Detroit Michigan Warranty Deed from Trustee to Individual

Description

How to fill out Michigan Warranty Deed From Trustee To Individual?

If you have utilized our service previously, sign in to your account and download the Detroit Michigan Warranty Deed from Trustee to Individual onto your device by clicking the Download button. Ensure your subscription is active. If not, renew it according to your payment method.

If this is your initial experience with our service, follow these straightforward steps to acquire your file.

You have uninterrupted access to each document you have acquired: you can locate it in your profile within the My documents section whenever you wish to reuse it. Utilize the US Legal Forms service to quickly identify and save any template for your personal or business requirements!

- Confirm you’ve found the correct document. Read the description and use the Preview feature, if accessible, to verify it fulfills your needs. If it does not fit your criteria, use the Search tab above to find the suitable one.

- Buy the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process your payment. Use your credit card information or the PayPal option to finalize the purchase.

- Retrieve your Detroit Michigan Warranty Deed from Trustee to Individual. Select the file format for your document and save it to your device.

- Finalize your document. Print it out or take advantage of professional online editors to complete it and sign it electronically.

Form popularity

FAQ

The buyer, or grantee, of a property benefits the most from obtaining a warranty deed. Through the recording of a warranty deed, the seller is providing assurances to the buyer should anything unexpected happen.

State Transfer Tax Rate ? $3.75 for every $500 of value transferred. County Transfer Tax Rate ? $0.55 for every $500 of value transferred.

If you die without a will in Michigan, also known as intestate, state law and the probate court will control the distribution of your estate. Your assets will be distributed to legally recognized beneficiaries according to intestacy succession law.

