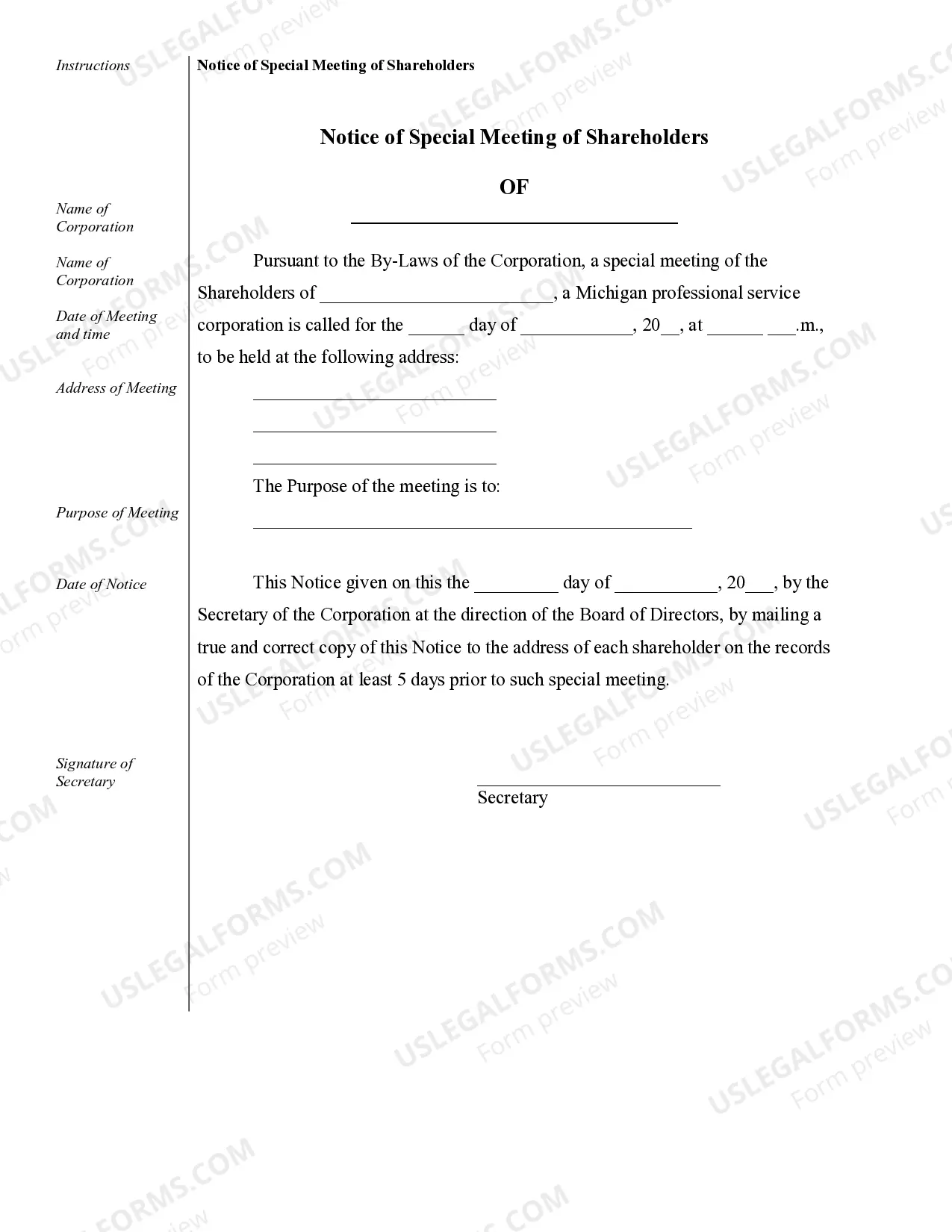

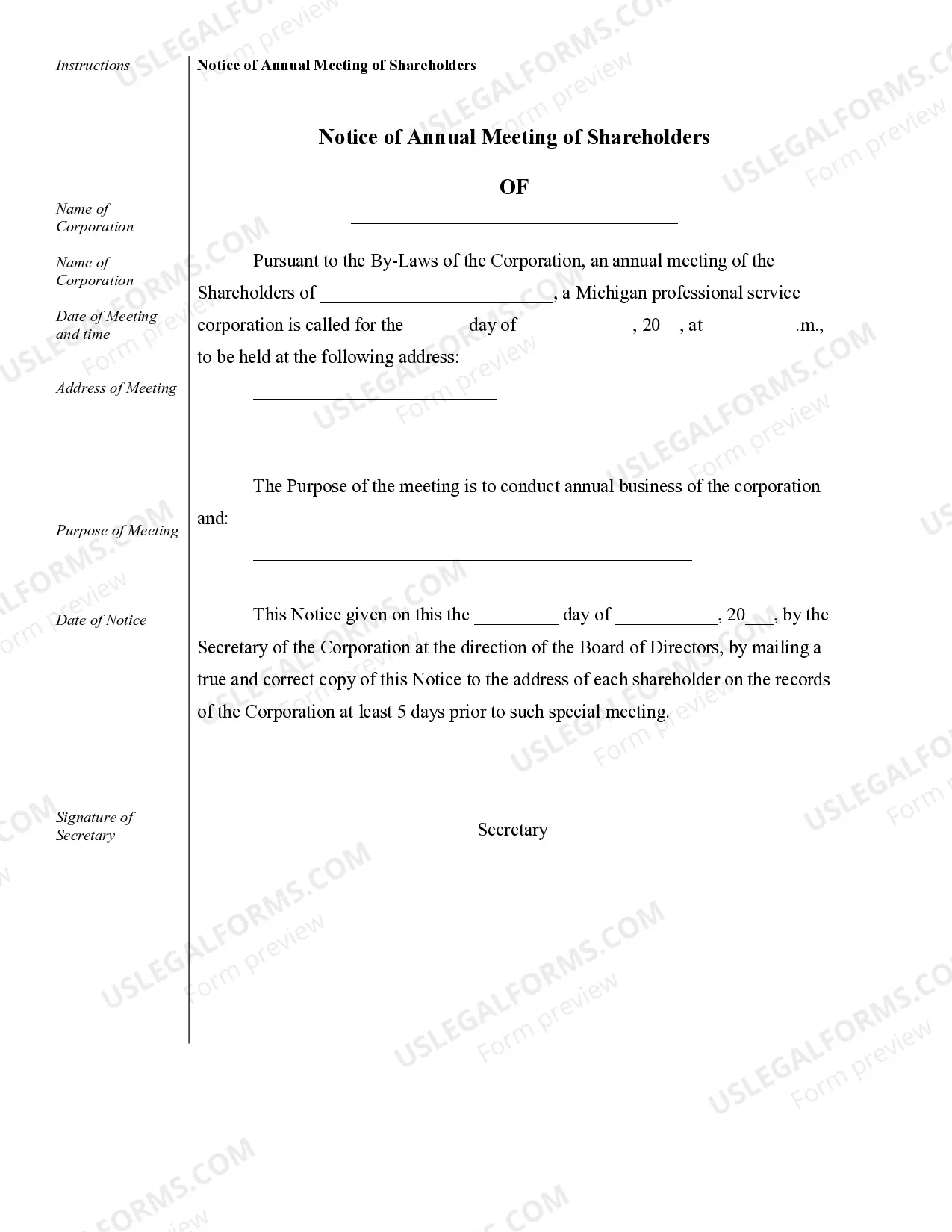

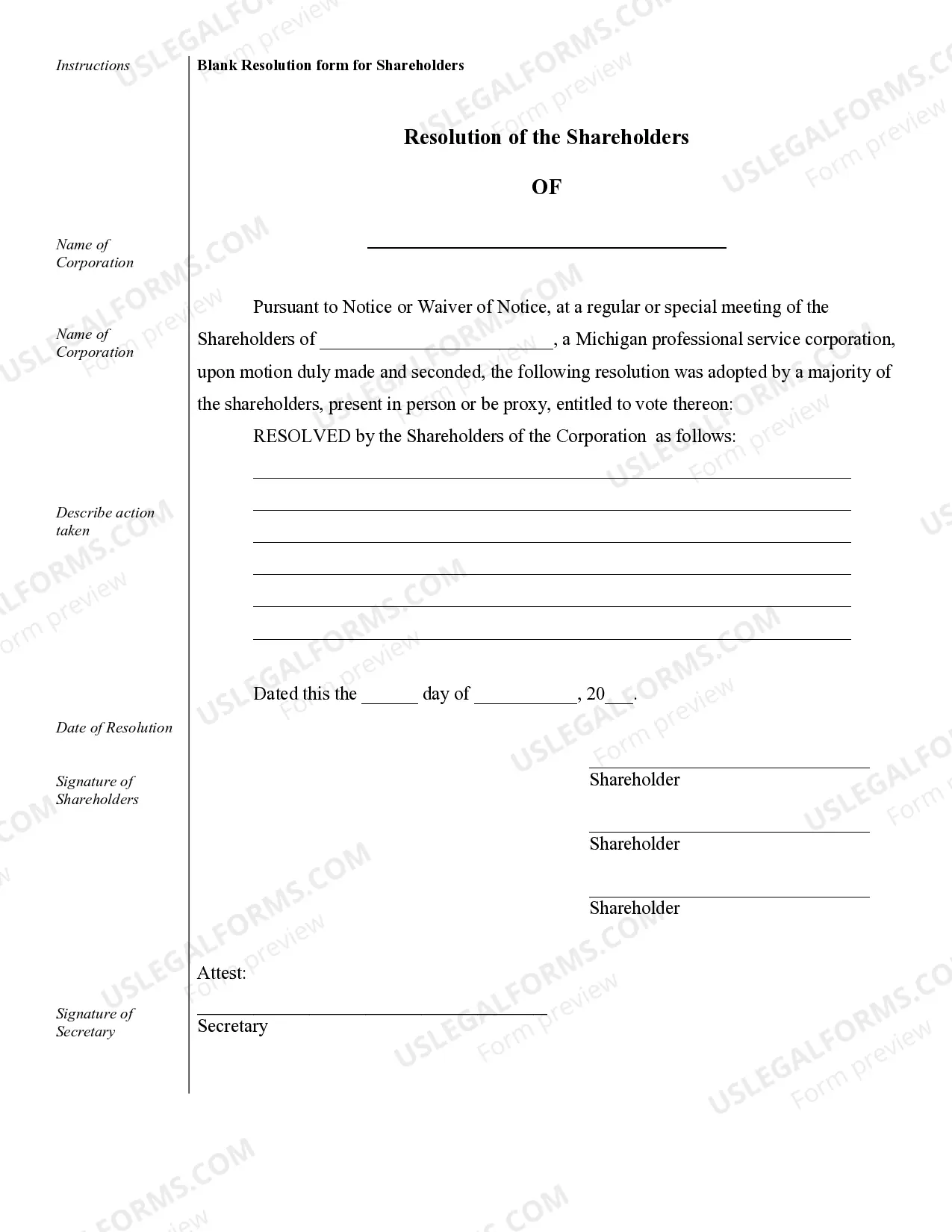

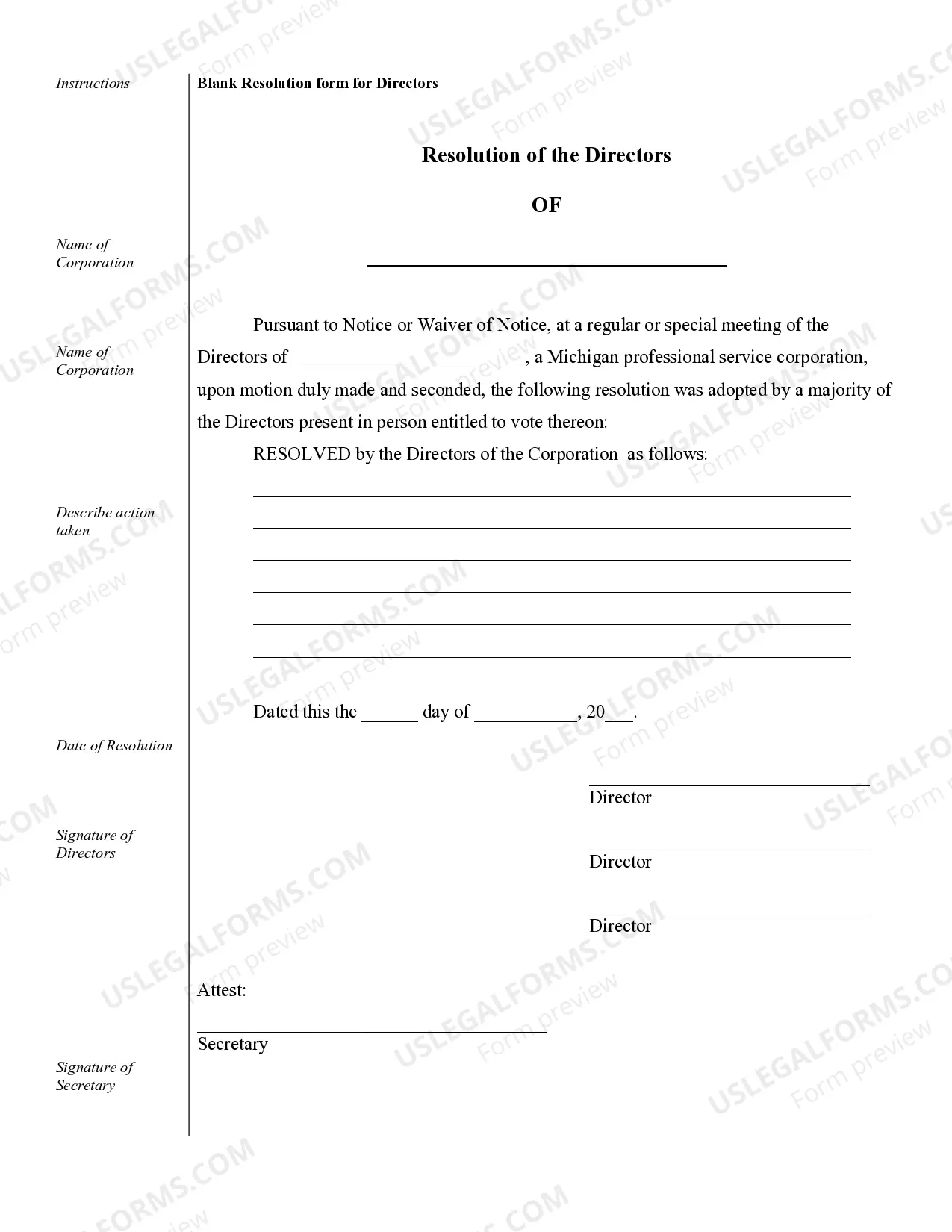

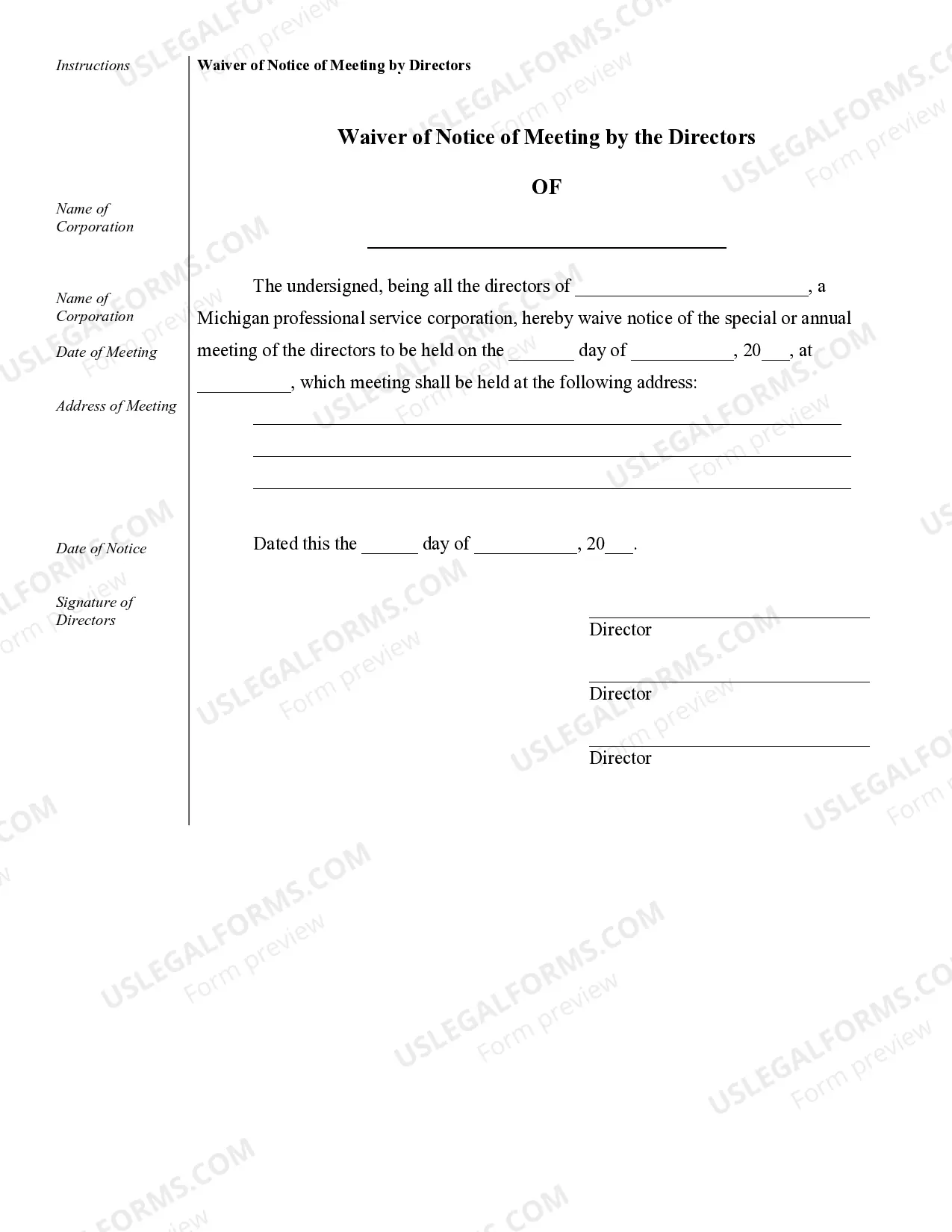

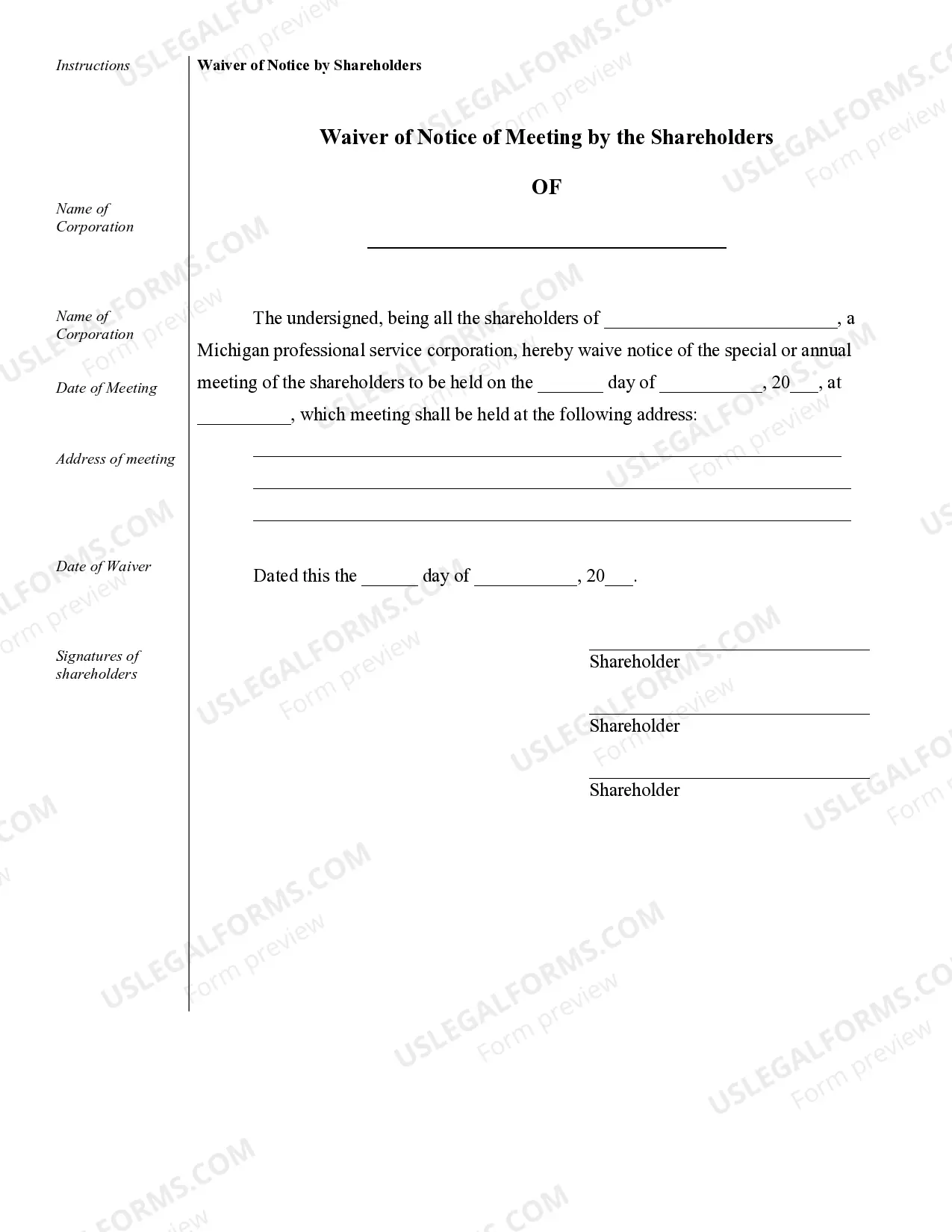

Detroit Sample Corporate Records for a Michigan Professional Corporation refer to a set of documents and records that are typically prepared and maintained by a professional corporation based in Detroit, Michigan. These records serve as an important tool for the corporation to comply with legal requirements, maintain transparency, and ensure proper corporate governance. Some common types of Detroit Sample Corporate Records for a Michigan Professional Corporation include: 1. Articles of Incorporation: This is the foundational document that establishes the existence of the corporation. It contains key information such as the corporation's name, purpose, duration, registered agent, and the number and types of shares authorized. 