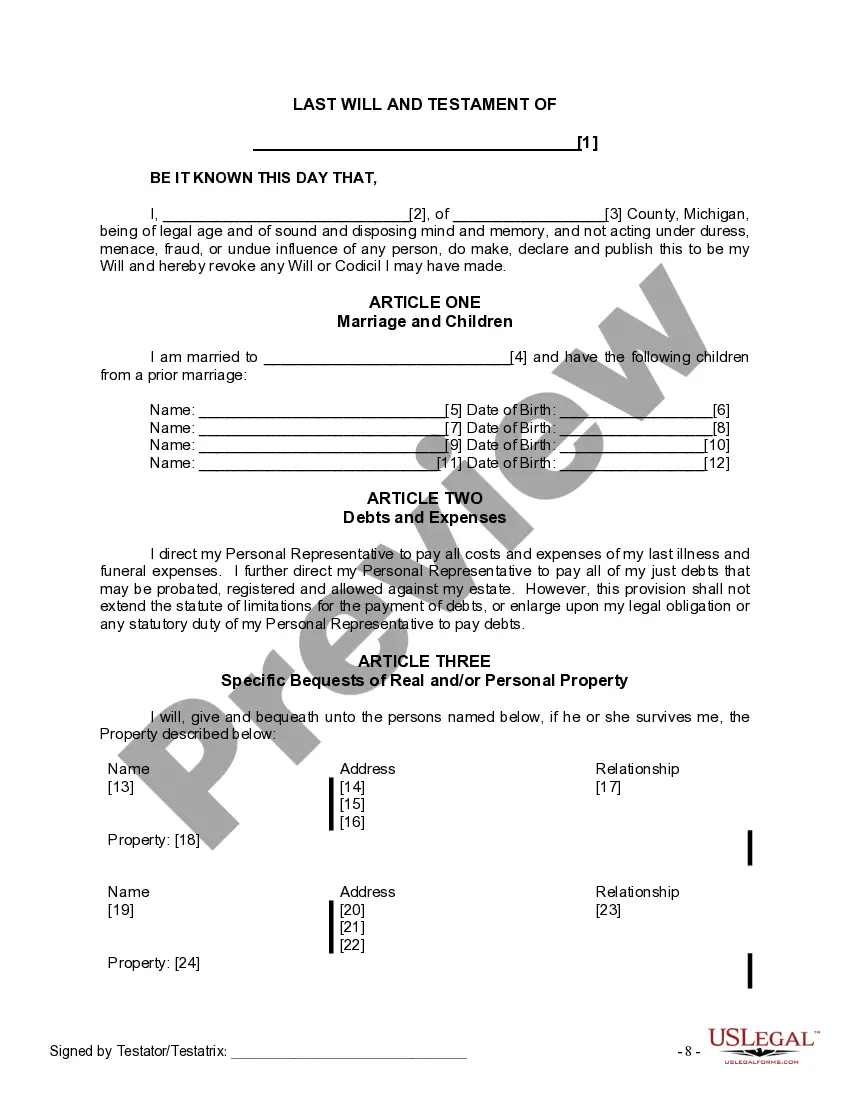

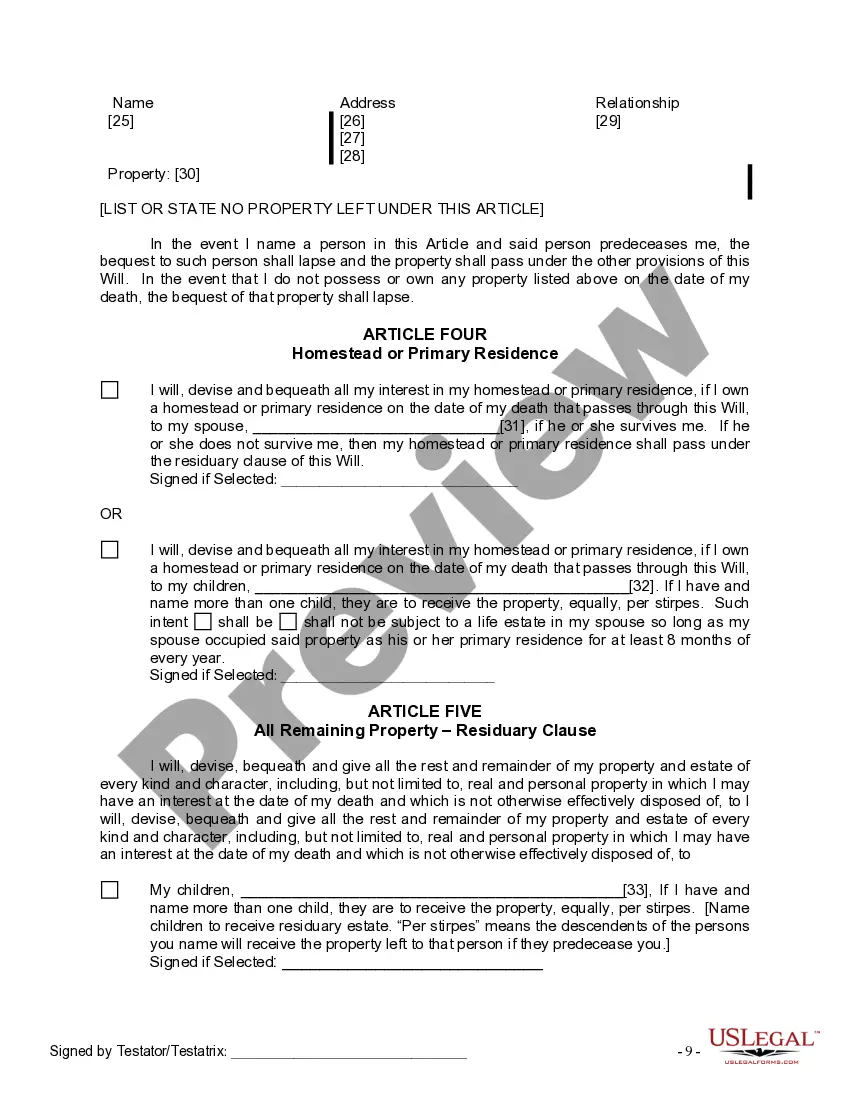

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will. The Sterling Heights Michigan Legal Last Will and Testament Form for Married Person with Adult and Minor Children from Prior Marriage is a legally binding document that helps individuals protect their assets and ensure the proper distribution of their estate after their passing. This specific form caters to individuals who are married and have both adult and minor children from a previous marriage. Key components of this Sterling Heights Michigan Legal Last Will and Testament Form include: 1. Identification of Testator: The form begins by identifying the person creating the will, known as the testator. 2. Appointment of Executor: The testator appoints an executor who will be responsible for managing the estate during the probate process and ensuring the distribution of assets according to the will's provisions. 3. Guardianship of Minor Children: If the testator has minor children from a prior marriage, this form allows them to designate a legal guardian who will take care of their children in the event of their demise. 4. Distribution of Assets: The testator can outline how they want their assets distributed among their beneficiaries, including their spouse, children, or other individuals named in the will. 5. Specific Bequests: The testator can make specific bequests, such as leaving certain items or amounts to particular individuals or organizations. 6. Residual Estate: The residual estate refers to the remaining assets not specifically bequeathed. The testator can specify how they want these assets distributed among the beneficiaries. 7. Contingency Plans: This form also allows the testator to include contingency plans, such as naming alternate beneficiaries or guardians in case the primary choices are unable or unwilling to fulfill their duties. Different types of Sterling Heights Michigan Legal Last Will and Testament Forms for Married Person with Adult and Minor Children from Prior Marriage may vary based on specific circumstances, preferences, or changes in state laws. Examples of potential variations include: 1. Simple Will: This form may be suitable for individuals with uncomplicated family situations and straightforward asset distribution preferences. 2. Testamentary Trust Will: Some individuals may choose to create a testamentary trust within their will, which helps protect assets for minor children until they reach a certain age or achieve specific milestones. 3. Living Will: A living will, also known as an advanced healthcare directive, is a separate legal document that outlines an individual's healthcare wishes in the event they become incapacitated and cannot make their own medical decisions. These variations may have additional sections or clauses that address specific concerns or requirements tailored to the testator's unique circumstances.