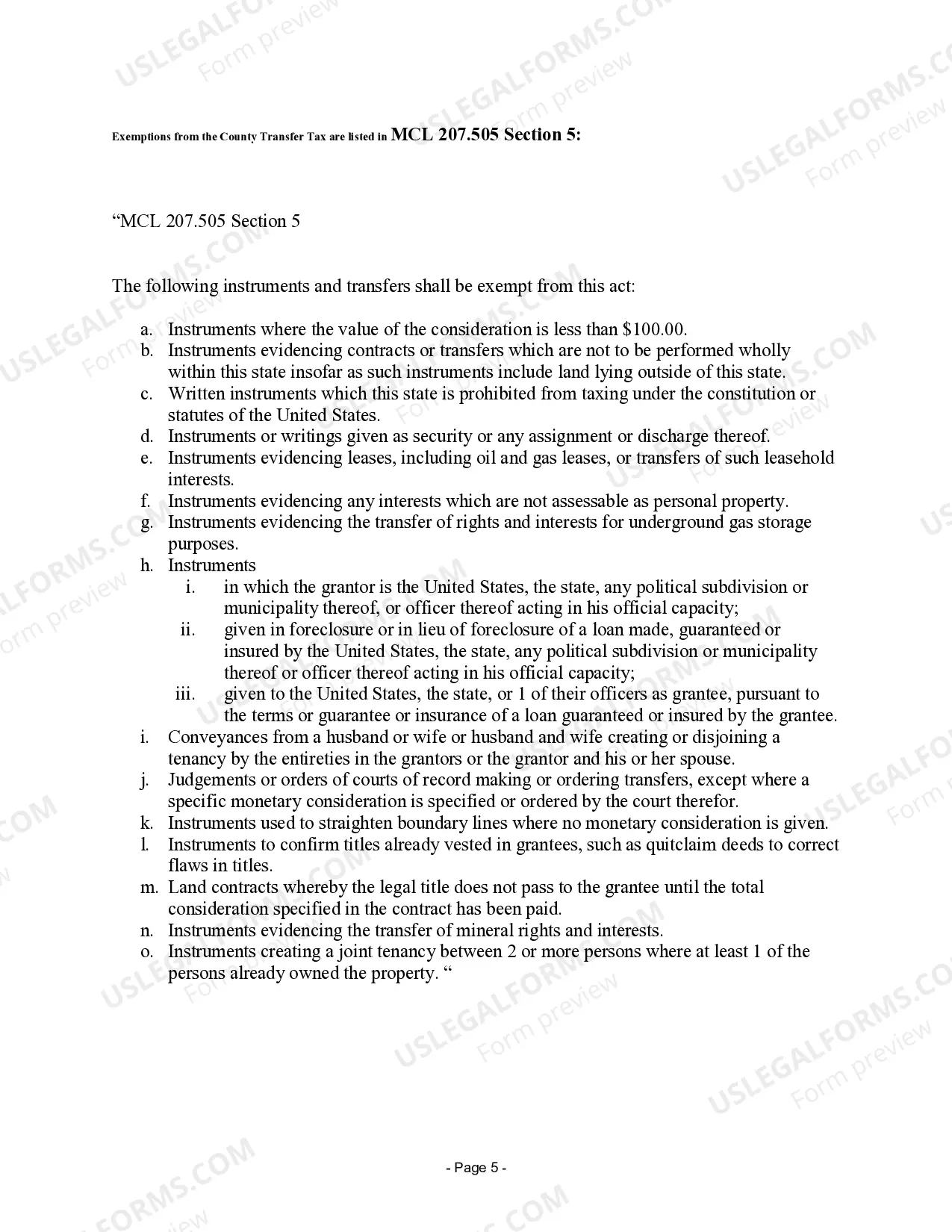

MCL 207.505/MCL 207.526 $7.50 is State Transfer Tax and $1.10 is County Transfer Tax. Transfer tax imposed by each act shall be collected unless said instrument of transfer is exempt from either or both acts and such exemptions are stated on the face of the deed.

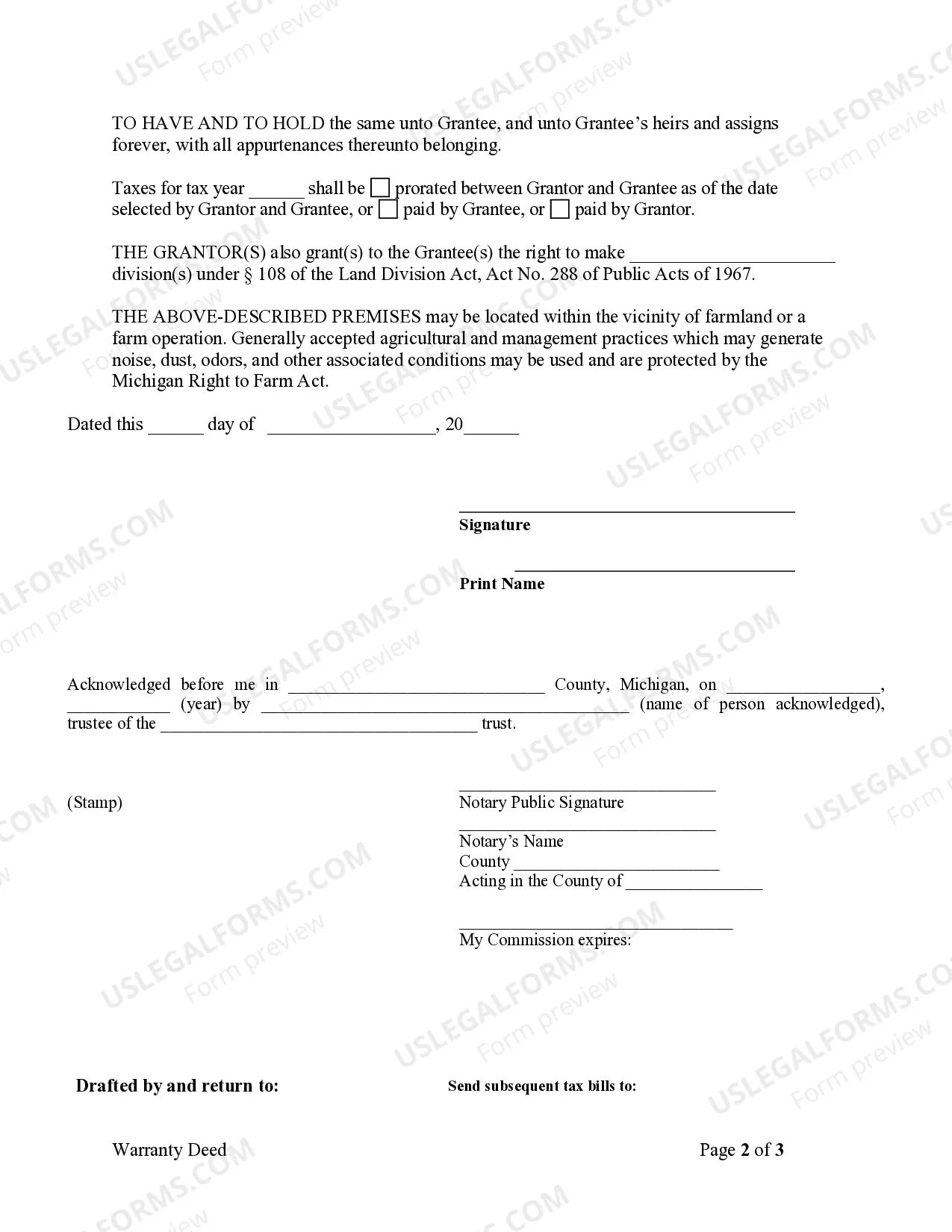

How to Transfer Michigan Real Estate Find the most recent deed to the property. It is helpful to begin by locating the most recent deed to the property (the deed that transferred the property to the current grantor).Create the new deed.Sign and notarize the deed.File the deed in the county land records.

