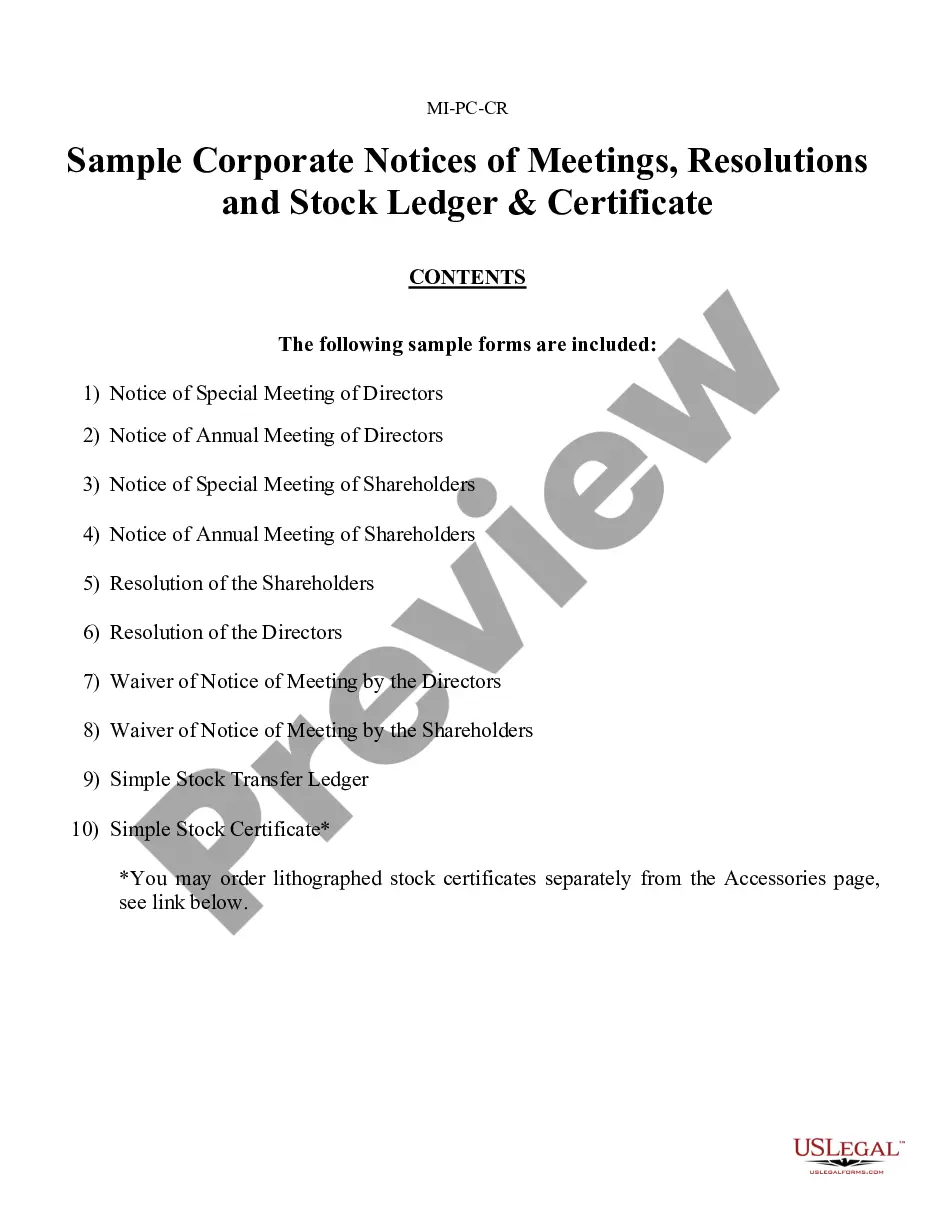

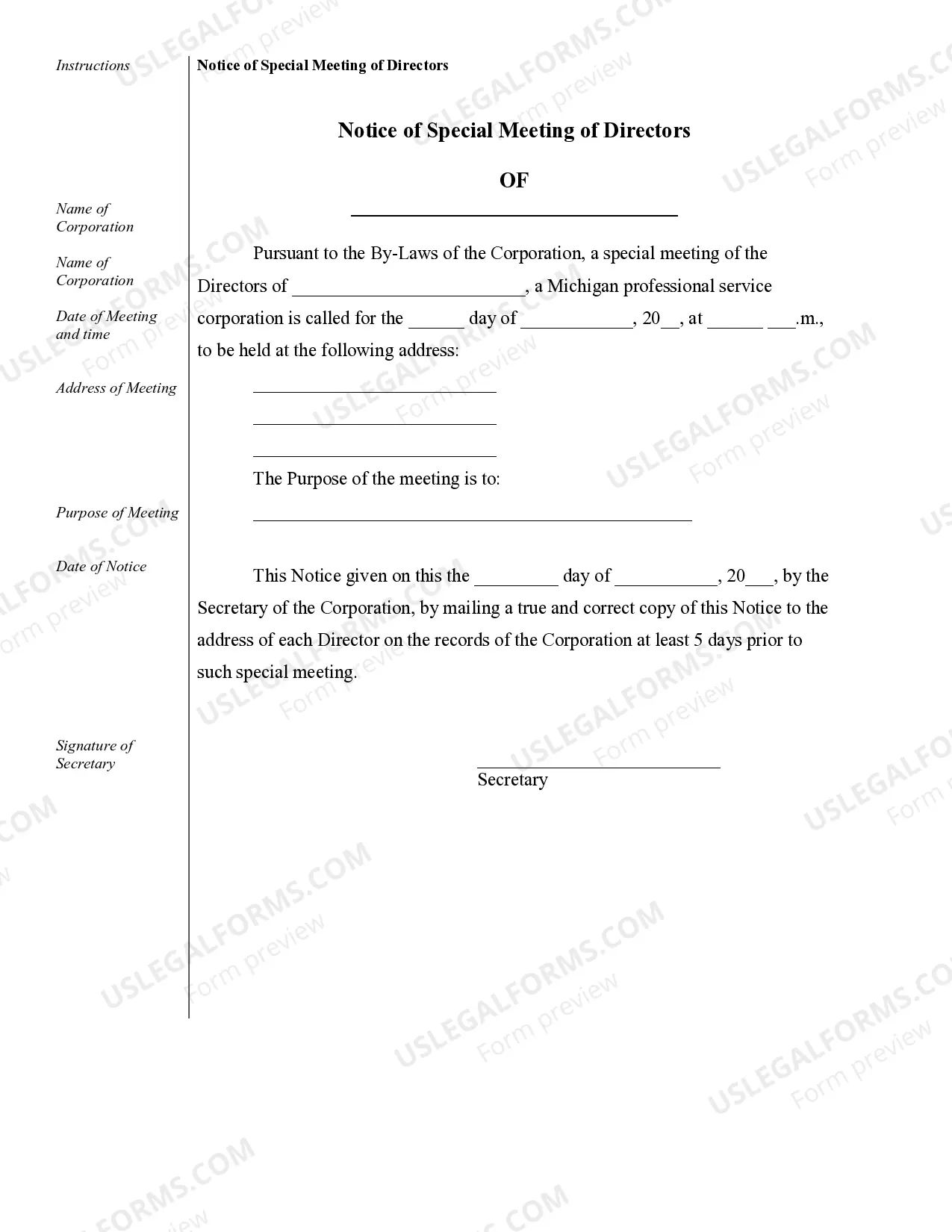

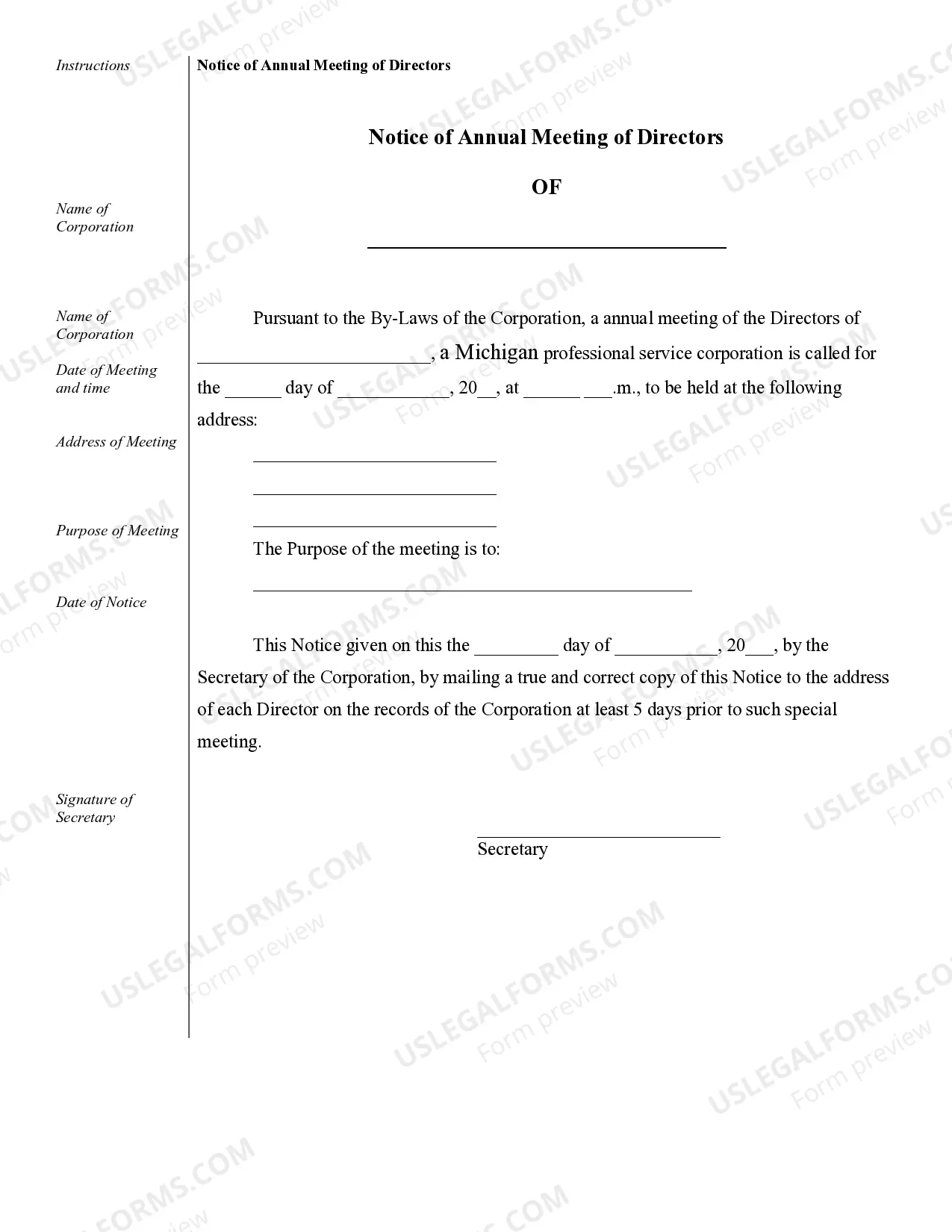

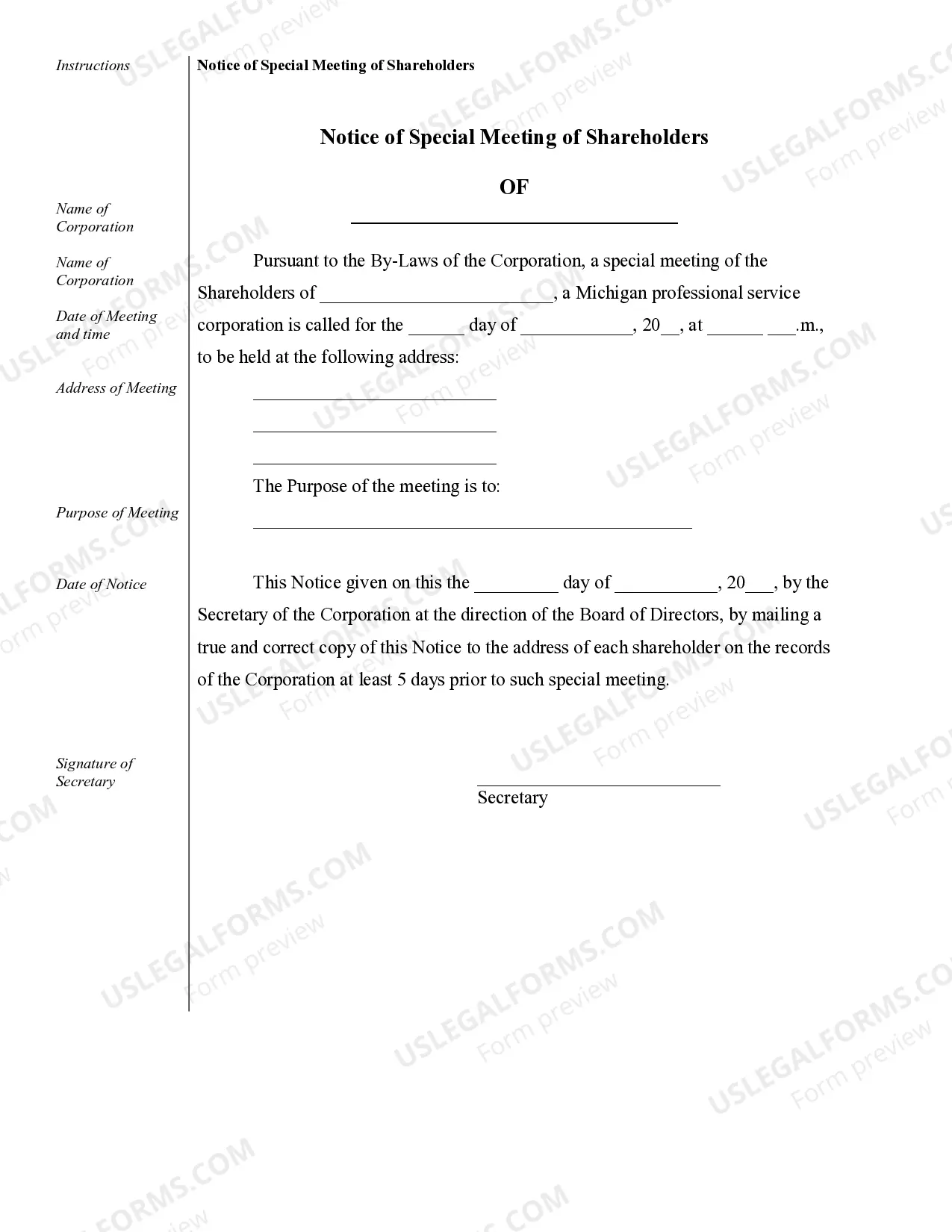

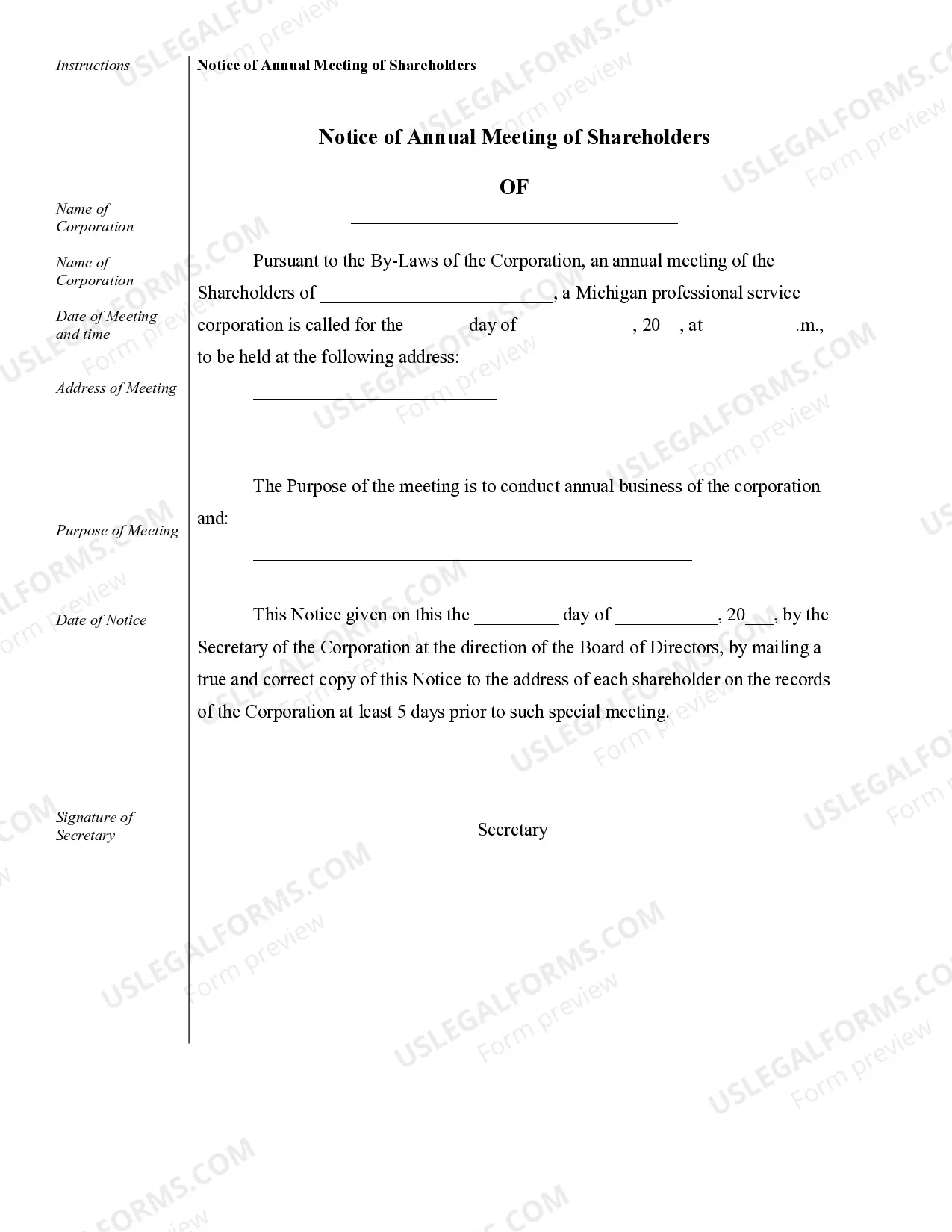

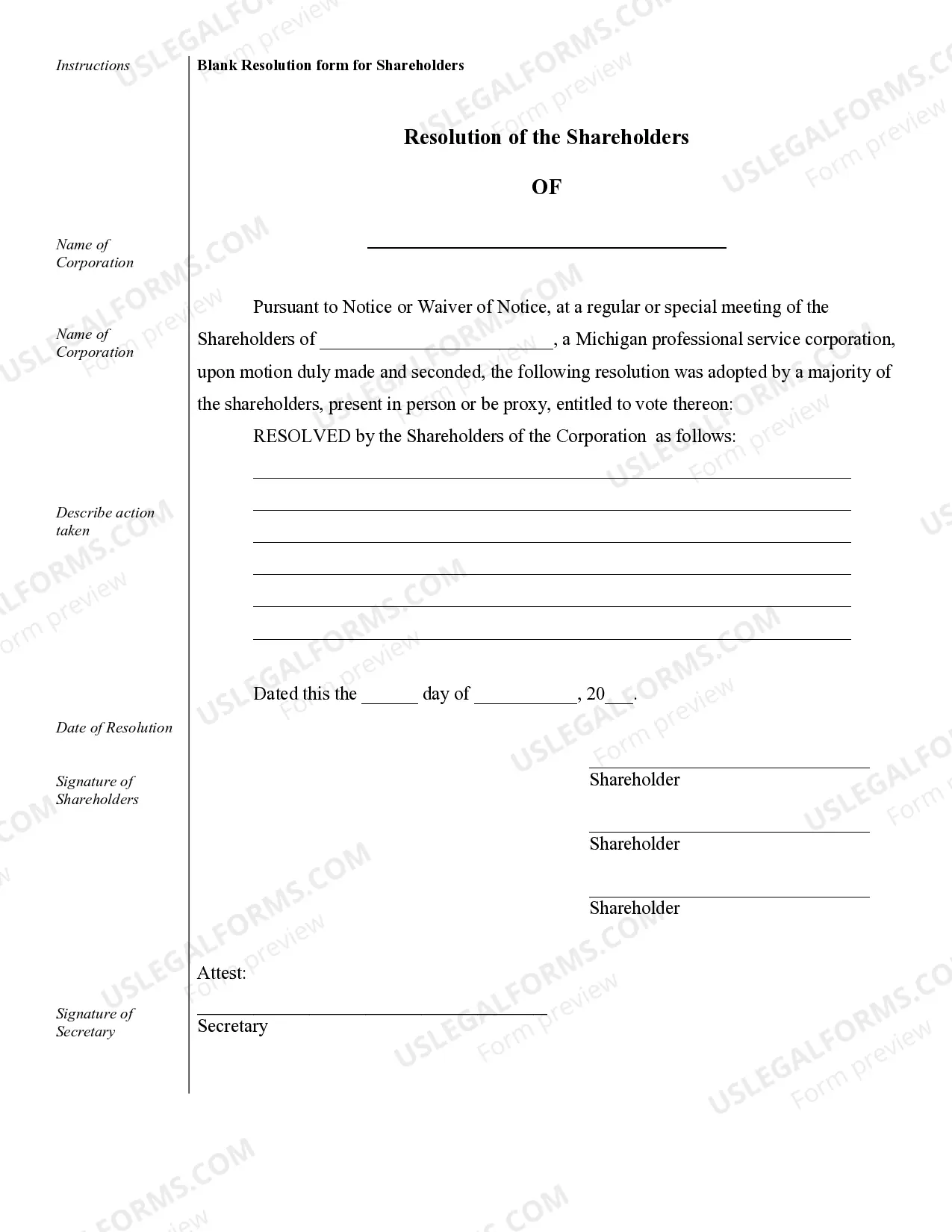

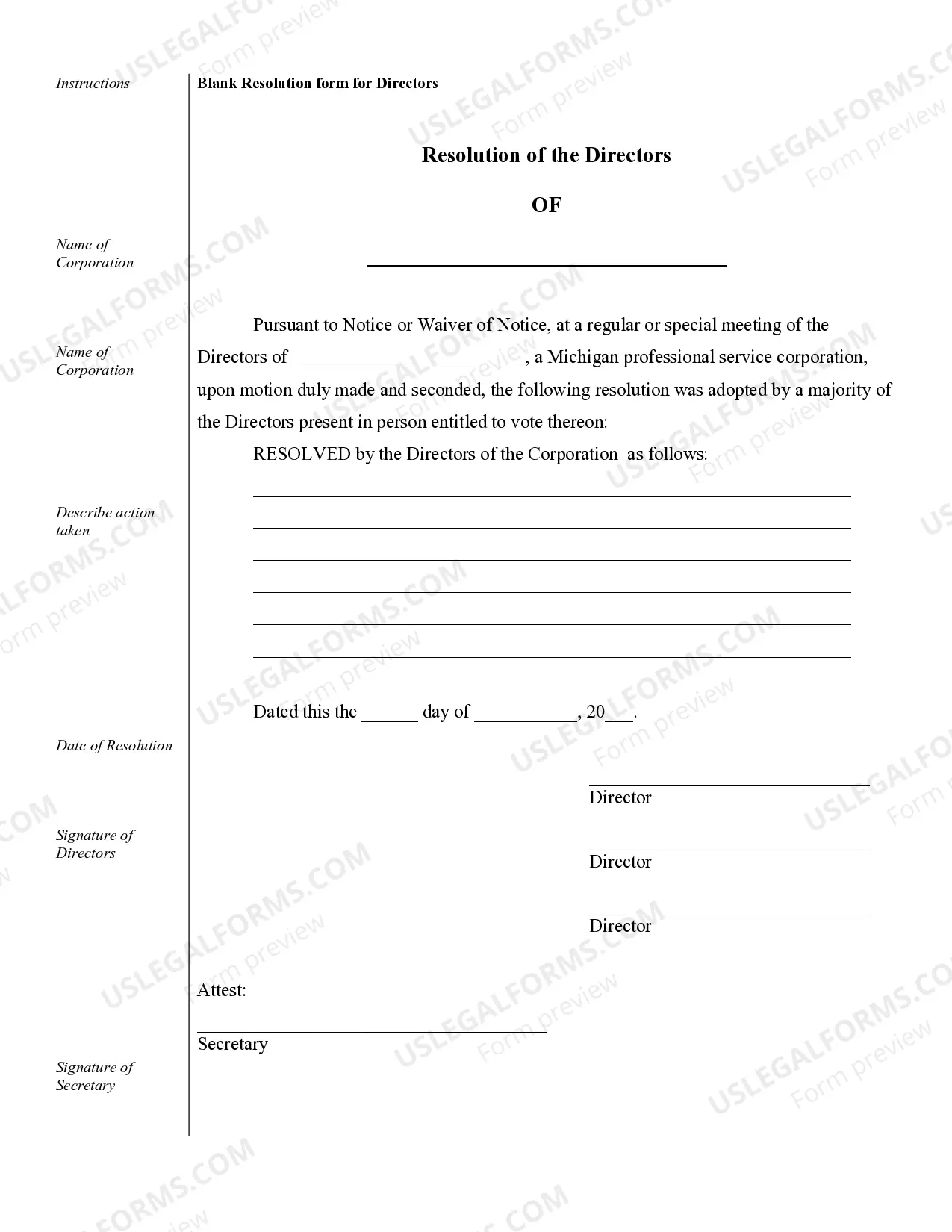

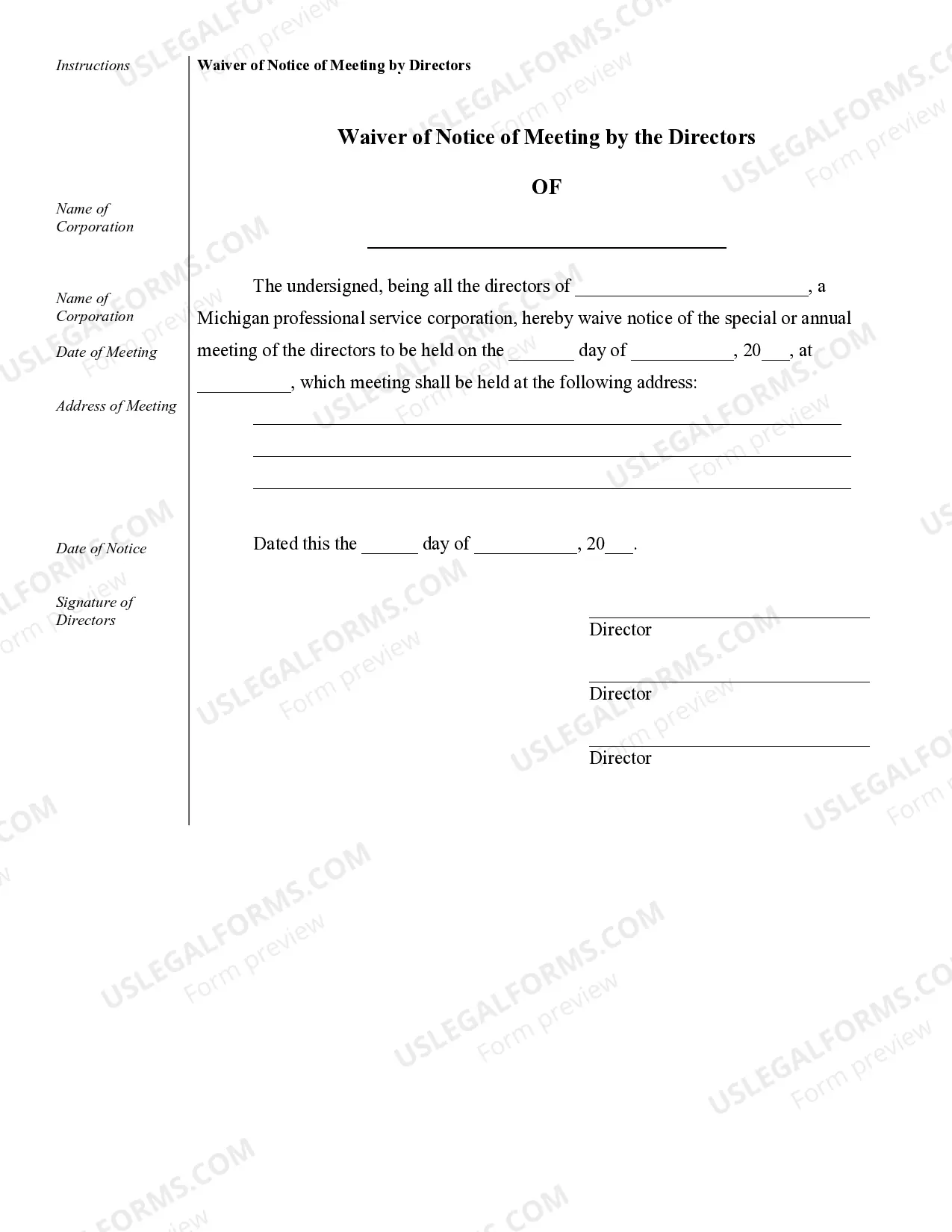

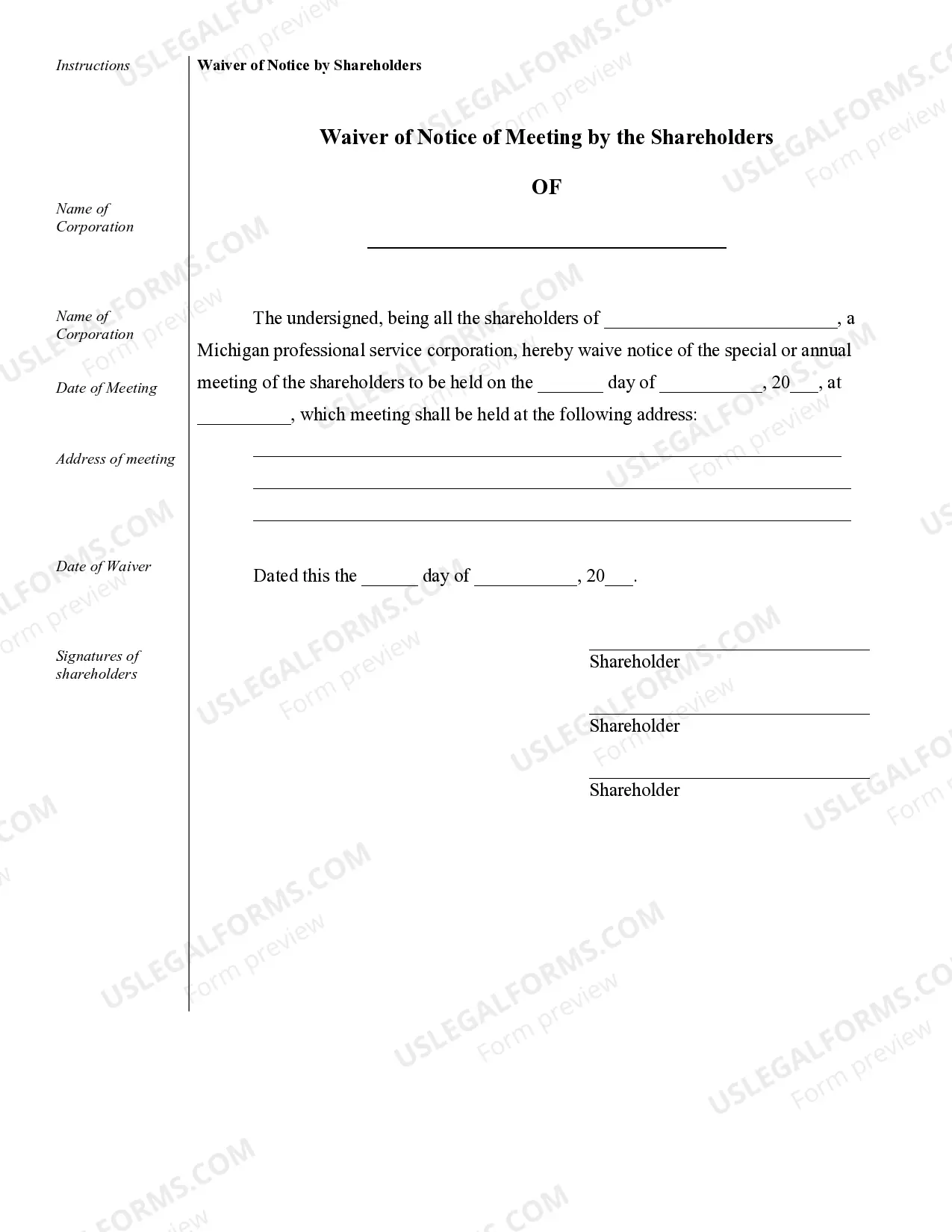

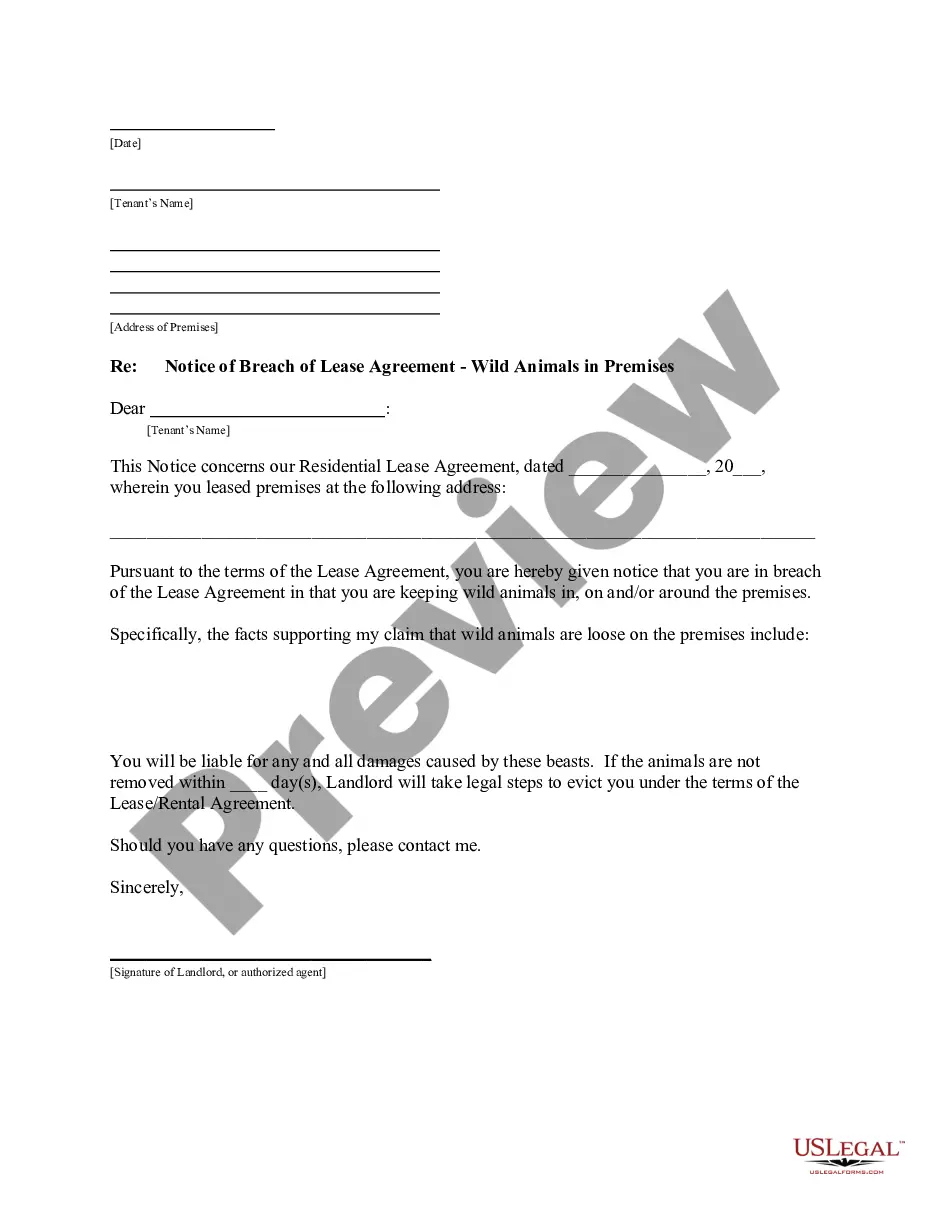

Sterling Heights Sample Corporate Records for a Michigan Professional Corporation play a vital role in ensuring the legal compliance, transparency, and consistent record-keeping for businesses operating in Sterling Heights, Michigan. These corporate records are prepared and maintained by professional corporations to maintain an accurate record of their corporate activities and to meet