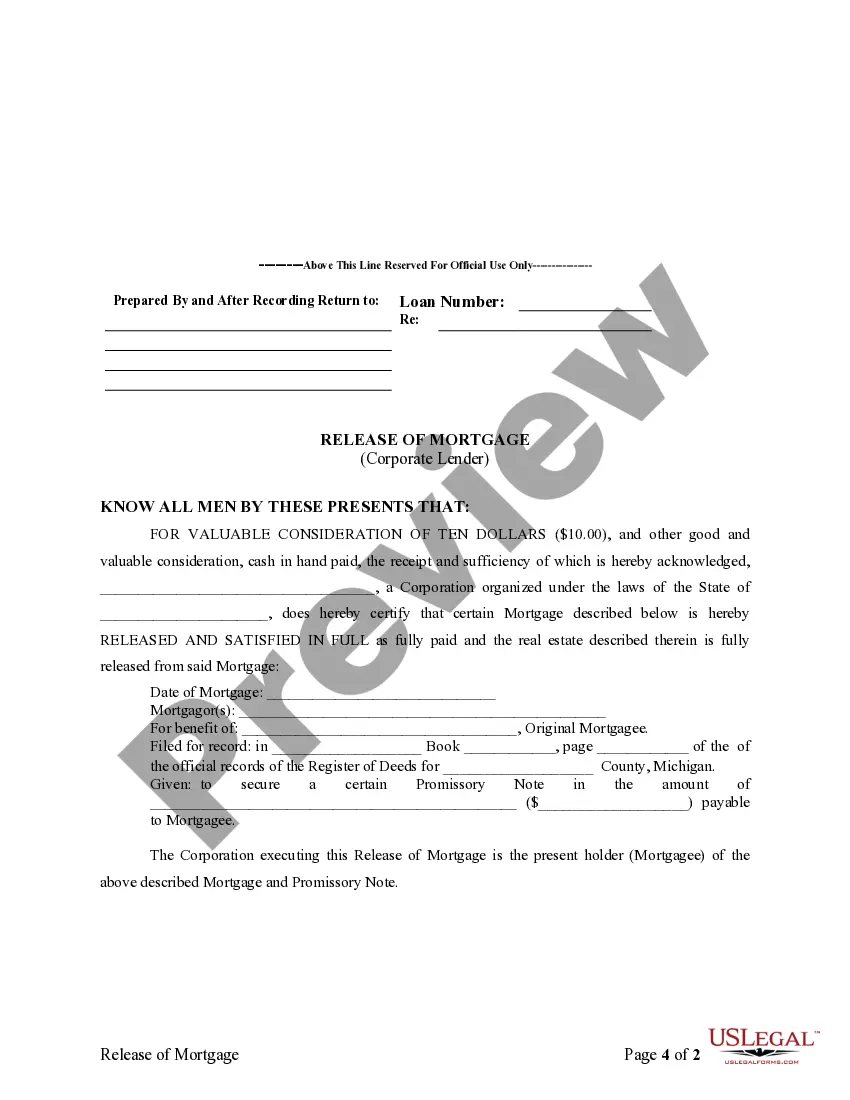

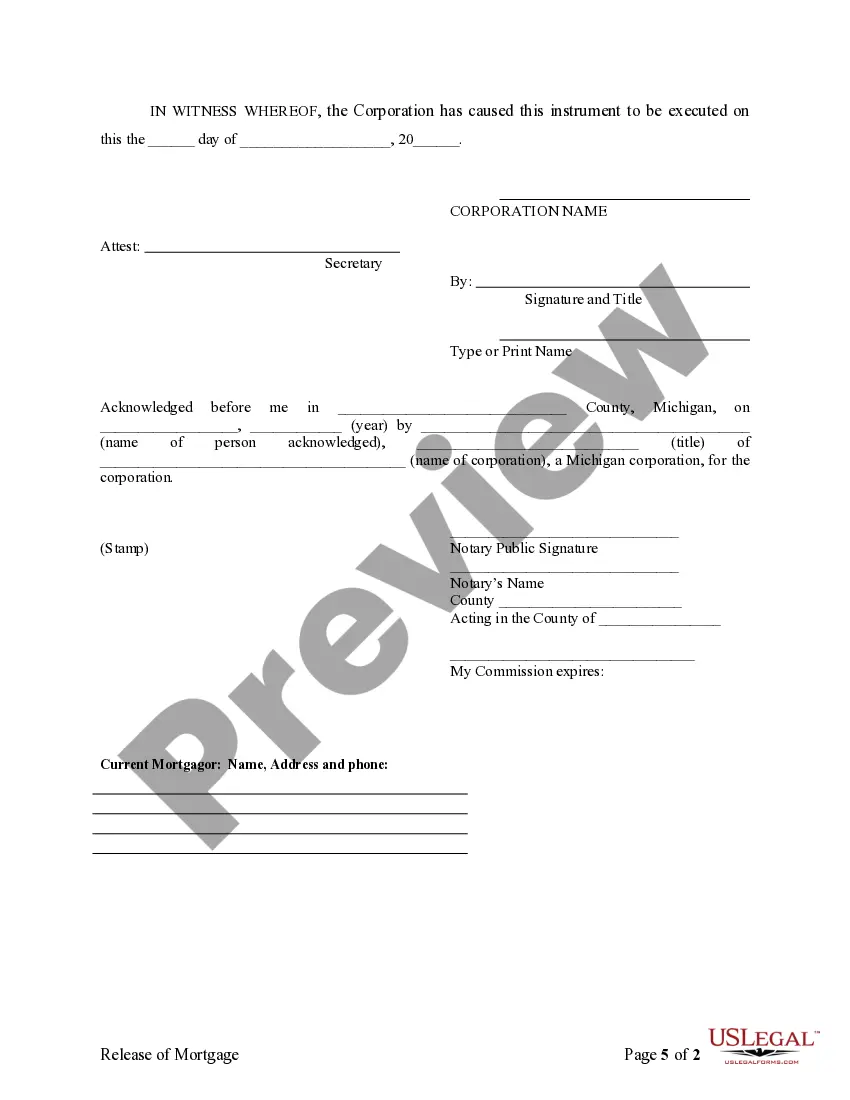

In Sterling Heights, Michigan, the Satisfaction, Release, or Cancellation of Mortgage by Corporation refers to a legal process that entails the finalization of a mortgage agreement between a corporation and a borrower. This comprehensive description will outline the key aspects, requirements, and types of Satisfaction, Release, or Cancellation of Mortgage by Corporation in Sterling Heights, Michigan, using relevant keywords to provide a well-rounded understanding of the topic. Keywords: Sterling Heights, Michigan, Satisfaction, Release, Cancellation, Mortgage, Corporation. Description: The Satisfaction, Release, or Cancellation of Mortgage by Corporation in Sterling Heights, Michigan is a vital legal procedure that signifies the conclusion of a mortgage agreement between a corporation and a borrower. This process ensures that the borrower's debt is fully settled, the mortgage lien is removed from the property's title, and the mortgage agreement is duly terminated. The primary purpose of the Satisfaction, Release, or Cancellation of Mortgage is to provide clarity and legal proof that the corporation has received full payment from the borrower, thus releasing them from any further obligations or liabilities tied to the mortgage loan. This process is crucial as it enables the borrower to regain full ownership of their property, unencumbered by any outstanding mortgage debt. To initiate the Satisfaction, Release, or Cancellation of Mortgage by Corporation in Sterling Heights, Michigan, certain requirements must be met. Firstly, the corporation must provide evidence of the borrower's complete payment of the mortgage loan amount. This may include copies of payment receipts, loan statements, or bank records demonstrating the final installment has been made. Once the corporation confirms the borrower's full payment, they are responsible for preparing the required documentation to release the mortgage lien. This typically includes drafting a Satisfaction, Release, or Cancellation of Mortgage form, also known as a Release Deed, which outlines the essential details of the original mortgage agreement. These details may consist of the borrower's name, property address, original loan amount, date of the mortgage agreement, and any associated legal descriptions. It is important to note that there may be variations or different types of Satisfaction, Release, or Cancellation of Mortgage by Corporation in Sterling Heights, Michigan, based on specific circumstances or clauses within the original mortgage agreement. These variations may include: 1. Traditional Full Satisfaction: This occurs when the borrower has fulfilled all financial obligations outlined in the mortgage agreement, resulting in the complete release of the mortgage lien, thereby providing complete ownership of the property to the borrower. 