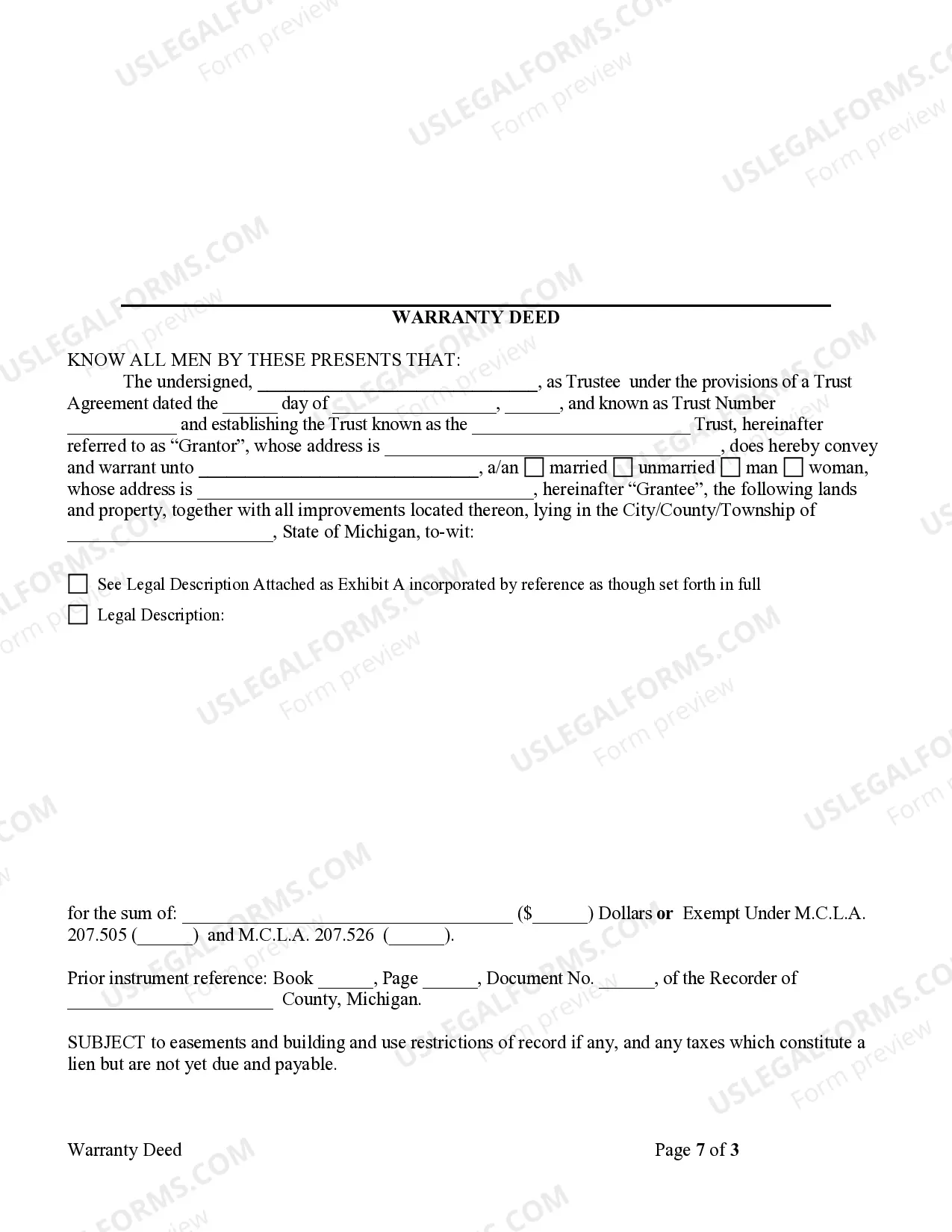

The Michigan warranty deed is a form of deed that provides an unlimited warranty of title. It makes an absolute guarantee that the current owner has good title to the property. The warranty is not limited to the time that the current owner owned the property.

How to Transfer Michigan Real Estate Find the most recent deed to the property. It is helpful to begin by locating the most recent deed to the property (the deed that transferred the property to the current grantor).Create the new deed.Sign and notarize the deed.File the deed in the county land records.

Once they finalise the distribution, heirs can draw a family settlement deed where each member signs, which can then be registered for official records. To transfer property, you need to apply at the sub-registrar's office. You will need the ownership documents, the Will with probate or succession certificate.

In Michigan, a Lady Bird Deed (also known as a Ladybird Deed or Enhanced Life Estate Deed) is a type of Quitclaim Deed that allows you, the creator, to transfer your property upon your death to a named beneficiary without having to go through the expensive and time consuming Probate process.

Warranty Deeds With a warranty deed, the grantor (seller) warrants that they have good title to the property and that they have a right to sell the property to the grantee (buyer). ?Good title? means that there are no liens, conditions, or restrictions on the property.