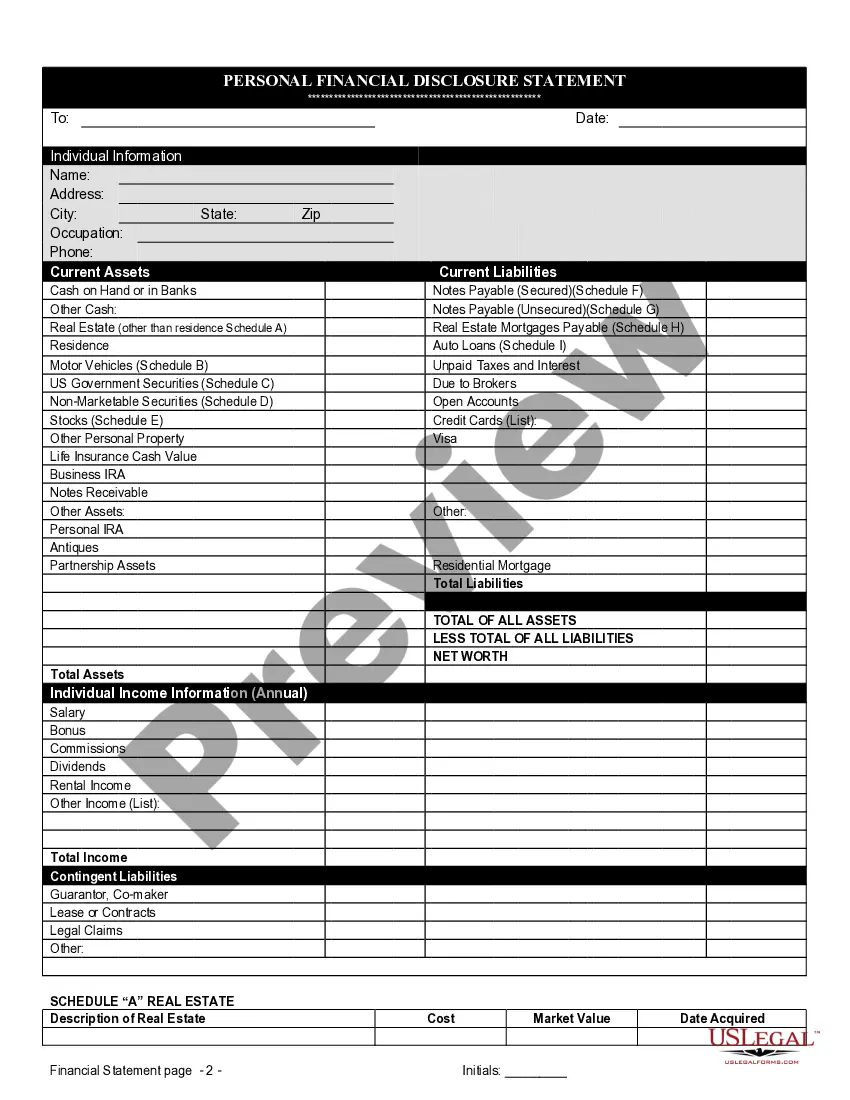

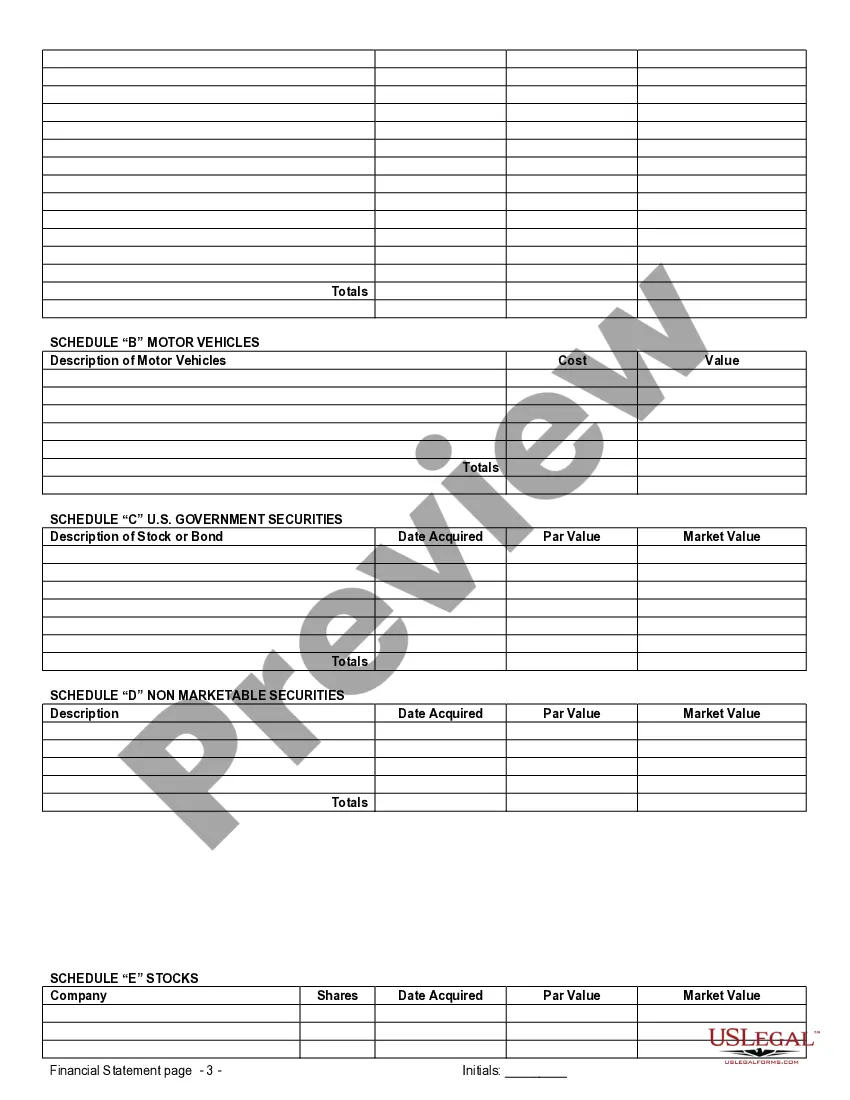

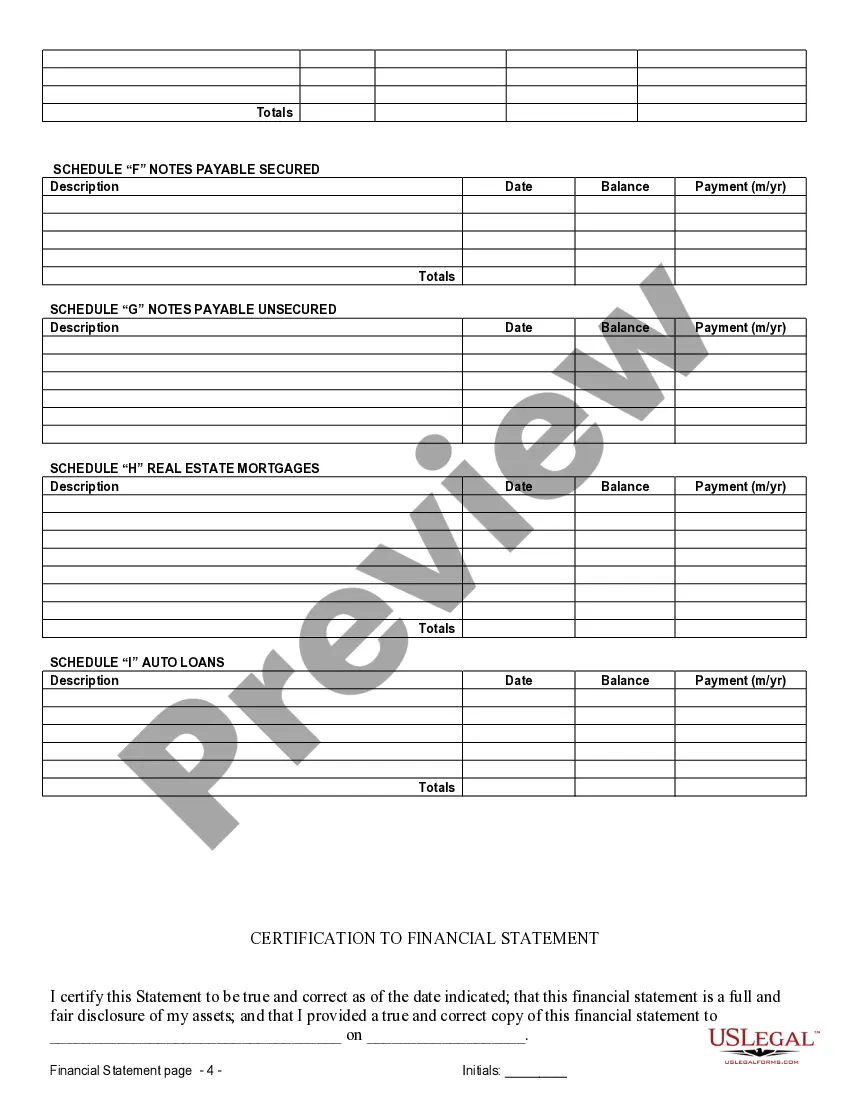

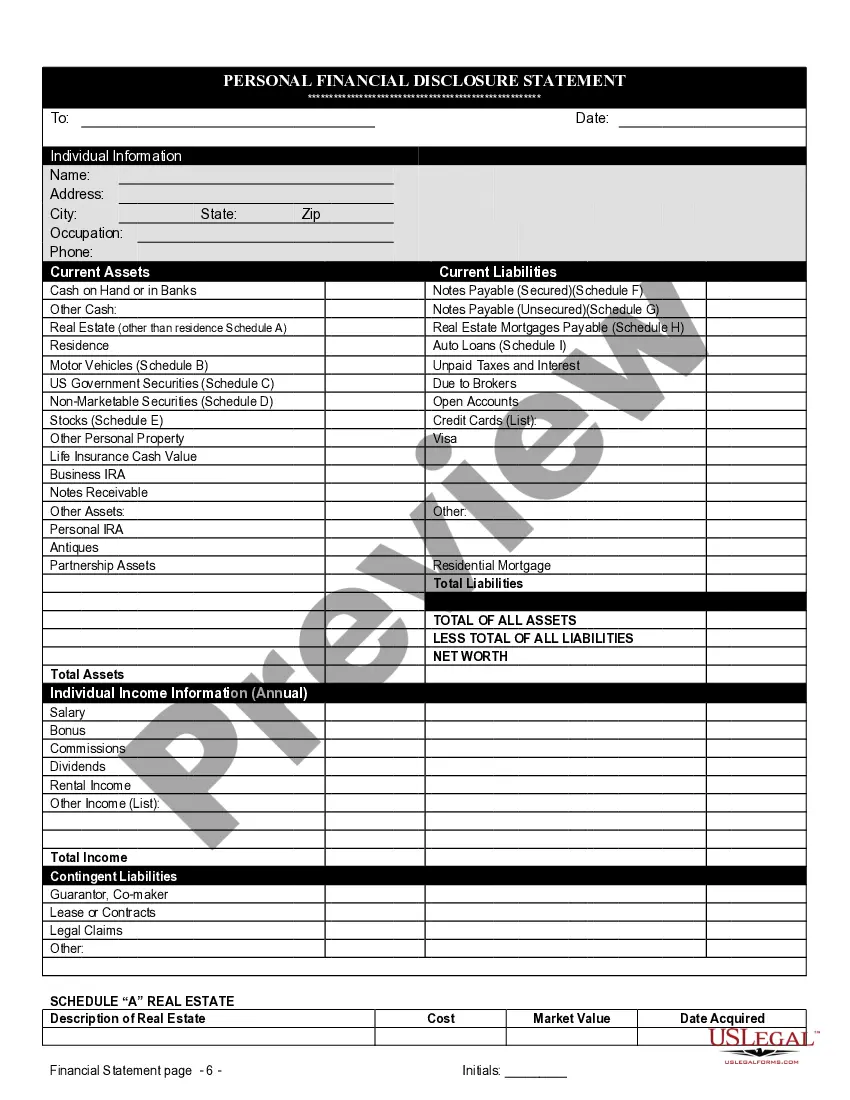

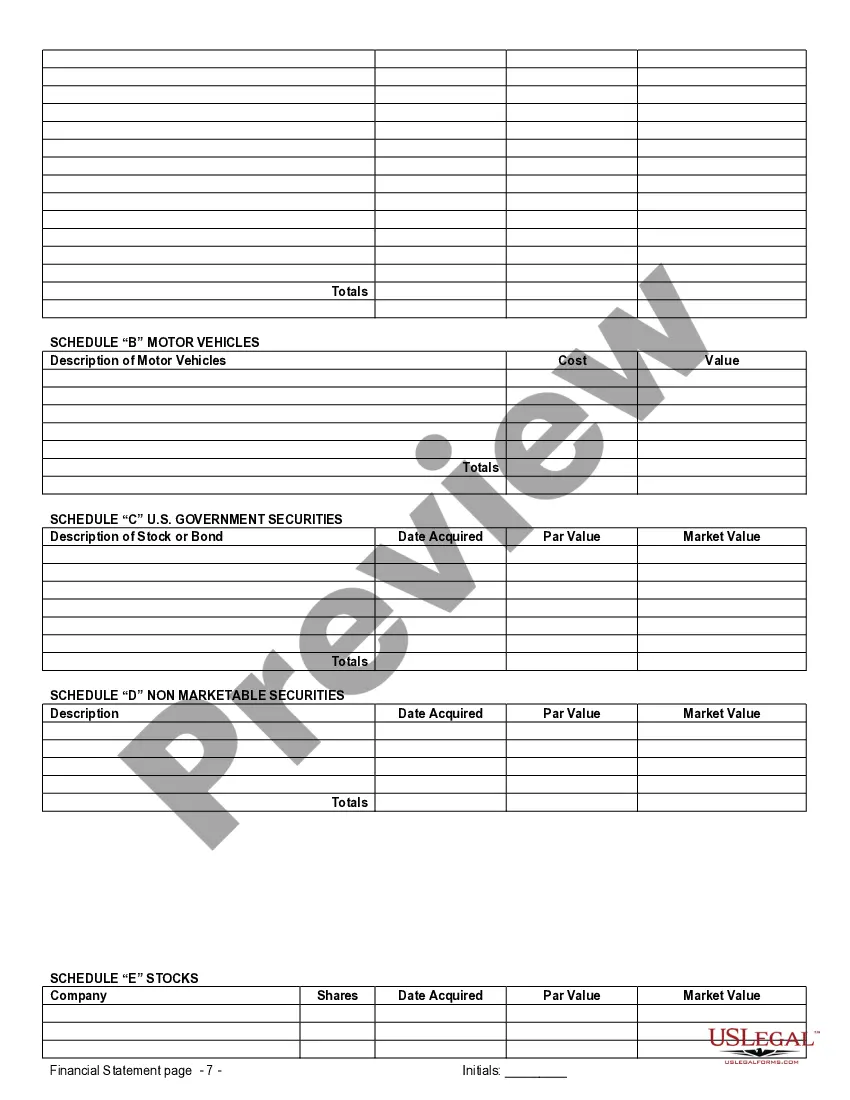

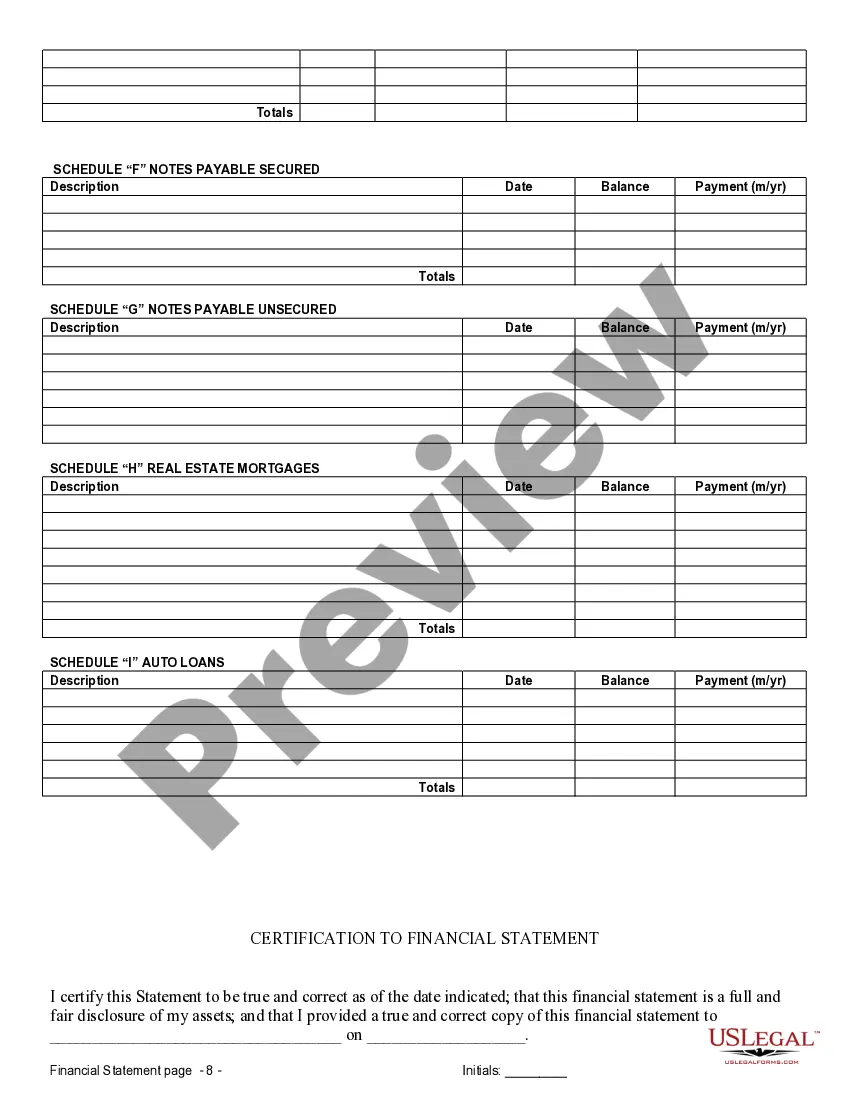

Minneapolis Minnesota Financial Statements in Connection with Prenuptial Premarital Agreement: A Detailed Description Financial statements play a crucial role in prenuptial or premarital agreements, providing an accurate representation of each party's financial situation before entering into the marriage. In Minneapolis, Minnesota, financial statements are required to be included in the prenuptial agreement to ensure transparency, fairness, and protection for both parties. The financial statements typically consist of various