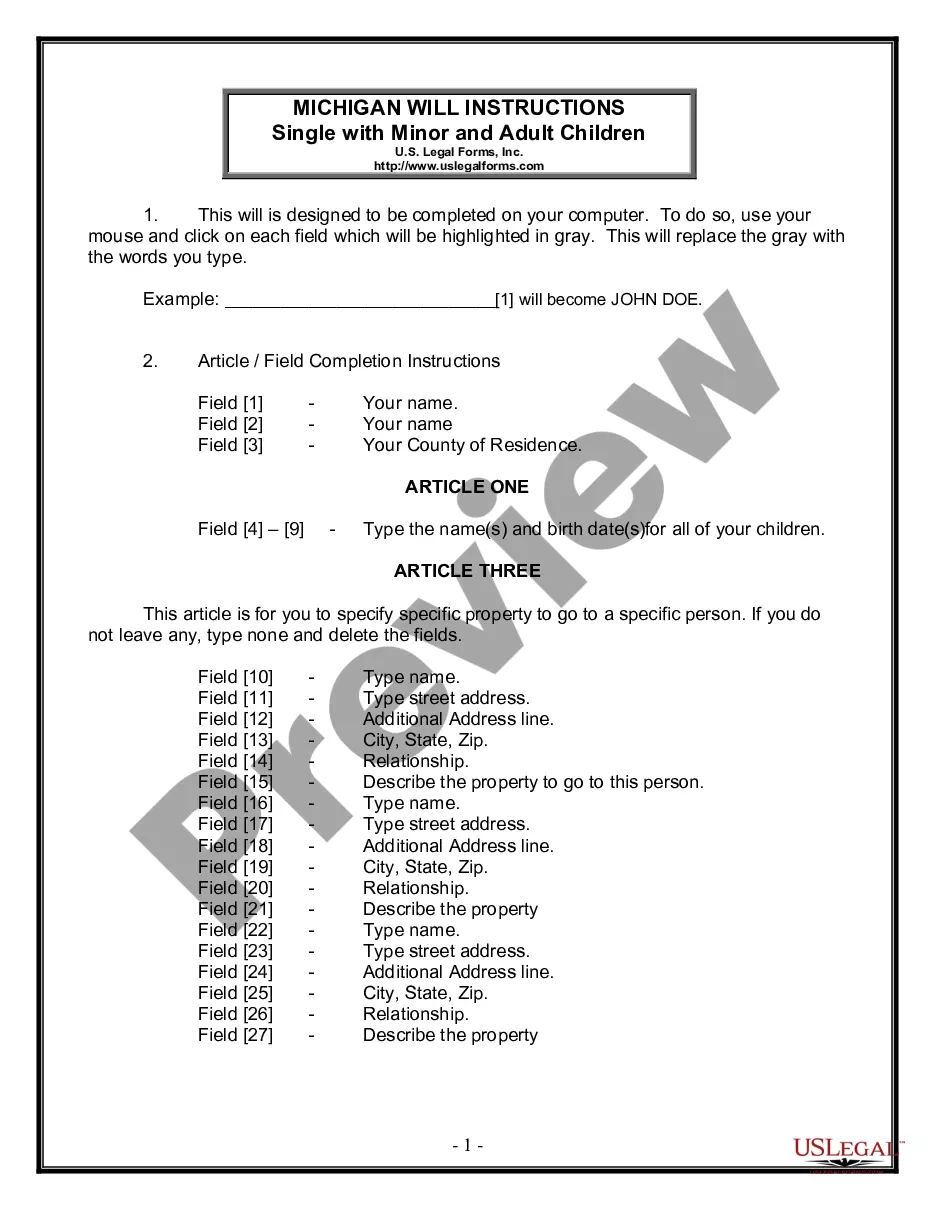

The Last Will and Testament Form with Instructions you have found is for a single person with adult and minor children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will. A Sterling Heights Michigan Legal Last Will and Testament Form for a Single Person with Adult and Minor Children is a legally-binding document that outlines the distribution of assets, appointment of guardianship, and other important instructions after the individual's passing. This particular form is specifically designed for individuals who are single and have both adult and minor children. The Sterling Heights Michigan Legal Last Will and Testament Form for Single Person with Adult and Minor Children covers various essential aspects of estate planning. Here are some relevant keywords related to this type of form: 1. Distribution of Assets: This form allows the individual to specify how their assets, including property, money, and personal belongings, will be distributed among their beneficiaries after their demise. 2. Appointment of Guardianship: In case the individual has minor children, this form allows them to name a guardian who will be responsible for their children's well-being and upbringing in the event of the individual's death. 3. Specific Bequests: The form also provides a space for the individual to make specific bequests or gifts to certain individuals or organizations. This ensures that sentimental or valuable items are given to the desired recipients. 4. Residuary Estate: The Sterling Heights Michigan Legal Last Will and Testament Form for Single Person with Adult and Minor Children includes a provision for the residuary estate. This covers any remaining assets that were not specifically mentioned in the will and ensures that they are distributed according to the individual's wishes. 5. Executor: This document lets the individual appoint an executor, who will be responsible for overseeing the distribution of assets and carrying out the instructions mentioned in the will. The executor ensures that the wishes of the deceased are fulfilled. 6. Testamentary Trust (if applicable): If the individual wishes to establish a trust for the benefit of their minor children, the form may include provisions for creating a testamentary trust. This trust allows the individual to dictate how their assets are managed and provides financial support for their children until they reach adulthood. Different types or variations of the Sterling Heights Michigan Legal Last Will and Testament Form for Single Person with Adult and Minor Children may exist, depending on specific state or regional laws or requirements. However, these key elements generally remain consistent in such forms to ensure proper estate planning and asset distribution for individuals in this specific situation.

A Sterling Heights Michigan Legal Last Will and Testament Form for a Single Person with Adult and Minor Children is a legally-binding document that outlines the distribution of assets, appointment of guardianship, and other important instructions after the individual's passing. This particular form is specifically designed for individuals who are single and have both adult and minor children. The Sterling Heights Michigan Legal Last Will and Testament Form for Single Person with Adult and Minor Children covers various essential aspects of estate planning. Here are some relevant keywords related to this type of form: 1. Distribution of Assets: This form allows the individual to specify how their assets, including property, money, and personal belongings, will be distributed among their beneficiaries after their demise. 2. Appointment of Guardianship: In case the individual has minor children, this form allows them to name a guardian who will be responsible for their children's well-being and upbringing in the event of the individual's death. 3. Specific Bequests: The form also provides a space for the individual to make specific bequests or gifts to certain individuals or organizations. This ensures that sentimental or valuable items are given to the desired recipients. 4. Residuary Estate: The Sterling Heights Michigan Legal Last Will and Testament Form for Single Person with Adult and Minor Children includes a provision for the residuary estate. This covers any remaining assets that were not specifically mentioned in the will and ensures that they are distributed according to the individual's wishes. 5. Executor: This document lets the individual appoint an executor, who will be responsible for overseeing the distribution of assets and carrying out the instructions mentioned in the will. The executor ensures that the wishes of the deceased are fulfilled. 6. Testamentary Trust (if applicable): If the individual wishes to establish a trust for the benefit of their minor children, the form may include provisions for creating a testamentary trust. This trust allows the individual to dictate how their assets are managed and provides financial support for their children until they reach adulthood. Different types or variations of the Sterling Heights Michigan Legal Last Will and Testament Form for Single Person with Adult and Minor Children may exist, depending on specific state or regional laws or requirements. However, these key elements generally remain consistent in such forms to ensure proper estate planning and asset distribution for individuals in this specific situation.