the legal and regulatory requirements set forth by the State of Michigan. Some key types of Sterling Heights Sample Corporate Records for a Michigan Professional Corporation include: 1. Articles of Incorporation: This document outlines the basic details of the corporation, including its name, purpose, location, registered agent, and the number of authorized shares. 2. Bylaws: The bylaws of a Michigan Professional Corporation provide a comprehensive framework for the corporation's internal governance. It includes provisions on shareholders' rights, board of directors' duties, procedures for meetings, dividend distributions, and more. 3. Shareholder Meeting Minutes: These records document the proceedings, discussions, resolutions, and decisions taken during annual or special shareholder meetings. It includes attendance records, voting results, and any actions taken during these meetings. 4. Board of Directors Meeting Minutes: Board of Directors Meeting Minutes capture the discussions, decisions, and actions taken by the board of directors during their meetings. This includes the election of officers, appointment of committees, approval of financial reports, and any significant corporate actions. 5. Stock Ledger: A Stock Ledger maintains accurate records of all stock issuance, transfers, and ownership in the corporation. It includes details such as shareholder names, addresses, the number of shares held, and dates of transactions. 6. Financial Statements and Reports: These records consist of financial statements, such as balance sheets, income statements, and cash flow statements, as well as annual reports, providing stakeholders with a comprehensive overview of the corporation's financial status and performance. 7. Annual Reports and Filings: Michigan Professional Corporations are required to file annual reports with the Michigan Department of Licensing and Regulatory Affairs (LARA). These reports disclose the corporation's current address, officers, directors, registered agent information, and any changes made during the reporting period. 8. Contracts and Agreements: Corporate records should include copies of important contracts or agreements entered into by the corporation, such as lease agreements, employment contracts, shareholder agreements, or purchase agreements. These documents help ensure transparency and accountability in the corporation's dealings. 