2. Conditional Satisfaction: In certain cases, the Satisfaction, Release, or Cancellation of Mortgage may be conditional. This type of satisfaction is dependent on specific conditions stated in the agreement, such as the completion of repairs or the resolution of any outstanding legal issues related to the property. 3. Release Upon Partial Payment: In some instances, the corporation may agree to release a portion of the mortgage lien upon receiving a partial payment from the borrower. This type of Satisfaction, Release, or Cancellation of Mortgage allows the borrower to regain partial ownership of the property while continuing to make subsequent payments to satisfy the remaining debt. In conclusion, the Satisfaction, Release, or Cancellation of Mortgage by Corporation in Sterling Heights, Michigan is a crucial legal process that signifies the successful completion of a mortgage agreement. By completing all necessary requirements and drafting the appropriate documentation, corporations can release the mortgage lien, thereby granting borrowers full ownership of their property, free from any encumbrances tied to the mortgage debt. Understanding the different types of satisfaction, release, or cancellation is essential to ensure compliance with the specific terms and conditions outlined in the original mortgage agreement.

Sterling Heights Michigan Satisfaction, Release or Cancellation of Mortgage by Corporation

Description

How to fill out Sterling Heights Michigan Satisfaction, Release Or Cancellation Of Mortgage By Corporation?

Do you need a reliable and affordable legal forms supplier to buy the Sterling Heights Michigan Satisfaction, Release or Cancellation of Mortgage by Corporation? US Legal Forms is your go-to solution.

No matter if you require a simple arrangement to set regulations for cohabitating with your partner or a set of forms to move your separation or divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t generic and framed based on the requirements of specific state and county.

To download the document, you need to log in account, find the needed template, and hit the Download button next to it. Please keep in mind that you can download your previously purchased document templates anytime in the My Forms tab.

Are you new to our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Sterling Heights Michigan Satisfaction, Release or Cancellation of Mortgage by Corporation conforms to the laws of your state and local area.

- Go through the form’s details (if provided) to find out who and what the document is intended for.

- Restart the search if the template isn’t suitable for your specific scenario.

Now you can register your account. Then select the subscription option and proceed to payment. As soon as the payment is completed, download the Sterling Heights Michigan Satisfaction, Release or Cancellation of Mortgage by Corporation in any provided format. You can get back to the website when you need and redownload the document without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about wasting your valuable time learning about legal paperwork online once and for all.