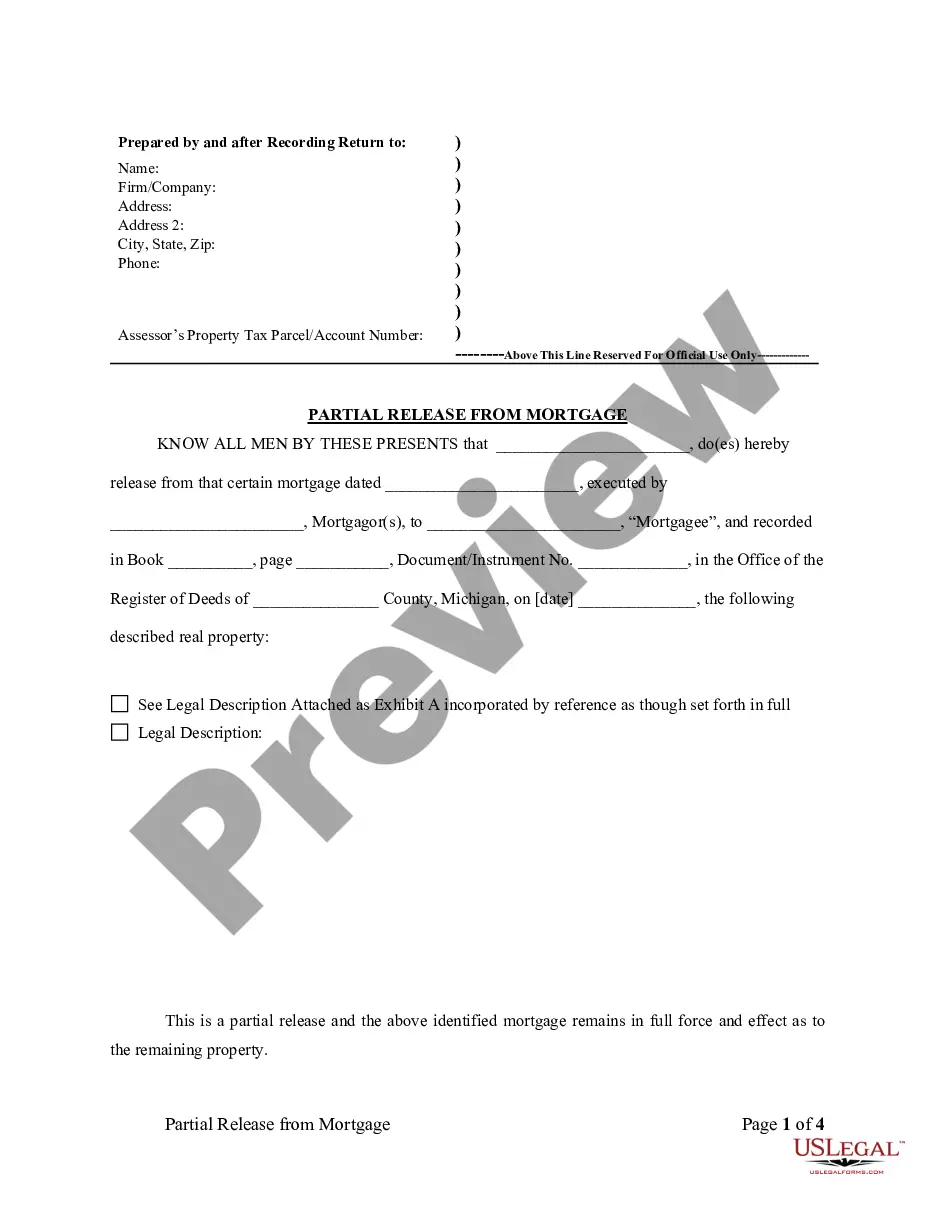

Grand Rapids Michigan Partial Release of Property From Mortgage for Corporation

Description

How to fill out Michigan Partial Release Of Property From Mortgage For Corporation?

Are you in search of a trustworthy and cost-effective legal documents provider to obtain the Grand Rapids Michigan Partial Release of Property From Mortgage for Corporation? US Legal Forms is your ideal answer.

Whether you need a straightforward arrangement to establish guidelines for living together with your partner or a collection of documents to facilitate your separation or divorce through the court, we have you covered. Our platform features over 85,000 current legal document templates for personal and business needs. All templates we provide are tailored and designed according to the regulations of individual states and regions.

To acquire the document, you must Log In to your account, locate the necessary form, and click the Download button adjacent to it. Please remember that you can retrieve your previously purchased document templates at any moment in the My documents section.

Is this your first time visiting our site? No problem. You can easily create an account, but before doing so, ensure you do the following.

Now, you can set up your account. After that, select your subscription choice and proceed to payment. Once the transaction is finalized, download the Grand Rapids Michigan Partial Release of Property From Mortgage for Corporation in any available format. You can return to the website whenever necessary and redownload the document without incurring additional charges.

Acquiring current legal forms has never been simpler. Try US Legal Forms today, and stop wasting your valuable time searching for legal documents online once and for all.

- Verify that the Grand Rapids Michigan Partial Release of Property From Mortgage for Corporation complies with the laws of your state and locality.

- Examine the form’s specifics (if available) to understand who and what the document is suitable for.

- Restart the search if the form does not fit your particular circumstances.

Form popularity

FAQ

Partial redemption of a mortgage refers to the process where a borrower pays off a part of their mortgage balance. This can reduce the overall debt and potentially lower interest payments in the long run. For corporations in Grand Rapids, Michigan, a partial redemption can be a strategic move to enhance financial liquidity, and ulegalforms can assist in navigating the necessary documentation for this process.