9. Licenses and Permits: In some cases, professional corporations may be required to obtain specific licenses or permits operating legally. Including copies of these licenses or permits in the corporate records helps demonstrate compliance with relevant regulations. Maintaining comprehensive and accurate Sterling Heights Sample Corporate Records for a Michigan Professional Corporation is crucial for legal compliance, ensuring transparency and traceability, and facilitating effective decision-making within the corporation. These records serve as a valuable resource for shareholders, regulators, auditors, and potential investors in assessing the corporation's financial health and corporate governance practices.

Sterling Heights Sample Corporate Records for a Michigan Professional Corporation

Description

How to fill out Sterling Heights Sample Corporate Records For A Michigan Professional Corporation?

If you are searching for a relevant form, it’s impossible to find a more convenient platform than the US Legal Forms website – probably the most considerable libraries on the internet. With this library, you can get thousands of form samples for business and personal purposes by categories and states, or key phrases. With our high-quality search option, finding the latest Sterling Heights Sample Corporate Records for a Michigan Professional Corporation is as elementary as 1-2-3. In addition, the relevance of each record is verified by a group of expert attorneys that on a regular basis review the templates on our platform and revise them according to the newest state and county regulations.

If you already know about our platform and have an account, all you should do to receive the Sterling Heights Sample Corporate Records for a Michigan Professional Corporation is to log in to your profile and click the Download option.

If you use US Legal Forms the very first time, just refer to the instructions below:

- Make sure you have discovered the sample you require. Read its information and make use of the Preview function (if available) to check its content. If it doesn’t meet your needs, utilize the Search option near the top of the screen to get the needed file.

- Affirm your choice. Click the Buy now option. After that, select the preferred subscription plan and provide credentials to sign up for an account.

- Make the financial transaction. Use your credit card or PayPal account to finish the registration procedure.

- Receive the template. Choose the file format and save it on your device.

- Make adjustments. Fill out, edit, print, and sign the acquired Sterling Heights Sample Corporate Records for a Michigan Professional Corporation.

Every single template you add to your profile has no expiration date and is yours forever. You always have the ability to gain access to them via the My Forms menu, so if you need to receive an extra duplicate for modifying or printing, feel free to return and download it once more whenever you want.

Take advantage of the US Legal Forms extensive catalogue to get access to the Sterling Heights Sample Corporate Records for a Michigan Professional Corporation you were seeking and thousands of other professional and state-specific templates in one place!