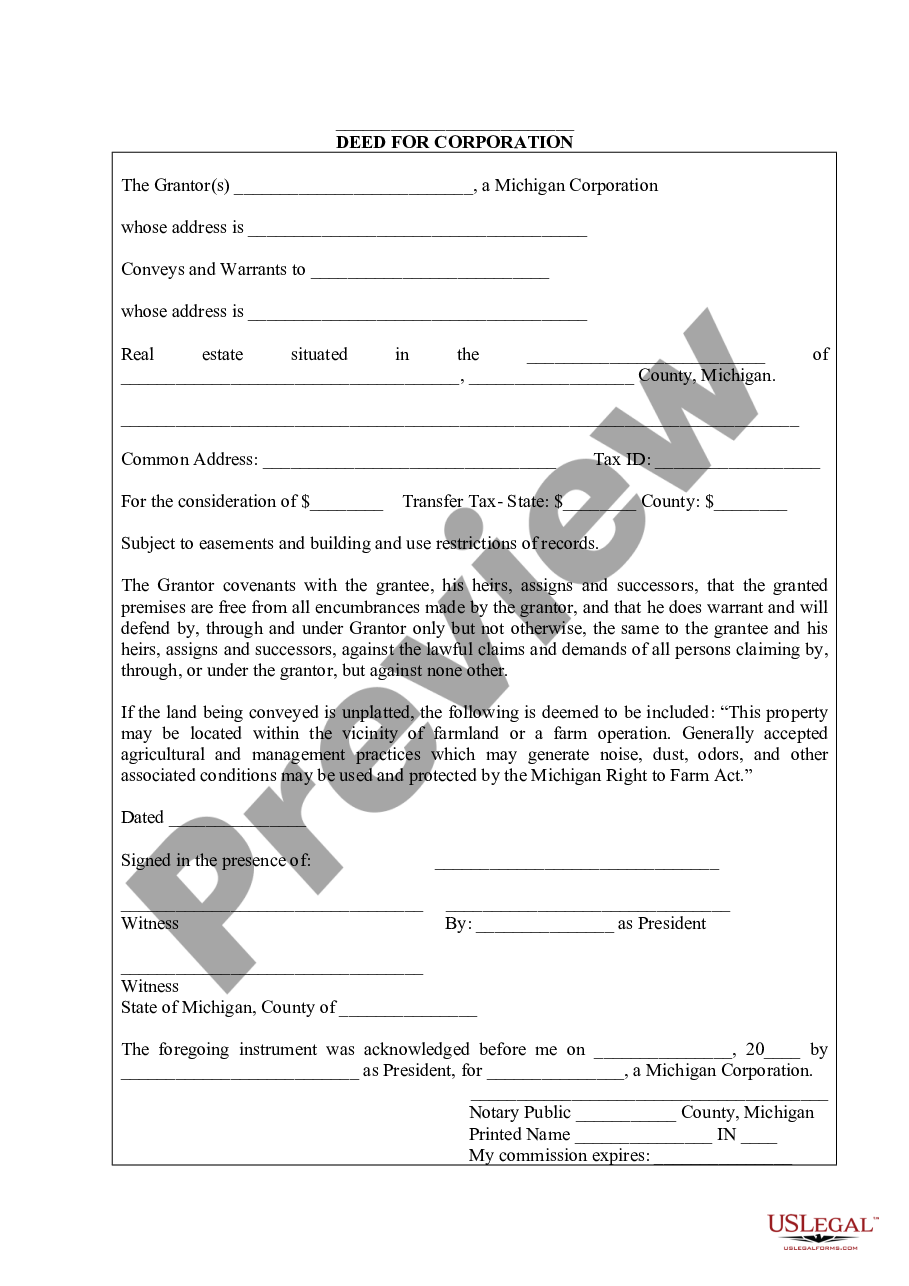

A Grand Rapids Michigan Warranty Deed for Not-For-Profit Corporation to Municipality is a legal document that transfers ownership of property owned by a not-for-profit corporation to a municipality while providing a guarantee (warranty) that the property is free from any defects or claims. This type of warranty deed serves as a critical legal instrument to ensure transparent and proper transfer of property rights between the not-for-profit corporation and the municipality. It establishes the rights and responsibilities of both parties and secures the municipality's ownership of the property for public use or other municipality-related purposes. The Grand Rapids Michigan Warranty Deed for Not-For-Profit Corporation to Municipality typically includes the following key information: 1. Names and addresses of both the not-for-profit corporation and the municipality involved in the transfer. 2. A detailed description of the property being conveyed, including the legal description, boundaries, and any survey information. 3. The consideration or payment for the transfer, if applicable. Often, when a not-for-profit organization donates property to a municipality, the consideration may be nominal, such as one dollar or for public benefit purposes. 4. The statement of warranty, assuring that the property is free from any liens, encumbrances, or title defects. This provides the municipality with protection against any claims or disputes arising from the property's ownership history. 5. Signatures of authorized representatives from the not-for-profit corporation and municipality, along with the date of execution. 6. Notarization, which may be required for the deed to be legally valid. Different types of Grand Rapids Michigan Warranty Deed for Not-For-Profit Corporation to Municipality may include variations based on specific circumstances or requirements. Some possible variations include: 1. Warranty Deed with Restrictive Covenants: This type of warranty deed may include additional clauses or restrictions that govern how the property can be used by the municipality. These restrictions could include maintaining the property for specific purposes or prohibiting certain activities on the premises. 2. Warranty Deed with Easements: If the not-for-profit corporation has granted any easements or rights-of-way on the property to third parties, these would need to be disclosed and transferred to the municipality through the warranty deed. 3. Warranty Deed with Tax Exempt Status Preservation: In some cases, a not-for-profit corporation may transfer property to a municipality while ensuring the preservation of its tax-exempt status. This type of warranty deed may contain provisions that specify the continued tax-exempt status of the property and the obligations of the municipality to maintain such status. In summary, a Grand Rapids Michigan Warranty Deed for Not-For-Profit Corporation to Municipality is a legal document that facilitates the transfer of ownership of property from a not-for-profit corporation to a municipality. It provides a warranty guaranteeing the absence of defects or claims on the property, ensuring a seamless and transparent transfer process. Variations of this warranty deed may exist to address specific requirements or considerations depending on the circumstances of the transfer.

