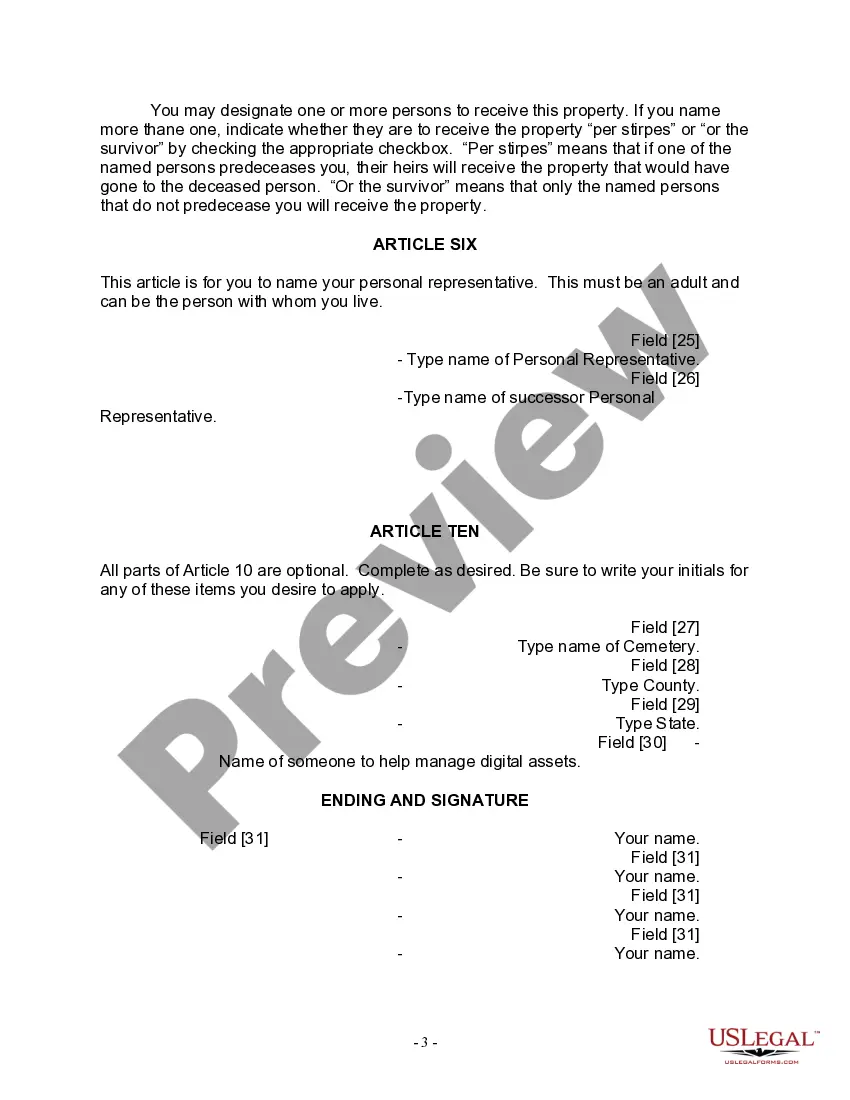

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

Detroit Michigan Last Will for a Widow or Widower with no Children

Description

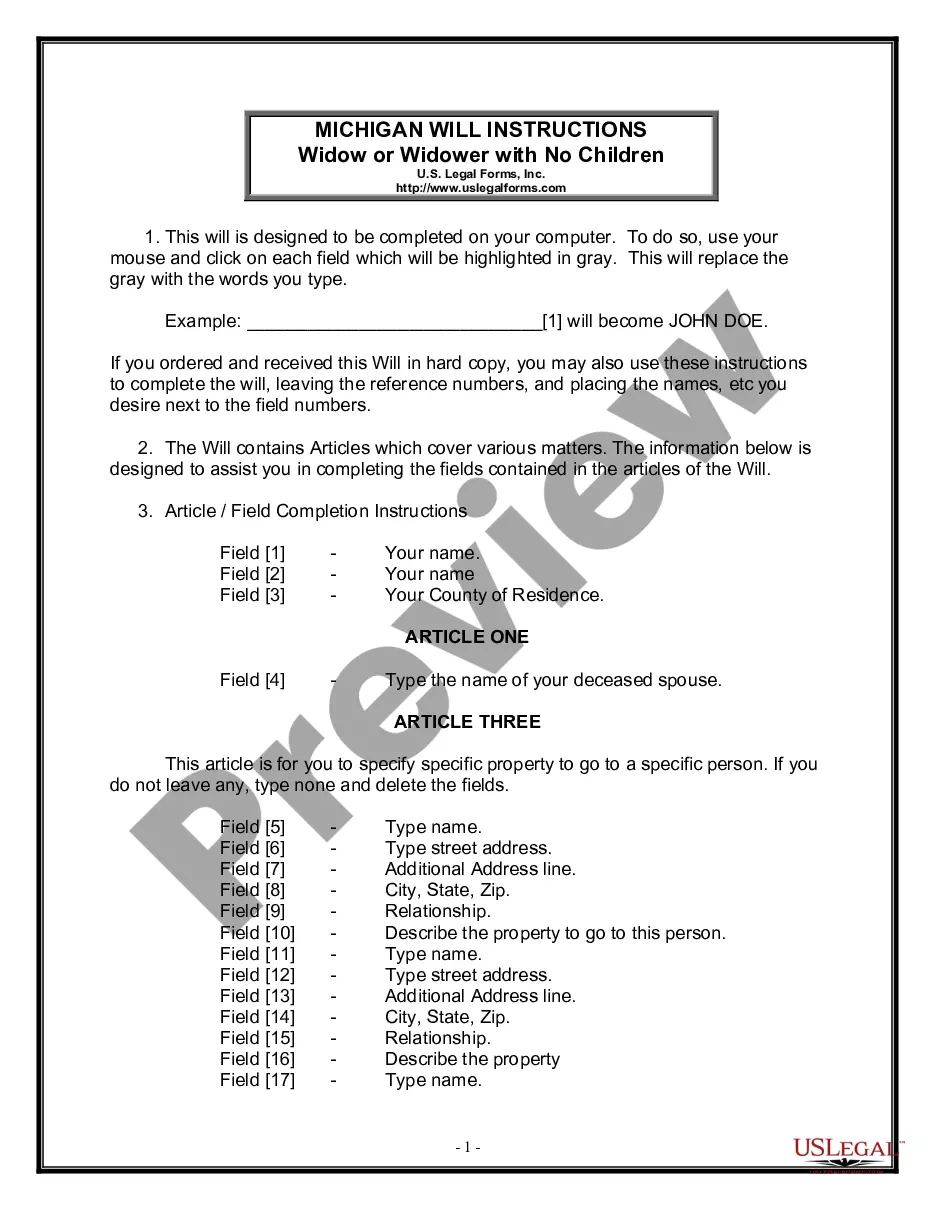

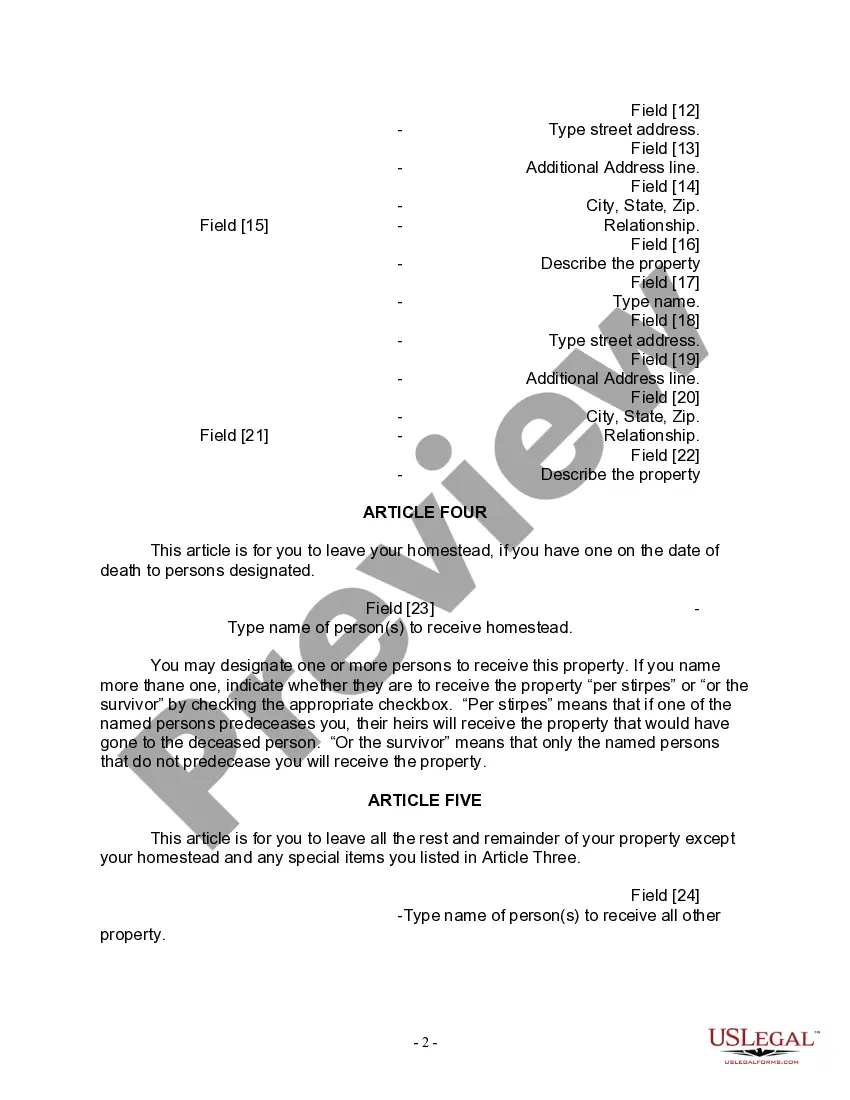

How to fill out Michigan Last Will For A Widow Or Widower With No Children?

Leverage the US Legal Forms to gain instant access to any form you require.

Our user-friendly platform featuring a vast array of templates streamlines the process of locating and acquiring nearly any document sample you need.

You can save, complete, and validate the Detroit Michigan Legal Last Will Form for a Widow or Widower with no Children in just a few minutes instead of spending hours online trying to find an appropriate template.

Utilizing our catalog is an excellent method to enhance the security of your document submissions.

The Download option will be available on all the templates you examine. Additionally, you can access all previously saved documents in the My documents section.

If you have not yet created an account, follow the instructions below: Access the page with the template you require. Confirm that it is the correct form by checking its title and details, and utilize the Preview option when it is accessible. If not, use the Search field to locate what you need.

