The Detroit Michigan Fiduciary Deed is a legal document that allows the transfer of real property from fiduciaries, such as Executors, Trustees, Trustees, Administrators, and other Fiduciaries, to the intended beneficiaries or new owners. This type of deed is specifically designed for fiduciaries who are responsible for managing the estate or property of another person or entity. Executors, as appointed by a will, are entrusted with the duty to distribute assets to the beneficiaries according to the deceased person's wishes. Trustees, on the other hand, manage assets held in trust for the benefit of beneficiaries. Trustees create the trust and appoint the trustee. Administrators are appointed by the court to oversee the distribution of property in a decedent's estate when there is no valid will or when there are complications in the distribution process. There may be different types or variations of the Detroit Michigan Fiduciary Deed for use by different types of fiduciaries. These may include: 1. Executor's Fiduciary Deed: This deed is used by Executors named in a will to transfer property from the deceased person's estate to the designated beneficiaries. 2. Trustee's Fiduciary Deed: Trustees, acting on behalf of the trust, use this deed to transfer property held in trust to the beneficiaries specified in the trust agreement. 3. Trust or's Fiduciary Deed: A Trust or, who created the trust, may use this deed to transfer property into the trust. 4. Administrator's Fiduciary Deed: Administrators, appointed by the court, utilize this deed to transfer property from a decedent's estate to the rightful heirs or beneficiaries. These different types of fiduciary deeds ensure the efficient and legal transfer of property while adhering to the fiduciary responsibilities and obligations that come with managing someone else's assets. It is crucial for fiduciaries to accurately complete, sign, and record the appropriate fiduciary deed to ensure proper documentation and protection of all parties involved in the transaction.

