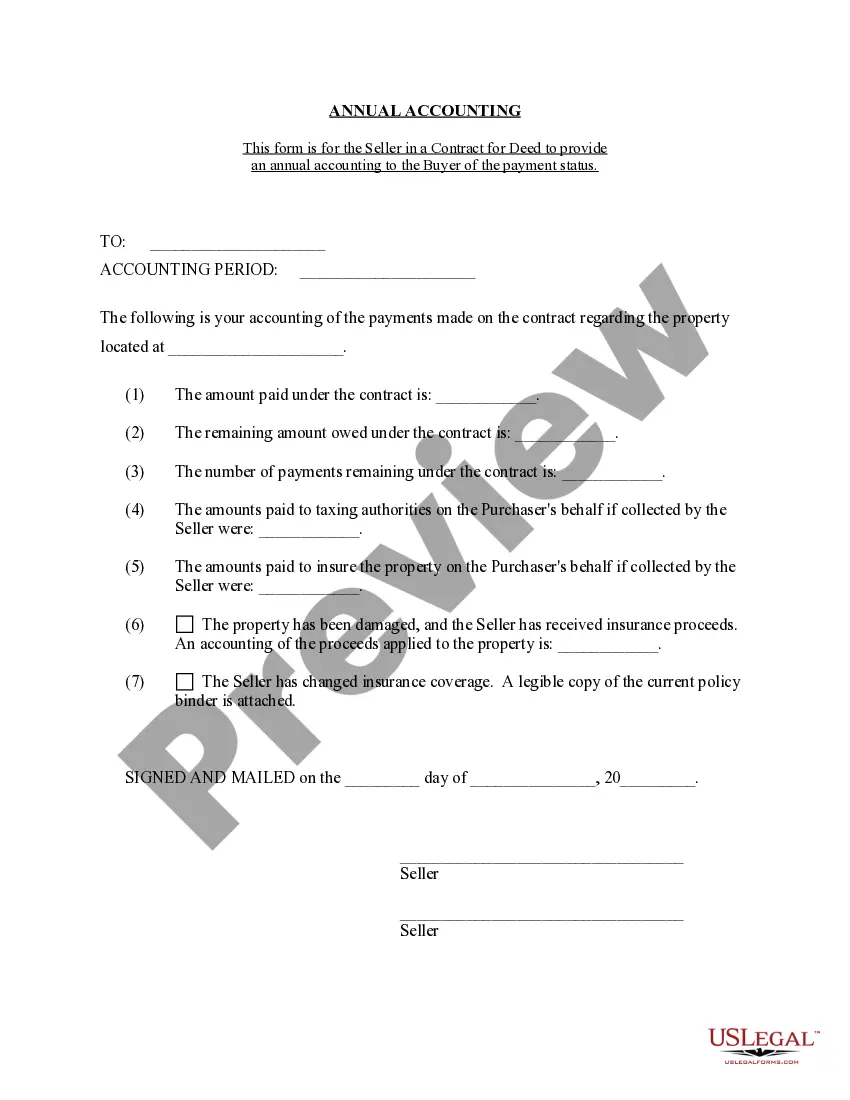

The Hennepin Minnesota Contract for Deed Seller's Annual Accounting Statement is a crucial document that provides a comprehensive financial overview of the seller's transactions and obligations in a contract for deed arrangement. This statement is prepared on an annual basis and helps both parties involved in the contract to track and understand the financial aspects of the agreement. The statement includes various key elements such as the names and contact information of the buyer and seller, property details, and the dates when the contract for deed was initiated and is expected to be fully paid off. It outlines all the financial transactions related to the contract, including the principal amount, interest payments, and any additional charges or fees. In addition to the above information, the Hennepin Minnesota Contract for Deed Seller's Annual Accounting Statement also provides a breakdown of the buyer's payments and balance remaining on the contract. It includes the amount of money paid towards principal, interest, and any applicable fees for the year. The statement also highlights any late payments or penalties incurred by the buyer, if applicable. This statement ensures transparency and clarity for both parties involved as it serves as a record of all financial transactions throughout the year. It assists the buyer in monitoring their progress towards full ownership of the property, while also allowing the seller to keep track of payments and ensure prompt receipt of funds. While variations of the Hennepin Minnesota Contract for Deed Seller's Annual Accounting Statement may exist based on specific contractual agreements, some specific types can be named: 1. Hennepin Minnesota Contract for Deed Seller's Annual Financial Statement: This variation highlights the seller's financial position by providing a detailed breakdown of income, expenses, and profit related to the contract for deed. 2. Hennepin Minnesota Contract for Deed Seller's Annual Payment Schedule: This version focuses primarily on the buyer's payment schedule, outlining the specific due dates and amounts for each installment throughout the year. 3. Hennepin Minnesota Contract for Deed Seller's Annual Tax Statement: This type of statement primarily focuses on tax-related information, including any property taxes paid by the seller on behalf of the buyer, or any tax deductions or benefits applicable to the contract for deed arrangement. In summary, the Hennepin Minnesota Contract for Deed Seller's Annual Accounting Statement is a critical document that ensures financial transparency and accountability between the buyer and seller in a contract for deed agreement. It serves as a comprehensive record of all financial transactions and obligations and assists both parties in tracking their progress and obligations throughout the year.

Hennepin Minnesota Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Hennepin Minnesota Contract For Deed Seller's Annual Accounting Statement?

Are you looking for a trustworthy and inexpensive legal forms supplier to get the Hennepin Minnesota Contract for Deed Seller's Annual Accounting Statement? US Legal Forms is your go-to option.

No matter if you require a simple agreement to set rules for cohabitating with your partner or a set of documents to move your separation or divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and framed in accordance with the requirements of particular state and county.

To download the form, you need to log in account, find the required template, and hit the Download button next to it. Please take into account that you can download your previously purchased document templates at any time in the My Forms tab.

Are you new to our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Hennepin Minnesota Contract for Deed Seller's Annual Accounting Statement conforms to the laws of your state and local area.

- Read the form’s details (if available) to find out who and what the form is good for.

- Restart the search if the template isn’t suitable for your specific situation.

Now you can create your account. Then pick the subscription plan and proceed to payment. Once the payment is done, download the Hennepin Minnesota Contract for Deed Seller's Annual Accounting Statement in any available format. You can get back to the website at any time and redownload the form free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about wasting hours researching legal papers online for good.