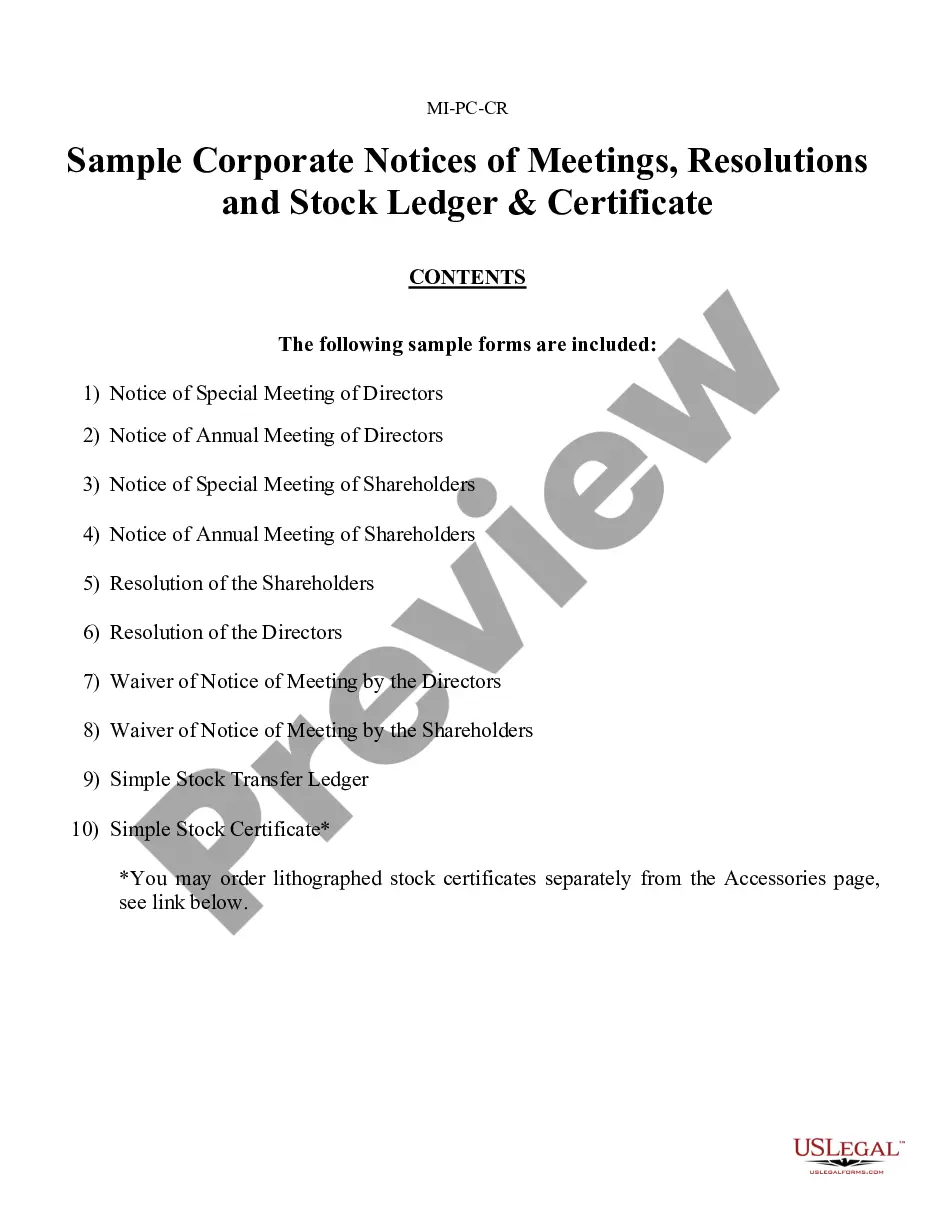

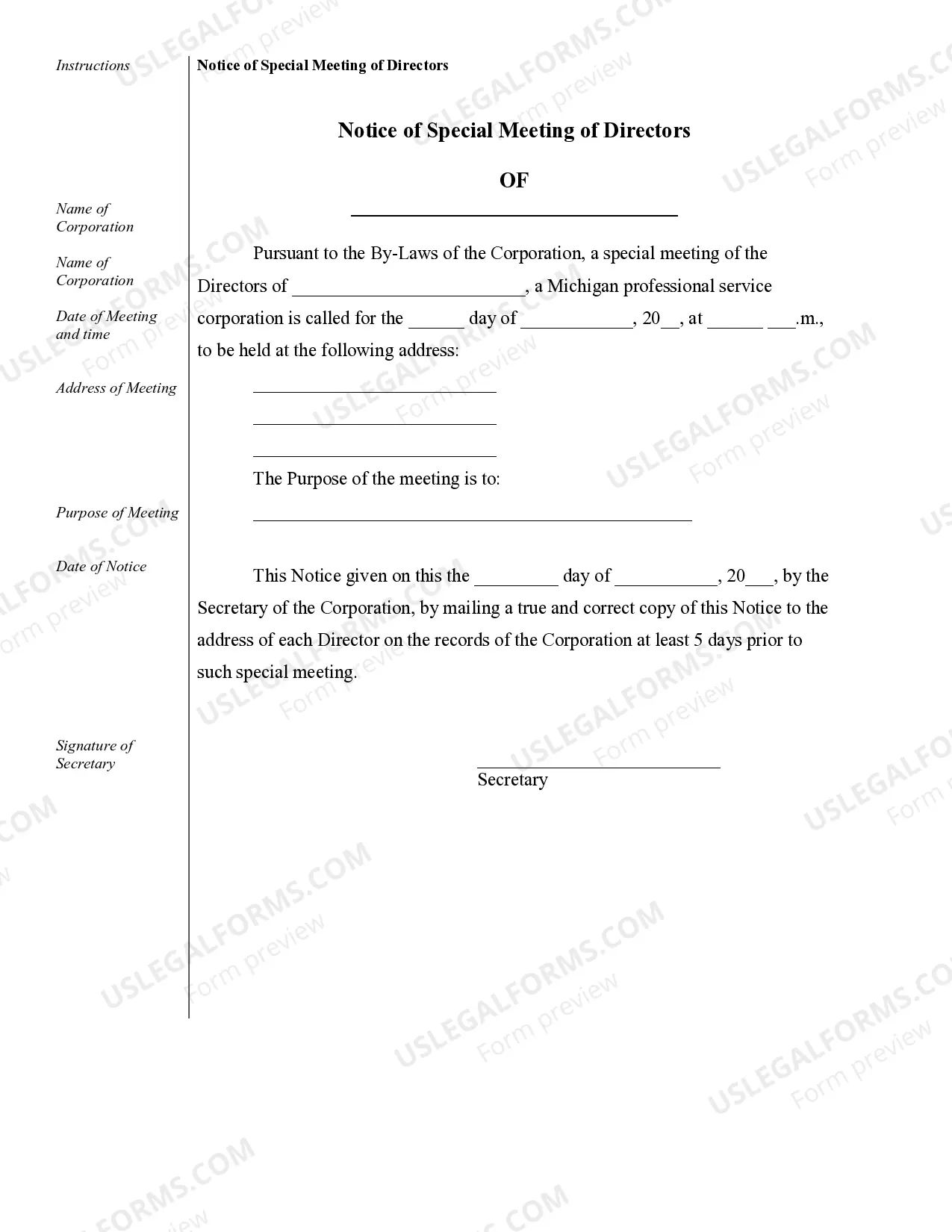

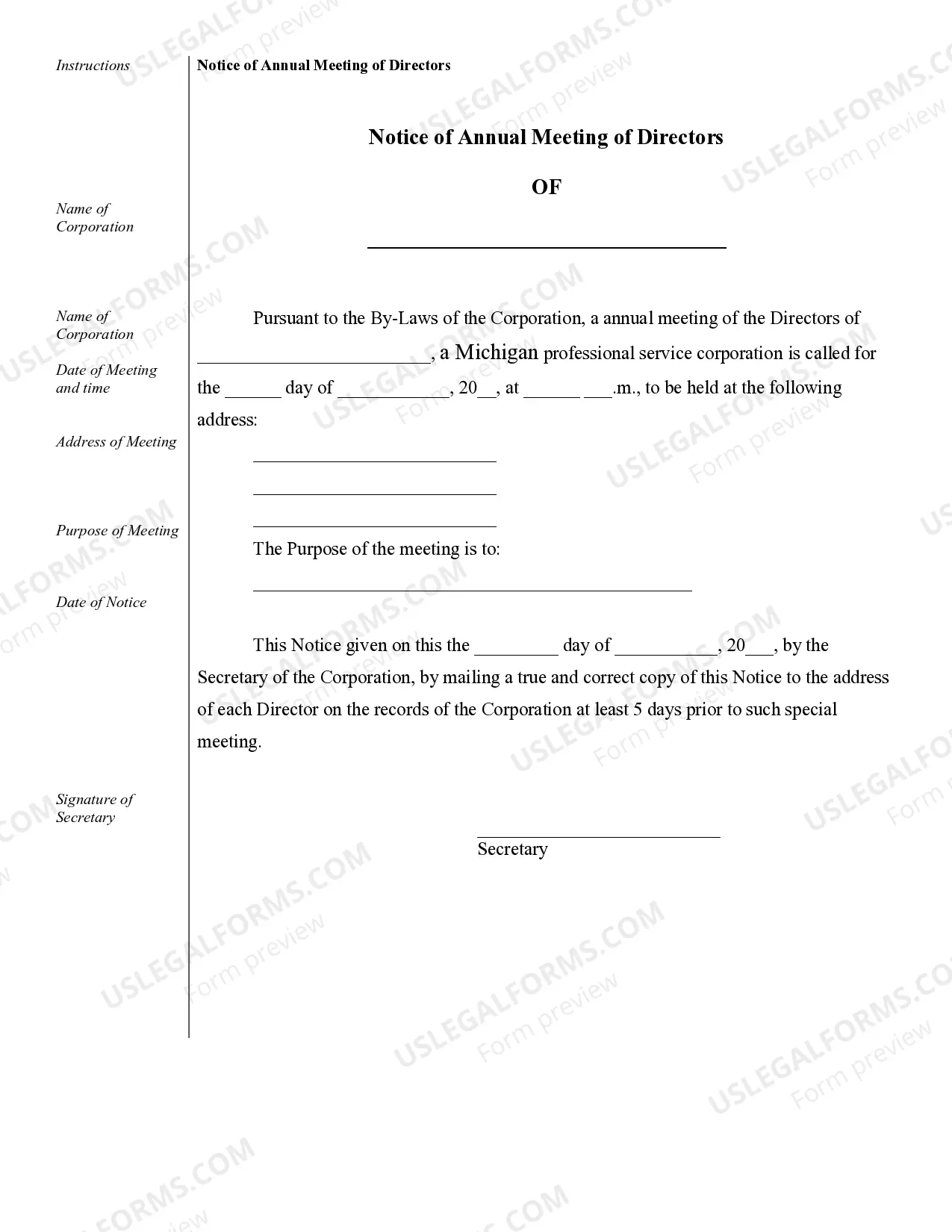

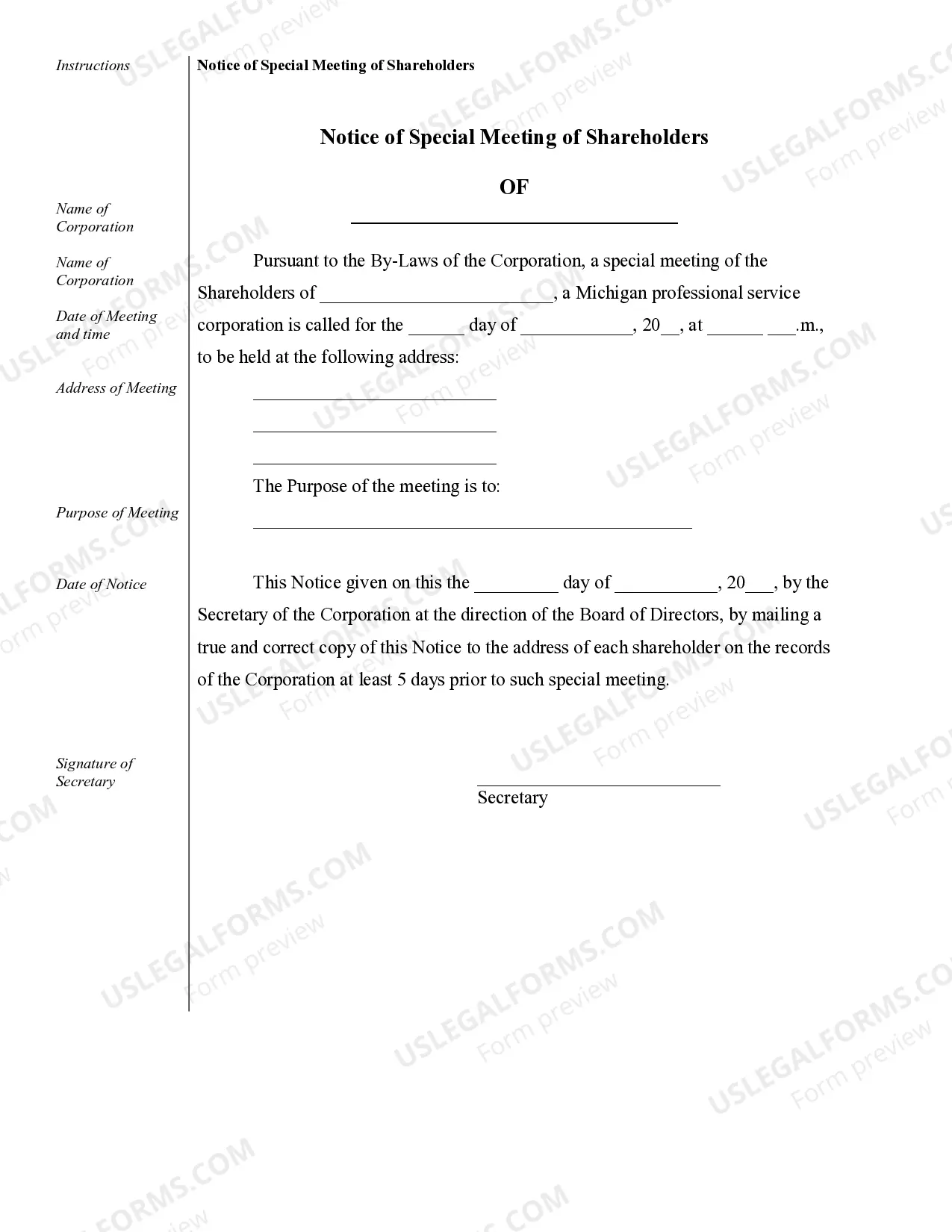

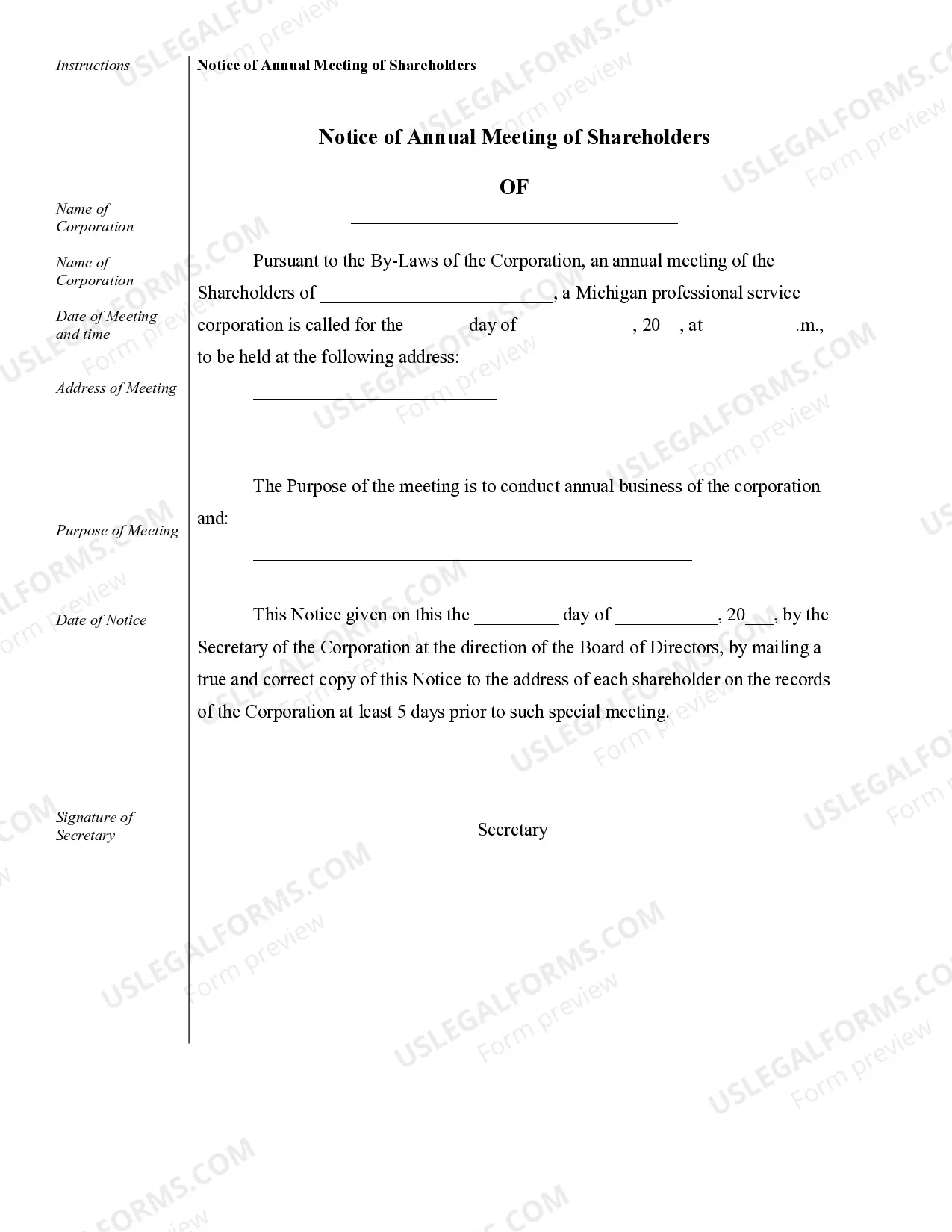

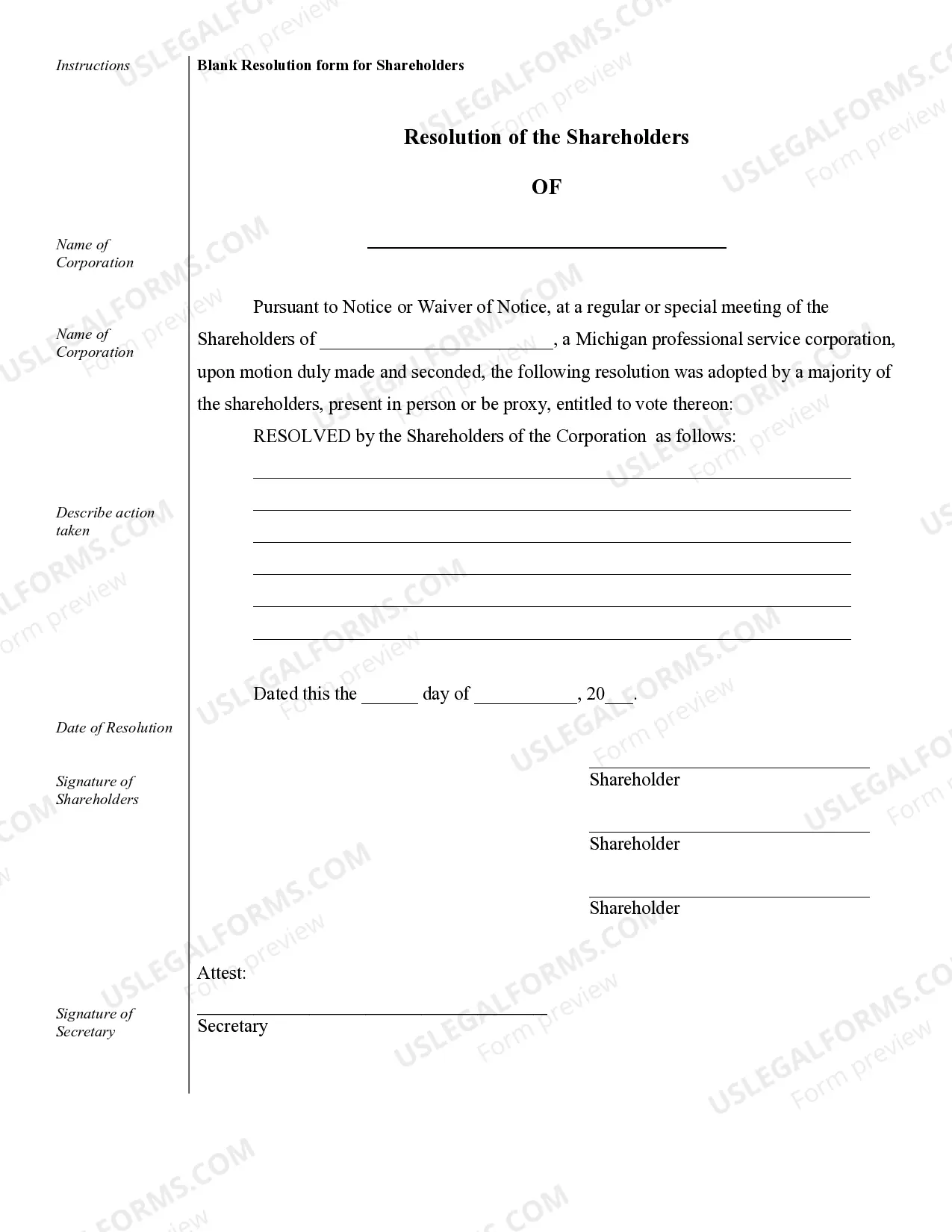

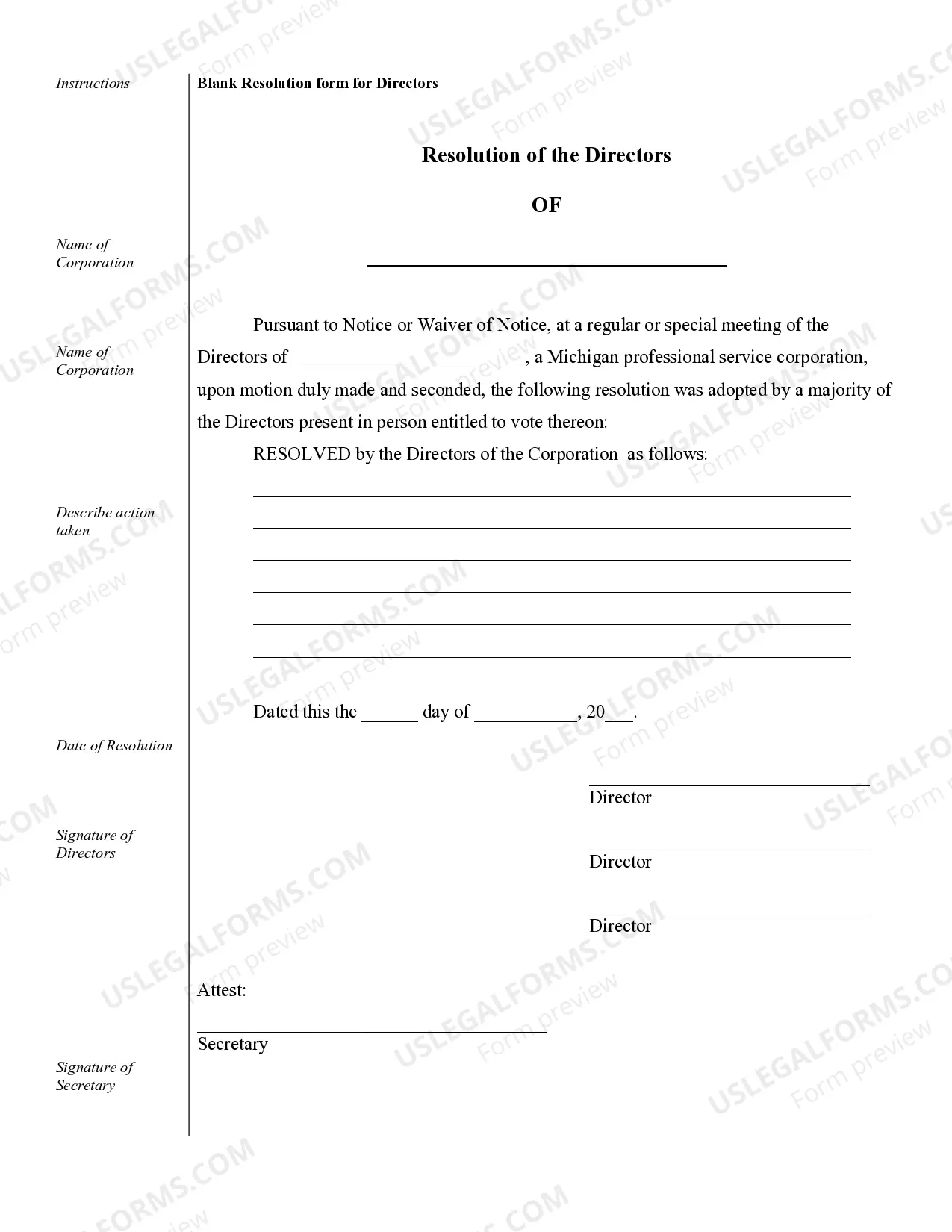

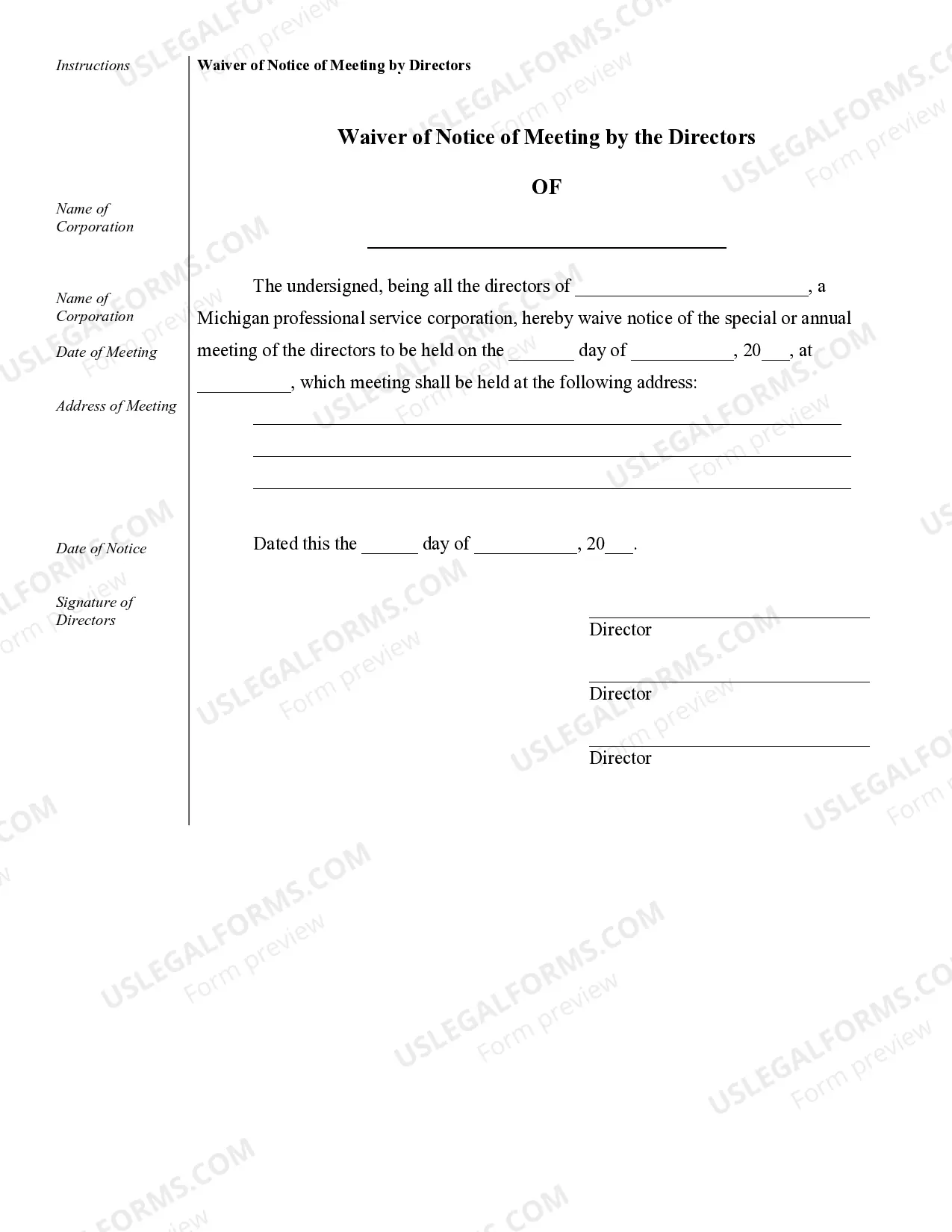

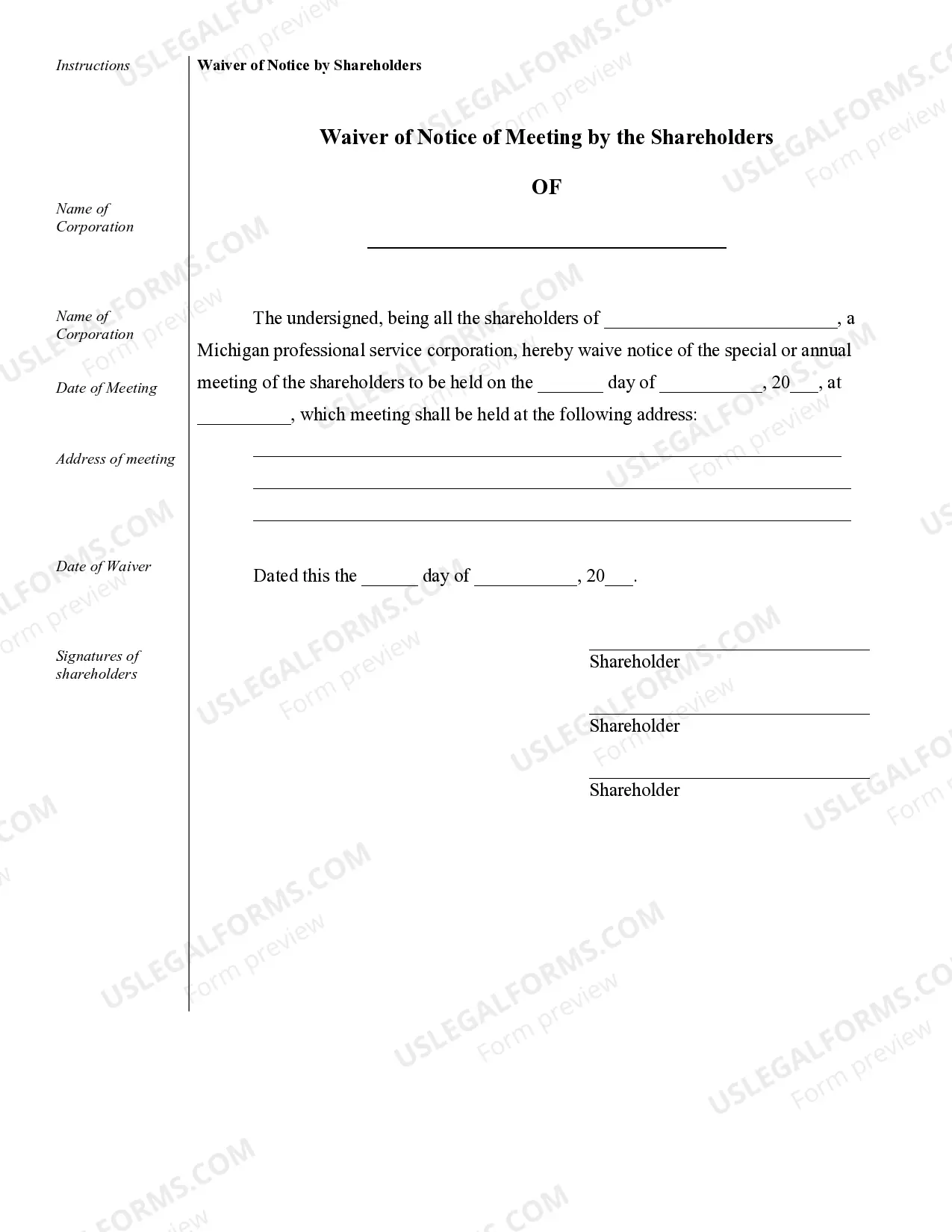

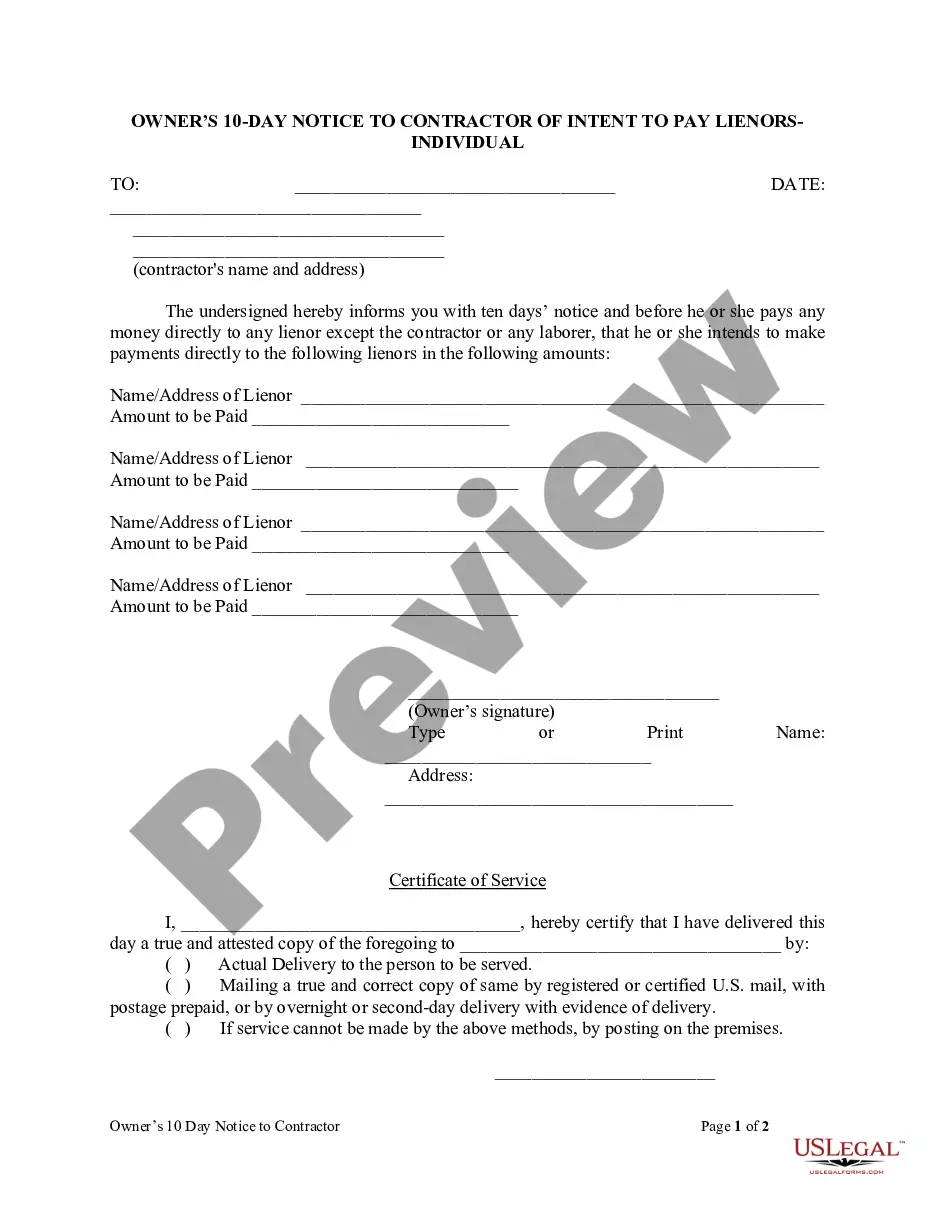

Lansing Sample Corporate Records for a Michigan Professional Corporation refer to a collection of essential documents and records