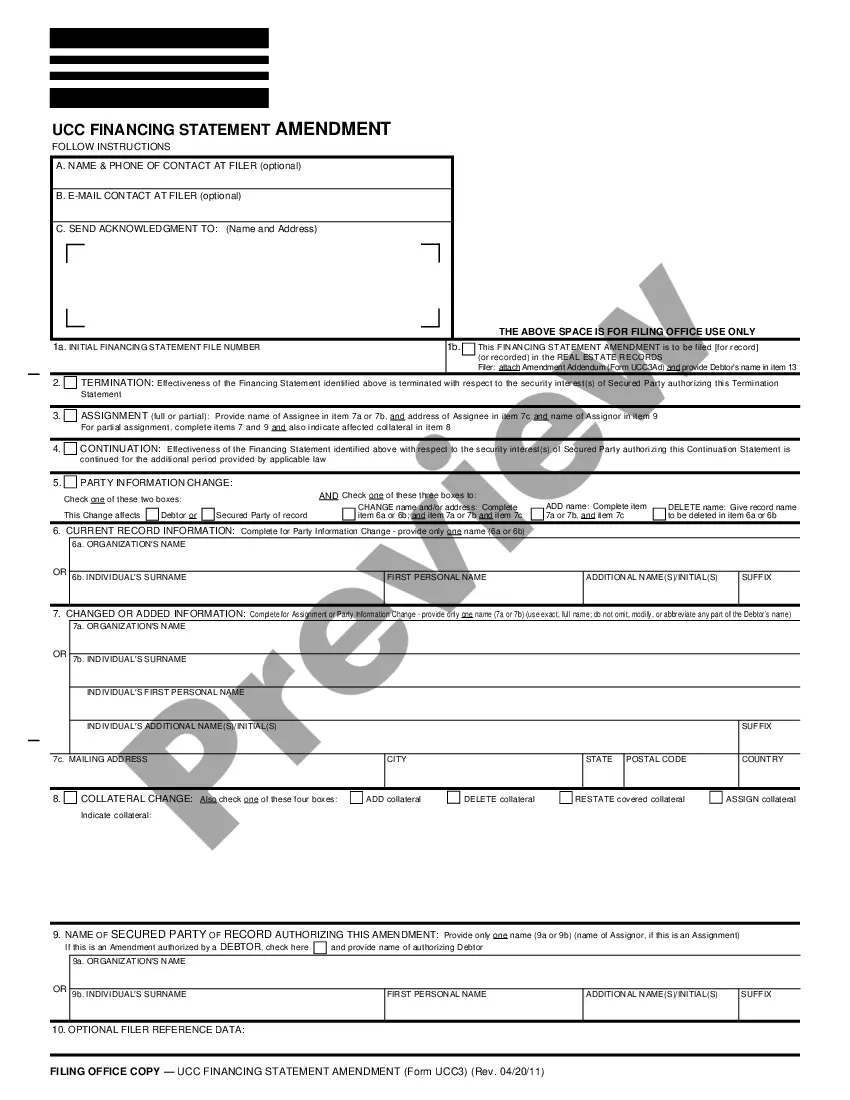

Oakland Michigan UCC1 Financing Statement

Description

How to fill out Michigan UCC1 Financing Statement?

Regardless of social or professional standing, filling out legal documents is an unfortunate requirement in today’s occupational landscape.

Frequently, it’s nearly unfeasible for individuals lacking any legal expertise to create these types of documents from the ground up, primarily due to the intricate terminology and legal subtleties they encompass.

This is where US Legal Forms comes to the aid.

Confirm that the template you selected is appropriate for your area, as the regulations of one state or county may not apply to another.

Review the document and read a brief overview (if available) of scenarios for which it can be utilized.

- Our service offers a vast collection of over 85,000 ready-to-use, state-specific forms applicable to nearly every legal situation.

- US Legal Forms also acts as an excellent resource for associates or legal advisors seeking to enhance their efficiency by using our DIY forms.

- Whether you need the Oakland Michigan UCC1 Financing Statement or any other document valid in your region, US Legal Forms has everything you need.

- Here’s how you can obtain the Oakland Michigan UCC1 Financing Statement in mere minutes with our dependable service.

- If you are already a customer, feel free to Log In to your account to download the correct form.

- However, if you are new to our platform, ensure to follow these steps before downloading the Oakland Michigan UCC1 Financing Statement.

Form popularity

FAQ

To look up a UCC-1 filing in Oakland, Michigan, you can visit the state’s Department of Licensing and Regulatory Affairs website or other online databases. These resources provide access to current filings and can help you verify secured interests against your property. Utilizing USLegalForms can also guide you through the lookup process, ensuring you find the information you need efficiently.

Yes, a UCC-1 is indeed a type of Financing Statement that is filed to perfect a security interest in personal property. This document is vital for establishing legal claim to collateral in Oakland, Michigan. Knowing this can help you navigate financing options confidently and protect your assets.

For a UCC fixture filing in Oakland, Michigan, you should file it in the county where the fixture is located. This helps secure your interest in fixtures that are considered part of real property. Accurate filing is essential to protect your investment, so using a reliable service like USLegalForms can streamline the submission process.

UCCs need to be filed in the specific location of the business or registered agent of the debtor. For businesses based in Oakland, Michigan, this means filing at the Secretary of State's office. This approach guarantees that UCC filings are accessible to interested parties and maintain a clear record of secured transactions.

If you're dealing with a foreign entity in Oakland, Michigan, you should file the UCC Financing Statement in the jurisdiction where your collateral is located. This ensures that all parties are aware of the secured interests and protects your rights. Using an easy-to-navigate platform like USLegalForms can simplify this process and help ensure compliance.

In Oakland, Michigan, UCC financing statements must be filed with the Department of Licensing and Regulatory Affairs. It is essential to ensure correct filing to protect your secured interests effectively. Proper filing helps maintain transparency in financial transactions and keeps your interests legally enforceable.

Yes, an UCC can indeed be assigned to another party. This process involves creating an assignment document that must then be filed with the appropriate state office. Always ensure that the assignment is completed correctly to maintain the legal standing of the financing statement.

In Oakland, Michigan, UCC-1 financing statements are filed with the Michigan Secretary of State's office. This central filing system stores all UCC-related documents, making it easier for creditors to find important information. If you need assistance, UsLegalForms offers helpful resources to guide you through the filing process.

Yes, a UCC financing statement can be assigned to a new secured party. The original secured party must create an assignment form and file it with the appropriate state authorities. This process updates the record and ensures transparency in the ownership of the security interest.

An Oakland Michigan UCC1 Financing Statement can become invalid if it lacks required information or contains incorrect details. Common issues include missing signatures, incomplete debtor names, or inadequate collateral descriptions. Ensuring accuracy and completeness is crucial to avoid complications.