Detroit Michigan Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description

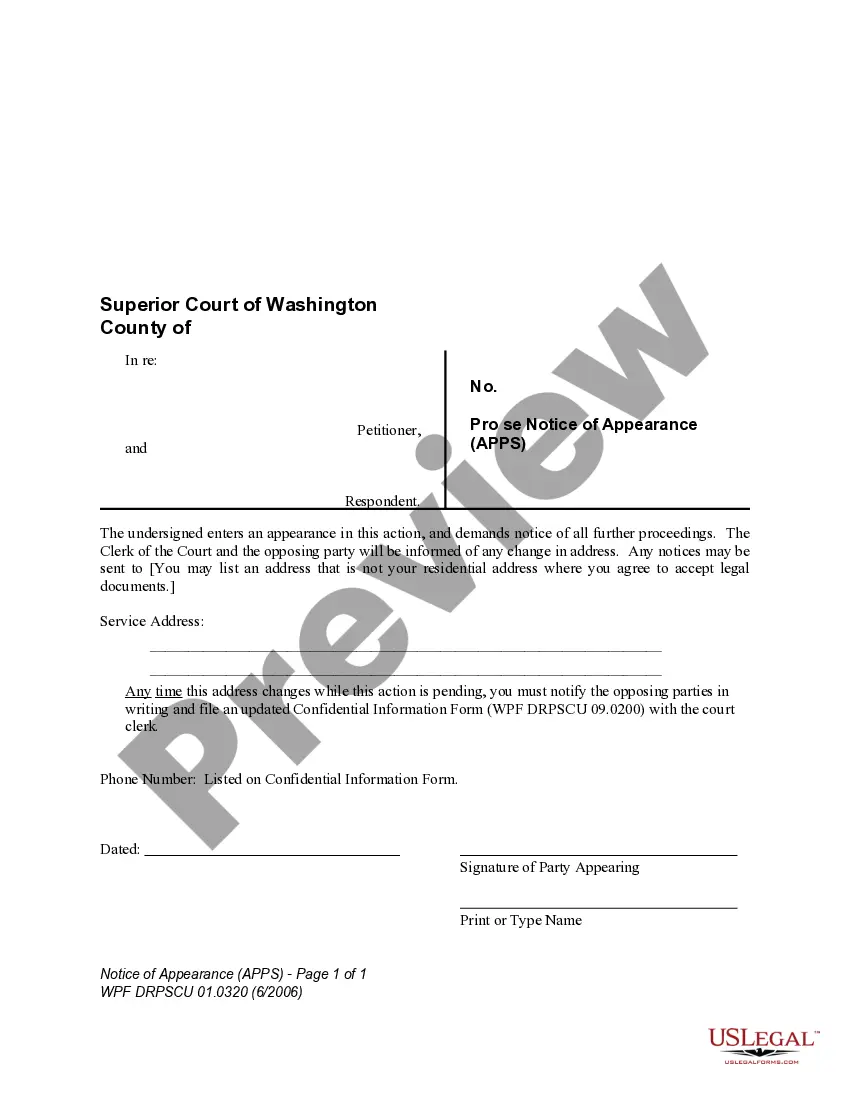

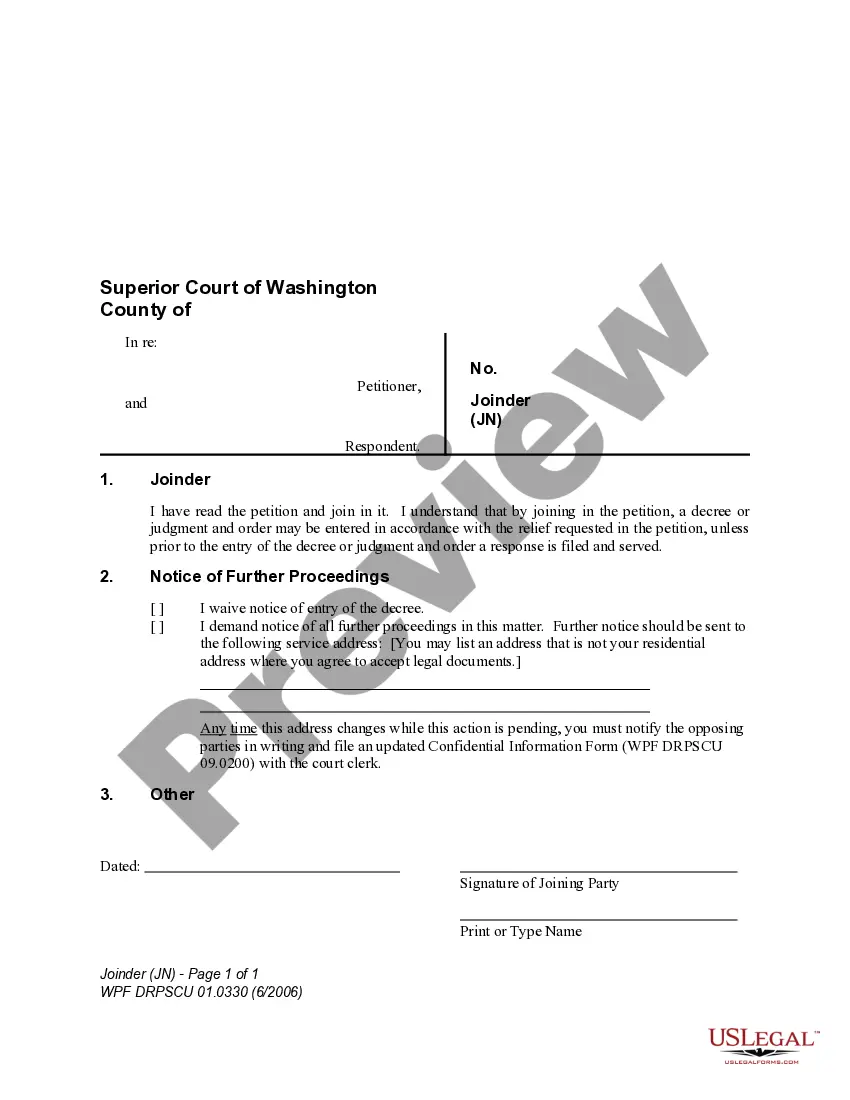

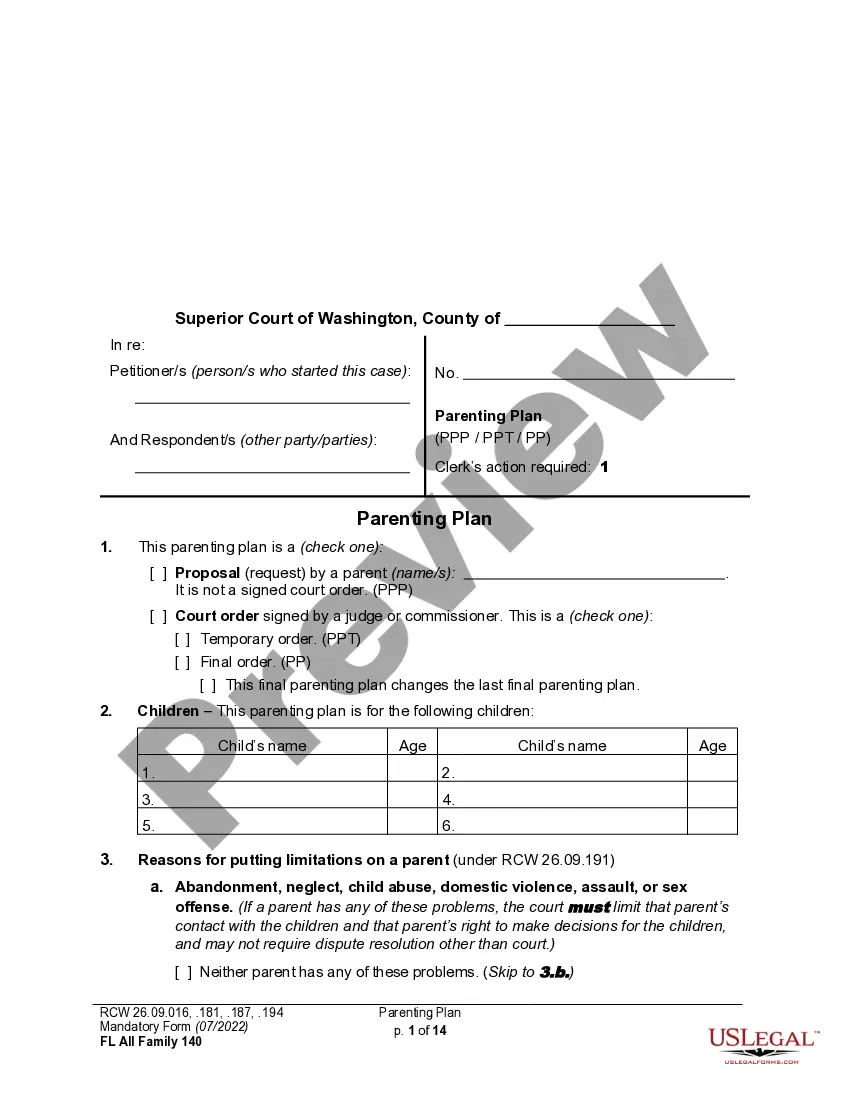

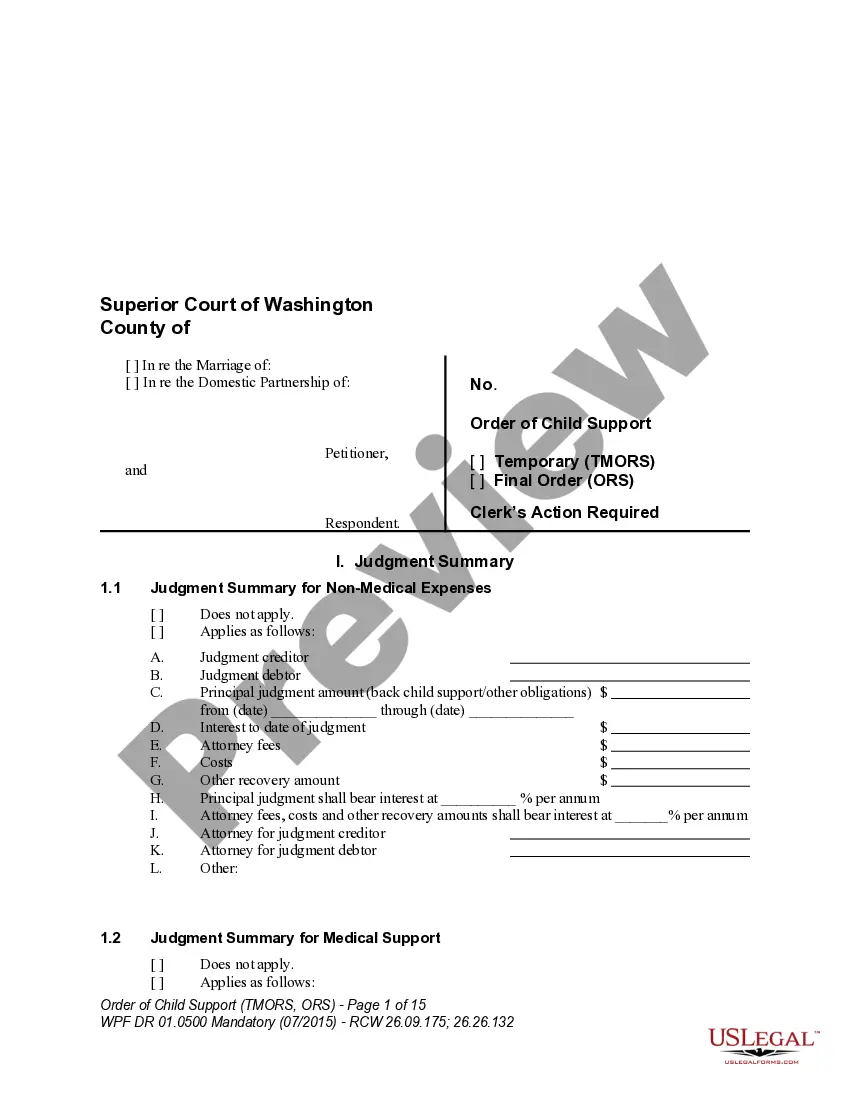

How to fill out Detroit Michigan Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

Acquiring authenticated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms database.

This is an online repository of over 85,000 legal documents catering to both personal and professional requirements across various real-world situations.

All files are systematically organized by application area and jurisdictional domains, making it straightforward and quick to find the Detroit Michigan Fiduciary Deed for the use of Executors, Trustees, Trustors, Administrators, and other Fiduciaries.

Maintaining documentation organized and aligned with legal standards is crucial. Leverage the US Legal Forms library to always have vital document templates for any requirements at your fingertips!

- For those already familiar with our catalog and who have used it previously, obtaining the Detroit Michigan Fiduciary Deed for Executors, Trustees, Trustors, Administrators, and other Fiduciaries is just a couple of clicks away.

- All that is required is to Log In to your account, select the document, and click Download to save it on your device.

- This process will involve just a few more steps for new users.

- Follow the instructions below to begin with the most comprehensive online form collection.

- Examine the Preview mode and document description. Ensure that you’ve selected the correct one that fulfills your needs and complies fully with your local jurisdiction requirements.

Form popularity

FAQ

A fiduciary deed is typically a type of covenant deed given by a personal representative of an estate or a trustee of a trust. These financial representatives are called fiduciaries, hence the name fiduciary deed.