- Our expert attorneys routinely review all documents to ensure that the templates are applicable for a specific state and adhere to the latest laws and regulations.

- How do you retrieve the Detroit Michigan Legal Last Will Form for a Widow or Widower with no Children.

- If you already possess an account, simply Log In to your profile.

Form popularity

FAQ

Under Michigan law, a will must be filed with the court with reasonable promptness after the death of the testator. MCL 700.2516. So, after you pass away, your will should be filed in your local probate court by the person named to be your personal representative (also called an ?executor? or ?administrator?).

A will is invalid if it is not properly witnessed or signed. Most commonly, two witnesses must sign the will in the testator's presence after watching the testator sign the will. The witnesses typically need to be a certain age, and should generally not stand to inherit anything from the will.

The requirements for a valid will under Michigan Law are set forth in Mich. Comp....To make a valid will under Michigan law, the will must be: In writing; Signed by the testator or by some other person in the testator's conscious presence and at the testator's direction; and. Signed by at least two witnesses.

You must sign your will in front of at least two witnesses, but you can have up to three witnesses. They must be 18 or older. It is helpful if they are people you know who could be located to testify about the will if necessary. A person who will inherit from your estate after you die can still serve as a witness.

A will drafted in the testator's handwriting is valid under state law. A Michigan holographic will is just as enforceable in a Michigan court as a normal will that meets the normal statutory requirements.

Steps to Create a Will in Michigan Decide what property to include in your will. Decide who will inherit your property. Choose an executor to handle your estate. Choose a guardian for your children. Choose someone to manage children's property. Make your will. Sign your will in front of witnesses.

Do I Need a Lawyer to Make a Will in Michigan? No. You can make your own will in Michigan, using Nolo's Quicken WillMaker & Trust. However, you may want to consult a lawyer in some situations.

Does my will have to be notarized? No. A will does not need to be notarized. However, there must be at least two witnesses.

Does my will have to be notarized? No. A will does not need to be notarized. However, there must be at least two witnesses.

Anyone who is 18 or older with sufficient mental capacity may make their own will. ?Sufficient mental capacity? means that the person making the will: Understands that making a will means planning to distribute property after death.