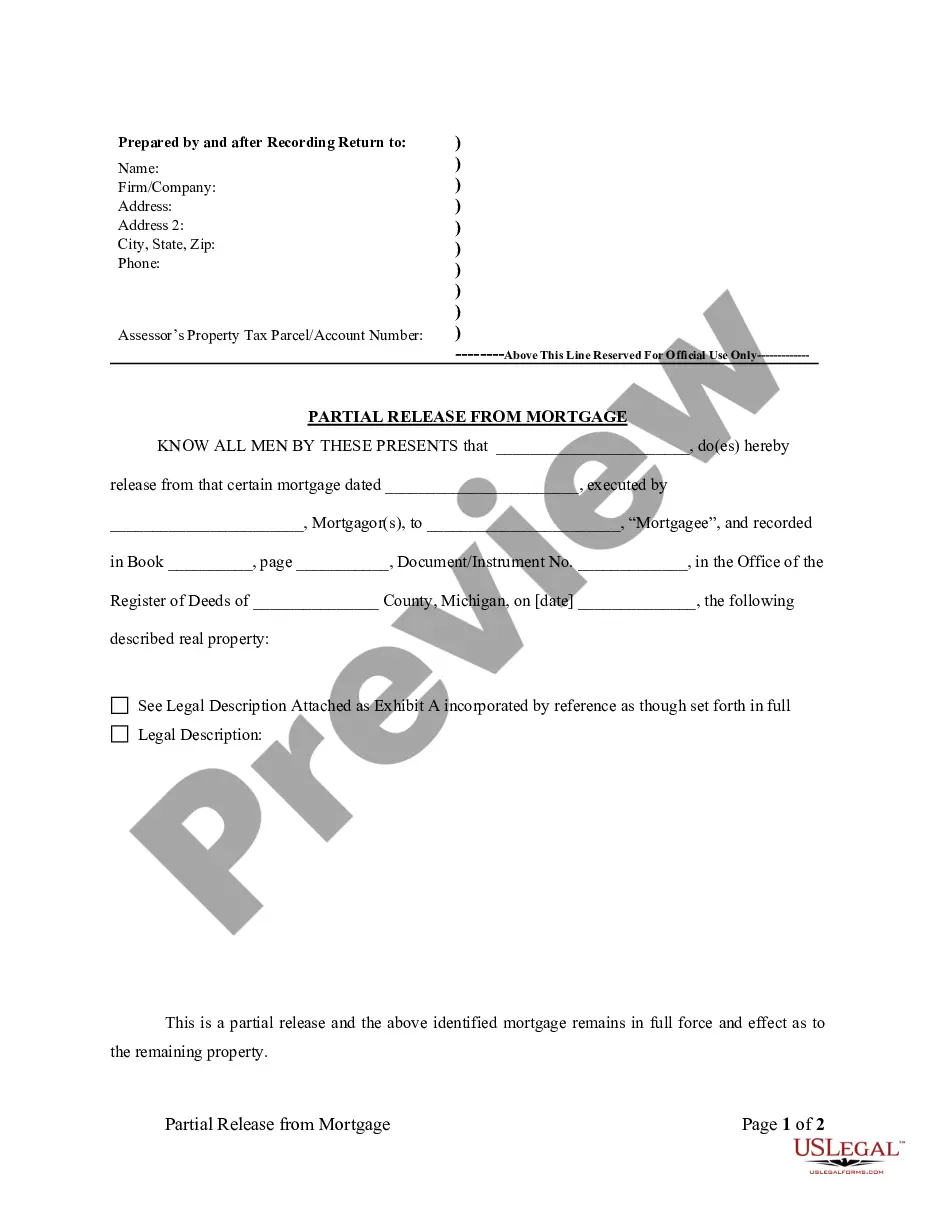

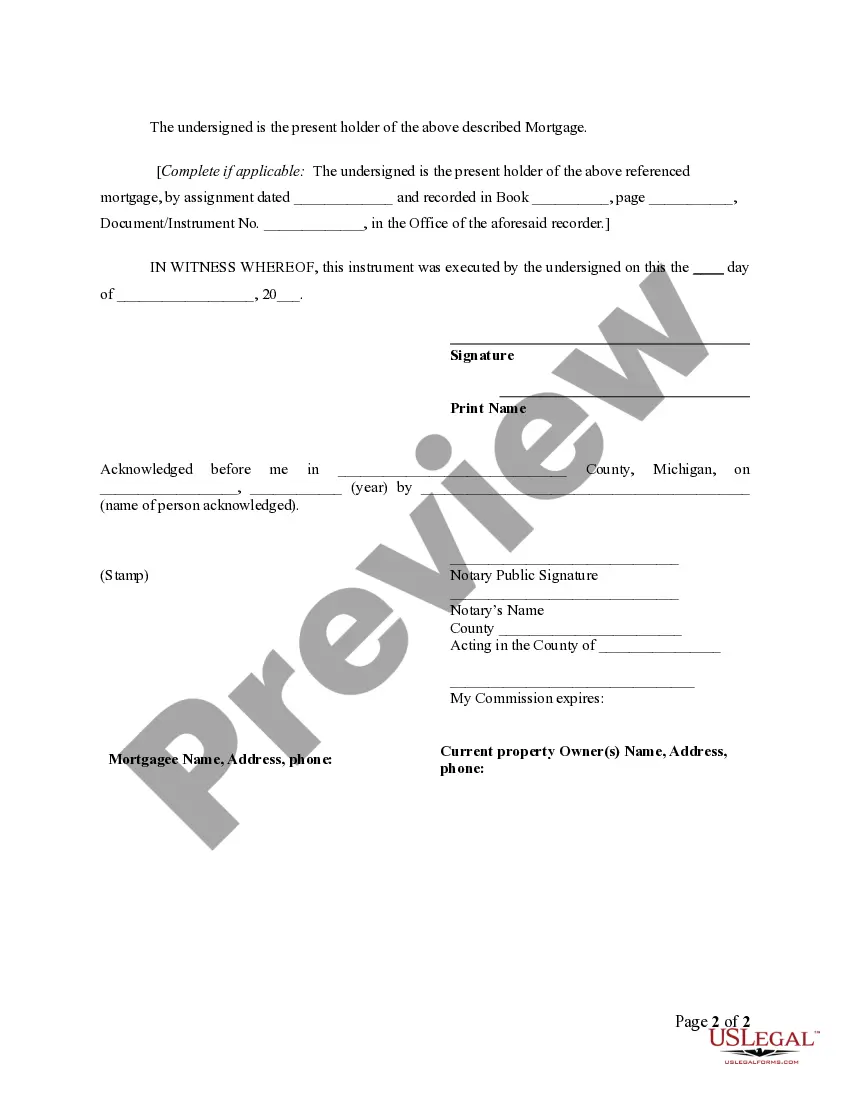

Grand Rapids Michigan Partial Release of Property From Mortgage by Individual Holder is a legal document that allows an individual mortgage holder to release a portion of a property from the existing mortgage lien. This type of partial release is commonly used when the property owner wants to sell or transfer a specific part of the property while keeping the remaining portion under the original mortgage. The Grand Rapids Michigan Partial Release of Property From Mortgage by Individual Holder serves as a written agreement between the mortgage holder and the property owner, ensuring that the released portion is no longer encumbered by the mortgage lien. This document is essential to protect the interests of both parties involved in the transaction. The individual releasing the property is typically referred to as the "Releaser" or "Mortgagee," while the individual receiving the released portion is called the "Released" or "Transferee." The partial release may cover various types of properties, including residential homes, commercial buildings, or vacant land. Key components of the Grand Rapids Michigan Partial Release of Property From Mortgage by Individual Holder include: 1. Names and Contact Information: The full legal names, addresses, and contact details of both the Releaser and Released, specifically identifying their roles in the transaction. 2. Description of the Property: A detailed legal description of the property, including its address, tax parcel number, and any other relevant identifying details. 3. Mortgage Information: The original mortgage details, such as the mortgage holder's name, date of creation, recording information, and the original amount of the mortgage. 4. Partial Release Details: A specific description of the portion of the property being released from the mortgage lien. This should include accurate measurements, boundaries, or any other relevant identification information. 5. Consideration: The amount or form of consideration the Released provides to the Releaser for the partial release. This can include monetary payment, property exchange, or any other agreed-upon consideration. 6. Signatures and Notarization: Both the Releaser and Released must sign the document, acknowledging their consent and understanding of the terms. It is crucial to have the document notarized to ensure its legal validity. Different types of Grand Rapids Michigan Partial Release of Property From Mortgage by Individual Holder may include variations based on the nature of the property, the terms of the original mortgage, or any specific agreements between the parties involved. These may include agricultural land releases, commercial property releases, or residential property releases. Overall, the Grand Rapids Michigan Partial Release of Property From Mortgage by Individual Holder is an essential legal document that allows property owners in Grand Rapids to release a portion of their property from a mortgage lien. It ensures transparency, protects the interests of both parties, and facilitates property transfers or sales while maintaining the integrity of the mortgage agreement.