The legal qualifications are simple: the trustee must be a bank or an individual over the age of 18 who is competent to manage his/her own affairs....With these things in mind, you have several options: Family Members. Friends and Business Associates. Institutions. Professional Advisors.

The trustee is in charge and as a beneficiary you have no control. This is a common misconception. The trustee is administering the trust on your behalf.

The Personal Representative may also sell real estate owned by the Decedent. All monies from the sale of these assets are then deposited into a an ?estate? bank account. The Personal Representative must first pay creditor claims, final expenses of the deceased, administration expenses, and other authorized expenses.

The trustee of an irrevocable trust can only withdraw money to use for the benefit of the trust according to terms set by the grantor, like disbursing income to beneficiaries or paying maintenance costs, and never for personal use.

And although a beneficiary generally has very little control over the trust's management, they are entitled to receive what the trust allocates to them. In general, a trustee has extensive powers when it comes to overseeing the trust.

A fiduciary transfer is a transfer of ownership accompanied by an obligation that limits the rights of the transferee with respect to the transferred proper- ty in such a way that the latter is obliged to use the ownership for a specific purpose and then to (re)transfer it to the original owner or a beneficiary.

A ?Fiduciary? is a person or an institution you choose to entrust with the management of your property. Included among Fiduciaries are Executors and Trustees. An Executor is a person you appoint to settle your estate and to carry out the terms of your Will after your death.

