Title: Understanding the Hennepin Minnesota Notice of Default for Past Due Payments in Connection with Contract for Deed Keywords: Hennepin Minnesota, Notice of Default, Past Due Payments, Contract for Deed Introduction: In Hennepin County, Minnesota, a Notice of Default for Past Due Payments is an important legal document related to a Contract for Deed. This notice serves as a formal communication from the lender to the buyer, indicating that they have failed to make the required payments on time. It is crucial to understand the implications of receiving a Notice of Default and the potential consequences that may follow. This article aims to provide a comprehensive overview of the different types of Hennepin Minnesota Notice of Default for Past Due Payments in connection with a Contract for Deed. Types of Hennepin Minnesota Notice of Default for Past Due Payments in Connection with Contract for Deed: 1. Initial Notice of Default: The Initial Notice of Default is the first official notification sent to the buyer by the lender, informing them that they have defaulted on their payment obligations within the terms of the Contract for Deed. This notice typically outlines the specific missed payments and provides a grace period for the buyer to rectify the situation. 2. Final Notice of Default: If the buyer fails to remedy the payment default within the grace period provided in the Initial Notice of Default, the lender issues a Final Notice of Default. This notice signifies that the buyer's non-payment issue still remains unresolved. It often includes a deadline by which the buyer must make the overdue payments to avoid further legal actions. 3. Notice of Intent to Accelerate: If the buyer fails to cure the default timely, the lender may issue a Notice of Intent to Accelerate, also known as a Demand Letter. This notice formally notifies the buyer that the entire outstanding balance under the Contract for Deed will become due immediately unless the default is resolved within a specified timeframe. This notice is considered a crucial stage in the foreclosure process. 4. Notice of Sale: If the buyer fails to rectify the default even after receiving the Notice of Intent to Accelerate, the lender may proceed with initiating foreclosure proceedings. The Notice of Sale is then issued, stating the intent to sell the property at a foreclosure auction. This notice provides information on the date, time, and location of the auction. Consequences of receiving a Hennepin Minnesota Notice of Default for Past Due Payments in connection with Contract for Deed: Receiving a Notice of Default can have severe repercussions for the buyer, including potential foreclosure, loss of equity, and damage to credit history. It is crucial for buyers to understand their rights and seek legal advice to explore possible alternatives and options to avoid foreclosure. Conclusion: When dealing with a Hennepin Minnesota Notice of Default for Past Due Payments in connection with a Contract for Deed, it is vital to act promptly and seek appropriate legal counsel. Understanding the different types of notices involved and their implications will help buyers navigate the situation effectively and explore suitable solutions to resolve the default and protect their interests.

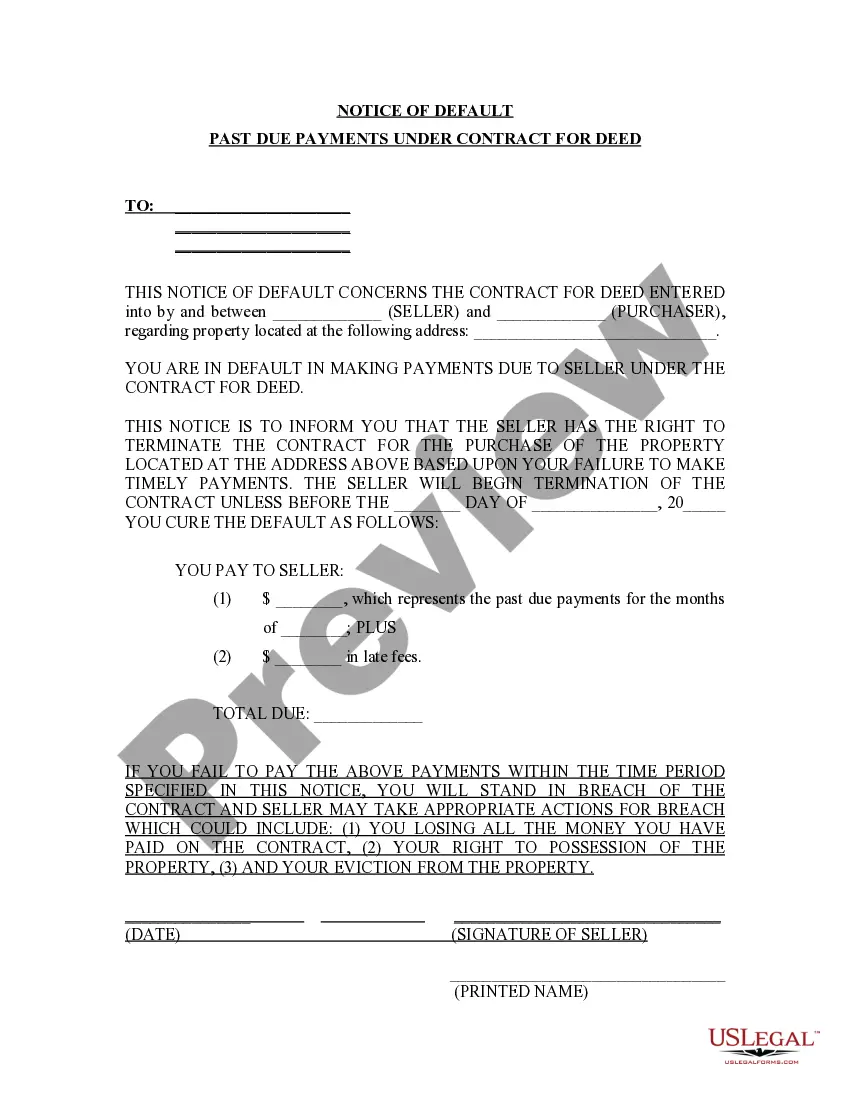

Hennepin Minnesota Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Hennepin Minnesota Notice Of Default For Past Due Payments In Connection With Contract For Deed?

No matter the social or professional status, filling out law-related documents is an unfortunate necessity in today’s world. Very often, it’s virtually impossible for someone with no law education to create such paperwork cfrom the ground up, mainly because of the convoluted jargon and legal subtleties they come with. This is where US Legal Forms can save the day. Our service offers a huge catalog with more than 85,000 ready-to-use state-specific documents that work for practically any legal case. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

Whether you require the Hennepin Minnesota Notice of Default for Past Due Payments in connection with Contract for Deed or any other paperwork that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Hennepin Minnesota Notice of Default for Past Due Payments in connection with Contract for Deed quickly employing our reliable service. In case you are presently a subscriber, you can proceed to log in to your account to get the appropriate form.

However, in case you are a novice to our platform, ensure that you follow these steps prior to obtaining the Hennepin Minnesota Notice of Default for Past Due Payments in connection with Contract for Deed:

- Ensure the template you have found is specific to your location considering that the rules of one state or area do not work for another state or area.

- Preview the document and go through a brief outline (if provided) of cases the document can be used for.

- If the form you picked doesn’t meet your requirements, you can start over and search for the suitable document.

- Click Buy now and pick the subscription plan you prefer the best.

- Log in to your account login information or create one from scratch.

- Select the payment method and proceed to download the Hennepin Minnesota Notice of Default for Past Due Payments in connection with Contract for Deed as soon as the payment is through.

You’re all set! Now you can proceed to print the document or fill it out online. Should you have any issues locating your purchased documents, you can quickly find them in the My Forms tab.

Whatever case you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.