that document the formation, activities, and legal compliance of a professional corporation operating in the state of Michigan. These records are crucial for maintaining transparency, meeting regulatory requirements, and ensuring the corporation operates in accordance with the applicable laws and regulations. Here are some key types of Lansing Sample Corporate Records for a Michigan Professional Corporation: 1. Articles of Incorporation: This is a foundational document that contains details about the professional corporation, such as its name, purpose, registered agent, and the names of initial directors and officers. 2. Bylaws: Bylaws outline the internal rules and procedures by which the corporation governs itself. They specify the responsibilities and powers of the shareholders, directors, and officers, as well as guidelines for holding meetings, voting, and decision-making processes. 3. Shareholder Records: These records include the names, addresses, and contact information of all shareholders, along with the number and class of shares held by each shareholder. 4. Director and Officer Records: These records encompass information about the individuals serving as directors and officers of the corporation. They typically include their names, addresses, roles, appointment dates, and any relevant financial interests. 5. Meeting Minutes: Meeting minutes document the proceedings and decisions made during shareholder and board of directors meetings. They include details such as the date, time, location of the meeting, attendees, agenda items, discussions, and resolutions passed. 6. Stock Certificates: Stock certificates are issued to shareholders as evidence of their ownership in the corporation. These physical or electronic documents contain information about the shareholder, the number and class of shares held, and may include unique identification numbers. 7. Annual Reports and Statements: Michigan requires professional corporations to file annual reports with the state. These reports contain important information about the corporation's activities, financial status, and any changes to its officers, directors, or registered agent. 8. Financial Records: These records include financial statements, balance sheets, income statements, and other financial reports that provide an overview of the corporation's financial performance and position. They are crucial for tax compliance and auditing purposes. 9. Licenses and Permits: Depending on the nature of the professional corporation's business, it may require specific licenses and permits operating legally. Records related to these licenses and permits, including applications, approvals, and renewals, should be maintained. 10. Contracts and Agreements: Any contracts or agreements entered into by the corporation, such as client engagements, partnerships, leases, or employment contracts, should be documented and kept in the corporate records. It is important to note that the specific content and format of Lansing Sample Corporate Records for a Michigan Professional Corporation may vary based on the corporation's activities, industry, and additional legal requirements. It is advisable to consult an attorney or legal advisor to ensure compliance and accuracy in documenting these records.