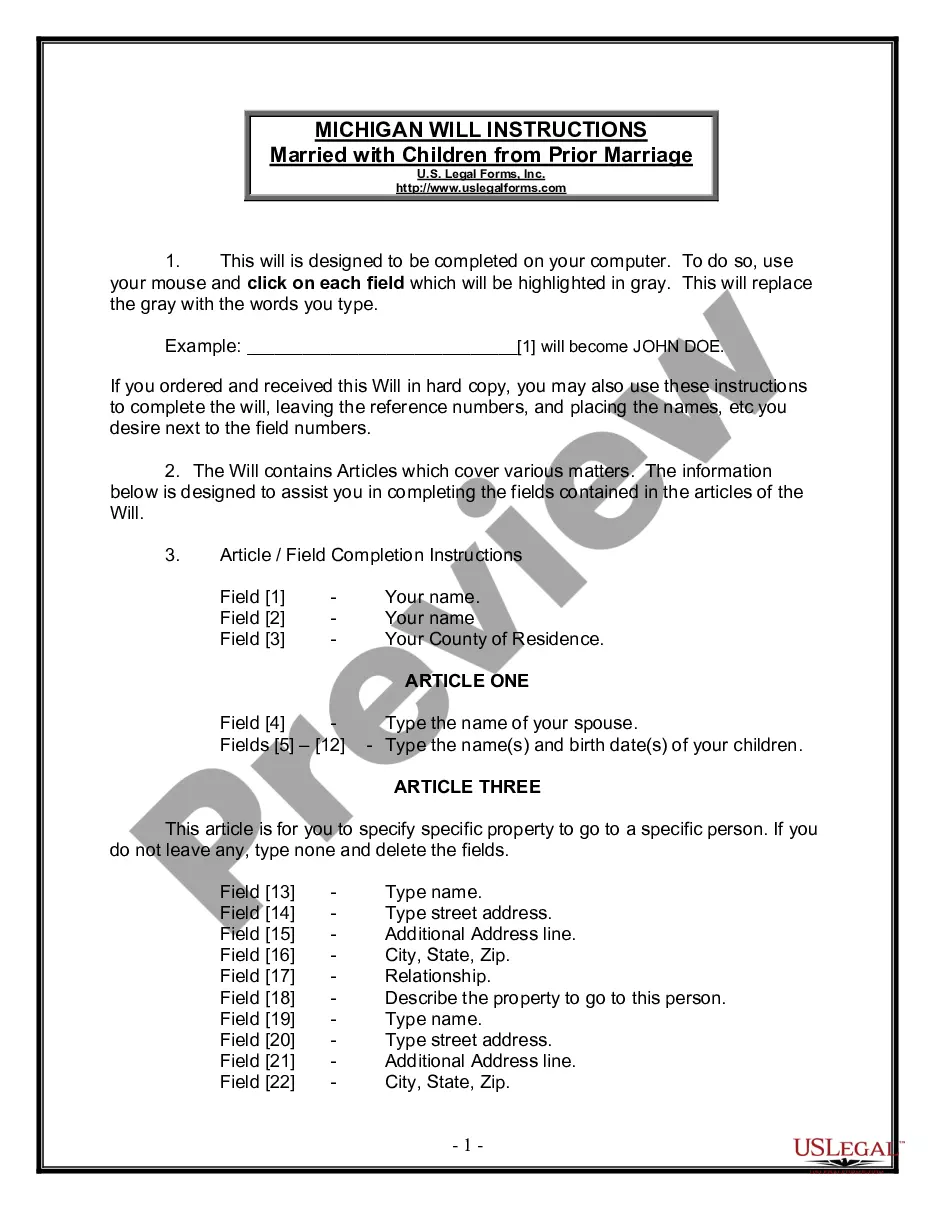

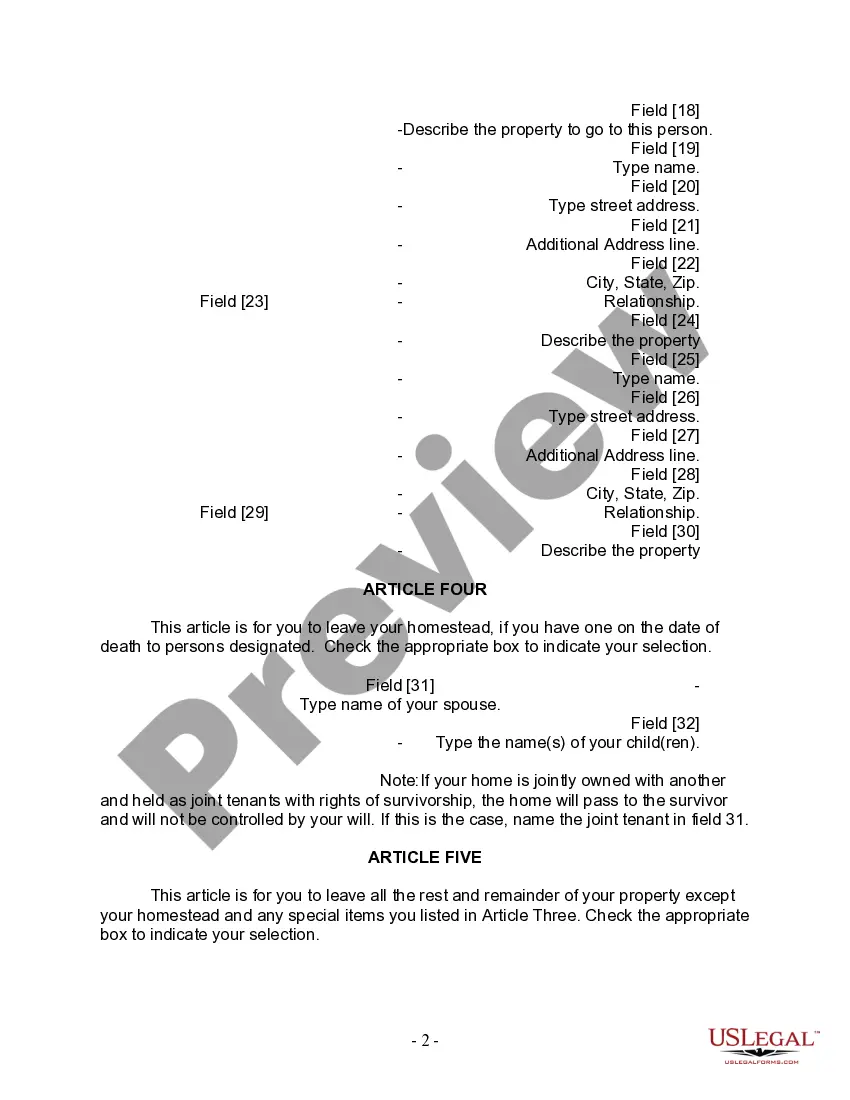

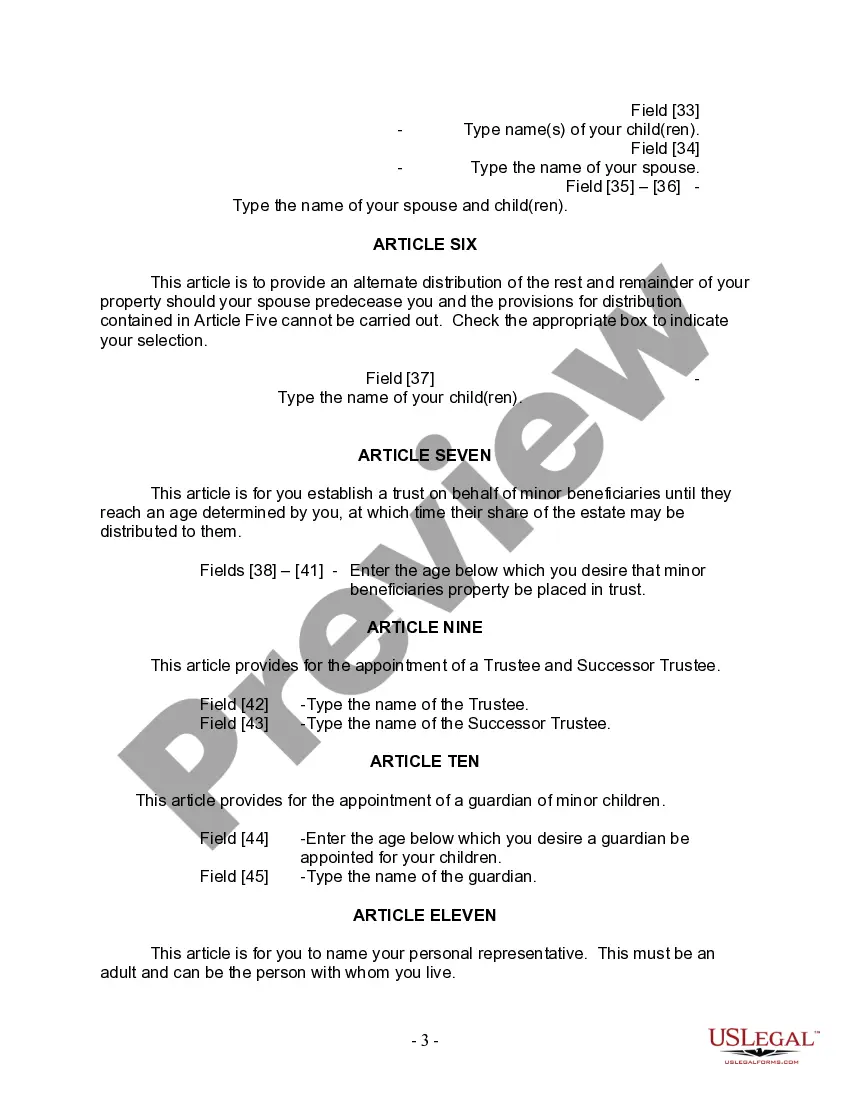

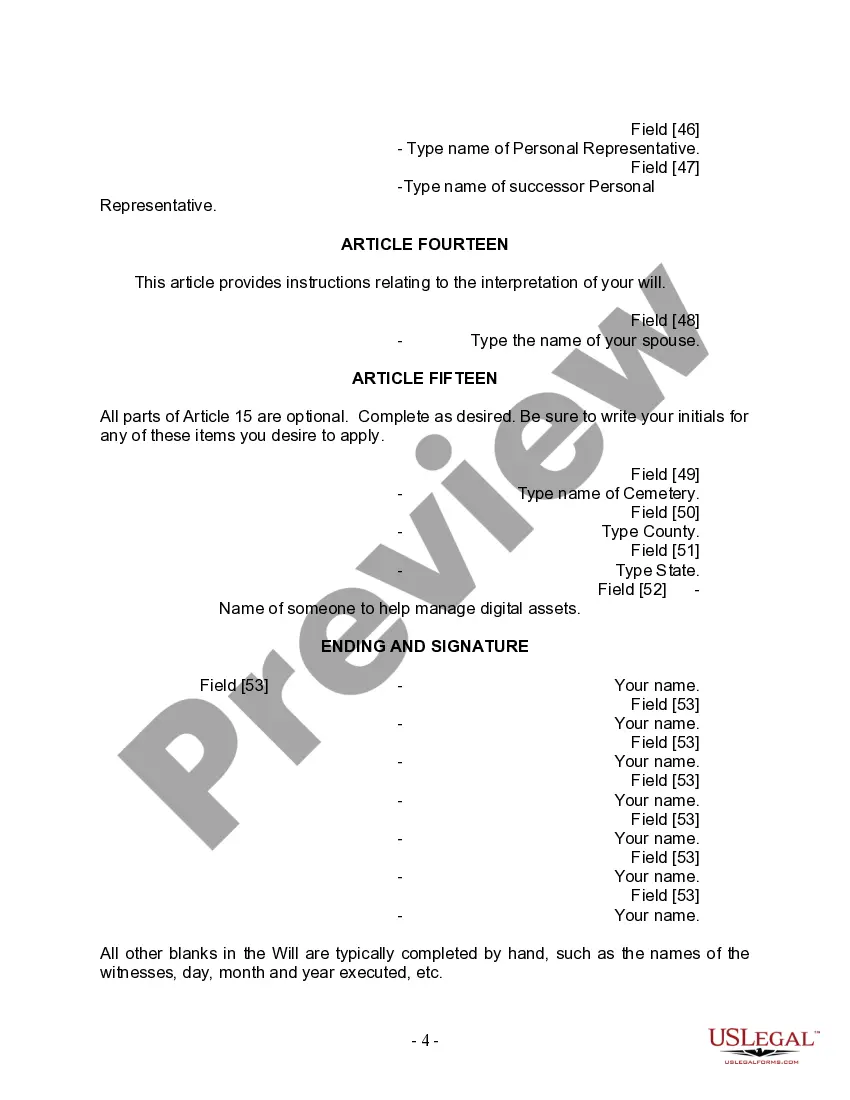

The Sterling Heights Michigan Legal Last Will and Testament Form for Married Person with Adult and Minor Children from Prior Marriage is a legally binding document that helps individuals protect their assets and ensure the proper distribution of their estate after their passing. This specific form caters to individuals who are married and have both adult and minor children from a previous marriage. Key components of this Sterling Heights Michigan Legal Last Will and Testament Form include: 1. Identification of Testator: The form begins by identifying the person creating the will, known as the testator. 