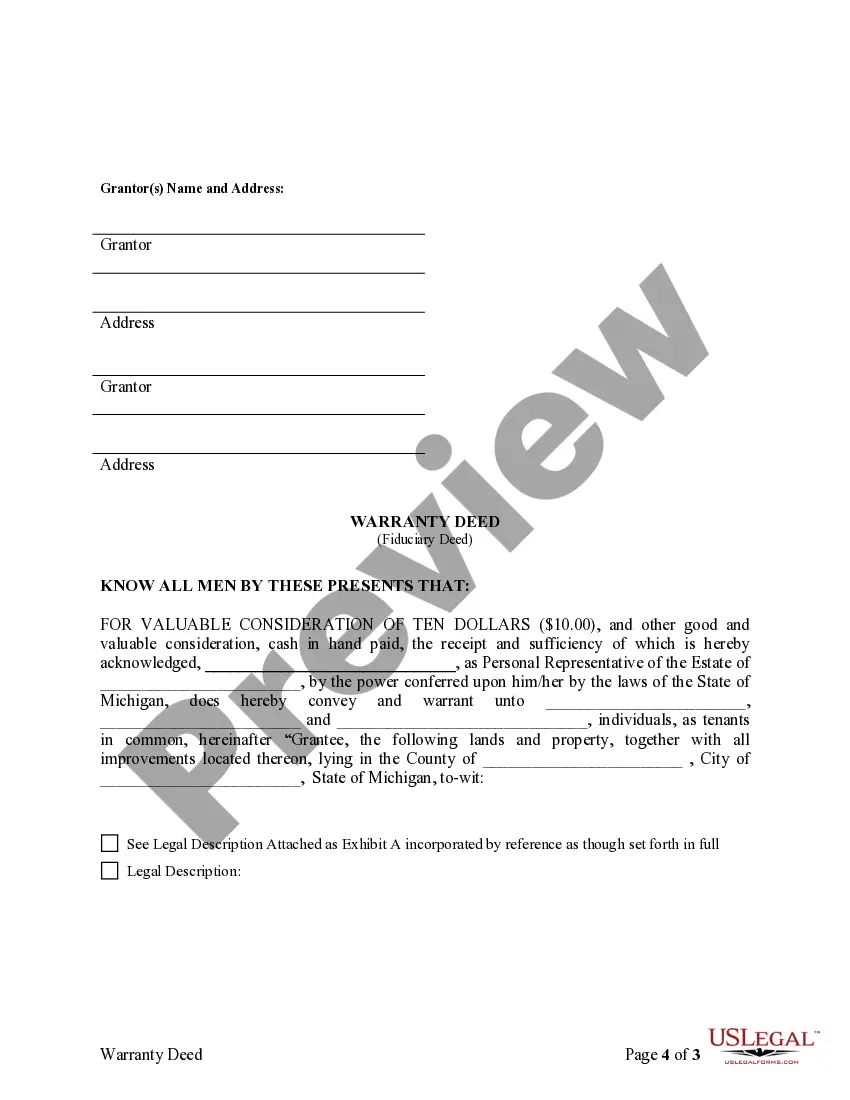

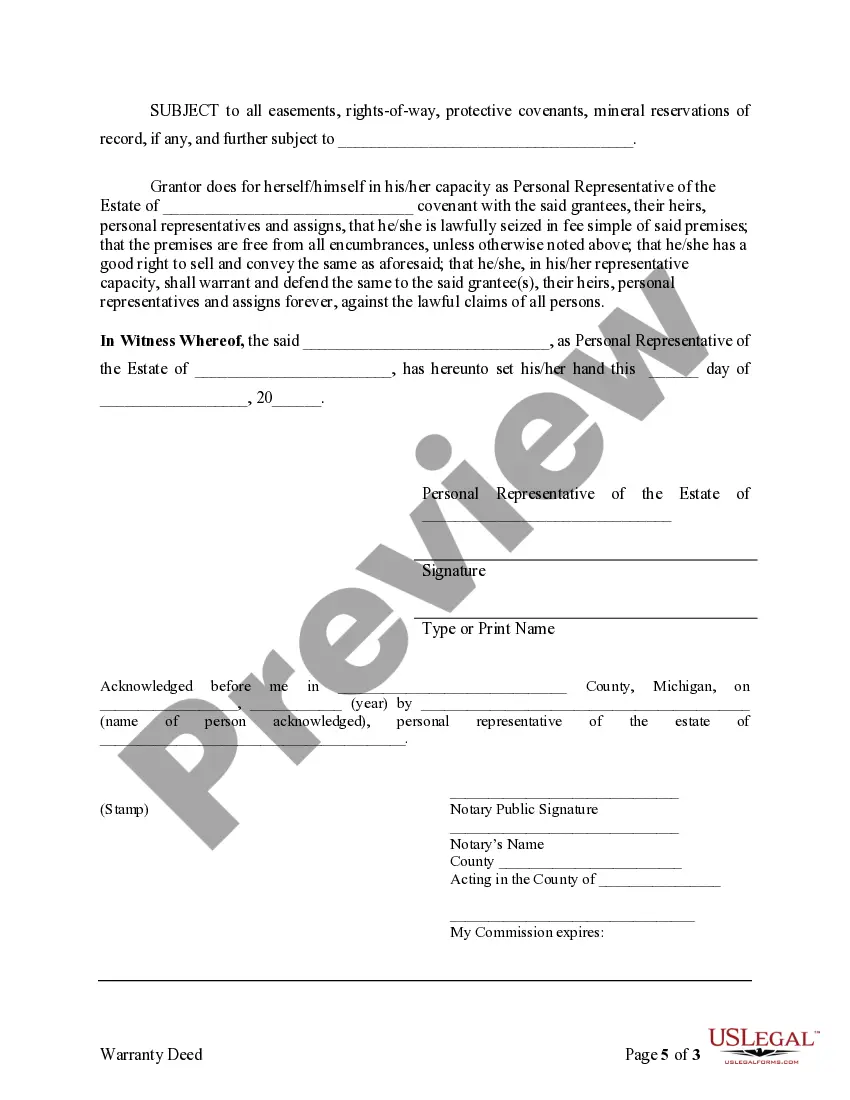

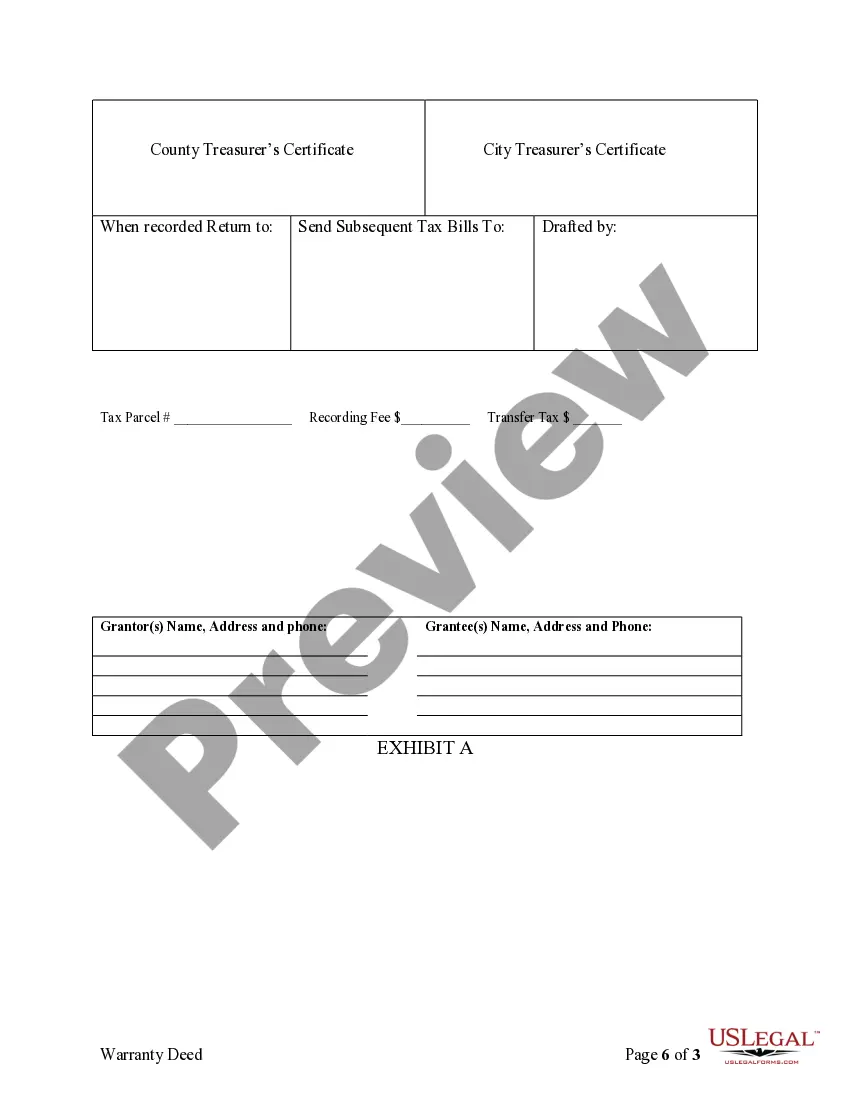

A Wayne Michigan Fiduciary Deed is a legal document specifically designed for use by Executors, Trustees, Trustees, Administrators, and other Fiduciaries involved in transferring real estate assets located in Wayne, Michigan. This deed is essential for ensuring a smooth and lawful transfer of property ownership from the estate or trust to the identified beneficiaries. Executors, Trustees, Trustees, Administrators, and other Fiduciaries encounter multiple scenarios where the Wayne Michigan Fiduciary Deed becomes vital. Some distinct types of Fiduciary Deeds include: 1. Executor's Fiduciary Deed: This deed is used when an individual's last will and testament designates an Executor to distribute the assets of the estate, including real property in Wayne, Michigan. The Executor, acting in their fiduciary capacity, must execute this deed to transfer the property according to the deceased's wishes. 2. Trustee's Fiduciary Deed: When assets are held in a trust, the designated Trustee has the responsibility to manage and distribute them as outlined in the trust documents. Upon selling, gifting, or transferring a specific property from the trust, the Trustee must use a Fiduciary Deed to convey the property to the intended recipient(s). 3. Trust or's Fiduciary Deed: This type of deed is executed by a Trust or, who establishes a trust during their lifetime, and designates a Trustee to oversee the assets. The Trust or may use a Fiduciary Deed to transfer real estate held under the trust to a beneficiary or another party as required by the trust agreement. 4. Administrator's Fiduciary Deed: In cases where an individual passes away without a valid will, a court appoints an Administrator to manage the estate's affairs, including the distribution of real property. The Administrator must execute an Administrator's Fiduciary Deed to transfer ownership of the property to the rightful heirs, following the legal procedures outlined by Michigan laws. The Wayne Michigan Fiduciary Deed contains crucial information, such as the legal names of the fiduciaries and beneficiaries, a detailed legal description of the property being transferred, and any encumbrances or restrictions on the property. It must be properly executed, acknowledged, and recorded with the appropriate county office to ensure its legal validity. Fiduciaries should always consult with legal professionals specializing in estate planning and real estate law to ensure compliance with Wayne, Michigan regulations and to accurately prepare and execute the required Fiduciary Deeds.

