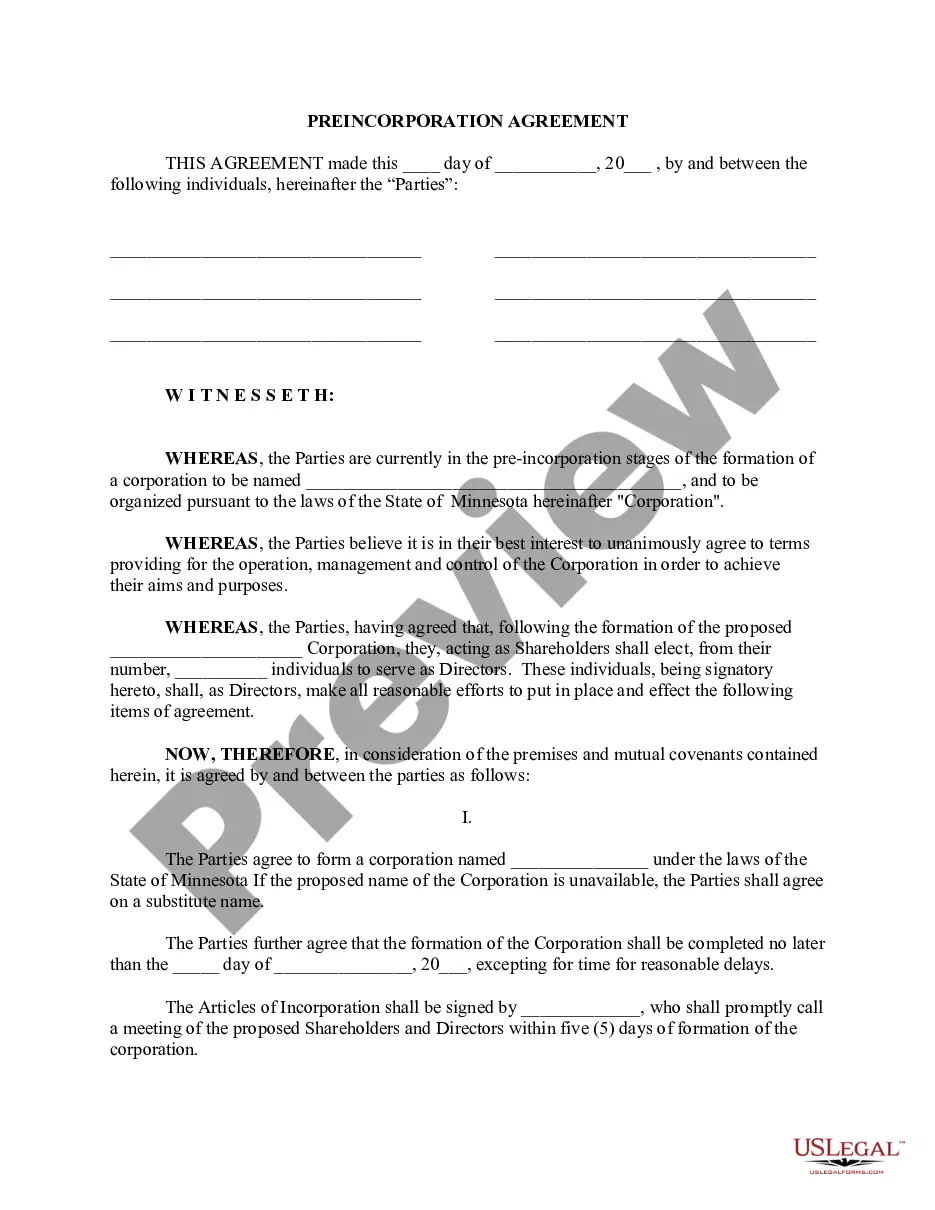

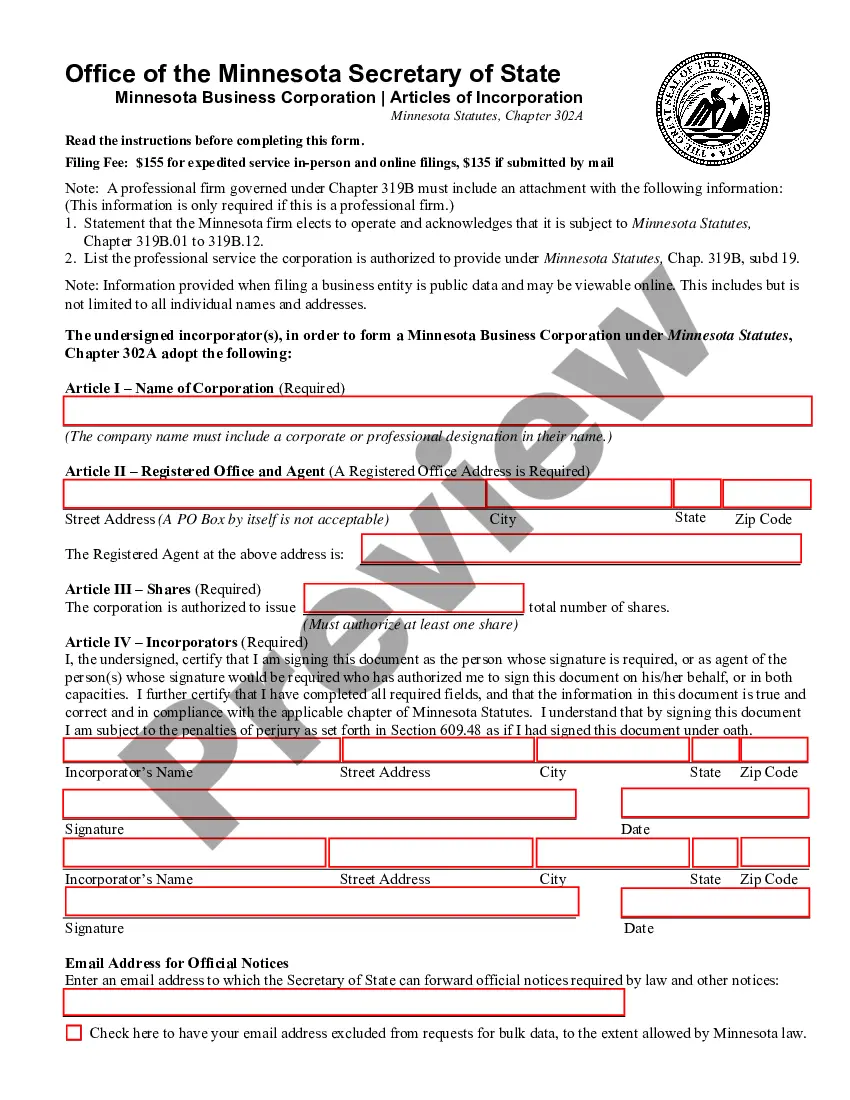

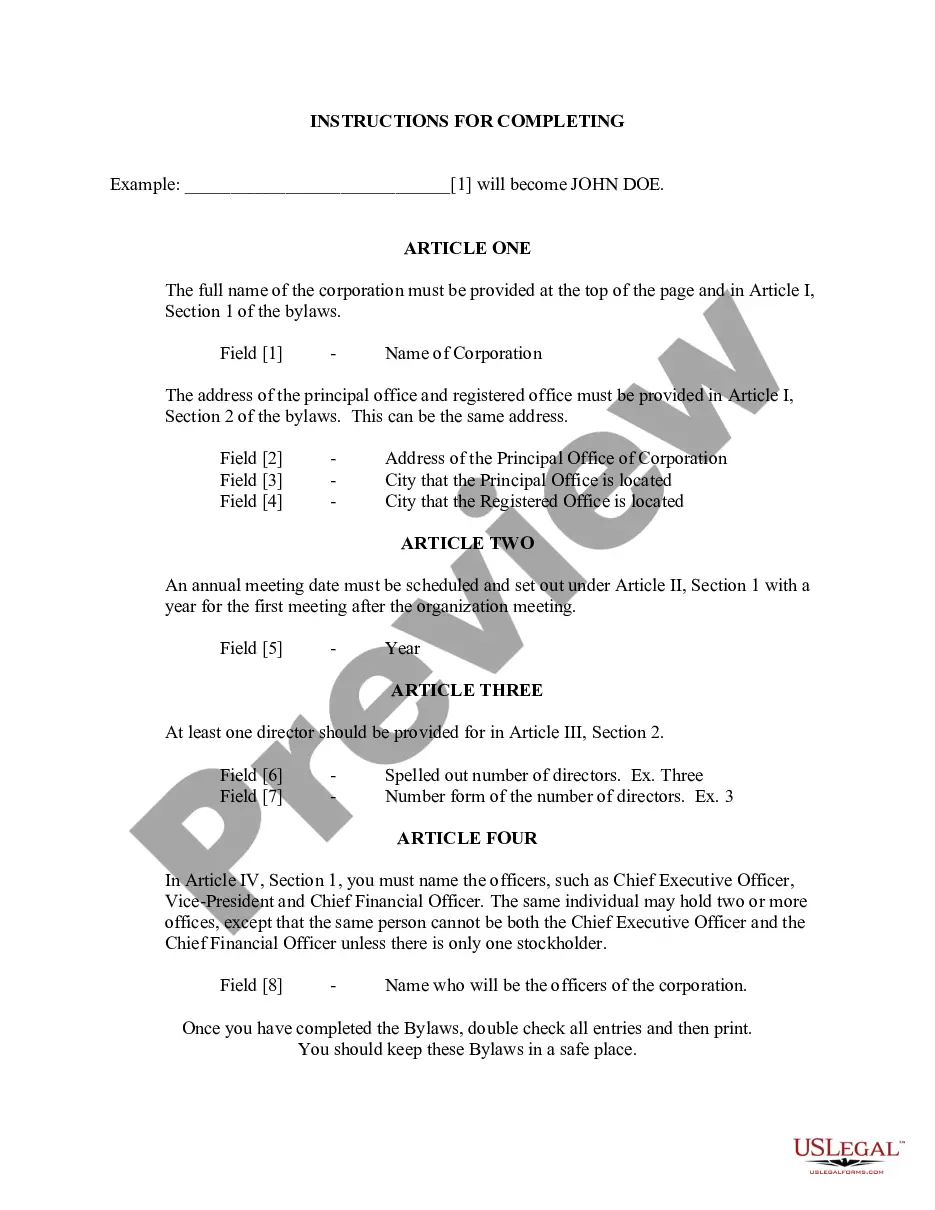

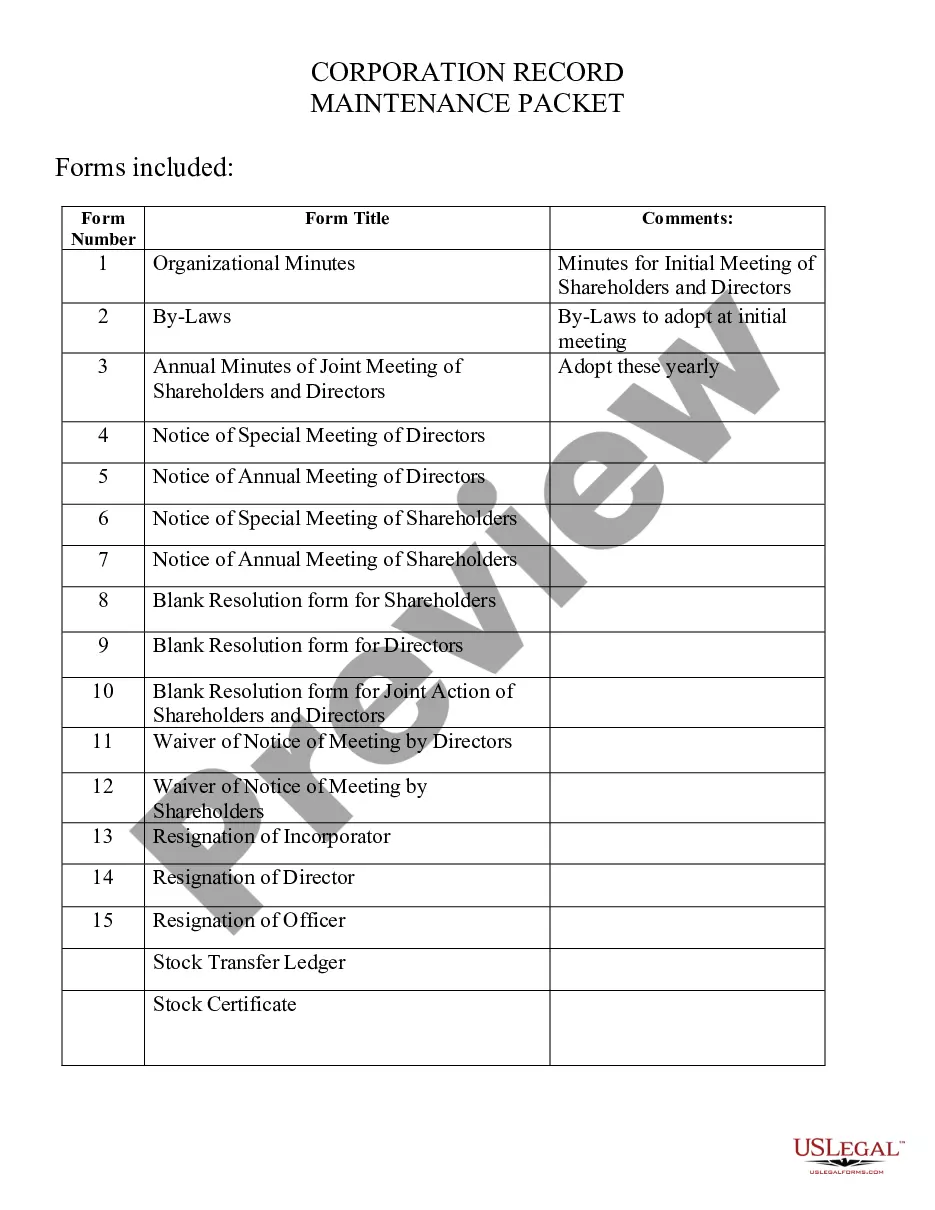

The Saint Paul Minnesota Business Incorporation Package is a comprehensive set of services designed to facilitate the process of incorporating a corporation in the region. This package includes all the essential elements required for successfully establishing a corporation in Saint Paul, Minnesota, ensuring a smooth and hassle-free incorporation process. The package includes expert guidance and assistance from professional incorporation consultants who are well-versed in the legal requirements and regulations specific to Saint Paul. These consultants will work closely with business owners, providing detailed information and guidance throughout the incorporation process. They will help entrepreneurs understand the necessary steps, forms, and documents needed to successfully form a corporation in Saint Paul. The Saint Paul Minnesota Business Incorporation Package covers a wide range of essential services. It includes the preparation and