2. Bylaws: Bylaws outline the rules and procedures for the corporation's internal governance. They typically address matters such as the roles and responsibilities of directors and officers, meeting procedures, voting rights, and the resolution of disputes. 3. Shareholder Agreements: Shareholder agreements are contracts among the shareholders of the professional corporation. They outline the rights and obligations of shareholders, including issues such as share ownership, voting rights, share transfer restrictions, dividends, and dispute resolution mechanisms. 4. Meeting Minutes: Meeting minutes are detailed records of the discussions, decisions, and actions taken during shareholder, board of directors, and committee meetings. They typically include attendance, a summary of discussions, voting results, and key resolutions or approvals. 5. Stock Ledgers: Stock ledgers are registers that record the ownership of the corporation's shares, including the details of each shareholder, the number of shares held, and any transfers or changes in ownership. 6. Financial Statements: Financial statements provide an overview of the corporation's financial position, performance, and cash flows. These records include balance sheets, income statements, and cash flow statements prepared in accordance with Generally Accepted Accounting Principles (GAAP). 7. Annual Reports: An annual report summarizes the corporation's financial performance, operations, accomplishments, and future plans for the benefit of shareholders and other stakeholders. It may also include a letter from the CEO or chairperson, auditors' report, and other relevant information. 8. Tax Filings: Tax filings include various federal, state, and local tax returns and supporting documentation, such as the corporation's income tax returns (Form 1120), payroll tax returns (Form 941), sales tax returns, and any other filings required by relevant tax authorities. 