2. Appointment of Executor: The testator appoints an executor who will be responsible for managing the estate during the probate process and ensuring the distribution of assets according to the will's provisions. 3. Guardianship of Minor Children: If the testator has minor children from a prior marriage, this form allows them to designate a legal guardian who will take care of their children in the event of their demise. 4. Distribution of Assets: The testator can outline how they want their assets distributed among their beneficiaries, including their spouse, children, or other individuals named in the will. 5. Specific Bequests: The testator can make specific bequests, such as leaving certain items or amounts to particular individuals or organizations. 6. Residual Estate: The residual estate refers to the remaining assets not specifically bequeathed. The testator can specify how they want these assets distributed among the beneficiaries. 7. Contingency Plans: This form also allows the testator to include contingency plans, such as naming alternate beneficiaries or guardians in case the primary choices are unable or unwilling to fulfill their duties. Different types of Sterling Heights Michigan Legal Last Will and Testament Forms for Married Person with Adult and Minor Children from Prior Marriage may vary based on specific circumstances, preferences, or changes in state laws. Examples of potential variations include: 1. Simple Will: This form may be suitable for individuals with uncomplicated family situations and straightforward asset distribution preferences. 2. Testamentary Trust Will: Some individuals may choose to create a testamentary trust within their will, which helps protect assets for minor children until they reach a certain age or achieve specific milestones. 3. Living Will: A living will, also known as an advanced healthcare directive, is a separate legal document that outlines an individual's healthcare wishes in the event they become incapacitated and cannot make their own medical decisions. These variations may have additional sections or clauses that address specific concerns or requirements tailored to the testator's unique circumstances.