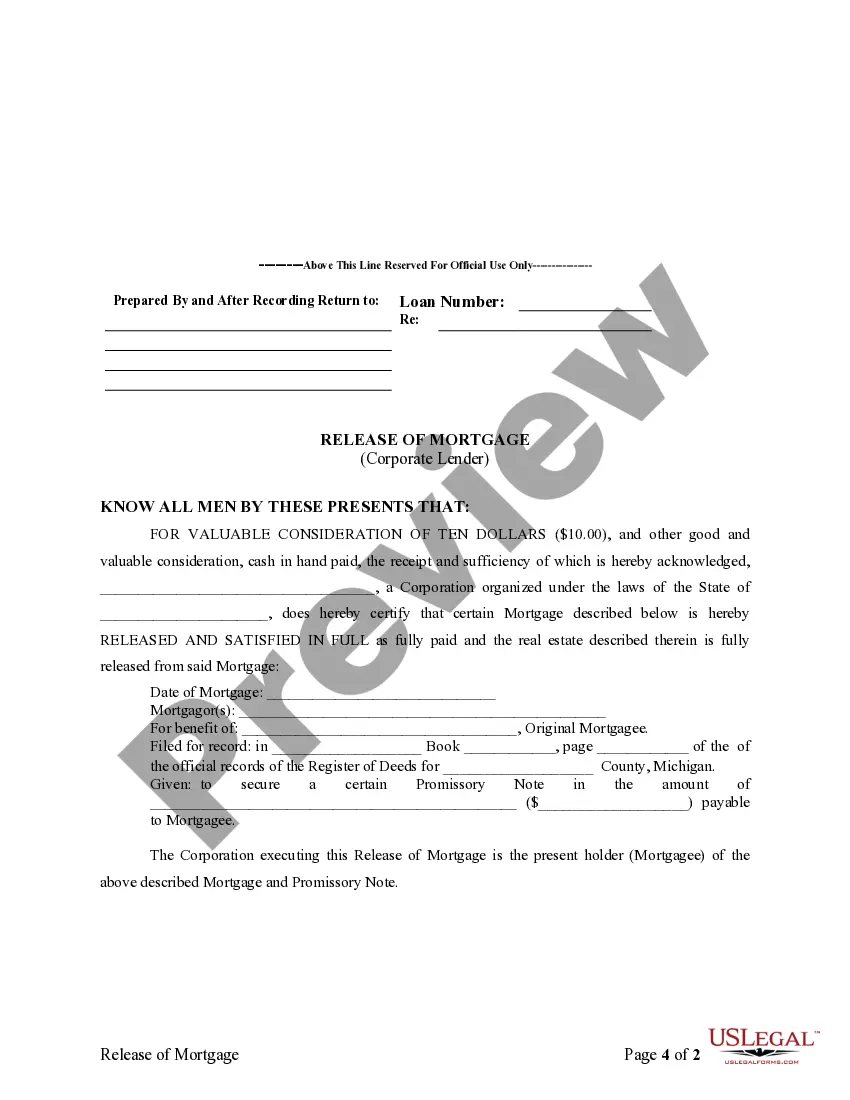

Detroit Michigan Satisfaction, Release or Cancellation of Mortgage by Corporation

Description

How to fill out Michigan Satisfaction, Release Or Cancellation Of Mortgage By Corporation?

If you have previously utilized our service, Log In to your account and download the Detroit Michigan Satisfaction, Release or Cancellation of Mortgage by Corporation to your device by clicking the Download button. Ensure your subscription remains active. If it’s expired, renew it based on your payment plan.

If this is your inaugural encounter with our service, follow these easy steps to obtain your file.

You will have continual access to every document you have purchased: you can locate it in your profile within the My documents section whenever you need to access it again. Utilize the US Legal Forms service to swiftly find and retrieve any template for your personal or professional requirements!

- Ensure you have found the suitable document. Browse through the description and use the Preview feature, if available, to verify if it suits your needs. If it does not, utilize the Search tab above to obtain the correct one.

- Acquire the template. Select the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process a payment. Use your credit card information or the PayPal option to finalize the purchase.

- Obtain your Detroit Michigan Satisfaction, Release or Cancellation of Mortgage by Corporation. Select the file format you want for your document and save it to your device.

- Finalize your sample. Print it out or utilize professional online editors to complete and sign it electronically.

Form popularity

FAQ

Upon receipt of the final payment, satisfying a mortgage, the mortgagee (lender) must execute and file a written document acknowledging that the mortgage has been satisfied (i.e., paid in full). This written document must be acknowledged, or proven (i.e., notarized).

A Satisfaction of Security Instrument is a document that shows an individual has paid a deed of trust or a mortgage in full.