Wayne Michigan Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description

How to fill out Wayne Michigan Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

Finding verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Wayne Michigan Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries becomes as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, getting the Wayne Michigan Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries takes just a couple of clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. This process will take just a few additional actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Look at the Preview mode and form description. Make certain you’ve picked the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, utilize the Search tab above to obtain the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Wayne Michigan Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!

Form popularity

FAQ

That it be signed by the grantor; That the grantor's signature be witnessed by a notary, who must acknowledge and seal the deed; That the deed be delivered and accepted by the grantee.

There are three main types of deeds in Michigan: warranty deeds, quitclaim deeds, and covenant deeds.

A fiduciary deed is used to transfer property when the executor is acting in his official capacity. A fiduciary deed warrants that the fiduciary is acting in the scope of his appointed authority but it does not guarantee title of the property.

A fiduciary deed is used to transfer property when the executor is acting in his official capacity. A fiduciary deed warrants that the fiduciary is acting in the scope of his appointed authority but it does not guarantee title of the property. (Oh.

Six Commonly Used Deed in Ohio General Warranty Deed. The most common form of deed used in Ohio is a General Warranty Deed.Limited Warranty Deed.Quit Claim Deed.Fiduciary Deed.Joint and Survivorship Deed.Transfer on Death Designation Affidavit.