documents and information that reflect an individual's assets, liabilities, income, and expenses. These statements serve to give a comprehensive overview of one's financial standing, enabling both parties to make informed decisions about property division, spousal support, or the handling of finances in case of divorce or separation. There are several types of financial statements involved in Minneapolis, Minnesota prenuptial agreements: 1. Personal Balance Sheet: This document provides a snapshot of an individual's assets (such as property, investments, personal belongings) and liabilities (such as mortgages, loans, credit card debts) at a specific point in time. It helps determine the net worth of each person before entering into the marriage. 2. Income Statement: An income statement outlines an individual's income and expenses over a specific period, usually the previous year. It includes details like wages, salaries, bonuses, investments, rental income, and any other sources of income. This statement helps evaluate the earning capacity and financial stability of both parties. 3. Bank Statements: Bank statements from all financial institutions where accounts are held are crucial for review. These statements provide an accurate record of deposits, withdrawals, and current balances. Bank statements help establish the liquidity and financial health of each person and may also reveal any undisclosed accounts or debts. 4. Tax Returns: Previous years' tax returns are often required to be included in the financial statements as they provide a comprehensive overview of an individual's income, tax liabilities, deductions, and financial activities. Tax returns help to identify any potential irregularities or unreported financial resources. 5. Investment Account Statements: Statements from investment accounts, such as brokerage or retirement accounts, help assess the value and nature of investments. These statements offer valuable insights into the growth of assets and potential future income streams for both parties. 6. Real Estate Documents: Any documents related to the ownership or mortgage of real estate properties need to be disclosed in financial statements. This includes property deeds, mortgage agreements, property tax documents, and appraisals. These documents help evaluate the value, equity, and ownership structure of properties held by either party. When drafting a Minneapolis, Minnesota prenuptial agreement, it is crucial to include these financial statements to ensure full disclosure and transparency. Both parties should have access to complete and accurate financial information before making decisions regarding property division, financial support, or other matters related to their marriage. It is advisable to seek the assistance of a qualified attorney to ensure that the financial statements satisfy the legal requirements of Minneapolis, Minnesota and adequately protect both parties' interests. A knowledgeable attorney can help navigate the complexities of prenuptial agreements and ensure that the financial statements are prepared correctly and aligned with state laws.