Lansing Sample Corporate Records for a Michigan Professional Corporation

Description

How to fill out Lansing Sample Corporate Records For A Michigan Professional Corporation?

Are you in search of a reliable and budget-friendly provider of legal forms to purchase the Lansing Sample Corporate Records for a Michigan Professional Corporation.

US Legal Forms is your ideal choice.

Whether you need a straightforward agreement to establish rules for cohabitating with your partner or a collection of documents to facilitate your divorce through the courts, we've got you covered.

Our site offers more than 85,000 current legal document templates for personal and commercial use. All templates we provide access to are not generic and are customized based on the requirements of particular states and regions.

If the template is not appropriate for your legal circumstances, initiate the search again.

Now you can set up your account. Then choose the subscription option and continue to payment. Once the payment is finalized, download the Lansing Sample Corporate Records for a Michigan Professional Corporation in any available format. You can revisit the website anytime and redownload the document at no cost.

- To download the document, you must Log In to your account, find the required template, and click the Download button next to it.

- Please note that you can download your previously acquired form templates at any time from the My documents tab.

- Are you unfamiliar with our website? No problem.

- You can create an account in just a few minutes, but first, ensure that the Lansing Sample Corporate Records for a Michigan Professional Corporation complies with the laws of your state and local area.

- Review the form’s specifics (if provided) to understand who and what the document is suitable for.

Form popularity

FAQ

To file an S Corp in Michigan, you first need to create a corporation by filing articles of incorporation with LARA. After that, you must elect S Corporation status by filing IRS Form 2553. This process can seem complex, but using Lansing Sample Corporate Records for a Michigan Professional Corporation can provide you with the necessary templates and instructions to simplify your filing.

Filing a corporation in Michigan involves several steps. First, you must select a unique name and then prepare and submit your articles of incorporation to LARA. Additionally, it is essential to follow state regulations and guidelines. For an efficient filing process, refer to Lansing Sample Corporate Records for a Michigan Professional Corporation to access the forms and information you need.

Yes, you can file articles of organization online in Michigan. The Michigan Department of Licensing and Regulatory Affairs (LARA) provides an online portal to streamline this process. Using this tool can save you time and ensure that you meet the necessary requirements. For comprehensive guidance, consider utilizing Lansing Sample Corporate Records for a Michigan Professional Corporation to organize your filings.

Filing Articles of Organization in Michigan typically costs around $50, though prices may vary depending on additional services you may require. Keep in mind any extra fees for expedited processing or other formalities. US Legal Forms helps you stay informed about costs and provides reliable templates to ensure your Lansing Sample Corporate Records for a Michigan Professional Corporation are accurately filed.

In Michigan, you need to complete the Articles of Organization form to establish your LLC. This form captures essential details about your business and is crucial for legal recognition. Using US Legal Forms provides you with the correct paperwork and ensures that your Lansing Sample Corporate Records for a Michigan Professional Corporation align with state requirements.

The processing time for Articles of Organization in Michigan typically ranges from a few days to several weeks. The speed largely depends on the method of submission you choose. If you file electronically through the state’s online system, you may see quicker results. US Legal Forms can help you prepare everything you need to expedite the process and ensure your Lansing Sample Corporate Records for a Michigan Professional Corporation are set up correctly.

Filing for an S Corp in Michigan involves choosing the corporate structure, submitting your Articles of Incorporation, and selecting S Corp status by filing IRS Form 2553. Once you fulfill these requirements, you'll enjoy the benefits of an S Corporation, including pass-through taxation and limited liability. For streamlined documentation and expert support, consider utilizing Lansing Sample Corporate Records for a Michigan Professional Corporation.

To file an S Corp in Michigan, you first need to establish a corporation and then file Form 2553 with the IRS. This form allows your corporation to elect S Corporation status for tax purposes, which can lead to significant savings. After setting up, ensure your records are accurate and compliant with local laws, which you can manage through Lansing Sample Corporate Records for a Michigan Professional Corporation.

Yes, you can check the status of an LLC in Michigan using the online business entity search tool provided by the Michigan Department of Licensing and Regulatory Affairs. This platform offers real-time updates on the status, active filing, and registration details of your LLC. Knowing your business's standing is essential, and you can supplement this information with Lansing Sample Corporate Records for a Michigan Professional Corporation.

You can look up a business in Michigan through the Michigan Department of Licensing and Regulatory Affairs online database. This tool allows you to search by name or ID number, providing valuable information about the business's status, registered office address, and more. This process is straightforward and crucial in verifying the legitimacy of a corporation, especially when consulting the Lansing Sample Corporate Records for a Michigan Professional Corporation.