Deeds by executors and administrators contain fiduciary covenants signifying that the grantor is the duly appointed, qualified, and acting fiduciary, and that he or she is authorized to make the sale and conveyance of the within described real property.

Fiduciary deeds are just one of several types of deeds used in property transfers. This type is used to transfer property such as real estate when the owner can't sign a deed for legal or other reasons. Fiduciary deeds are commonly employed when settling estates and the original owner of the property is deceased.

In Ohio, a Survivorship Deed is used to convey title to real estate to two or more people as joint tenants with rights of survivorship. Upon the death of an owner, the property passes to the surviving owner(s). A Survivorship Deed is commonly utilized to convey property to spouses.

A fiduciary transfer is a transfer of ownership accompanied by an obligation that limits the rights of the transferee with respect to the transferred proper- ty in such a way that the latter is obliged to use the ownership for a specific purpose and then to (re)transfer it to the original owner or a beneficiary.

An Executor's Deed in Texas is used to transfer real property from the estate of a deceased property owner to the heir or heirs designated in their Will. It is signed by a court appointed Executor, who is the person named in a will to execute the terms of a Will.

Interesting Questions

More info

010, (3) and (4) and (6); ORS and (3) et seq. (4) and (6); PENUMBRA (3) and (5) and (3) et seq. Trustees of corporations: ORS (3) and (1) and (3); PENUMBRA (4) (2) and (5) and (6); PENUMBRA (17) and (18); PENUMBRA (17) (2) (a) and (c); PENUMBRA (3) (a) and (c) (as modified×. Trustees of limited partnerships, limited liability companies and joint stock association limited partners are also generally not entitled to a share of the property or profits or income from the sale or transfer of the general partnership interest. Trustees of real estate and limited partnerships: ORS (1) and (2); PENUMBRA (4) and (5×. Other personal representatives: ORS and (3) and (2) (a) and (b); PENUMBRA (3) (e); PENUMBRA (8); PENUMBRA (1×. All the personal representatives of the decedent and all members of the decedent's immediate family were treated as beneficiaries. 2.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.