Minneapolis Minnesota Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

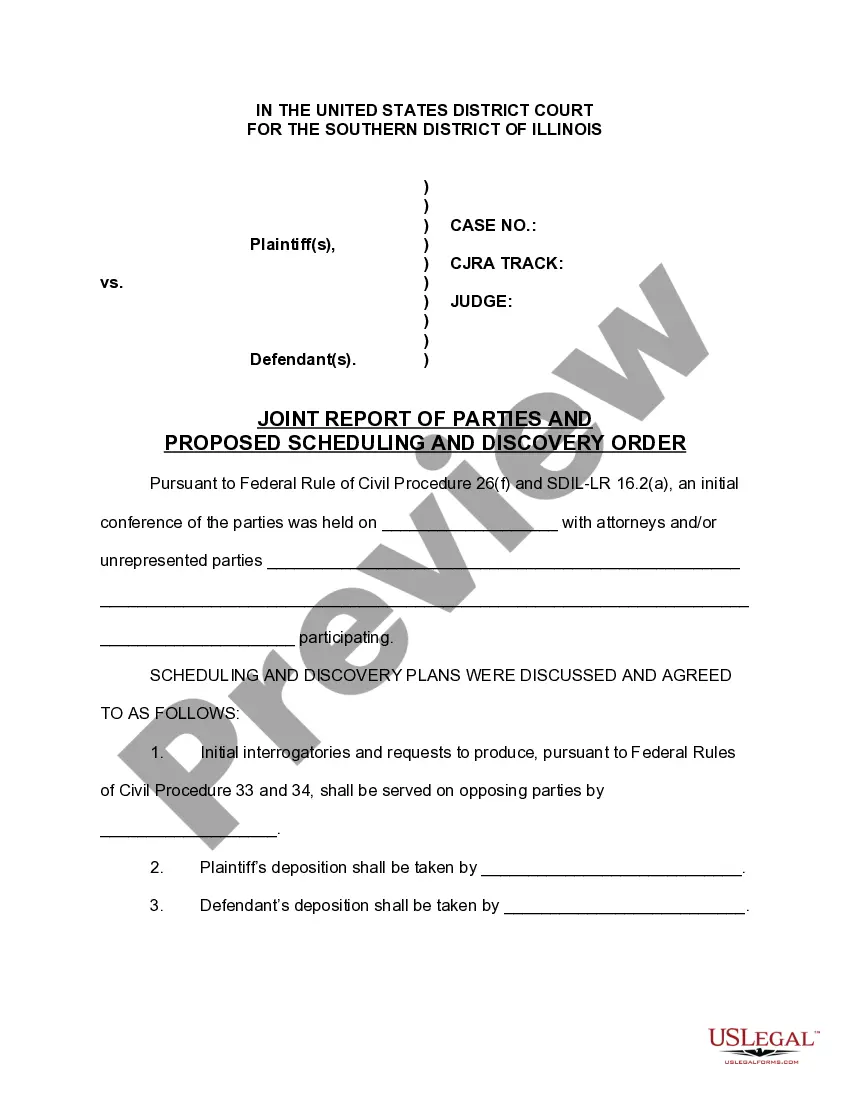

How to fill out Minneapolis Minnesota Financial Statements Only In Connection With Prenuptial Premarital Agreement?

Benefit from the US Legal Forms and have instant access to any form template you want. Our helpful platform with a large number of documents simplifies the way to find and obtain virtually any document sample you need. It is possible to save, complete, and sign the Minneapolis Minnesota Financial Statements only in Connection with Prenuptial Premarital Agreement in just a couple of minutes instead of browsing the web for hours attempting to find a proper template.

Using our catalog is a great way to raise the safety of your record filing. Our experienced legal professionals on a regular basis review all the records to make sure that the templates are relevant for a particular state and compliant with new acts and regulations.

How can you obtain the Minneapolis Minnesota Financial Statements only in Connection with Prenuptial Premarital Agreement? If you already have a subscription, just log in to the account. The Download option will appear on all the samples you view. Furthermore, you can get all the earlier saved records in the My Forms menu.

If you don’t have a profile yet, stick to the instruction below:

- Open the page with the template you require. Make certain that it is the template you were looking for: check its name and description, and make use of the Preview function if it is available. Otherwise, use the Search field to look for the needed one.

- Start the saving procedure. Click Buy Now and choose the pricing plan you prefer. Then, sign up for an account and pay for your order with a credit card or PayPal.

- Export the document. Indicate the format to obtain the Minneapolis Minnesota Financial Statements only in Connection with Prenuptial Premarital Agreement and change and complete, or sign it for your needs.

US Legal Forms is among the most considerable and reliable document libraries on the web. We are always ready to help you in any legal process, even if it is just downloading the Minneapolis Minnesota Financial Statements only in Connection with Prenuptial Premarital Agreement.

Feel free to make the most of our platform and make your document experience as efficient as possible!