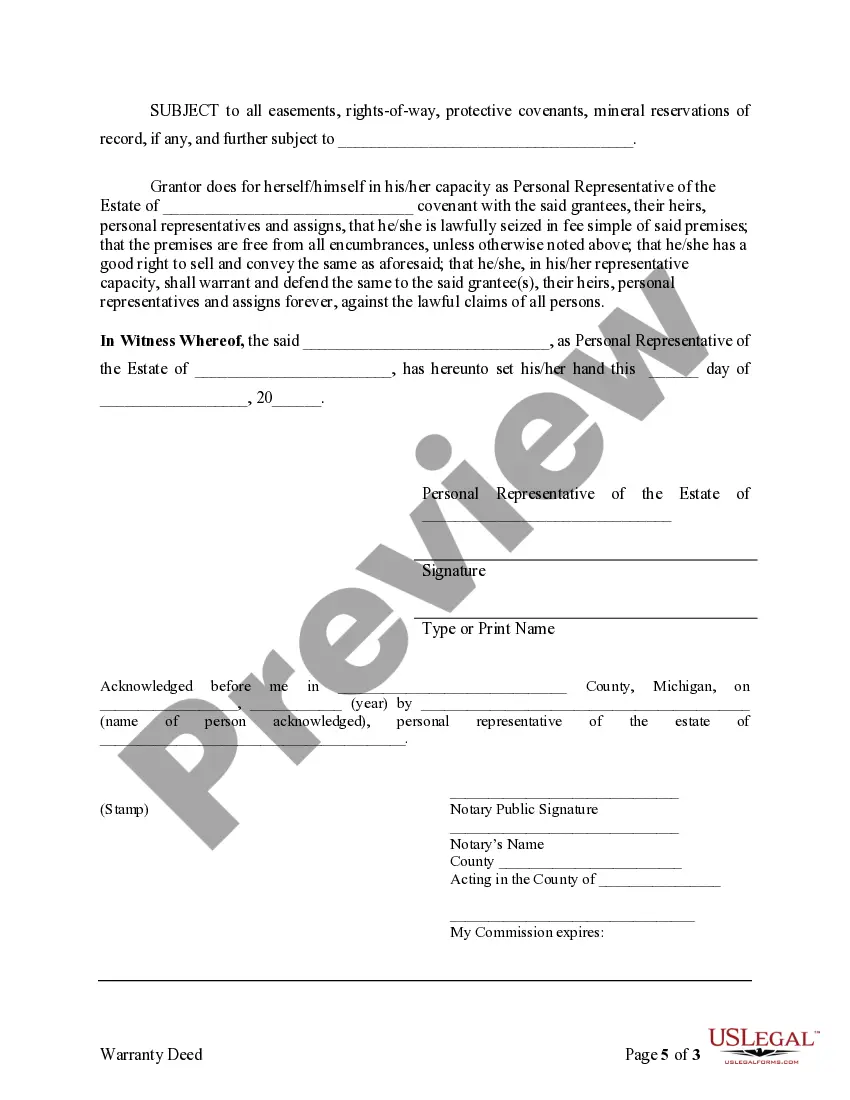

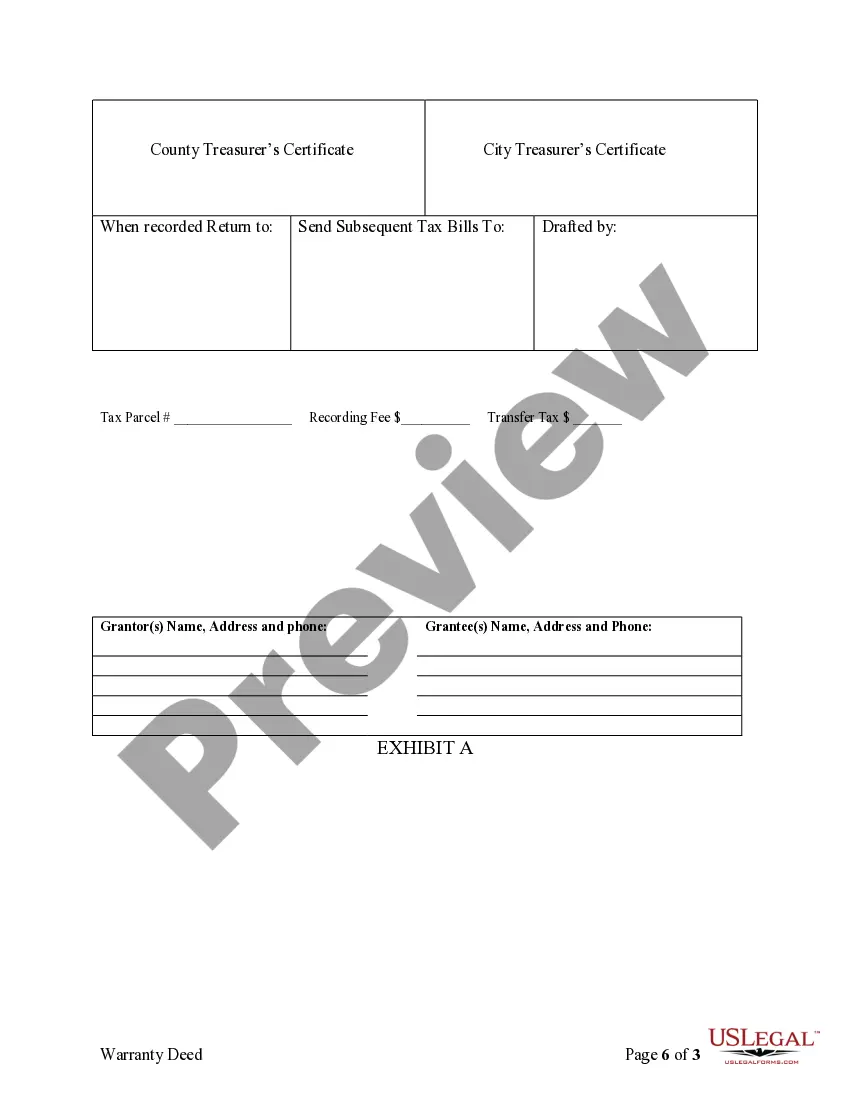

That it be signed by the grantor; That the grantor's signature be witnessed by a notary, who must acknowledge and seal the deed; That the deed be delivered and accepted by the grantee.

There are three main types of deeds in Michigan: warranty deeds, quitclaim deeds, and covenant deeds.