This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

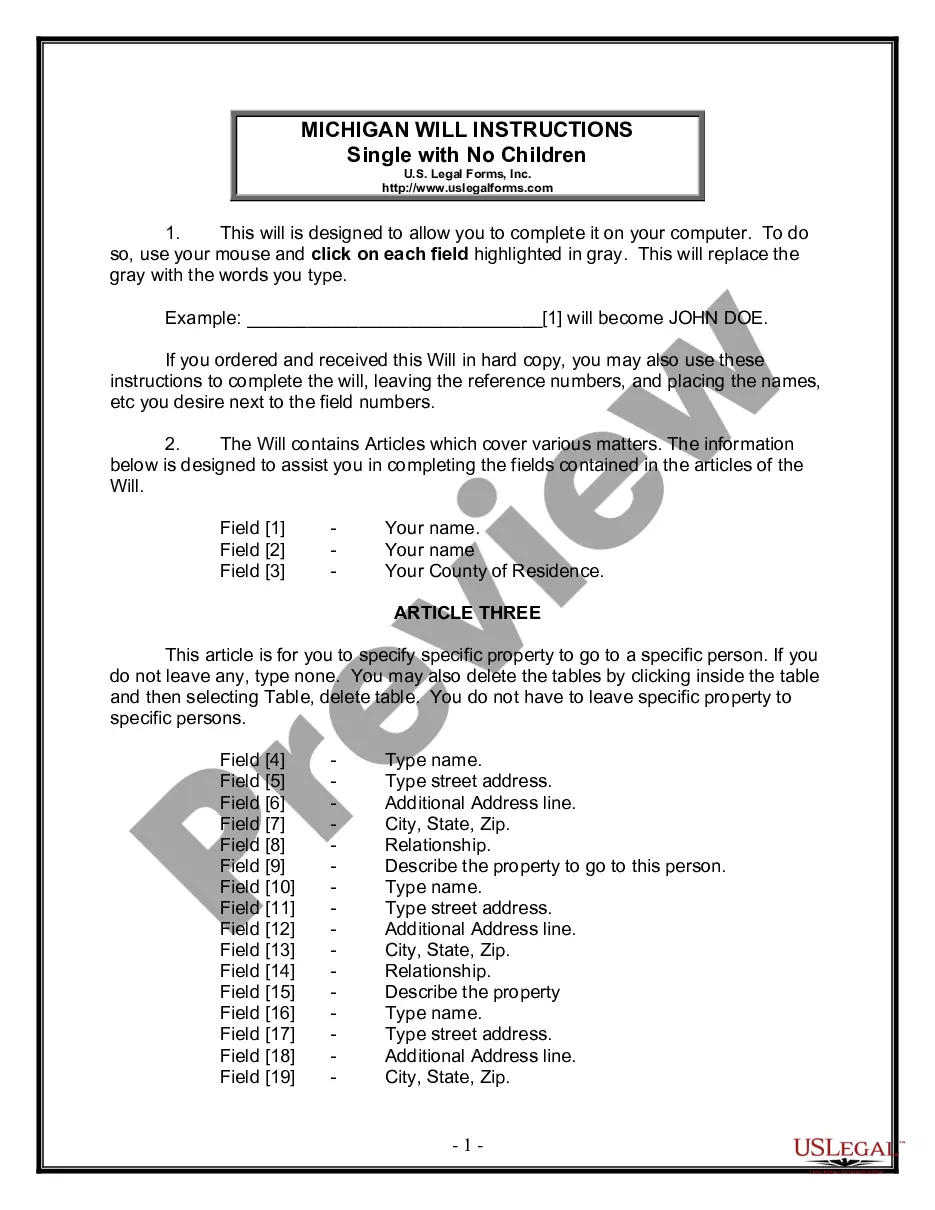

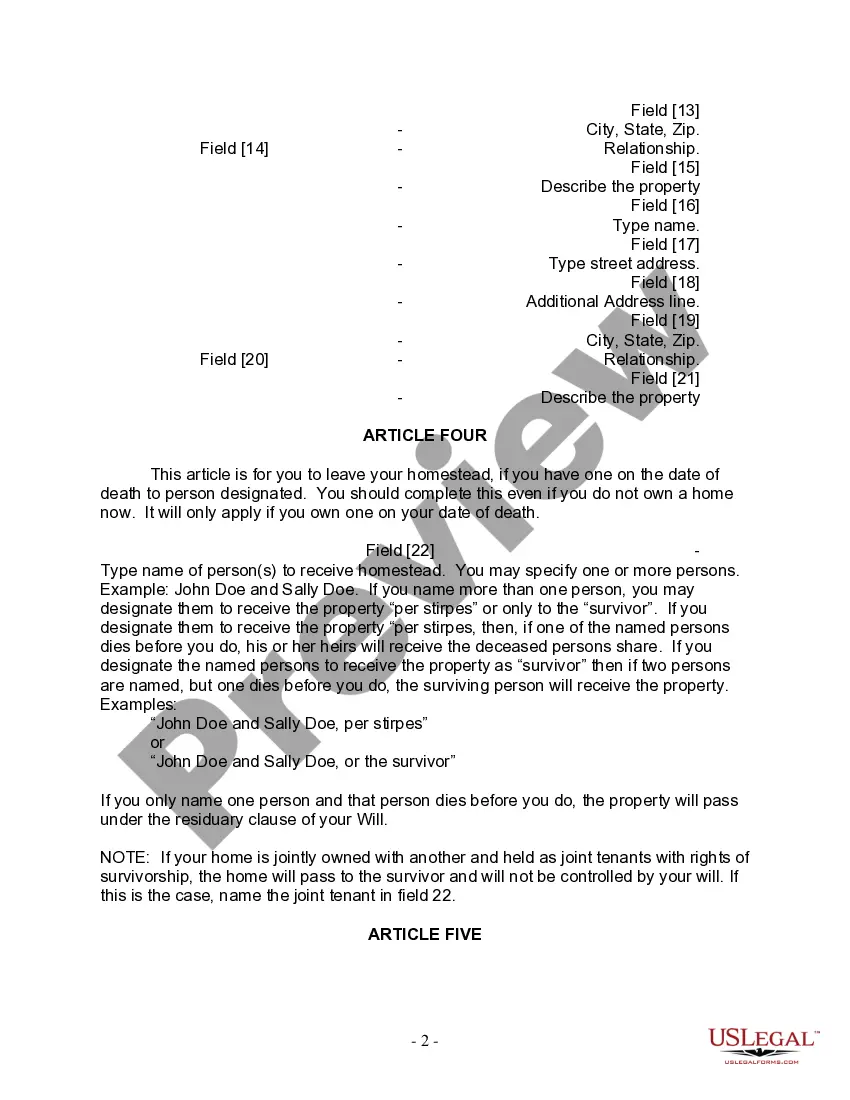

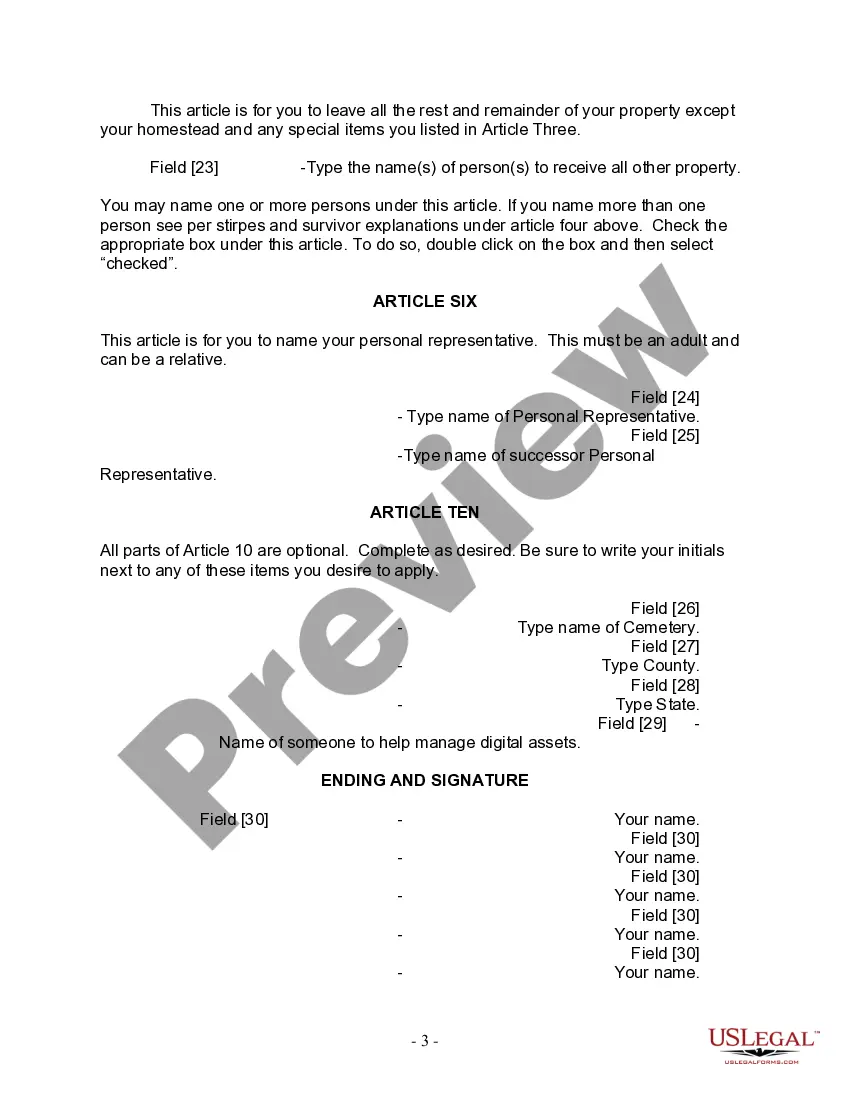

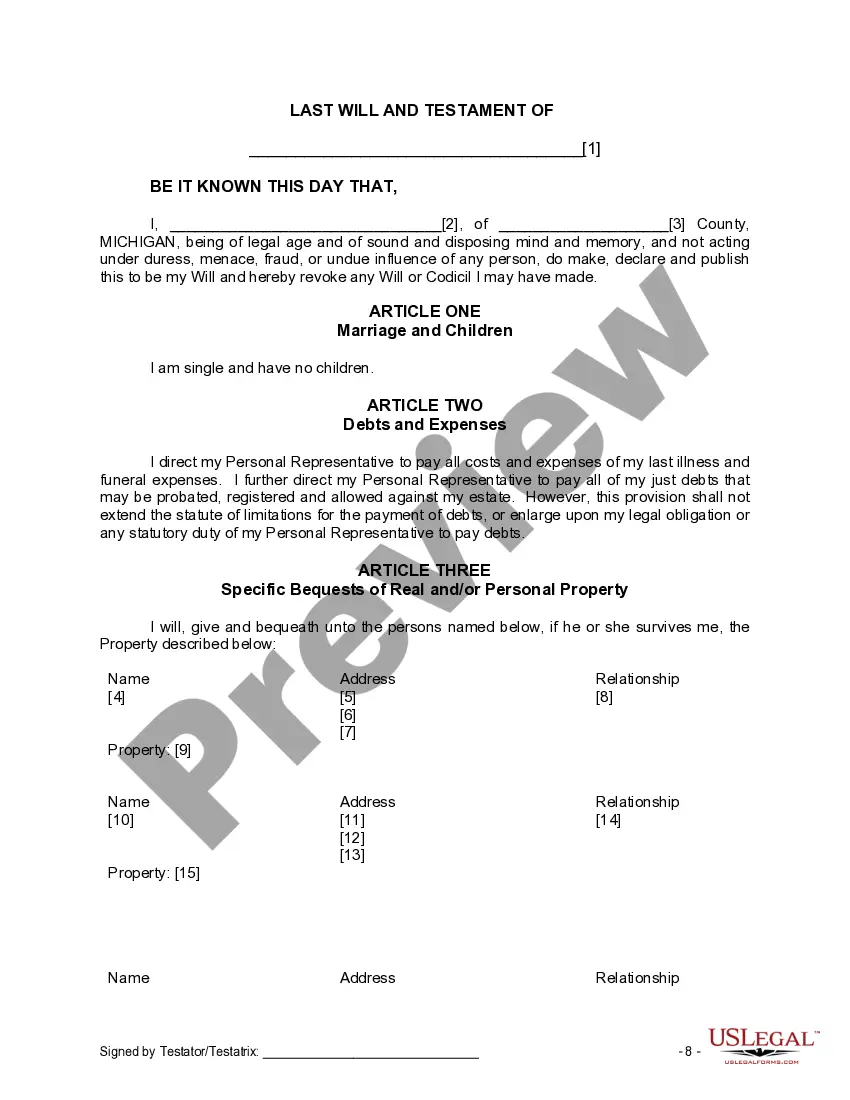

The Grand Rapids Michigan Legal Last Will and Testament Form for Single Person with No Children is a legal document that allows individuals in Grand Rapids, Michigan, who are single and do not have any children, to outline their wishes regarding the distribution of their assets and appoint an executor to handle their affairs after their passing. This form serves as a written record of a person's final wishes, ensuring that their property, finances, and personal belongings are distributed according to their desired instructions. It helps eliminate confusion and potential disputes among family members or other parties after the individual's death. The Grand Rapids Michigan Legal Last Will and Testament Form for Single Person with No Children may include the following key points: 1. Distribution of Property: The form provides the opportunity to specify how assets, such as real estate, bank accounts, investments, personal belongings, and other properties, should be distributed among beneficiaries and any charitable organizations. 