Detroit Michigan Warranty Deed for Not For-Profit Corporation to Municipality

Description

How to fill out Michigan Warranty Deed For Not For-Profit Corporation To Municipality?

If you are looking for an appropriate form template, it’s exceptionally difficult to locate a more user-friendly platform than the US Legal Forms website – one of the largest online archives.

With this collection, you can find a vast array of templates for both organizational and personal uses categorized by types and states, or by keywords.

Using our sophisticated search tool, locating the most current Detroit Michigan Warranty Deed for Not For-Profit Corporation to Municipality is as simple as 1-2-3.

Make alterations. Complete, modify, print, and sign the obtained Detroit Michigan Warranty Deed for Not For-Profit Corporation to Municipality.

Every form you save in your user account has no expiration date and is permanently yours. You can conveniently access them through the My documents menu, so if you wish to receive an additional copy for editing or printing, you can return and save it again at any time.

- Ensure you have found the form you are seeking.

- Review its description and use the Preview feature to examine its contents. If it doesn’t satisfy your needs, utilize the Search function at the top of the page to find the suitable document.

- Confirm your choice. Select the Buy now option. Then, choose your desired subscription plan and provide the necessary information to create an account.

- Complete the transaction. Use your credit card or PayPal account to finish the registration process.

- Obtain the form. Choose the file format and save it on your device.

Form popularity

FAQ

The buyer, or grantee, of a property benefits the most from obtaining a warranty deed. Through the recording of a warranty deed, the seller is providing assurances to the buyer should anything unexpected happen.

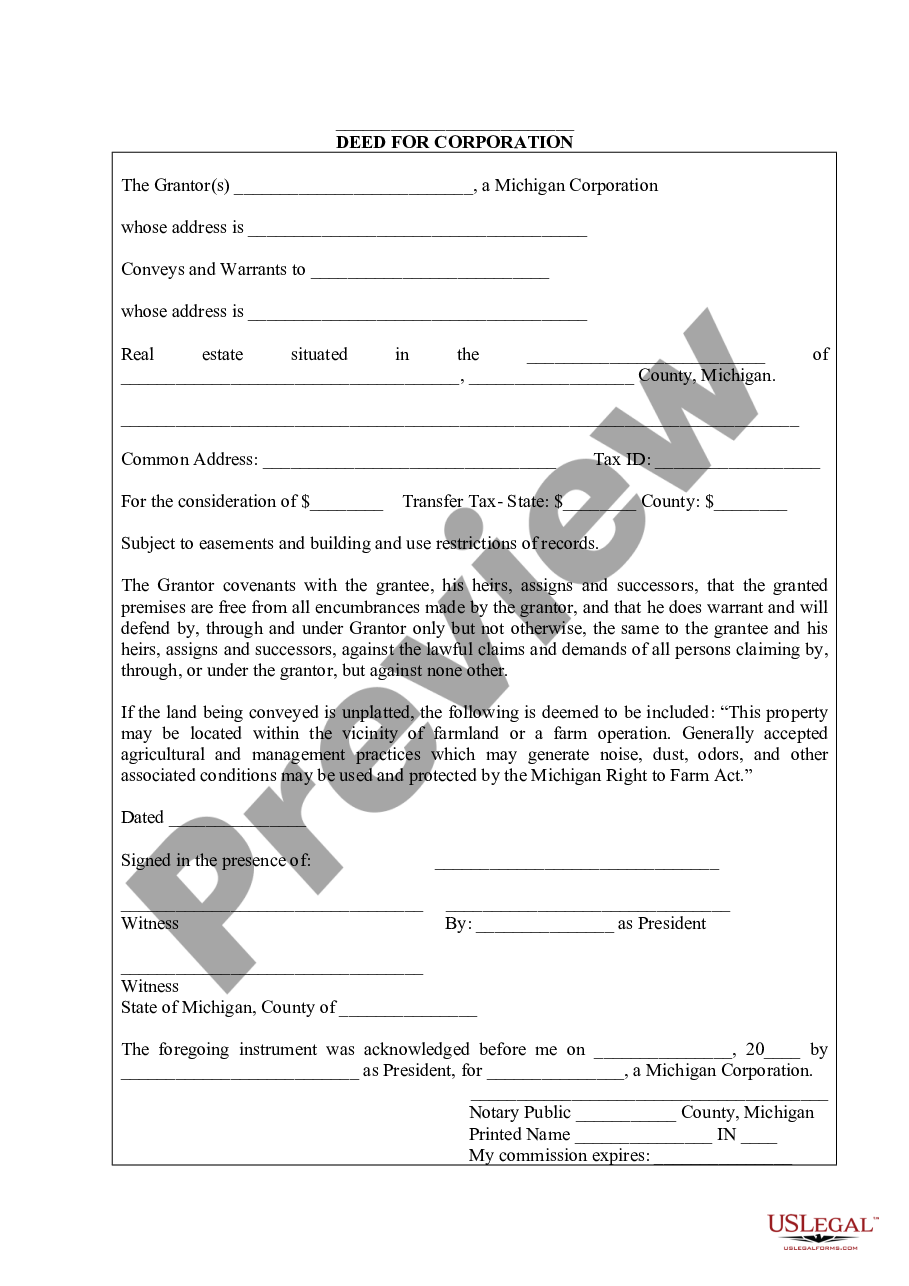

The Michigan warranty deed is a form of deed that provides an unlimited warranty of title. It makes an absolute guarantee that the current owner has good title to the property. The warranty is not limited to the time that the current owner owned the property.

According to Legal Zoom, a general warranty deed guarantees that: The grantor legally owns the property and has the legal right to transfer it. There are no outstanding mortgages, liens or other claims against the property by any creditor.

How to Transfer Michigan Real Estate Find the most recent deed to the property. It is helpful to begin by locating the most recent deed to the property (the deed that transferred the property to the current grantor).Create the new deed.Sign and notarize the deed.File the deed in the county land records.

The deed does not need to be recorded in the office of the County Recorder of Deeds in order to be valid between the grantor and the grantee. However, it is still very important to record the deed. Recording the deed establishes priority and the sequence of ownership.

Visit our Office We are located at 400 Monroe, 7th floor - above Fishbones Restaurant in Greektown (downtown Detroit). Search fee for a property is $5.00. This fee is waived if you can provide proof you are searching for your personal residence (valid driver's license, for example).

Warranty Deeds With a warranty deed, the grantor (seller) warrants that they have good title to the property and that they have a right to sell the property to the grantee (buyer). ?Good title? means that there are no liens, conditions, or restrictions on the property.

A warranty deed, also known as a general warranty deed, is a legal real estate document between the seller (grantor) and the buyer (grantee).

Warranty Deeds With a warranty deed, the grantor (seller) warrants that they have good title to the property and that they have a right to sell the property to the grantee (buyer). ?Good title? means that there are no liens, conditions, or restrictions on the property.