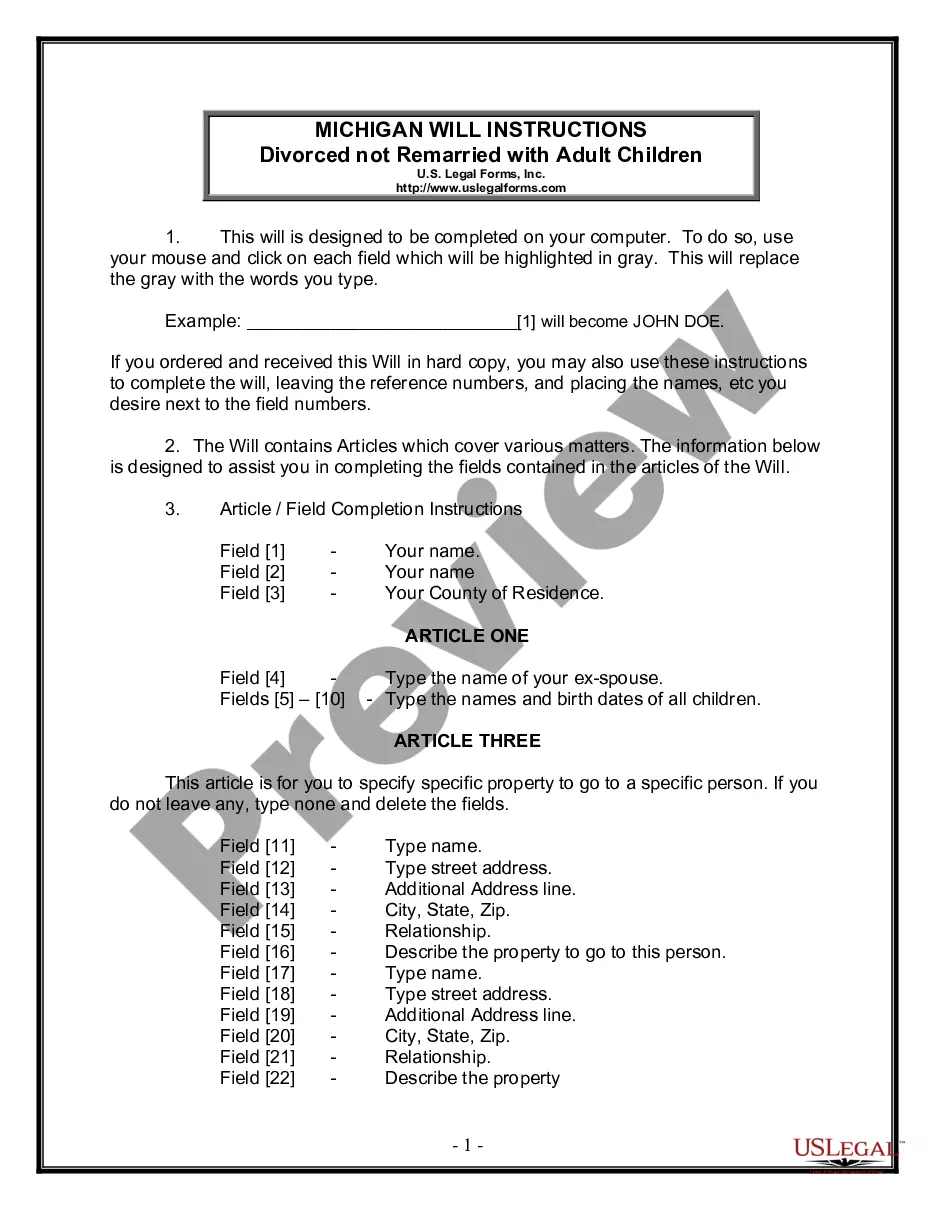

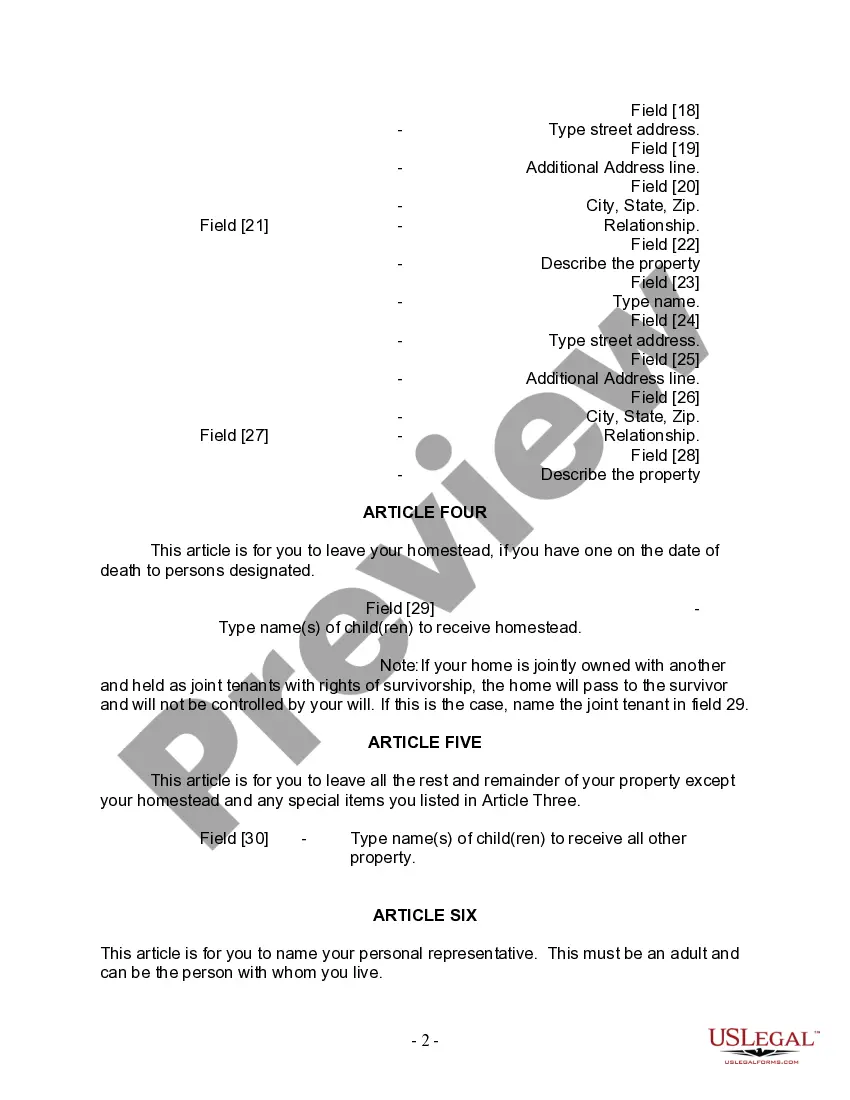

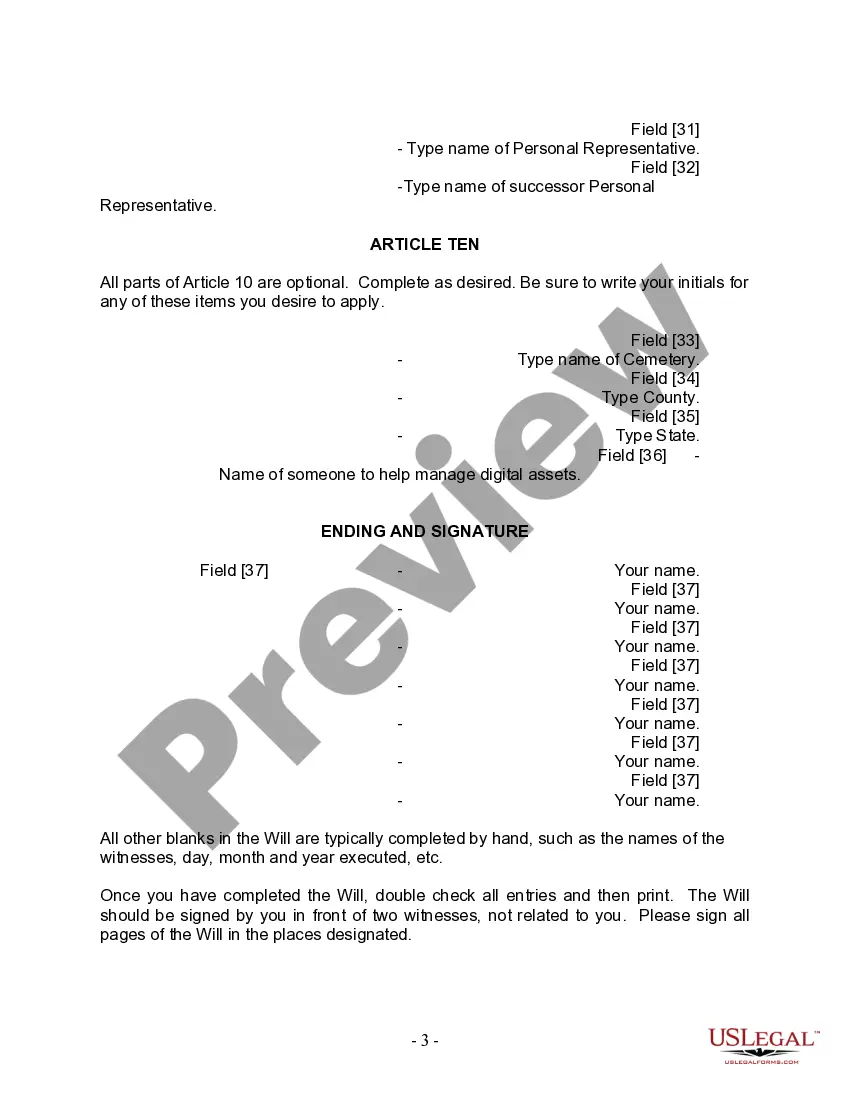

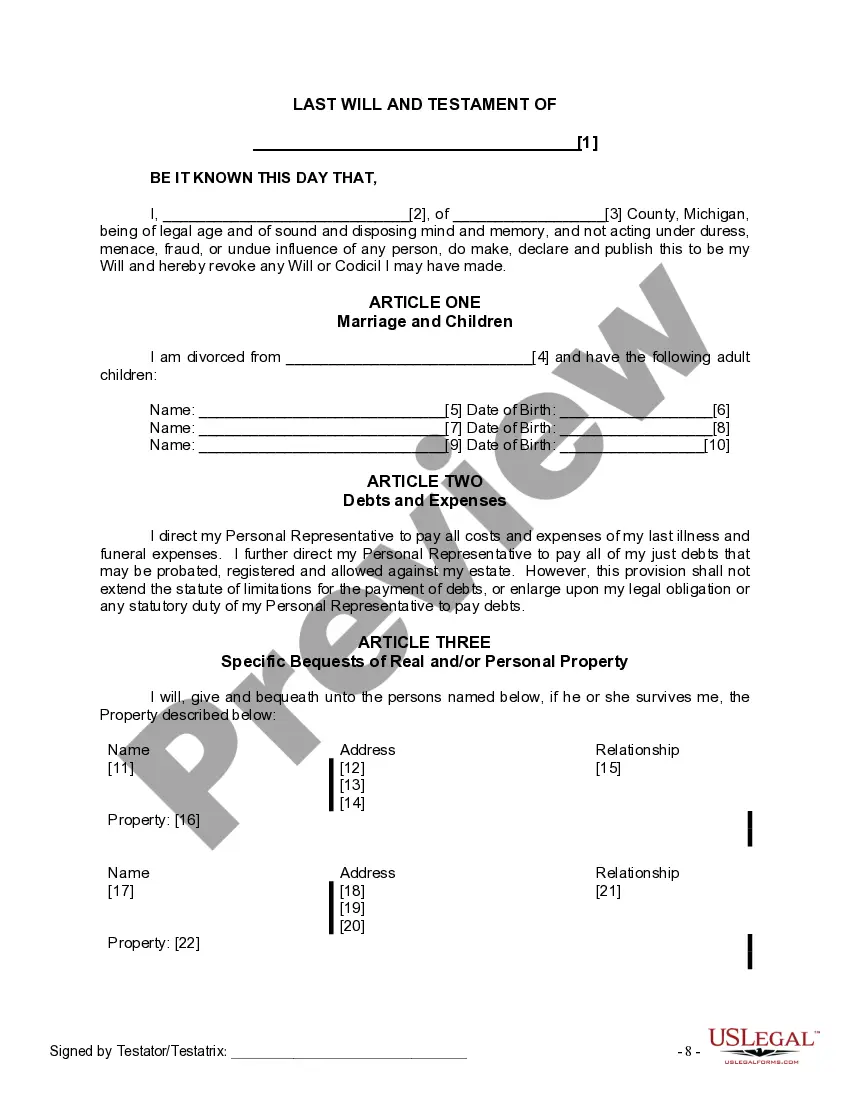

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will. Description: A Sterling Heights Michigan Legal Last Will and Testament Form for Divorced person not Remarried with Adult Children is a legally binding document created by individuals who have been previously divorced and have adult children. This specific type of will outline the wishes and instructions of the divorced individual regarding the distribution of their assets, property, and belongings after their passing. Keywords: Sterling Heights Michigan, Legal, Last Will and Testament Form, Divorced person, not Remarried, Adult Children. In Sterling Heights Michigan, there might be different variations or specific types of Legal Last Will and Testament Forms tailored to the needs of divorced individuals who are not remarried and have adult children. Some of these variations may include: 1. Sterling Heights Michigan Legal Last Will and Testament Form with Asset Distribution: This type of will specifically addresses the distribution of various assets, such as real estate, investments, bank accounts, or personal belongings owned by the divorced individual. It ensures clarity and avoids potential disputes among adult children or other beneficiaries. 