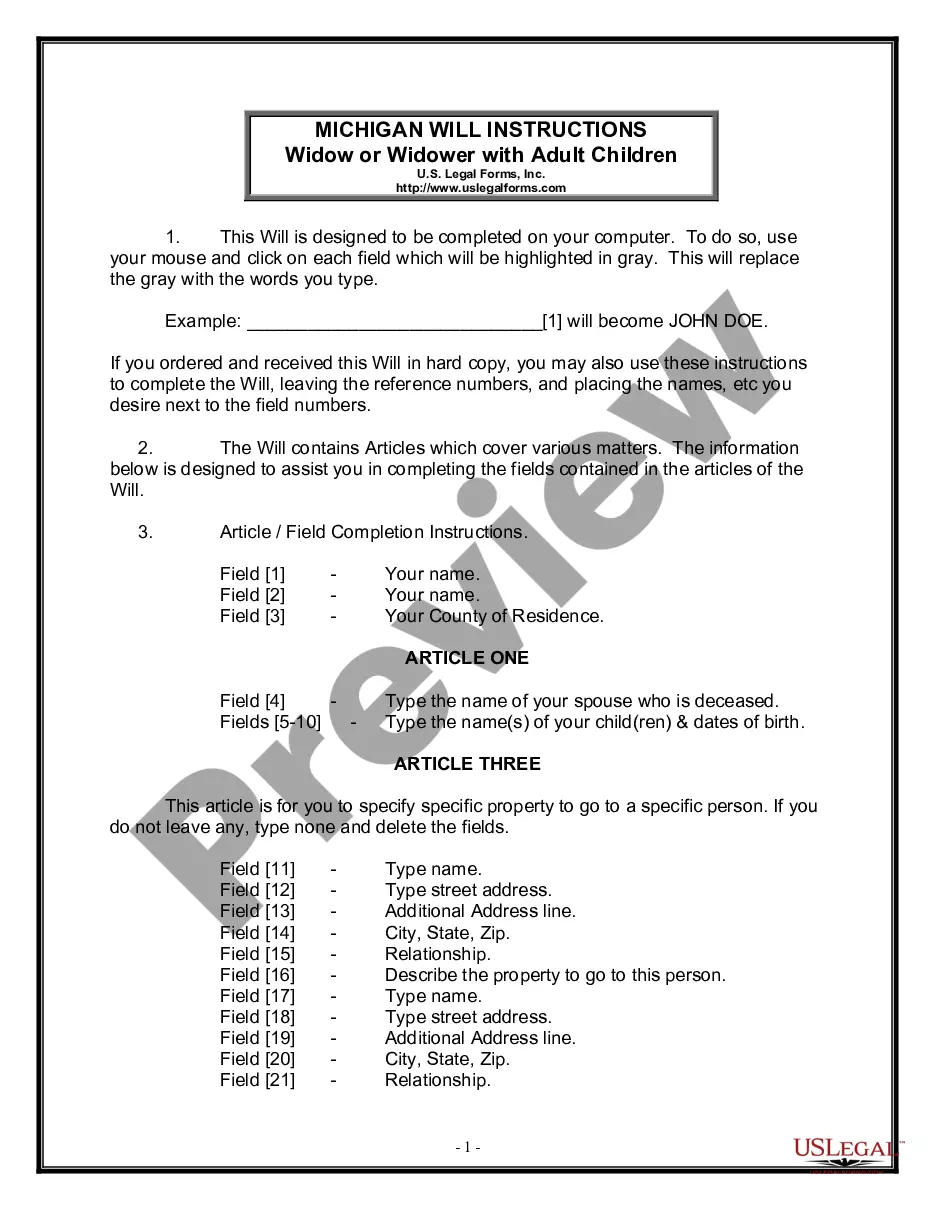

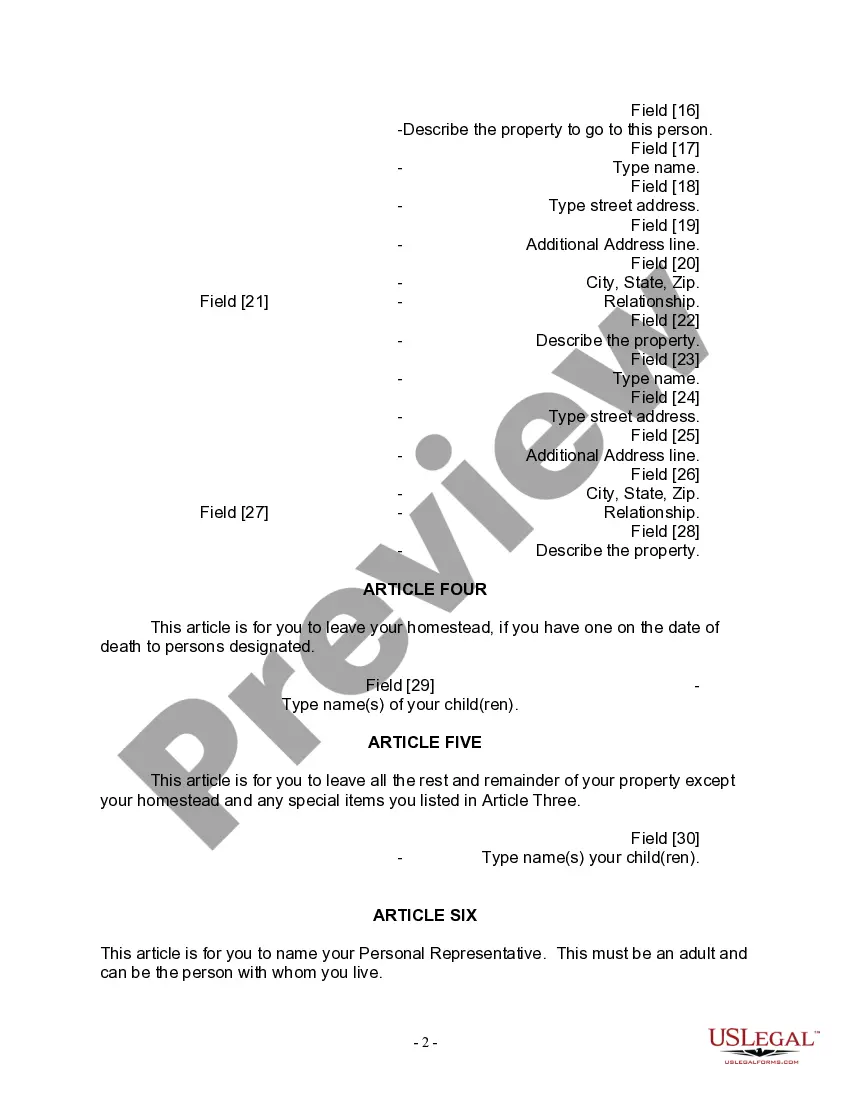

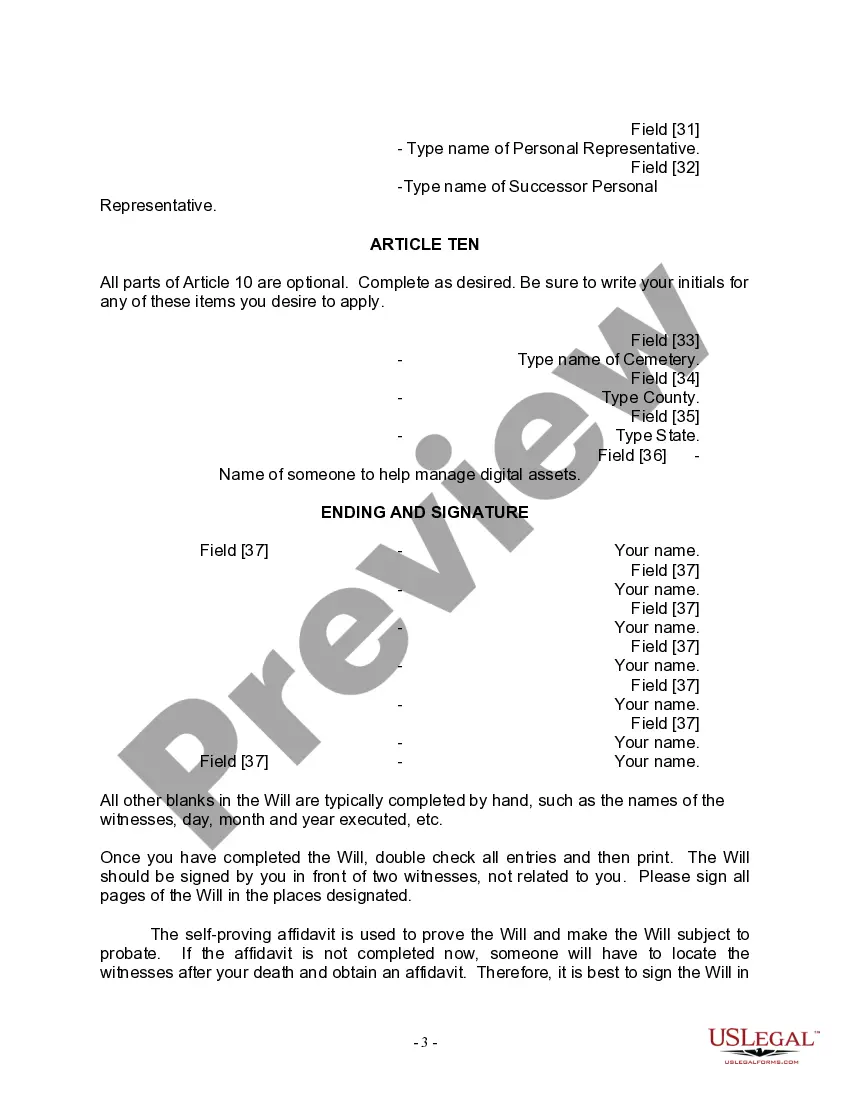

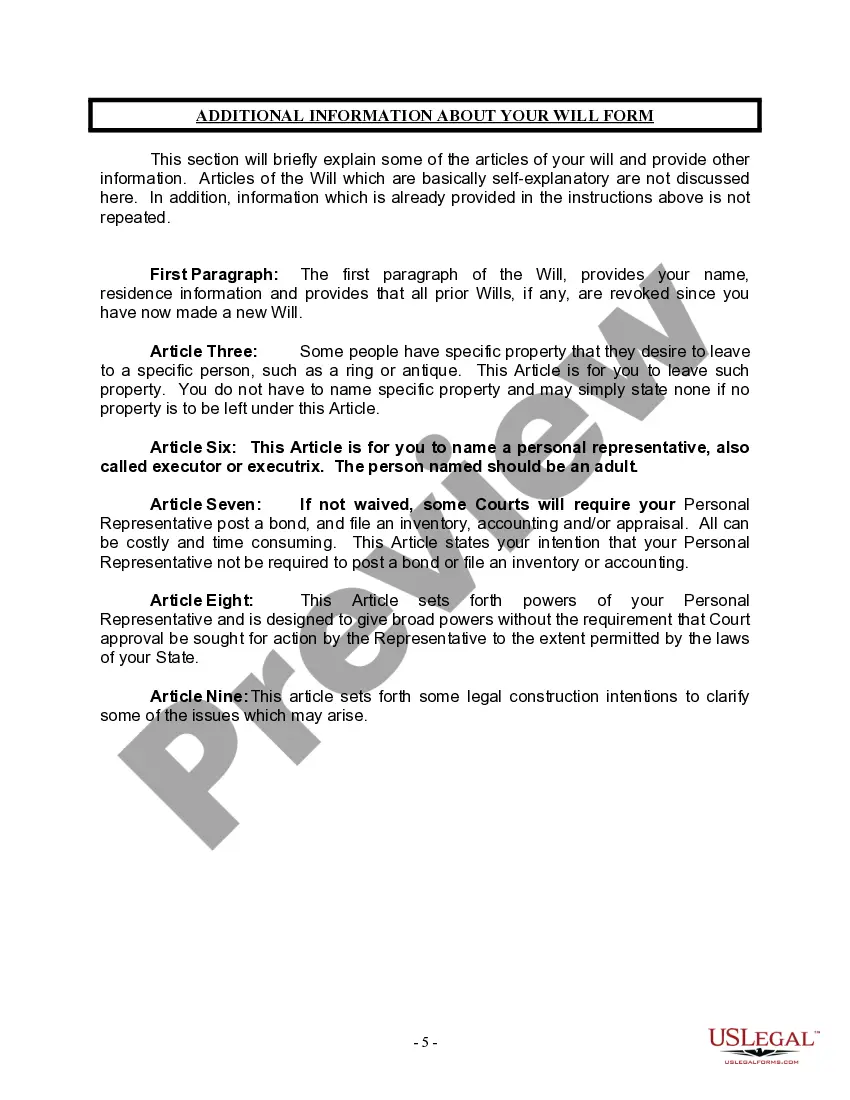

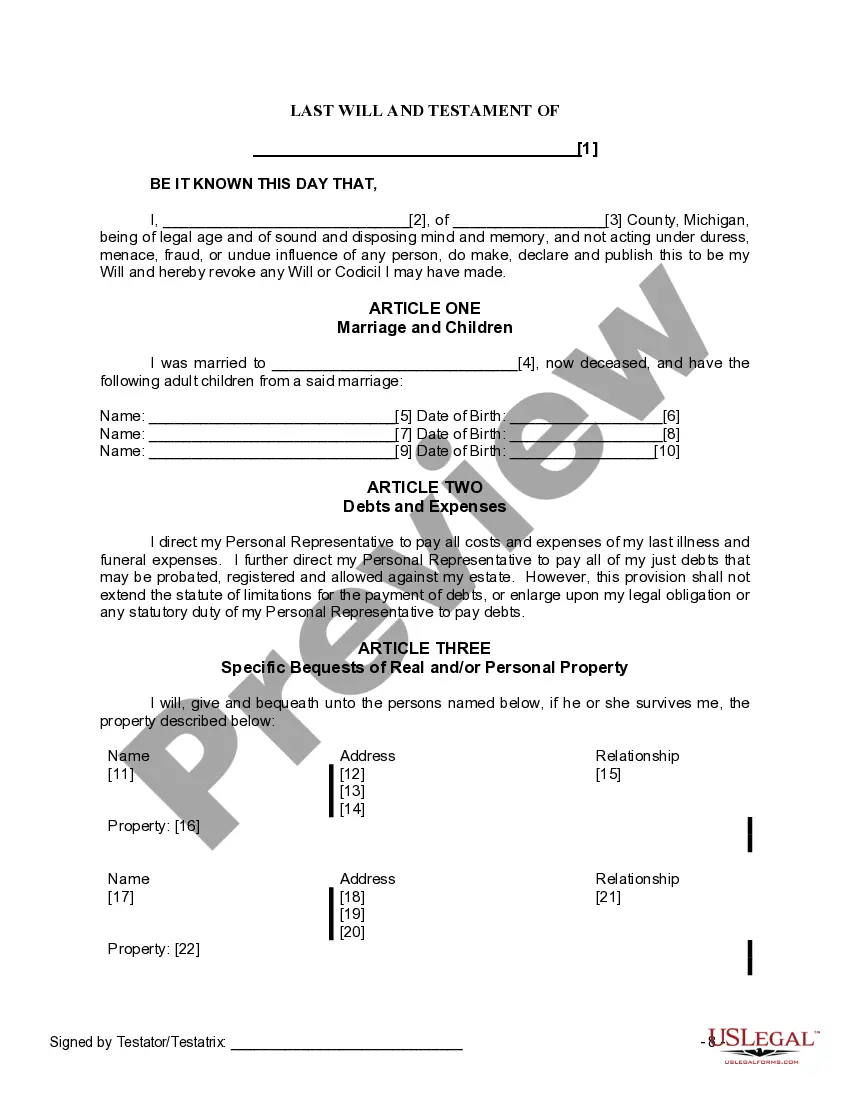

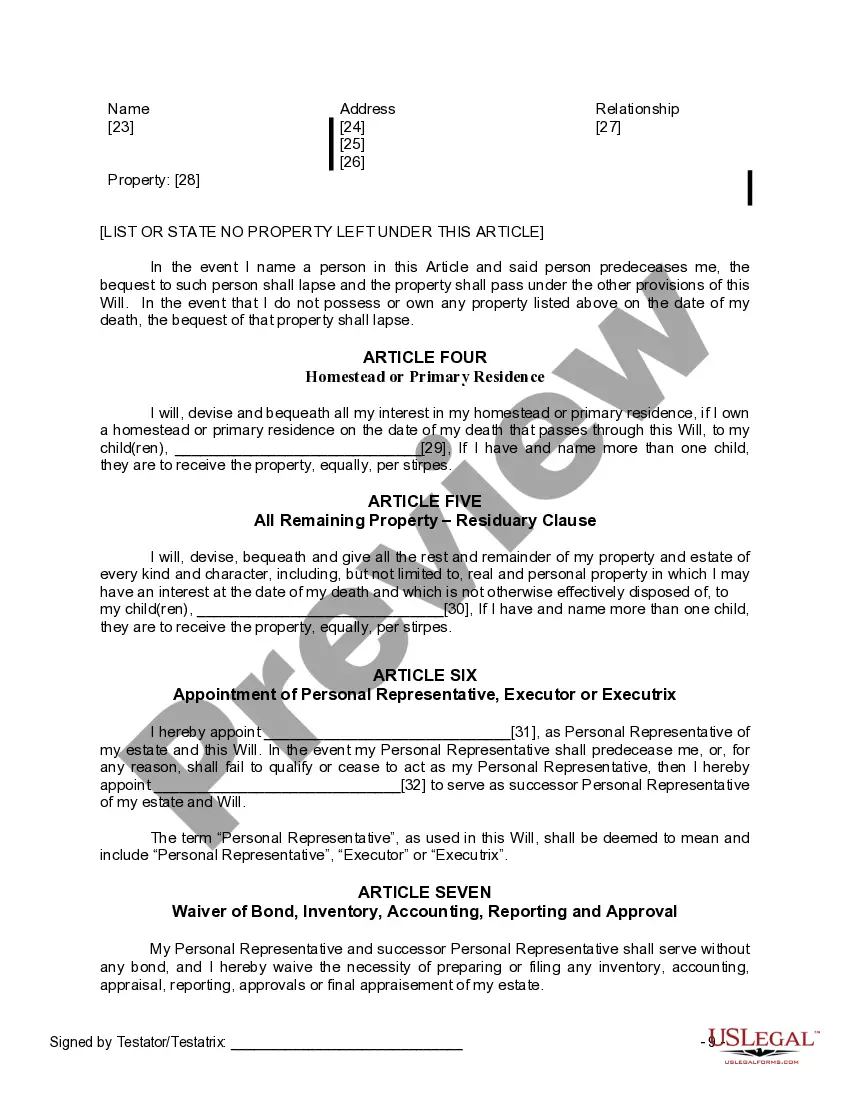

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will. A Last Will and Testament is a crucial legal document that allows individuals to outline their wishes regarding the distribution of their assets, care for their loved ones, and appoint guardians for minor children after their demise. For widows or widowers in Sterling Heights, Michigan, having adult children, it is essential to understand the specific provisions relevant to their unique circumstances. The Sterling Heights Michigan Legal Last Will and Testament Form for a Widow or Widower with Adult Children caters to individuals who have experienced the loss of their spouse and have adult children who need to be accounted for in their estate planning. This