2. Appointment of Executor: This form allows individuals to name a trusted person as the executor of their estate. The executor is responsible for managing and distributing assets, paying debts and taxes, and handling any legal matters pertaining to the estate. 3. Guardianship of Pets: If the individual owns pets, the form can also address their care and the appointment of a guardian to ensure they are properly taken care of after the individual's passing. 4. Debt and Tax Obligations: Individuals can use this form to express their intentions on how their outstanding debts, funeral expenses, and taxes will be settled using the assets from their estate. 5. Residual Clause: A residual clause provides instructions regarding what should be done with any remaining assets that have not been specifically addressed in the will. It is important to note that there may be different versions or variations of the Grand Rapids Michigan Legal Last Will and Testament Form for Single Person with No Children, depending on the specific requirements of the individual and any changes in state laws. It is recommended to consult with an attorney or a legal professional to ensure compliance with the most updated and appropriate legal documentation for individual circumstances.

The Grand Rapids Michigan Legal Last Will and Testament Form for Single Person with No Children is a legal document that allows individuals in Grand Rapids, Michigan, who are single and do not have any children, to outline their wishes regarding the distribution of their assets and appoint an executor to handle their affairs after their passing. This form serves as a written record of a person's final wishes, ensuring that their property, finances, and personal belongings are distributed according to their desired instructions. It helps eliminate confusion and potential disputes among family members or other parties after the individual's death. The Grand Rapids Michigan Legal Last Will and Testament Form for Single Person with No Children may include the following key points: 1. Distribution of Property: The form provides the opportunity to specify how assets, such as real estate, bank accounts, investments, personal belongings, and other properties, should be distributed among beneficiaries and any charitable organizations. 2. Appointment of Executor: This form allows individuals to name a trusted person as the executor of their estate. The executor is responsible for managing and distributing assets, paying debts and taxes, and handling any legal matters pertaining to the estate. 3. Guardianship of Pets: If the individual owns pets, the form can also address their care and the appointment of a guardian to ensure they are properly taken care of after the individual's passing. 4. Debt and Tax Obligations: Individuals can use this form to express their intentions on how their outstanding debts, funeral expenses, and taxes will be settled using the assets from their estate. 5. Residual Clause: A residual clause provides instructions regarding what should be done with any remaining assets that have not been specifically addressed in the will. It is important to note that there may be different versions or variations of the Grand Rapids Michigan Legal Last Will and Testament Form for Single Person with No Children, depending on the specific requirements of the individual and any changes in state laws. It is recommended to consult with an attorney or a legal professional to ensure compliance with the most updated and appropriate legal documentation for individual circumstances.