filing of important legal documents such as articles of incorporation, bylaws, and corporate resolutions. These documents are vital for establishing and governing the operations of the corporation. Additionally, the incorporation package ensures that all necessary paperwork is accurately completed and submitted to the appropriate government agencies. This includes obtaining an Employer Identification Number (EIN) from the Internal Revenue Service (IRS) and filing with the Minnesota Secretary of State's office. The package may also offer provisions for additional services such as obtaining necessary licenses and permits for business operations specific to Saint Paul, Minnesota. This may include licenses for regulated industries or specific permits required for operating in certain locations within the city. There may be different variations or levels of the Saint Paul Minnesota Business Incorporation Package to cater to the specific needs of different businesses. Some packages may offer additional features, such as expedited processing times, priority support, or personalized consultation sessions with incorporation experts. Overall, the Saint Paul Minnesota Business Incorporation Package is a comprehensive and all-inclusive solution for entrepreneurs and businesses seeking to incorporate a corporation in Saint Paul, Minnesota. It provides peace of mind and professional assistance throughout the entire incorporation process, ensuring compliance with all legal requirements and a seamless transition into the corporate world.

Saint Paul Minnesota Business Incorporation Package to Incorporate Corporation

Description

How to fill out Saint Paul Minnesota Business Incorporation Package To Incorporate Corporation?

We constantly endeavor to minimize or avert legal repercussions when addressing intricate legal or financial issues.

To achieve this, we seek legal assistance that is often highly expensive.

Nonetheless, not every legal issue is equally intricate; many can be managed independently.

US Legal Forms is a digital repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button next to it. If you misplace the document, you can always retrieve it again from the My documents section. The procedure is just as simple if you’re new to the platform! You can set up your account in a matter of minutes. Ensure that the Saint Paul Minnesota Business Incorporation Package to Incorporate Corporation complies with your state's and area's laws and regulations. It’s also vital to review the form’s description (if provided), and if you find any inconsistencies with your initial requirements, look for an alternative form. Once you confirm that the Saint Paul Minnesota Business Incorporation Package to Incorporate Corporation is suitable for you, you can choose a subscription option and move forward to payment. You will then be able to download the document in any available format. For over 24 years, we’ve assisted millions by providing customizable and current legal forms. Take full advantage of US Legal Forms now to conserve time and resources!

- Our library empowers you to handle your affairs without relying on a lawyer's services.

- We offer access to legal form templates that are not always available to the public.

- Our templates are tailored to specific states and regions, greatly easing the search process.

