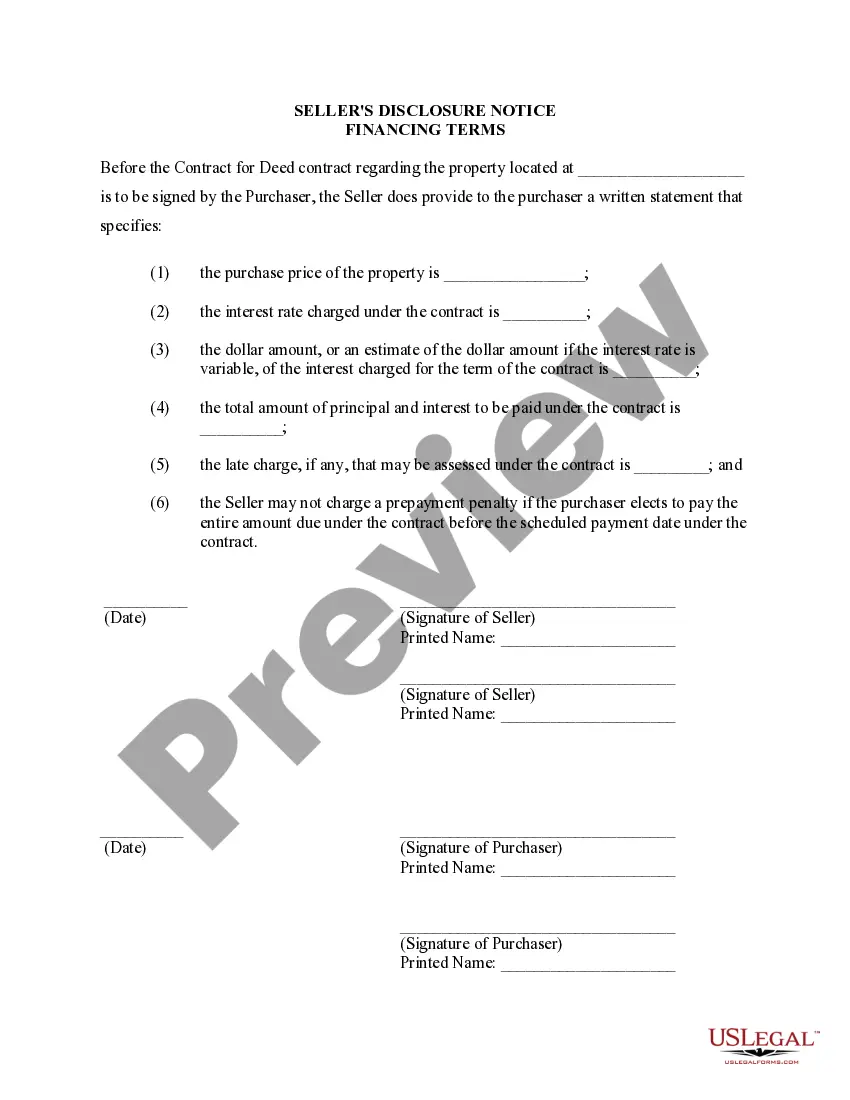

Minneapolis Minnesota Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

How to fill out Minnesota Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

We continually aim to minimize or evade legal repercussions when handling intricate legal or financial situations.

To achieve this, we seek legal assistance that is typically quite costly.

Nevertheless, not all legal challenges are of the same complexity. Many can be managed by ourselves.

US Legal Forms is an online repository of current DIY legal documents, encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button adjacent to it. If you happen to misplace the form, you can always re-download it from the My documents section. The procedure is equally simple if you are not accustomed to the website! You can create your account in a matter of minutes. Ensure that the Minneapolis Minnesota Seller's Disclosure of Financing Terms for Residential Property in relation to the Contract or Agreement for Deed, a/k/a Land Contract, complies with the laws and regulations applicable to your state and area. Additionally, it is crucial to review the form’s description (if available), and if you detect any inconsistencies with what you originally needed, look for an alternative form. Once you've verified that the Minneapolis Minnesota Seller's Disclosure of Financing Terms for Residential Property concerning the Contract or Agreement for Deed, a/k/a Land Contract, is suitable for you, you can choose a subscription option and proceed with the payment. You may then download the form in any preferred format. For more than 24 years in the industry, we’ve assisted millions by providing ready-to-customize and contemporary legal documents. Take advantage of US Legal Forms today to conserve time and resources!

- Our platform enables you to take control of your affairs without needing legal advice.

- We offer access to legal document templates that are not always publicly accessible.

- Our templates are tailored to specific states and regions, significantly streamlining the search process.

- Utilize US Legal Forms whenever you need to locate and download the Minneapolis Minnesota Seller's Disclosure of Financing Terms for Residential Property associated with a Contract or Agreement for Deed, also known as a Land Contract, or any other document swiftly and safely.

Form popularity

FAQ

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate.

Disadvantages of Common Law Contracts Contracts cost time and money to write. Whether they're drafted by a lawyer or reviewed by one, or even if they are written by an HR professional, contracts require a good deal of energy and are not an inexpensive undertaking.

The seller will retain legal title to the real estate identified in the Minnesota Contract for Deed until the entire purchase price has been paid ? at which time the final deed of conveyance must be delivered to the purchaser.

In Florida the seller of a contract for deed can sell the rights to a property to a third party while the buyer is making payments. However, Florida land contract law requires the seller to provide the buyer with a signed and notarized notice stating the contract for deed has been assigned to another party.

How long are you liable when selling a house in Minnesota? You can be held liable for two years from the closing date.

Minnesota law specifies that the seller of a residential property must make a written disclosure to the prospective buyer that includes all ?material facts of which the seller is aware that could adversely and significantly affect 1) an ordinary buyer's use and enjoyment of the property, or 2) any intended use of the

The contract for deed shall contain a recital of the terms of the sale, the amount of cash paid at the sale, the amount of each of the annual installments, the date of payment of such annual installments, and the rate of interest thereon.

If you fall behind on payments, the contract can be terminated and you will lose whatever equity was previously built. Furthermore, if the seller has a mortgage and defaults on their payments, you may lose the property even though your own payments to the seller are current.

Instead of purchasing a home with a mortgage, the buyer agrees to directly pay the seller in monthly installments. The buyer is able to occupy the home after the closing of the sale, but the seller still retains legal title to the property. Actual ownership passes to the buyer only after the final payment is made.

But, there are 12 states that are still considered ?non-disclosure:? Alaska, Idaho, Kansas, Louisiana, Mississippi, Missouri (some counties), Montana, New Mexico, North Dakota, Texas, Utah and Wyoming. In a non-disclosure state, transaction sale prices are not available to the public.