2. Sterling Heights Michigan Legal Last Will and Testament Form with Guardianship Provisions: This variation of the will goes beyond asset distribution and focuses on designating a guardian for any minor children. Although this might not be applicable in the case of adult children, some individuals may have dependents with special needs who require ongoing care. 3. Sterling Heights Michigan Legal Last Will and Testament Form with Trust Provisions: This type of will incorporates provisions for creating trusts to manage and distribute certain assets or financial resources, ensuring long-term financial security for the adult children or other beneficiaries. Trusts can provide protection, tax benefits, and added control over the inheritance. 4. Sterling Heights Michigan Legal Last Will and Testament Form with Charitable Donations: Some divorced individuals may have philanthropic aspirations and would like to leave a portion of their estate to charitable organizations or causes that are important to them. This type of will outline the preferred charitable donations and ensures their intentions are fulfilled. Remember, it is essential to consult with a legal professional or an attorney specializing in estate planning in Sterling Heights, Michigan, to ensure that the specific requirements and laws of the state are properly addressed in the Last Will and Testament Form. Customization and modifications may be necessary to align the document with personal circumstances and preferences.

Description: A Sterling Heights Michigan Legal Last Will and Testament Form for Divorced person not Remarried with Adult Children is a legally binding document created by individuals who have been previously divorced and have adult children. This specific type of will outline the wishes and instructions of the divorced individual regarding the distribution of their assets, property, and belongings after their passing. Keywords: Sterling Heights Michigan, Legal, Last Will and Testament Form, Divorced person, not Remarried, Adult Children. In Sterling Heights Michigan, there might be different variations or specific types of Legal Last Will and Testament Forms tailored to the needs of divorced individuals who are not remarried and have adult children. Some of these variations may include: 1. Sterling Heights Michigan Legal Last Will and Testament Form with Asset Distribution: This type of will specifically addresses the distribution of various assets, such as real estate, investments, bank accounts, or personal belongings owned by the divorced individual. It ensures clarity and avoids potential disputes among adult children or other beneficiaries. 2. Sterling Heights Michigan Legal Last Will and Testament Form with Guardianship Provisions: This variation of the will goes beyond asset distribution and focuses on designating a guardian for any minor children. Although this might not be applicable in the case of adult children, some individuals may have dependents with special needs who require ongoing care. 3. Sterling Heights Michigan Legal Last Will and Testament Form with Trust Provisions: This type of will incorporates provisions for creating trusts to manage and distribute certain assets or financial resources, ensuring long-term financial security for the adult children or other beneficiaries. Trusts can provide protection, tax benefits, and added control over the inheritance. 4. Sterling Heights Michigan Legal Last Will and Testament Form with Charitable Donations: Some divorced individuals may have philanthropic aspirations and would like to leave a portion of their estate to charitable organizations or causes that are important to them. This type of will outline the preferred charitable donations and ensures their intentions are fulfilled. Remember, it is essential to consult with a legal professional or an attorney specializing in estate planning in Sterling Heights, Michigan, to ensure that the specific requirements and laws of the state are properly addressed in the Last Will and Testament Form. Customization and modifications may be necessary to align the document with personal circumstances and preferences.