- Utilize US Legal Forms whenever you need to obtain and download the Saint Paul Minnesota Business Incorporation Package to Incorporate Corporation or any other document swiftly and securely.

Form popularity

FAQ

To dissolve your Minnesota corporation after it has issued shares, you must first file the Intent to Dissolve form with the Minnesota Secretary of State (SOS). Then the corporation will file the Articles of Dissolution Chapter 302A. 7291 or 302A.

If you filed federal Form 2553 with the Internal Revenue Service (IRS) to elect to become an S corporation, you do not need to file a similar form with Minnesota. Minnesota automatically accepts your S corporation status once approved by the IRS. Before doing so, complete federal Form 1120-S and supporting schedules.

Both types of entities have the significant legal advantage of helping to protect assets from creditors and providing an extra layer of protection against legal liability. In general, the creation and management of an LLC are much easier and more flexible than that of a corporation.

How much does it cost to incorporate in California? Incorporating in California will cost a minimum of $125. Broken down, the standard filing fee for incorporating in California is $100. For an extra $15, you can hand deliver your Articles of Incorporation to the California Secretary of State's office in Sacramento.

States with the Highest Business Registration Costs RankStateCorporation Filing Fees1Massachusetts$2752Washington DC$2203Nevada$7254Rhode Island$23047 more rows

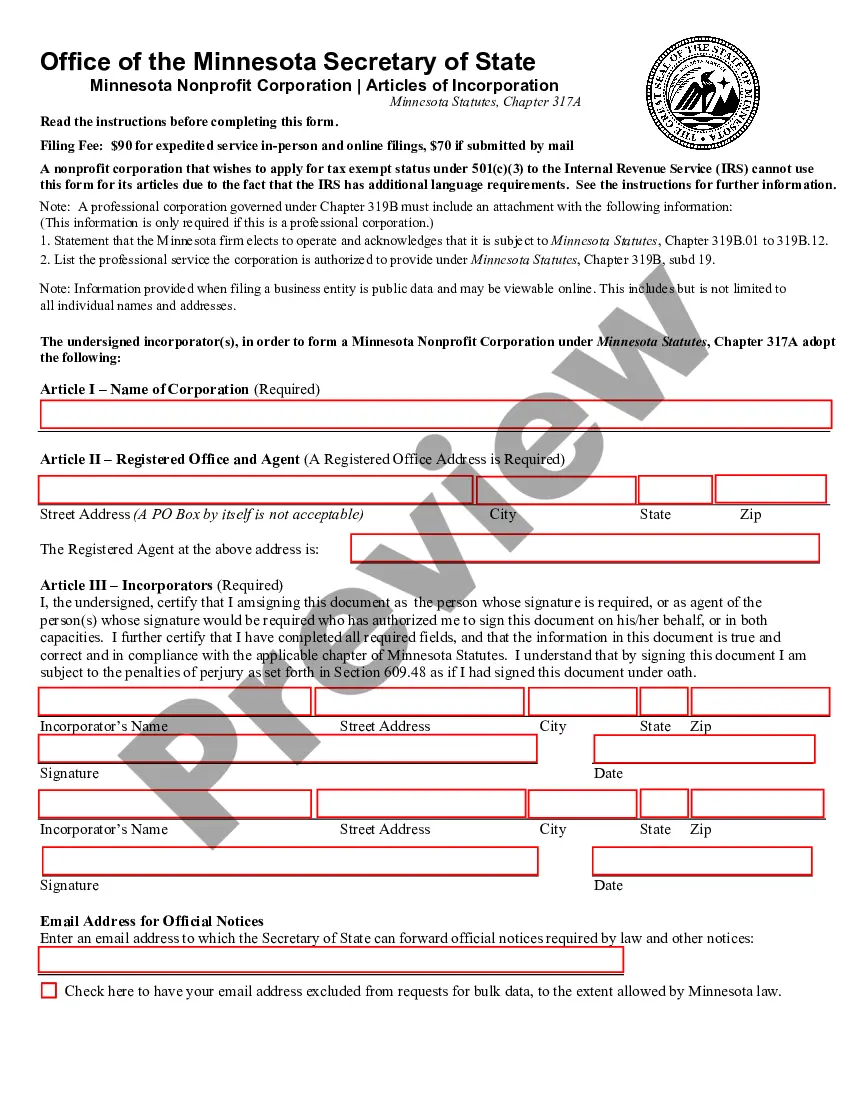

How to Form a Corporation in Minnesota Choose a Corporate Name.Prepare and File Articles of Incorporation.Appoint a Registered Agent.Set Up a Corporate Records Book.Prepare Corporate Bylaws.Appoint Initial Corporate Directors.Hold Your First Board of Directors Meeting.Issue Stock.