Grand Rapids Michigan Warranty Deed for Not For-Profit Corporation to Municipality

Description

How to fill out Michigan Warranty Deed For Not For-Profit Corporation To Municipality?

Utilize the US Legal Forms and gain instant access to any form template you need.

Our advantageous platform with a multitude of documents facilitates the discovery and acquisition of virtually any document sample you desire.

You can preserve, complete, and validate the Grand Rapids Michigan Warranty Deed for Not For-Profit Corporation to Municipality in just a few minutes instead of browsing the web for hours searching for a suitable template.

Leveraging our catalog is a superb approach to enhance the security of your form submissions.

If you haven’t created an account yet, follow the instructions below.

Locate the form you require. Confirm that it is the document you were looking for: verify its title and description, and utilize the Preview option when available. Otherwise, use the Search field to find the desired one.

- Our experienced attorneys routinely review all documents to ensure that the forms are pertinent to a specific jurisdiction and adhere to new regulations and guidelines.

- How can you acquire the Grand Rapids Michigan Warranty Deed for Not For-Profit Corporation to Municipality.

- If you already possess an account, simply Log In to your profile. The Download button will be available on all the samples you examine. Additionally, you can access all previously saved documents in the My documents section.

Form popularity

FAQ

Filling out a quit claim deed in Michigan requires you to provide specific information about the property, the grantor, and the grantee. You should include the legal description of the property, the names and addresses of all parties involved, and any necessary signatures. It is essential to ensure that your document complies with Michigan laws, particularly if you're working with a Grand Rapids Michigan Warranty Deed for Not For-Profit Corporation to Municipality. Using platforms like USLegalForms can simplify this process by providing templates and guides tailored to your needs.

Yes, you can often obtain a copy of a house deed online, depending on the county in Michigan. Many register of deeds offices provide digital access to public records, allowing you to search for your Grand Rapids Michigan Warranty Deed for Not For-Profit Corporation to Municipality electronically. This convenience makes it easier for you to access important documents from the comfort of your own home, saving you time and effort.

Yes, deeds are public record in Michigan. This means that anyone can access them through the register of deeds office. Whether you need information for personal use or business, you can view the Grand Rapids Michigan Warranty Deed for Not For-Profit Corporation to Municipality for any transactions recorded. Public access to deeds promotes transparency and protects property rights.

To obtain a copy of a deed in Michigan, you can visit the register of deeds office in the county where the property is located. Many counties also offer online search options through their websites. You can search for the Grand Rapids Michigan Warranty Deed for Not For-Profit Corporation to Municipality by entering details like the property address or the names of the parties involved. This process helps ensure you have the necessary documentation for any future needs.

After closing on your property, you will receive a Grand Rapids Michigan Warranty Deed for Not For-Profit Corporation to Municipality, typically from your closing agent or attorney. The deed will be recorded with the local register of deeds, and you will often get a copy of it shortly after the closing. If you do not receive it, you can request a copy directly from your closing agent. This document is important for verifying ownership and ensuring the legal transfer of property.

A deed in Michigan is valid when it includes essential elements like the grantor's and grantee's names, a legal description of the property, and the necessary signatures. The deed must also be notarized and recorded at the county register of deeds for public notice. When dealing with a Grand Rapids Michigan Warranty Deed for Not For-Profit Corporation to Municipality, ensuring these factors are in order is crucial for a smooth transaction.

The rights of survivorship on a quit claim deed in Michigan specify that, upon the death of one owner, their share of the property automatically transfers to the surviving owners. This arrangement is beneficial for families or partners, ensuring property remains within the group without the need for probate. When considering a Grand Rapids Michigan Warranty Deed for Not For-Profit Corporation to Municipality, it’s essential to understand how different deeds function.

Filling out a warranty deed in Michigan involves several key steps. First, you need to include the names of both the grantor and grantee, along with their addresses. Next, detail the property being transferred using a legal description, and finally, sign the deed in front of a notary. Using resources from uslegalforms can simplify this process, offering templates and guidance specifically for a Grand Rapids Michigan Warranty Deed for Not For-Profit Corporation to Municipality.

A warranty deed in Michigan is a legal document that transfers property ownership. It guarantees that the seller has clear title, meaning there are no claims or liens against the property. When executing a Grand Rapids Michigan Warranty Deed for Not For-Profit Corporation to Municipality, the grantor assures the grantee of their right to the property, providing peace of mind for both parties.

A covenant deed typically includes promises or 'covenants' made by the seller regarding the property, but it may not provide the same level of protection as a warranty deed. A warranty deed offers a comprehensive guarantee against defects in title. When dealing with property transfers such as a Grand Rapids Michigan Warranty Deed for Not For-Profit Corporation to Municipality, understanding these differences helps in choosing the right deed for your situation.