This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

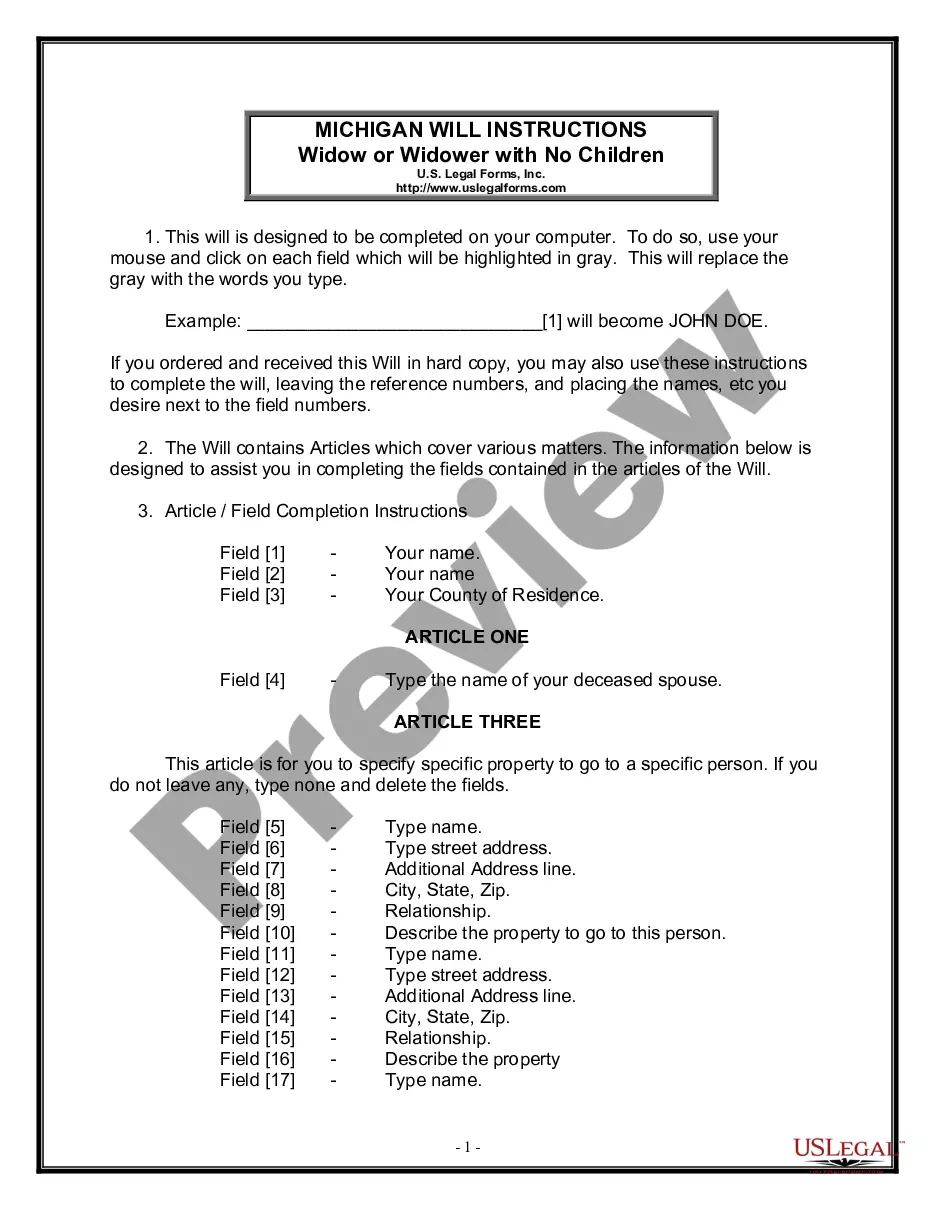

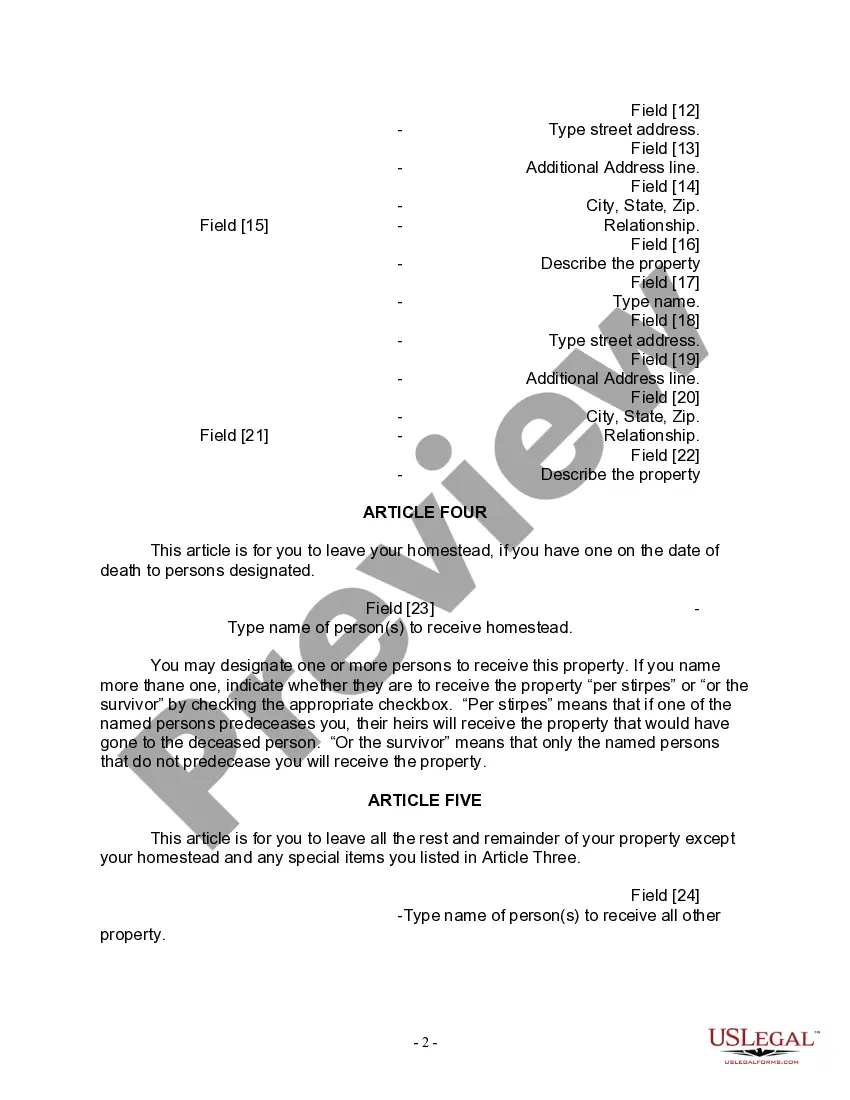

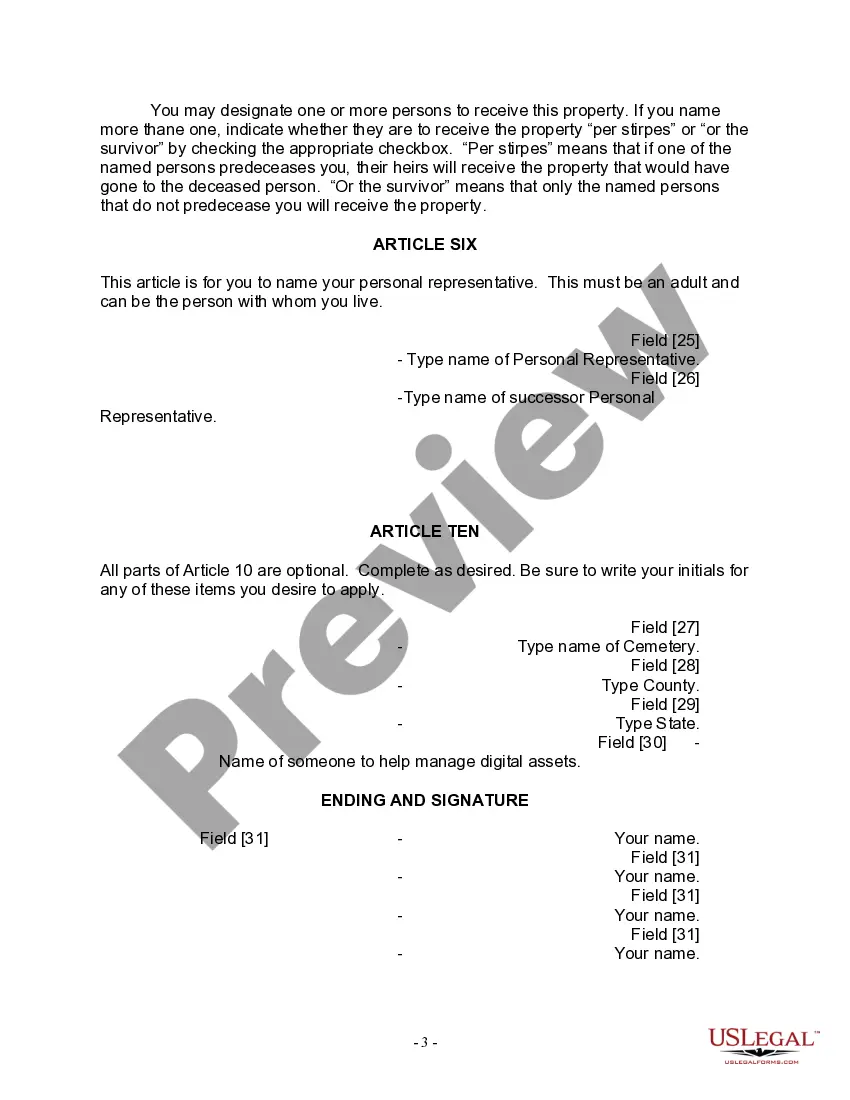

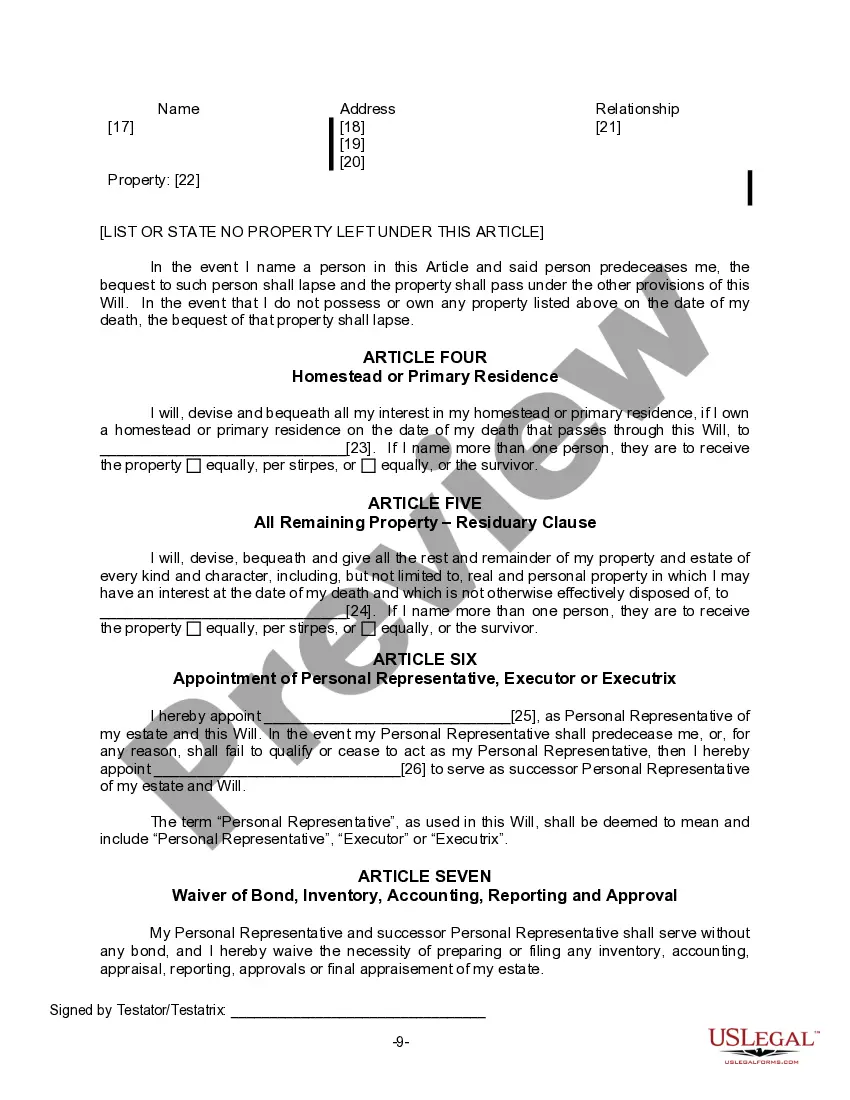

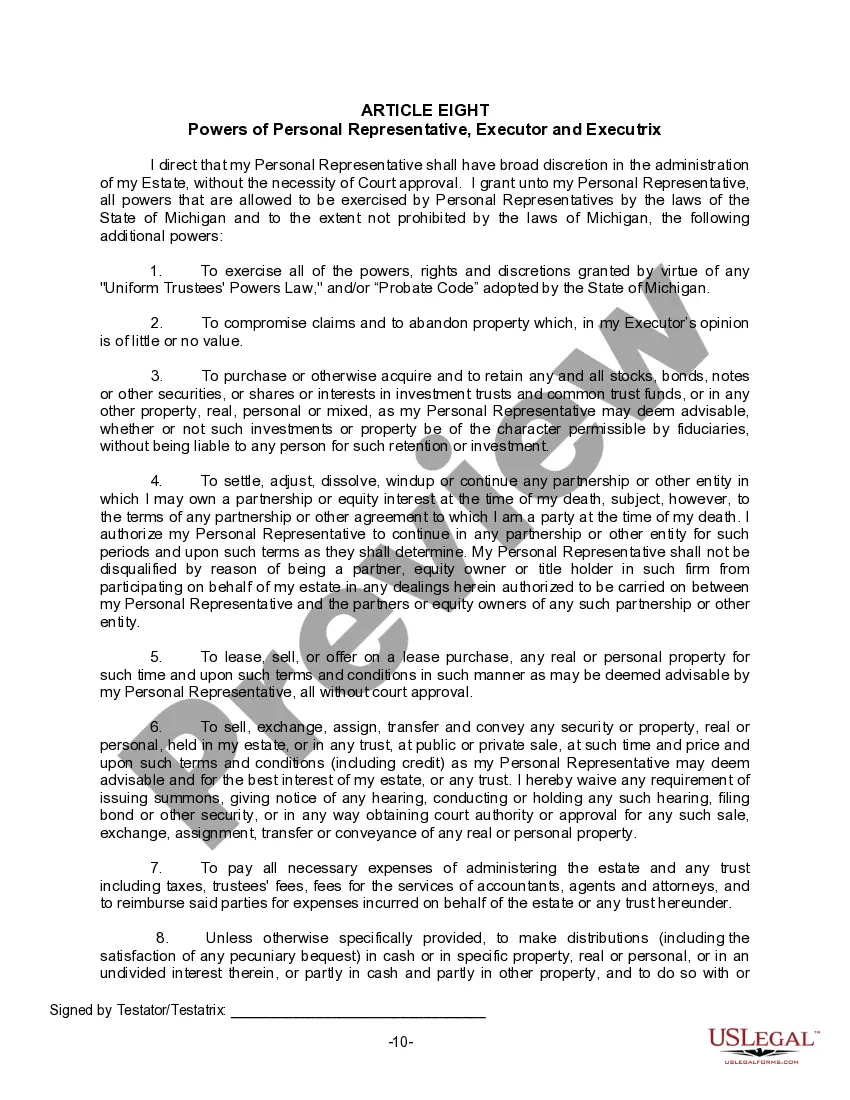

Sterling Heights Michigan Legal Last Will Form for a Widow or Widower with no Children: Types and Detailed Description In Sterling Heights, Michigan, a Last Will and Testament is a crucial legal document that allows individuals to dictate how their assets and estate will be distributed after their passing. For widows or widowers without children, it is essential to have a specific Last Will Form that caters to their unique circumstances. Below, we will delve into the details of a Sterling Heights Michigan Legal Last Will Form for a Widow or Widower with no Children, exploring its importance and providing relevant keywords to ensure comprehensive content. 