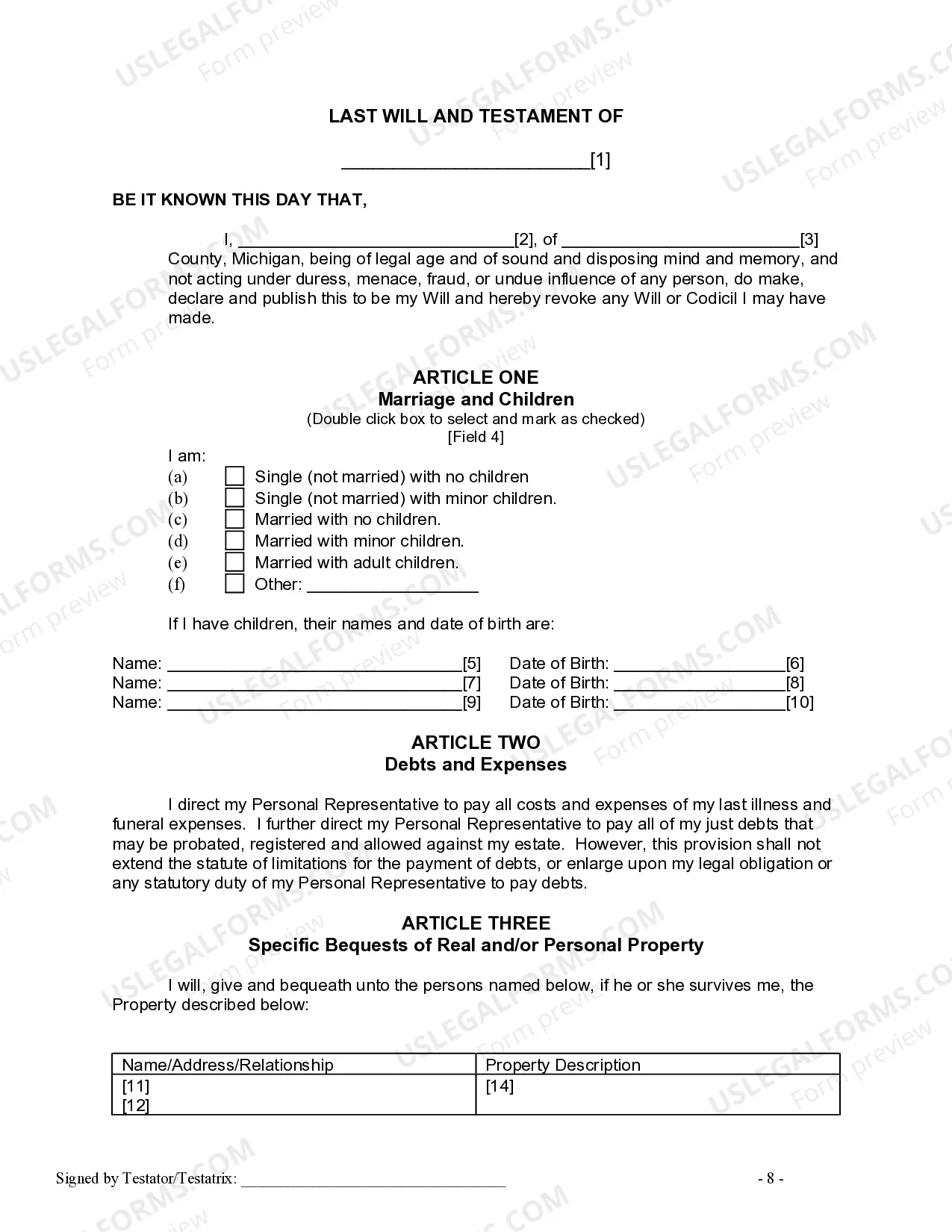

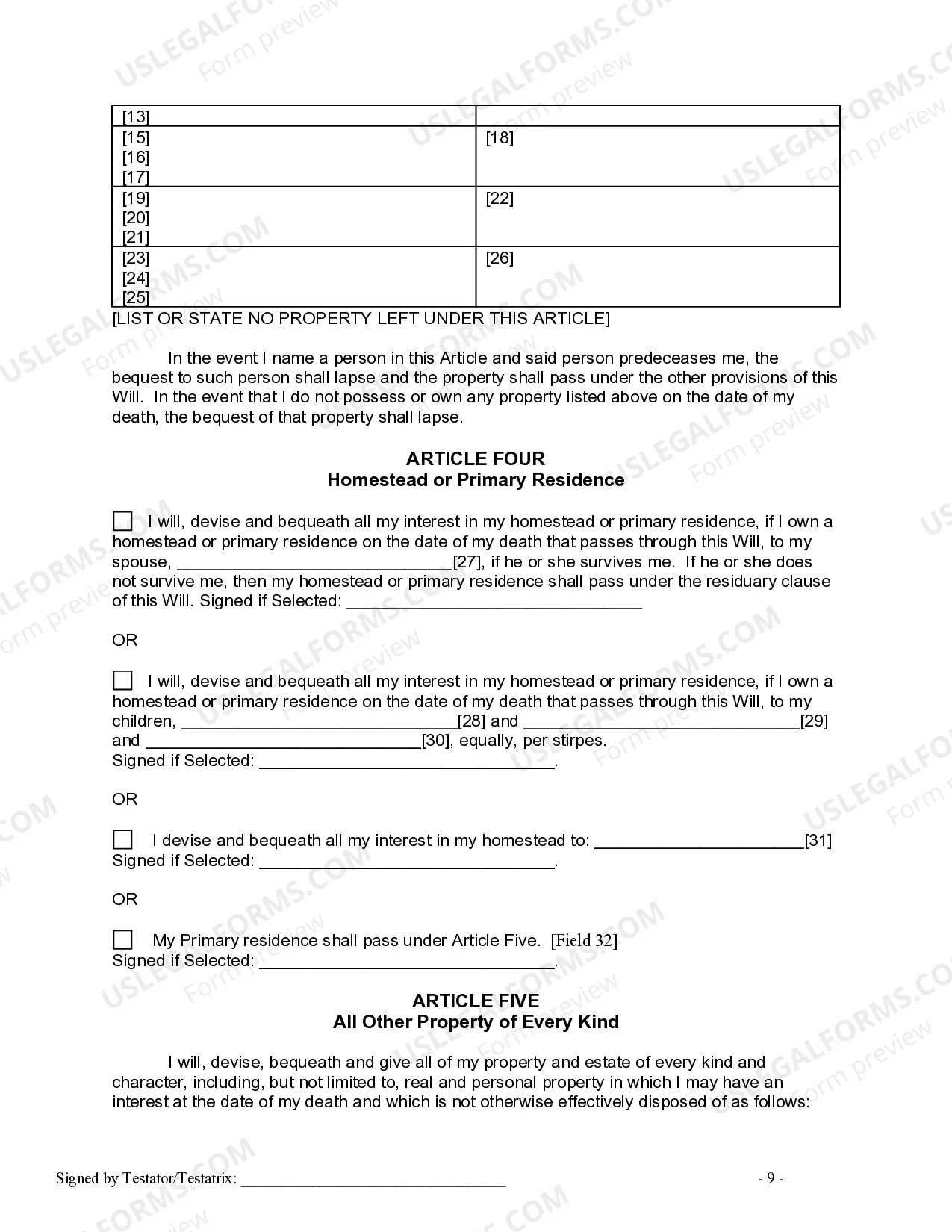

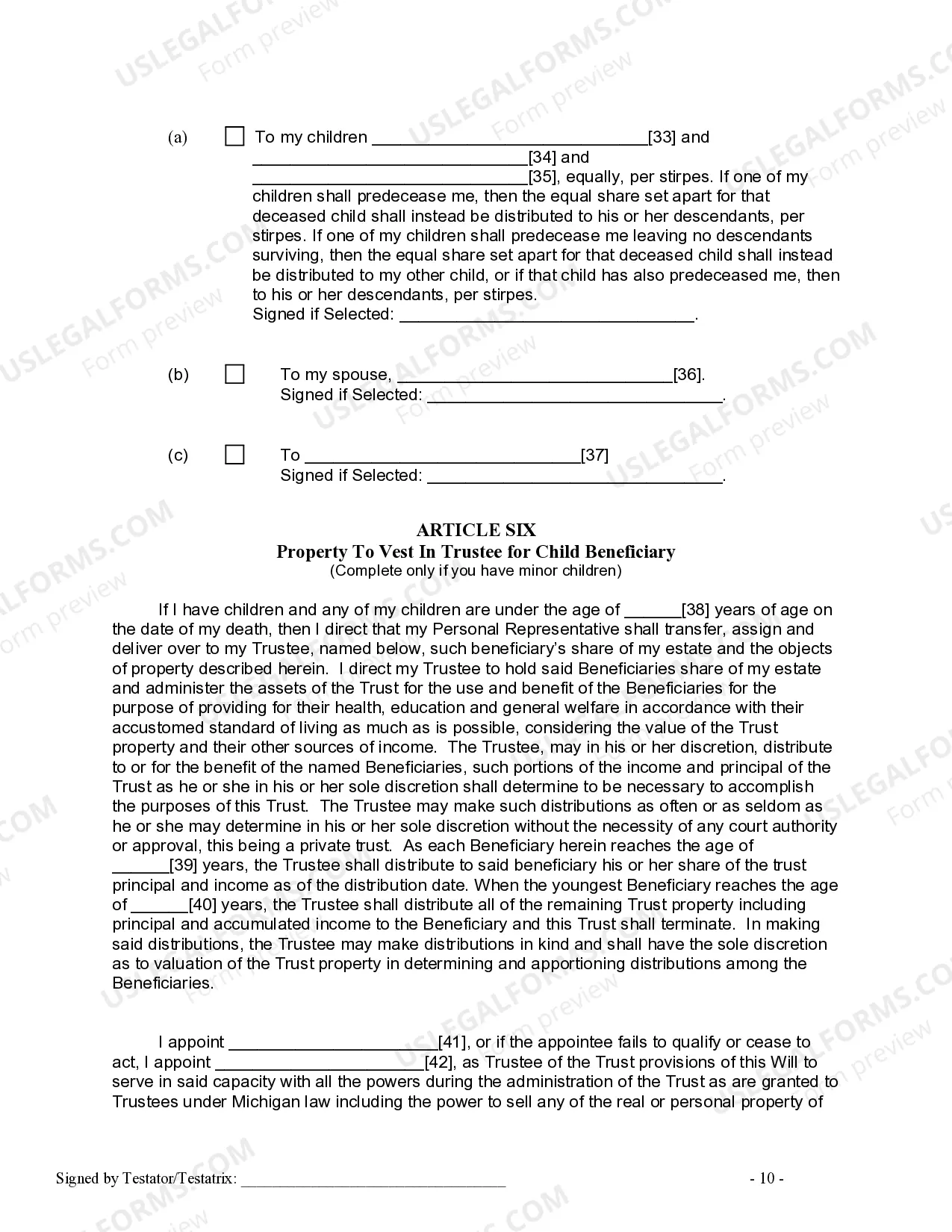

Title: Grand Rapids Michigan Last Will and Testament — A Comprehensive Guide for Personal Estate Planning Introduction: A Grand Rapids Michigan Last Will and Testament is a legally binding document that allows individuals to express their final wishes regarding the distribution of their property and assets after their death. It is an essential part of estate planning, ensuring that loved ones are taken care of and assets are allocated as intended. In Grand Rapids, Michigan, there are different types of Last Will and Testament options available, each serving specific purposes and addressing varying personal circumstances. Types of Grand Rapids Michigan Last Will and Testament: 1. Simple Grand Rapids Michigan Last Will and Testament: A simple Last Will and Testament is suitable for individuals with uncomplicated estate plans. It outlines how assets are to be allocated, appoints an executor, and designates guardians for minor children if applicable. 2. Pour-over Grand Rapids Michigan Last Will and Testament: This type of Last Will and Testament is often used in conjunction with a living trust. It directs all assets not already designated to be transferred into the living trust upon the testator's death. 