Grand Rapids Michigan Partial Release of Property From Mortgage by Individual Holder is a legal document that allows an individual mortgage holder to release a portion of a property from the existing mortgage lien. This type of partial release is commonly used when the property owner wants to sell or transfer a specific part of the property while keeping the remaining portion under the original mortgage. The Grand Rapids Michigan Partial Release of Property From Mortgage by Individual Holder serves as a written agreement between the mortgage holder and the property owner, ensuring that the released portion is no longer encumbered by the mortgage lien. This document is essential to protect the interests of both parties involved in the transaction. The individual releasing the property is typically referred to as the "Releaser" or "Mortgagee," while the individual receiving the released portion is called the "Released" or "Transferee." The partial release may cover various types of properties, including residential homes, commercial buildings, or vacant land. Key components of the Grand Rapids Michigan Partial Release of Property From Mortgage by Individual Holder include: 1. Names and Contact Information: The full legal names, addresses, and contact details of both the Releaser and Released, specifically identifying their roles in the transaction. 2. Description of the Property: A detailed legal description of the property, including its address, tax parcel number, and any other relevant identifying details. 3. Mortgage Information: The original mortgage details, such as the mortgage holder's name, date of creation, recording information, and the original amount of the mortgage. 4. Partial Release Details: A specific description of the portion of the property being released from the mortgage lien. This should include accurate measurements, boundaries, or any other relevant identification information. 5. Consideration: The amount or form of consideration the Released provides to the Releaser for the partial release. This can include monetary payment, property exchange, or any other agreed-upon consideration. 6. Signatures and Notarization: Both the Releaser and Released must sign the document, acknowledging their consent and understanding of the terms. It is crucial to have the document notarized to ensure its legal validity. Different types of Grand Rapids Michigan Partial Release of Property From Mortgage by Individual Holder may include variations based on the nature of the property, the terms of the original mortgage, or any specific agreements between the parties involved. These may include agricultural land releases, commercial property releases, or residential property releases. Overall, the Grand Rapids Michigan Partial Release of Property From Mortgage by Individual Holder is an essential legal document that allows property owners in Grand Rapids to release a portion of their property from a mortgage lien. It ensures transparency, protects the interests of both parties, and facilitates property transfers or sales while maintaining the integrity of the mortgage agreement.