9. Licenses and Permits: As a professional corporation, there may be specific licenses or permits required to operate legally in Detroit or the state of Michigan. These documents should be maintained in the corporate records, ensuring compliance with all licensing regulations. It is important to note that this is a general description of some common Detroit Sample Corporate Records for a Michigan Professional Corporation. The specific records required may vary based on the nature of the corporation's business, specific legal requirements, and any industry-specific regulations. Consulting with legal and accounting professionals is advisable to ensure compliance with all applicable laws and regulations.

Detroit Sample Corporate Records for a Michigan Professional Corporation

Description

How to fill out Detroit Sample Corporate Records For A Michigan Professional Corporation?

If you are looking for a valid form template, it’s impossible to find a better place than the US Legal Forms website – one of the most extensive libraries on the internet. Here you can get a large number of templates for business and individual purposes by types and regions, or keywords. With the high-quality search option, finding the most recent Detroit Sample Corporate Records for a Michigan Professional Corporation is as elementary as 1-2-3. Moreover, the relevance of each and every record is proved by a team of expert lawyers that on a regular basis check the templates on our website and revise them according to the newest state and county regulations.

If you already know about our platform and have a registered account, all you need to get the Detroit Sample Corporate Records for a Michigan Professional Corporation is to log in to your account and click the Download button.

If you use US Legal Forms for the first time, just refer to the instructions listed below:

- Make sure you have found the form you need. Read its information and utilize the Preview option to check its content. If it doesn’t suit your needs, use the Search option near the top of the screen to find the appropriate record.

- Affirm your choice. Choose the Buy now button. After that, choose the preferred pricing plan and provide credentials to register an account.

- Make the transaction. Utilize your credit card or PayPal account to complete the registration procedure.

- Obtain the form. Select the format and download it on your device.

- Make modifications. Fill out, revise, print, and sign the acquired Detroit Sample Corporate Records for a Michigan Professional Corporation.

Every single form you add to your account does not have an expiration date and is yours forever. You can easily gain access to them via the My Forms menu, so if you want to have an extra copy for modifying or creating a hard copy, you may come back and export it once more at any moment.

Take advantage of the US Legal Forms extensive library to get access to the Detroit Sample Corporate Records for a Michigan Professional Corporation you were seeking and a large number of other professional and state-specific samples on one website!