1. Details of a Sterling Heights Michigan Legal Last Will Form for a Widow or Widower with no Children: — Introduction: The form will typically start with an introduction clarifying that it is solely designed for widows or widowers who do not have any children. — Personal Information: The individual's full legal name, address, and any relevant identification details will be included. — Executor: Naming an executor, who will be responsible for overseeing the distribution of assets according to the terms outlined in the will, is an essential element. — Beneficiaries: The widow or widower must specify the individuals or organizations who will inherit their assets, such as close friends, relatives, or charitable institutions. — Asset DistributionTheyhe will form should precisely outline how the individual's assets, including bank accounts, real estate, investments, personal belongings, or any other property, should be distributed among the named beneficiaries. — Specific Bequests: Any specific bequests, such as sentimental items or valuable possessions, can be added to ensure they are gifted to the desired recipients. — Alternate Beneficiaries: In case any primary beneficiary predeceases the individual or declines the bequest, the will form can include alternate beneficiaries. — End of Life Preferences: Including any specific instructions for end-of-life care, funeral arrangements, or organ donation can be part of the Sterling Heights Michigan Legal Last Will Form. — Witnesses: Generally, two witnesses are required to sign the will in the presence of the testator (the individual creating the will) to make it legally valid. — Notarization: Although not mandatory in Michigan, it is advisable to have the will notarized to add an extra layer of authenticity. Types of Sterling Heights Michigan Legal Last Will Form for a Widow or Widower with no Children: 1. Simple Last Will for Widows or Widowers without Children: This is a straightforward form that covers the basics mentioned above, without any complex instructions or provisions. 2. Living Will with Testamentary Capacity: This comprehensive form not only covers asset distribution but also includes end-of-life preferences and healthcare decisions, giving the individual more control over their future medical treatments. Remember, it is crucial to consult with an attorney when creating or updating any legal documents, including a Last Will. They can provide personalized advice and ensure that the form complies with all relevant local laws and regulations, providing you peace of mind for the future.