legal document ensures that the wishes of the testator (the person creating the will) are respected and carried out according to the state laws of Michigan. Key provisions commonly found in a Sterling Heights Michigan Legal Last Will and Testament Form for a Widow or Widower with Adult Children may include: 1. Identification: The will typically begins with the identification of the testator, stating their full name, residence, and any relevant identification numbers. 2. Executor: The testator appoints an executor, someone responsible for managing and distributing the estate according to the terms of the will. This person will ensure the will is probated and all debts, taxes, and expenses are addressed. 3. Disposition of Assets: The will identifies how the testator's assets, such as property, finances, personal belongings, and investments, should be distributed among their adult children. It may specify whether the distribution will occur equally or based on specific percentages, as desired by the testator. 4. Guardianship: While guardianship is typically associated with minor children, in this scenario, adult children may have disabilities or require special care. The testator may designate a specific adult child or trusted individual as the legal guardian to ensure their continued welfare. 5. Debts and Expenses: Any outstanding debts, taxes, or other expenses owed by the testator should be addressed in the will. This provision ensures that these obligations are settled before the distribution of assets. It is crucial to consult an attorney specializing in estate planning when creating a Sterling Heights Michigan Legal Last Will and Testament Form for a Widow or Widower with Adult Children. They can provide personalized guidance and expertise to ensure all legal requirements and the testator's intentions are properly incorporated into the document. Note: It's important to conduct research to see if there