3. Joint Grand Rapids Michigan Last Will and Testament: A joint Last Will and Testament is designed for spouses or domestic partners who wish to express mutual wishes for their estate. It stipulates how shared assets are to be distributed after the death of both partners. 4. Living Grand Rapids Michigan Last Will and Testament: Also known as a living will or advance directive, this document allows individuals to outline their healthcare and end-of-life preferences while they are still alive but unable to make decisions themselves. Key Elements of a Grand Rapids Michigan Last Will and Testament: 1. Appointment of an executor: Names a trusted individual responsible for administering the estate and ensures proper execution of the will's instructions. 2. Distribution of assets: Clearly states how the testator's property and assets should be divided among beneficiaries or organizations. 3. Guardianship provisions: Addresses the care and custody of minor children, nominating trusted individuals as potential guardians. 4. Debts, taxes, and expenses: Specifies how outstanding debts, funeral expenses, and taxes are to be settled from the estate. 5. Residual clause: Deals with any remaining assets not specifically mentioned in the will, ensuring their distribution according to the testator's intentions. 6. Witnesses and notarization: Requires witnesses and/or notarization in adherence to Michigan state laws. Conclusion: Creating a Grand Rapids Michigan Last Will and Testament is crucial to ensure that your estate is distributed according to your wishes after your passing. Depending on individual circumstances, various types of wills cater to different needs. By understanding the different options available and considering the relevant keywords mentioned above, individuals can make informed decisions in planning their personal estate effectively.

Grand Rapids Michigan Last Will and Testament for other Persons

Description

How to fill out Grand Rapids Michigan Last Will And Testament For Other Persons?

Getting verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Grand Rapids Michigan Last Will and Testament for other Persons gets as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, obtaining the Grand Rapids Michigan Last Will and Testament for other Persons takes just a couple of clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. This process will take just a few more steps to complete for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make certain you’ve chosen the right one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, use the Search tab above to find the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Grand Rapids Michigan Last Will and Testament for other Persons. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!