What Documents Can You Expect? Canceled promissory note (?note?). A promissory note states that someone promises to pay something?in this case, a mortgage.Deed of trust or mortgage deed (?deed?).Certificate of satisfaction.Final mortgage statement.Loan payoff letter.

A satisfaction of mortgage is a signed document confirming that the borrower has paid off the mortgage in full and that the mortgage is no longer a lien on the property.

Both a satisfaction of mortgage and deed of reconveyance indicate that the loan has been fully paid and the lien on the property has been released. A deed of reconveyance, however, is typically used in states where a deed of trust is also utilized.

You can find information on property records by contacting your local Secretary of State or county recorder of deeds. After you pay off your mortgage, your lender should also return the original note to you. You can also contact the company that paid off your loan to find out if the lien was released.

A mortgage is a loan extended to someone in order to purchase a property. A mortgage deed is a legally binding document outlining the terms of a mortgage that puts a lien on the house until the lender repays the loan in full.

Chapter 183, Section 55 requires the lender to discharge the mortgage within 45 days of receipt of full payment of the loan by (i) recording an executed and acknowledged discharge and (ii) providing the closing attorney, settlement agent, or other person transmitting the payoff (typically the title company) with a copy

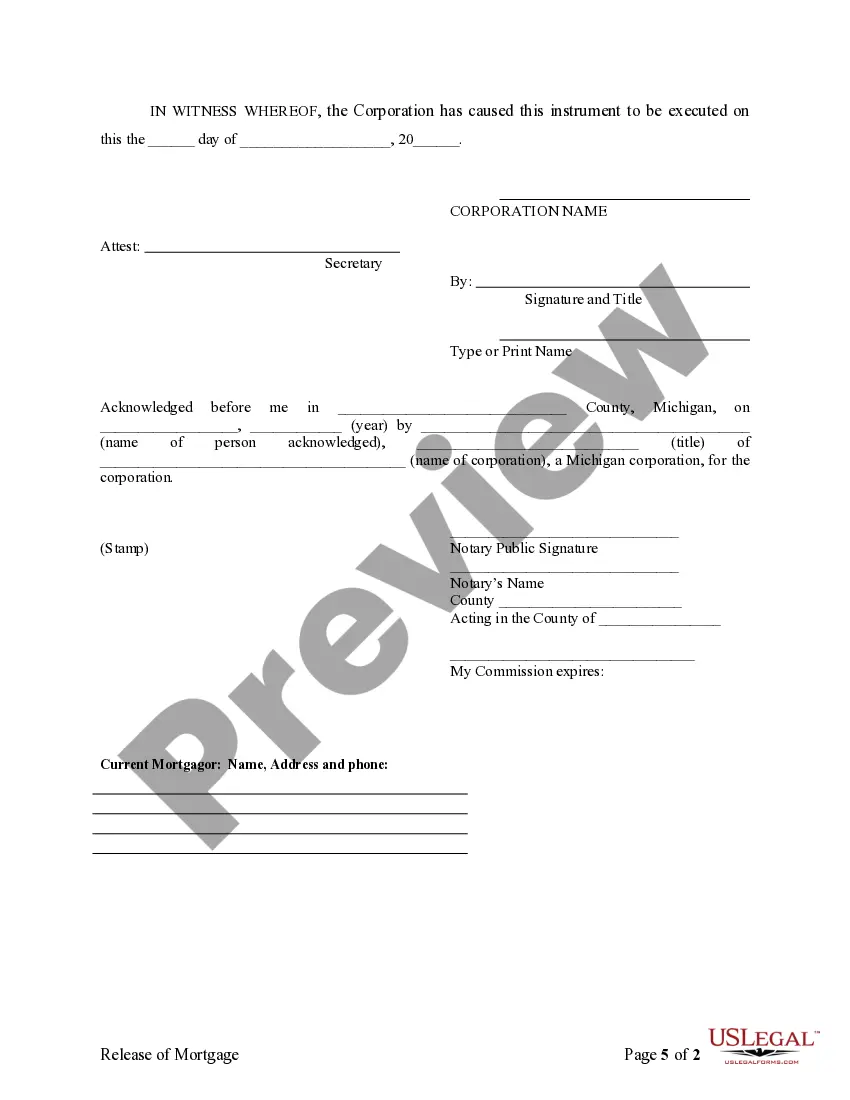

How do you get a Satisfaction of Mortgage? A Satisfaction of Mortgage is issued by the lender after they have received the final mortgage payment from the borrower. It's signed by the mortgagee (in the presence of a witness in some states and counties) and then notarized by a registered notary public.

How long does a discharge of mortgage take to process? A discharge of mortgage will usually take 14-21 days to process. In years gone by, processing times could take as little as 10 days. However, due to a rapid rise in the number of refinanced home loans taking place, these waiting periods have been set back.