The Legal Last Will and Testament Form with Instructions you have found, is for a single person (never married) with adult children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

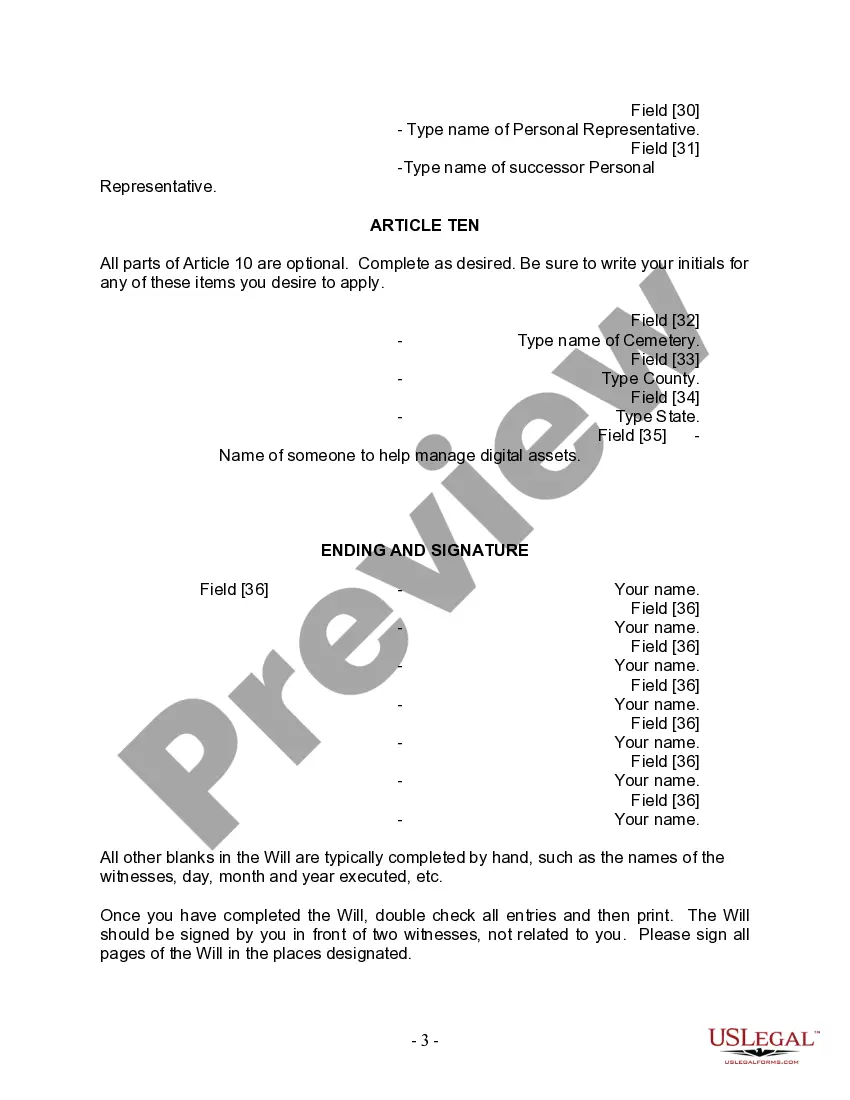

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

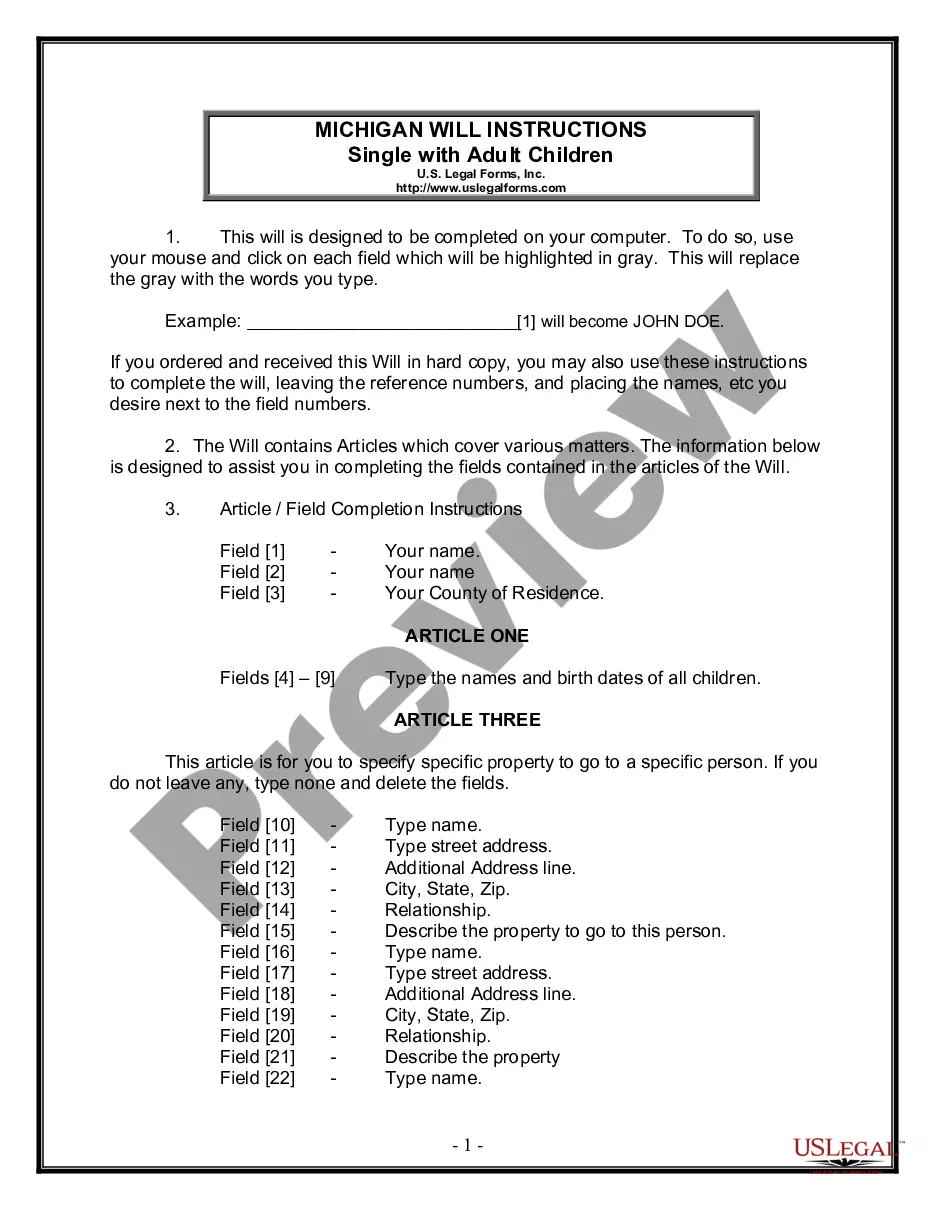

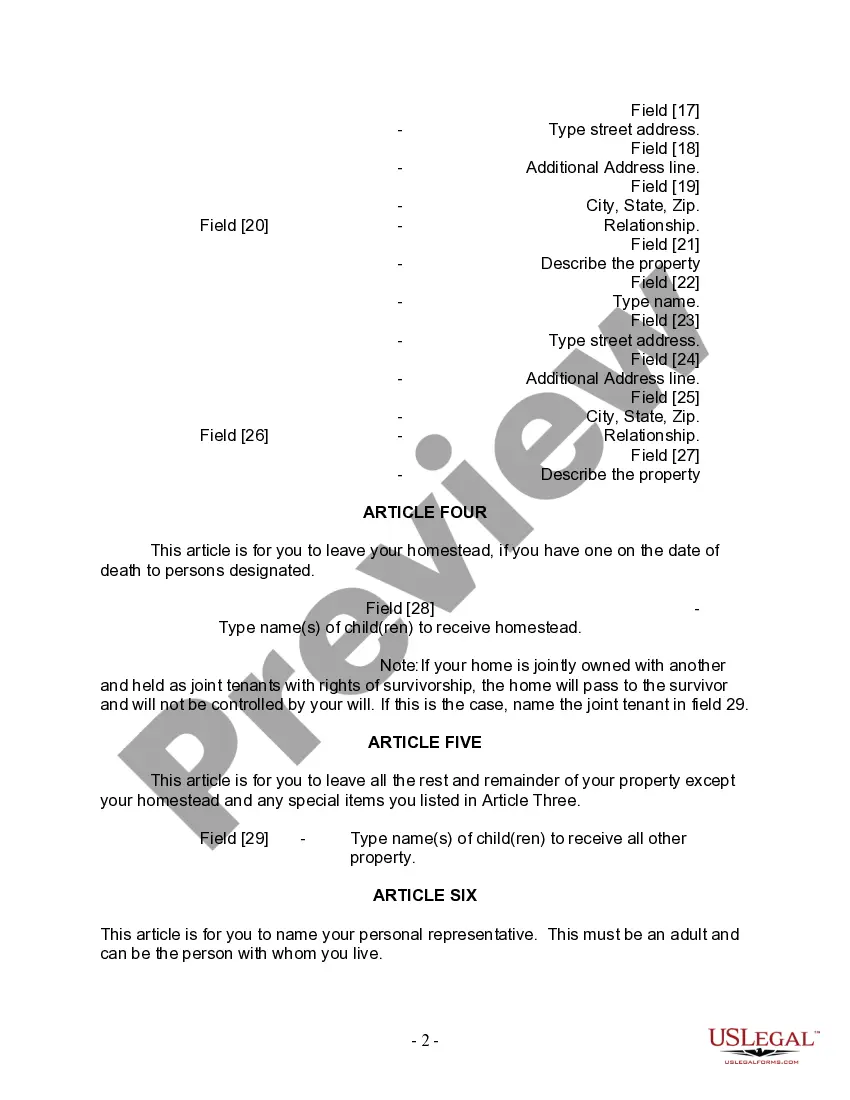

A Sterling Heights Michigan Legal Last Will and Testament Form for Single Person with Adult Children is a legally binding document that allows individuals in Sterling Heights, Michigan to outline their final wishes and distribute their assets among their adult children upon their passing. This comprehensive form ensures that the person's estate is distributed according to their preferences, minimizing potential conflicts and ensuring a smooth transfer of assets. The Sterling Heights Michigan Legal Last Will and Testament Form for Single Person with Adult Children typically includes the following key components: 1. Personal Information: This section requires the individual's full legal name, current address, and any other relevant identification information. 