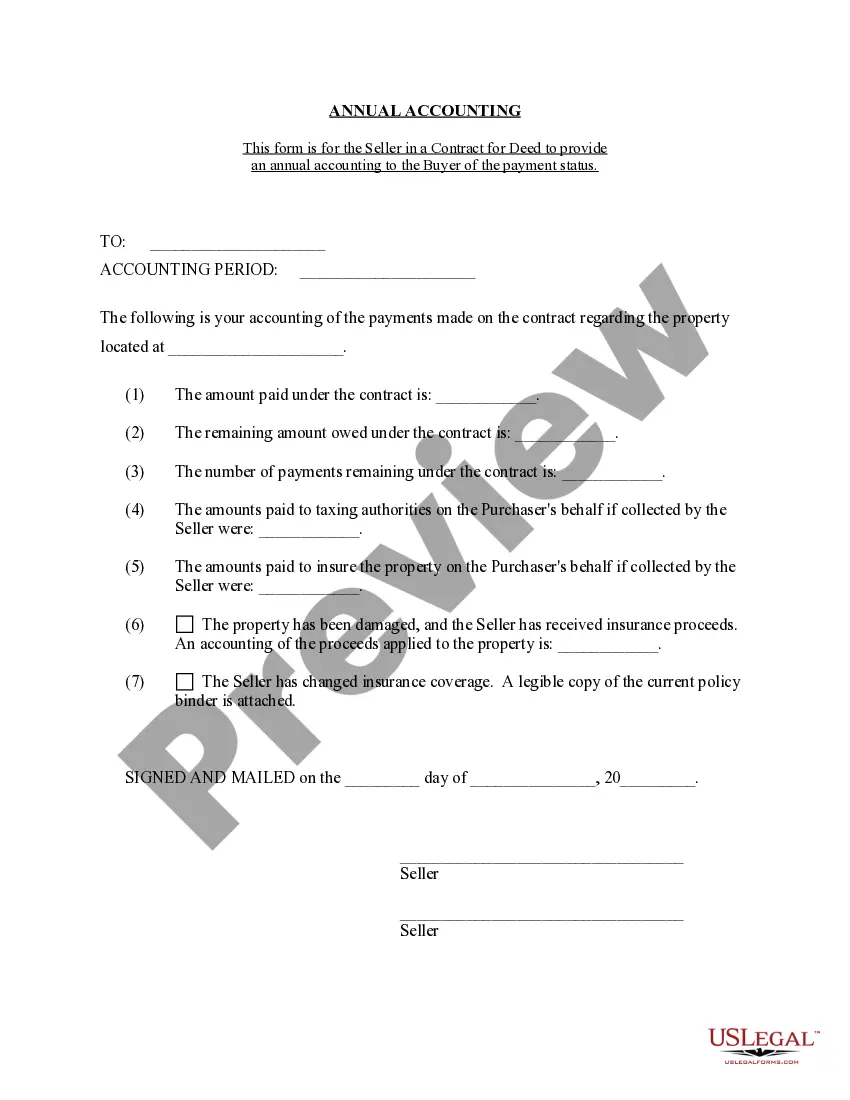

The Saint Paul Minnesota Contract for Deed Seller's Annual Accounting Statement is a comprehensive document that provides a detailed overview of financial transactions and activities related to a contract for deed agreement in the state of Minnesota, specifically in the city of Saint Paul. This statement serves as a vital tool for sellers to track, evaluate, and report the financial performance and obligations associated with the contract for deed. Key components of the Saint Paul Minnesota Contract for Deed Seller's Annual Accounting Statement include income and expenses related to the property, payment history, outstanding balances, interest calculations, and any other crucial financial information relevant to the contract for deed. This statement is often prepared and provided by the seller to the buyer on an annual basis to maintain transparency and ensure compliance with the contractual obligations. Different types of Saint Paul Minnesota Contract for Deed Seller's Annual Accounting Statements may include: 1. Property Income Statement: This statement presents a summary of all income generated from the property associated with the contract for deed. It includes details such as rental income, lease payments, or any other financial inflows. 2. Expense Statement: This statement outlines all the expenses incurred by the seller in relation to the contract for deed property, including maintenance costs, property taxes, insurance premiums, and other relevant expenditures. 3. Principal and Interest Statement: This statement focuses on the repayment of the contract for deed, detailing the principal amount received, interest calculations, and the outstanding balance over the course of the year. 4. Tax Statement: A tax statement is a crucial element of the annual accounting statement and provides information on property tax payments made by the seller, ensuring compliance with tax obligations. 5. Property Improvement Statement: In cases where the seller has made significant improvements or renovations to the property, this statement highlights the costs incurred and showcases the added value to the property. 6. Insurance Statement: As property insurance is a vital requirement, this statement reflects the details of insurance policies held by the seller, including premiums paid and coverage information. It is important to note that the specific content and organization of the annual accounting statement may vary depending on the terms and conditions outlined in individual contract for deed agreements and the requirements set by the city of Saint Paul, Minnesota. Sellers are advised to consult legal professionals or experts in contract for deed transactions to ensure accuracy and compliance with relevant laws and regulations.

Saint Paul Minnesota Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Saint Paul Minnesota Contract For Deed Seller's Annual Accounting Statement?

No matter what social or professional status, filling out law-related forms is an unfortunate necessity in today’s world. Too often, it’s virtually impossible for someone without any law background to draft this sort of papers from scratch, mainly due to the convoluted terminology and legal nuances they involve. This is where US Legal Forms comes to the rescue. Our service offers a massive library with more than 85,000 ready-to-use state-specific forms that work for practically any legal scenario. US Legal Forms also is a great resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

Whether you want the Saint Paul Minnesota Contract for Deed Seller's Annual Accounting Statement or any other document that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Saint Paul Minnesota Contract for Deed Seller's Annual Accounting Statement quickly using our reliable service. If you are presently an existing customer, you can go on and log in to your account to download the appropriate form.

Nevertheless, if you are new to our platform, ensure that you follow these steps prior to obtaining the Saint Paul Minnesota Contract for Deed Seller's Annual Accounting Statement:

- Ensure the template you have chosen is good for your area because the rules of one state or county do not work for another state or county.

- Review the document and read a short description (if provided) of scenarios the paper can be used for.

- In case the one you picked doesn’t meet your needs, you can start over and search for the necessary form.

- Click Buy now and choose the subscription plan you prefer the best.

- Access an account {using your login information or create one from scratch.

- Pick the payment method and proceed to download the Saint Paul Minnesota Contract for Deed Seller's Annual Accounting Statement as soon as the payment is through.

You’re all set! Now you can go on and print out the document or complete it online. Should you have any problems getting your purchased forms, you can quickly find them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.