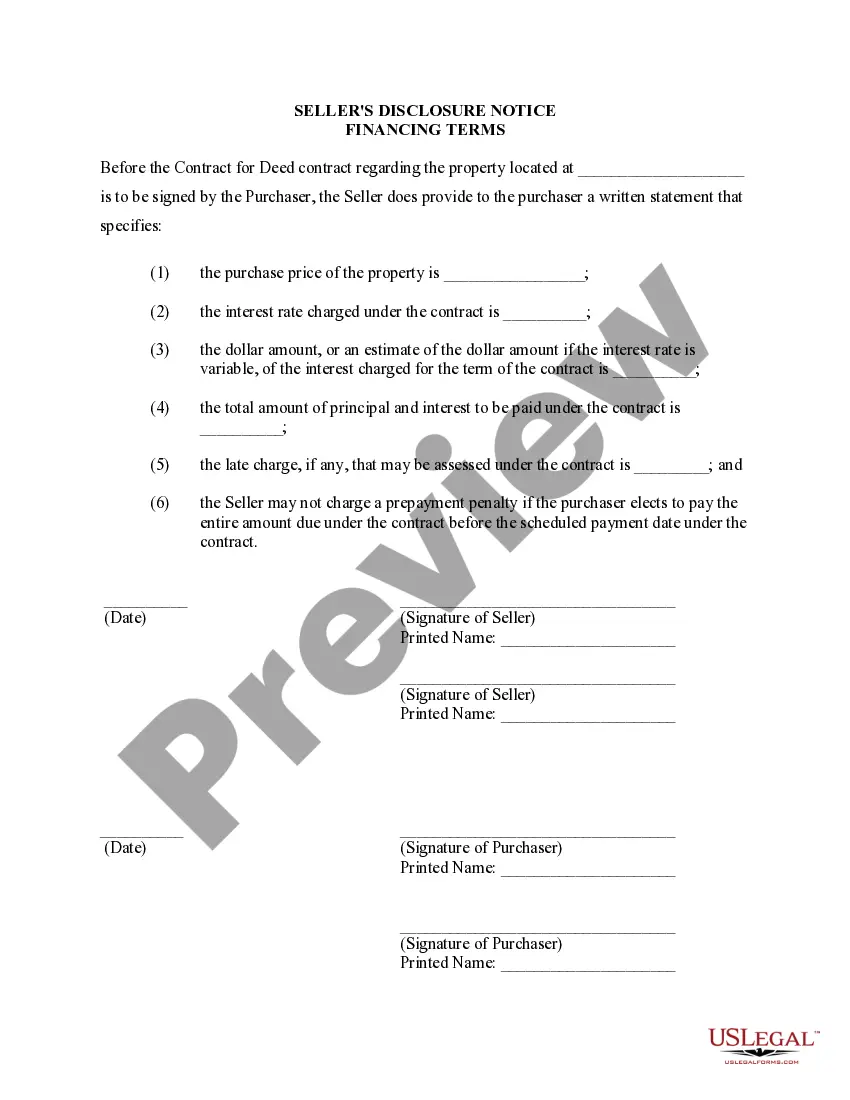

The Hennepin County Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract is an important document that outlines the specific terms and conditions related to the financing of a residential property in Hennepin County, Minnesota. This disclosure is crucial because it ensures transparency and protects both the seller and the buyer during the transaction process. The Hennepin County Seller's Disclosure of Financing Terms for Residential Property may vary depending on the specific details of the agreement. Some key elements that may be included in the disclosure are: 1. Purchase price: The disclosed document should clearly state the agreed-upon purchase price of the property. This amount is the total cost that the buyer is required to pay under the Contract or Agreement for Deed. 2. Down payment: The disclosure should outline the amount of money the buyer agrees to pay upfront as a down payment. This information helps establish the initial investment the buyer needs to make to secure ownership of the property. 3. Interest rate: The disclosure should specify the interest rate that will be applied to the outstanding balance of the financing arrangement. This rate determines the cost of borrowing and affects the overall amount payable by the buyer over the duration of the agreement. 4. Payment schedule: The disclosure should detail the agreed-upon payment schedule, including the frequency (e.g., monthly, bi-monthly) and due dates for the payments. This schedule ensures transparency and helps the buyer plan their financial obligations appropriately. 5. Payment allocation: The document should explain how each payment is allocated between principal and interest, so the buyer understands how their installment amounts contribute to the overall repayment of the property. 6. Late payment penalties: The disclosure may outline any penalties or fees associated with late payments. This helps establish the consequences of non-compliance with the repayment terms and encourages timely payment from the buyer. 7. Balloon payment: In some cases, a balloon payment may be included in the financing terms. This means that at a specific point in the agreement, the buyer must make a substantial payment to settle the remaining balance. The disclosure should clearly state the conditions and timing of any potential balloon payments. It is important to note that the specific terms and conditions outlined in the Hennepin County Seller's Disclosure of Financing Terms for Residential Property may vary depending on individual agreements between the buyer and seller. It is always recommended for both parties to carefully review and understand the disclosure to ensure a successful and fair transaction.

Hennepin Minnesota Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

How to fill out Hennepin Minnesota Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

Getting verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Hennepin Minnesota Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract becomes as quick and easy as ABC.

For everyone already familiar with our service and has used it before, getting the Hennepin Minnesota Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract takes just a couple of clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. This process will take just a couple of additional actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Look at the Preview mode and form description. Make certain you’ve chosen the correct one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to obtain the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Hennepin Minnesota Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!