2. Executor Appointment: The person creating the will, also known as the testator, appoints an executor who will be responsible for carrying out the instructions laid out in the will. The executor oversees the distribution of assets and ensures the testator's final wishes are fulfilled. 3. Asset Distribution: The testator specifies in detail how their assets, including real estate properties, bank accounts, investments, vehicles, personal belongings, and other valuables, should be divided among their adult children. It is essential to provide clear instructions to avoid any confusion or disputes. 4. Guardianship: If the testator has minor children, this section allows them to name a guardian who will take care of the children's well-being in the event of their untimely demise. However, since this form is specifically for single persons with adult children, this section may not be applicable. 5. Debts and Taxes: The testator may specify how any outstanding debts, taxes, funeral expenses, or other liabilities should be paid using their assets before distributing the remaining estate among their adult children. 6. Residuary Clause: This clause covers any assets or property that were not specifically mentioned in the will. It ensures that the remaining estate is distributed according to the testator's wishes. 7. Witnesses and Signature: To ensure the will's validity, it must be signed by the testator in the presence of at least two witnesses. The witnesses also need to sign the document, indicating that they saw the testator sign and that they are of sound mind and not under any undue influence. Different variations of the Sterling Heights Michigan Legal Last Will and Testament Form for Single Person with Adult Children may exist to accommodate specific preferences or individual circumstances. Examples include a Living Will, which outlines medical preferences and end-of-life care, and a Pour Over Will, which works in conjunction with a trust to transfer assets not already covered by the trust. It is crucial to consult with a qualified lawyer or estate planning professional when preparing a Last Will and Testament to ensure compliance with local laws and regulations and to address any unique concerns or preferences.