A part and part mortgage can provide flexibility and financial management for corporations. By utilizing this strategy, a corporation can allow for partial releases without fully refinancing their entire mortgage. Companies in Grand Rapids, Michigan, can benefit from this approach, particularly when they wish to optimize their property investments while maintaining favorable mortgage terms.

A partial release of a mortgage allows a borrower to release a specific portion of their property from the mortgage obligations. This process is particularly beneficial for companies looking to manage their real estate assets effectively. In Grand Rapids, Michigan, a partial release of property from mortgage for a corporation can be an excellent way to facilitate the sale or refinancing of a portion of the property, while retaining ownership of the remainder.

To release a lien means that the lender removes their legal claim against a property, allowing the owner to have an unobstructed title. This often occurs once the debt has been fully repaid, or in the case of partial releases. Understanding the implications of releasing a lien can help corporations in Grand Rapids, Michigan better navigate their financial obligations and asset management strategies.

Commercial mortgages often contain a partial release clause that allows borrowers the option to release portions of the property from the mortgage agreement. This feature is particularly essential for corporations in Grand Rapids, Michigan, as it provides them with the flexibility to make property adjustments according to their business needs. Engaging with professionals can ensure you have the right mortgage structure.

A partial discharge of a mortgage occurs when a lender agrees to release a specific portion of the mortgaged property from the lender’s claim. This means the borrower is no longer responsible for that segment of the property under the mortgage terms. Corporations in Grand Rapids, Michigan may find this beneficial as it can facilitate flexibility in property management and financial commitments.

A partial lien arises when a lender has a claim on only a part of a property, rather than the entire property. Essentially, the borrower retains ownership of some parts of the asset while still being responsible for the mortgage on the remaining parts. This situation can be especially useful for corporations in Grand Rapids, Michigan, looking to optimize their assets through a partial release of property from mortgage.

A partial release refers to the process of removing a portion of the property from the mortgage obligation. This means that the borrower no longer holds the liability on the released portion while the remaining property continues under the mortgage agreement. Often, businesses in Grand Rapids, Michigan, seek a partial release of property from mortgage for corporation needs during expansions or sales.

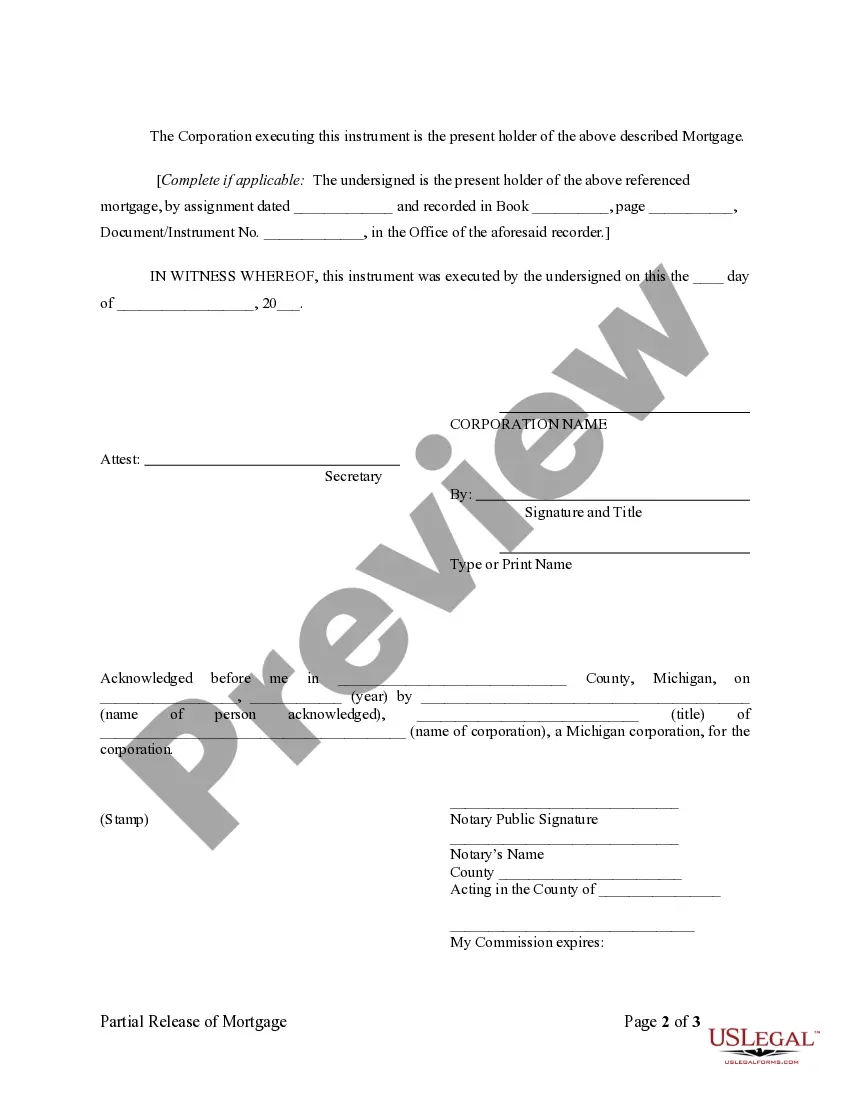

The process of a partial release typically involves submitting a request to your lender to release a specific portion of the property from mortgage obligations. In Grand Rapids Michigan, this allows corporate property owners to increase the value of their remaining assets and improve financial flexibility. Always work closely with your lender and consider using platforms like US Legal Forms to manage the necessary documentation smoothly.

Transferring ownership of a property in Michigan involves several steps, including preparing a deed, signing it in front of a notary, and recording it with the local register of deeds. In Grand Rapids Michigan, it’s crucial to ensure that any existing mortgage obligations are addressed during the transfer. Consulting with a legal expert can simplify this process and help you understand any related partial release of property from mortgage for corporations.