are any specific named forms for Sterling Heights, Michigan, as the content provided here is a general outline of what might be included in such a form.

A Last Will and Testament is a crucial legal document that allows individuals to outline their wishes regarding the distribution of their assets, care for their loved ones, and appoint guardians for minor children after their demise. For widows or widowers in Sterling Heights, Michigan, having adult children, it is essential to understand the specific provisions relevant to their unique circumstances. The Sterling Heights Michigan Legal Last Will and Testament Form for a Widow or Widower with Adult Children caters to individuals who have experienced the loss of their spouse and have adult children who need to be accounted for in their estate planning. This legal document ensures that the wishes of the testator (the person creating the will) are respected and carried out according to the state laws of Michigan. Key provisions commonly found in a Sterling Heights Michigan Legal Last Will and Testament Form for a Widow or Widower with Adult Children may include: 1. Identification: The will typically begins with the identification of the testator, stating their full name, residence, and any relevant identification numbers. 2. Executor: The testator appoints an executor, someone responsible for managing and distributing the estate according to the terms of the will. This person will ensure the will is probated and all debts, taxes, and expenses are addressed. 3. Disposition of Assets: The will identifies how the testator's assets, such as property, finances, personal belongings, and investments, should be distributed among their adult children. It may specify whether the distribution will occur equally or based on specific percentages, as desired by the testator. 4. Guardianship: While guardianship is typically associated with minor children, in this scenario, adult children may have disabilities or require special care. The testator may designate a specific adult child or trusted individual as the legal guardian to ensure their continued welfare. 5. Debts and Expenses: Any outstanding debts, taxes, or other expenses owed by the testator should be addressed in the will. This provision ensures that these obligations are settled before the distribution of assets. It is crucial to consult an attorney specializing in estate planning when creating a Sterling Heights Michigan Legal Last Will and Testament Form for a Widow or Widower with Adult Children. They can provide personalized guidance and expertise to ensure all legal requirements and the testator's intentions are properly incorporated into the document. Note: It's important to conduct research to see if there are any specific named forms for Sterling Heights, Michigan, as the content provided here is a general outline of what might be included in such a form.