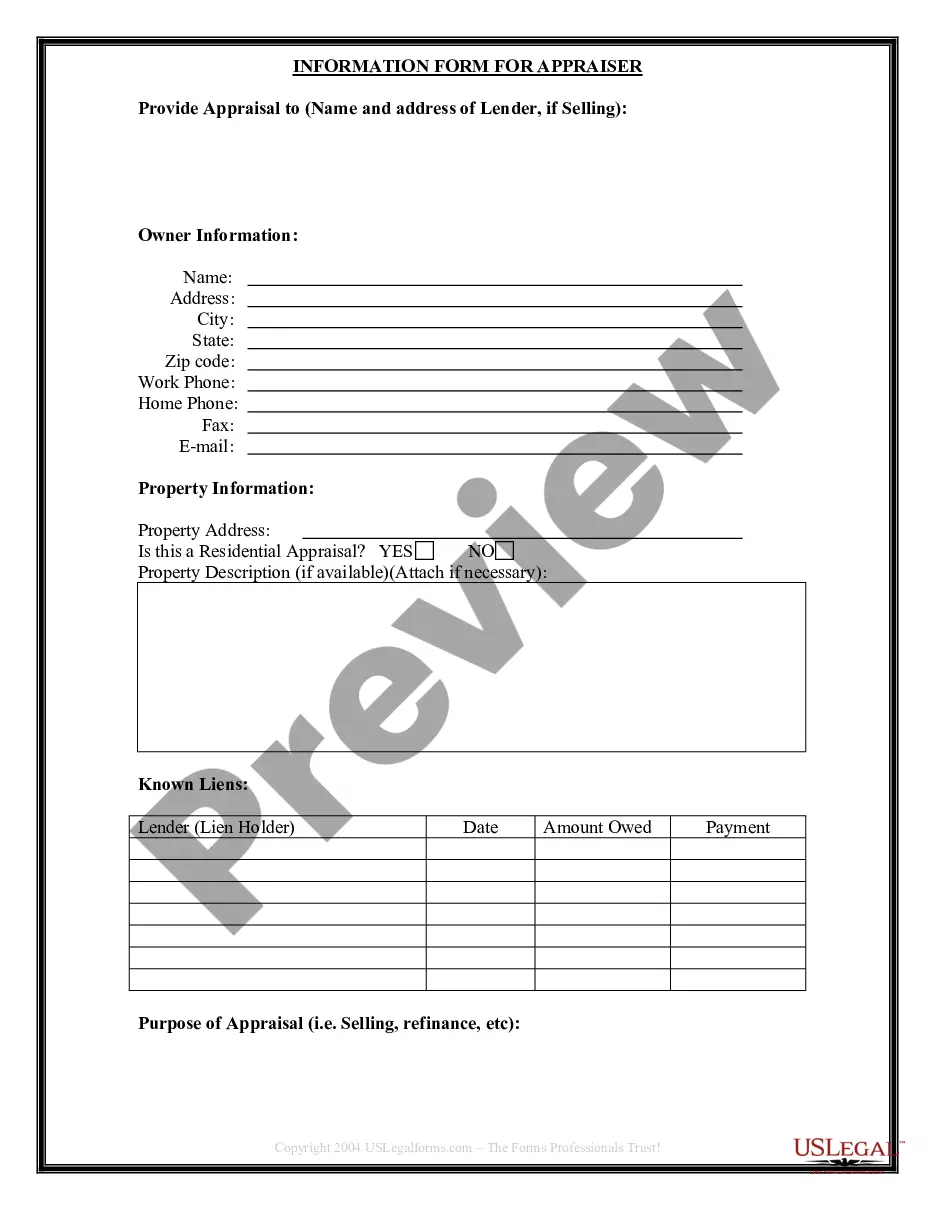

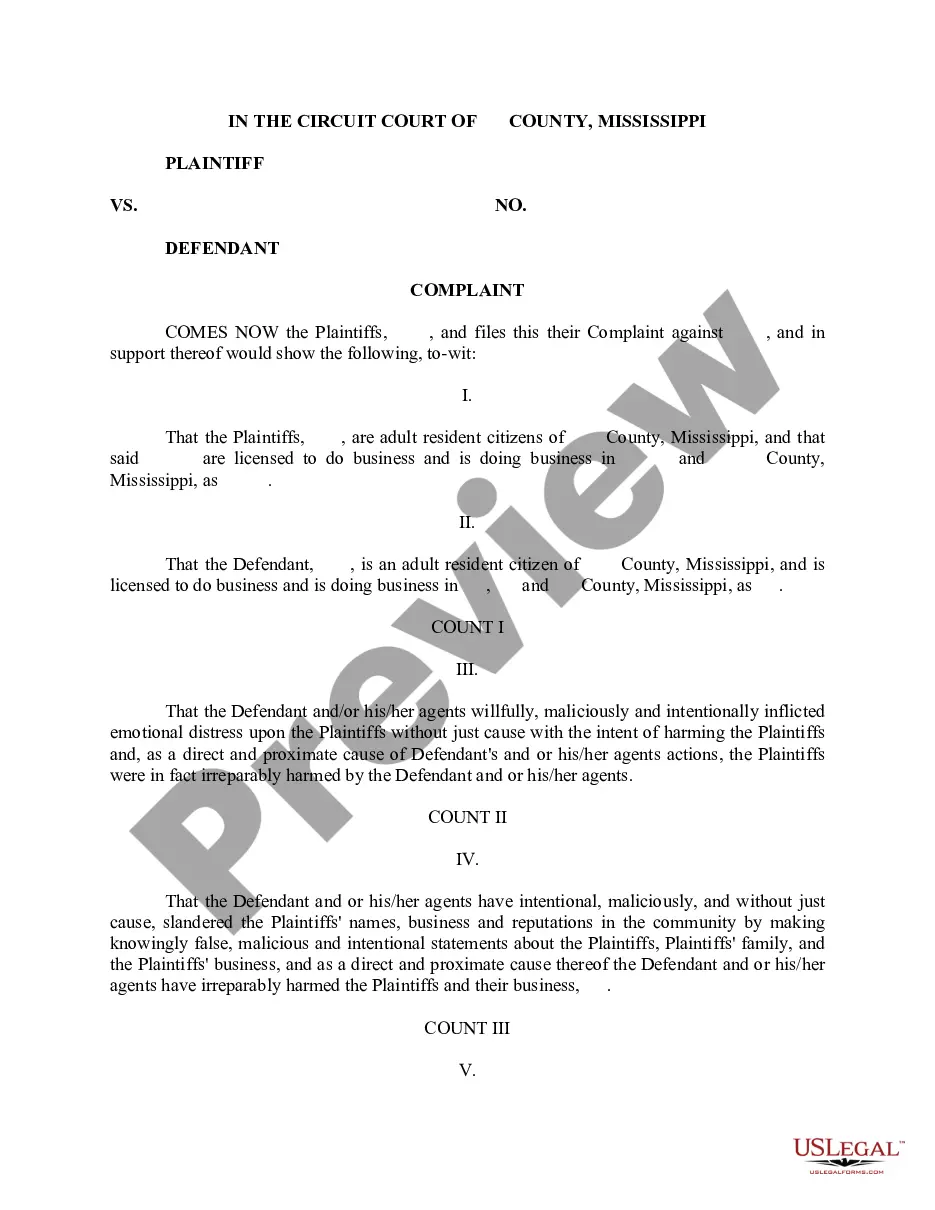

Legal Documents Needed To Incorporate Your Business Request for Reservation of Corporate Name. This form verifies and reserves the proposed corporate name.Articles of Incorporation.Corporate Bylaws.Minutes of First Meeting.Stock Certificate(s).

Business Filing & Certification Fee Schedule Assumed Name - Chapter 333Mail Filing FeeIn Person and Online Filing Fee (Not Available online)Articles of Incorporation ? Original Filing$70.00$90.00Amendment$35.00$55.00Annual Renewal$0$0Annual Reinstatement$0$0160 more rows

The main advantage of having an LLC taxed as a corporation is that the owner doesn't have to take all of the business income on their personal tax return. They also don't have to pay self-employment tax on their income as an owner of the corporation. The main disadvantage is double taxation.

The main advantage to an LLC is in the name: limited liability protection. Owners' personal assets can be protected from business debts and lawsuits against the business when an owner uses an LLC to do business. An LLC can have one owner (known as a ?member?) or many members.