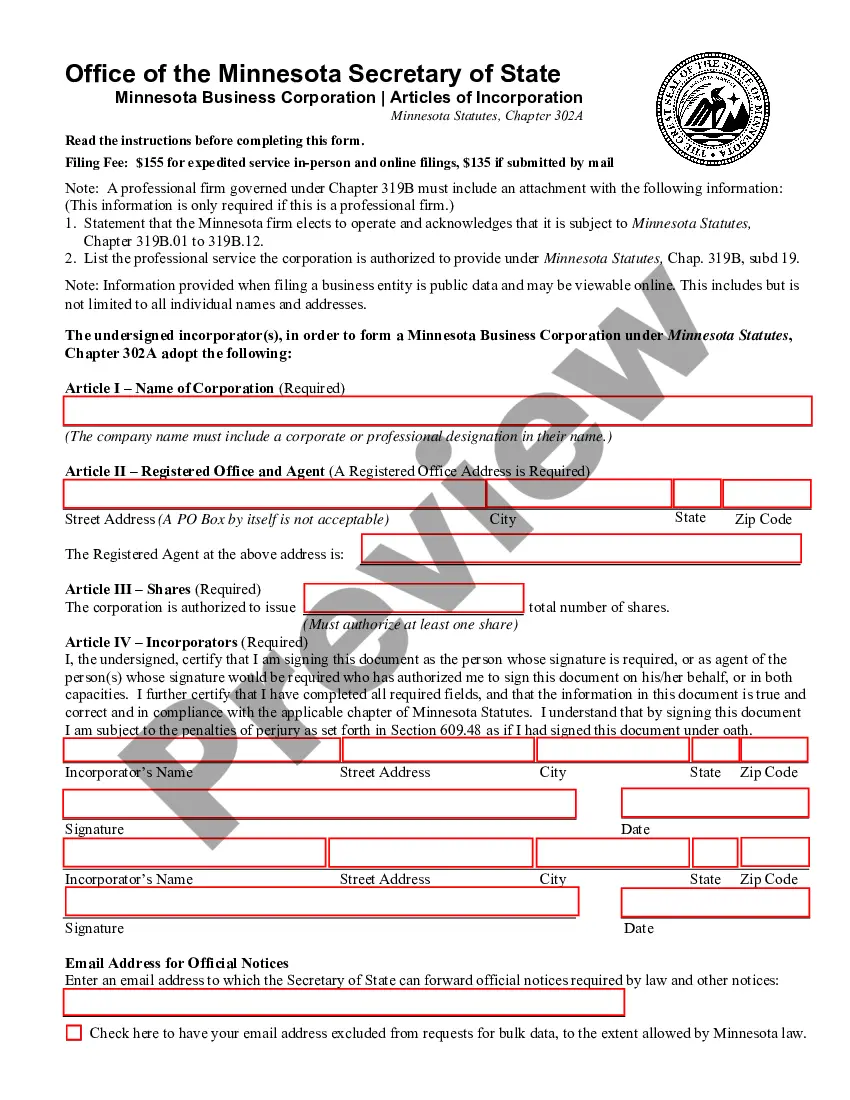

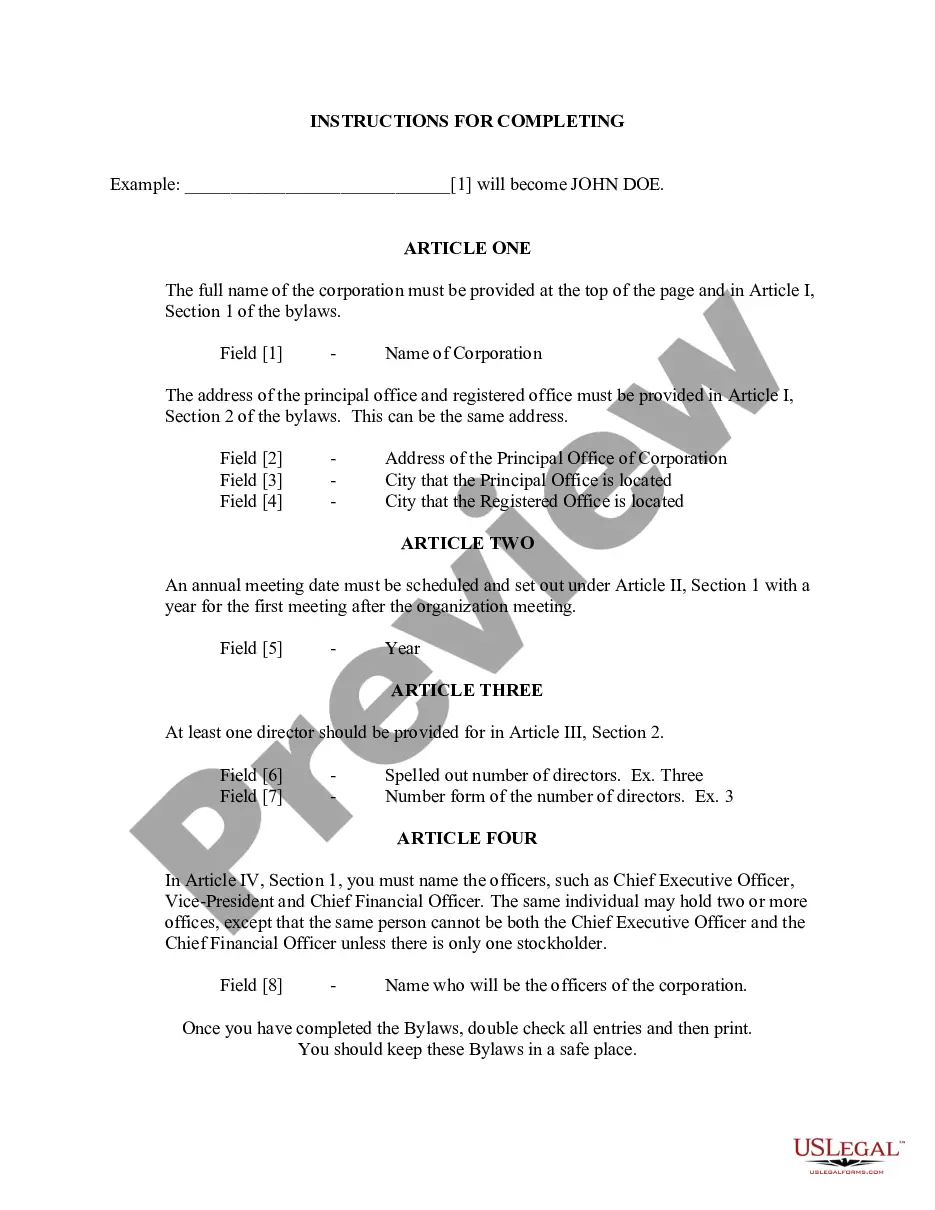

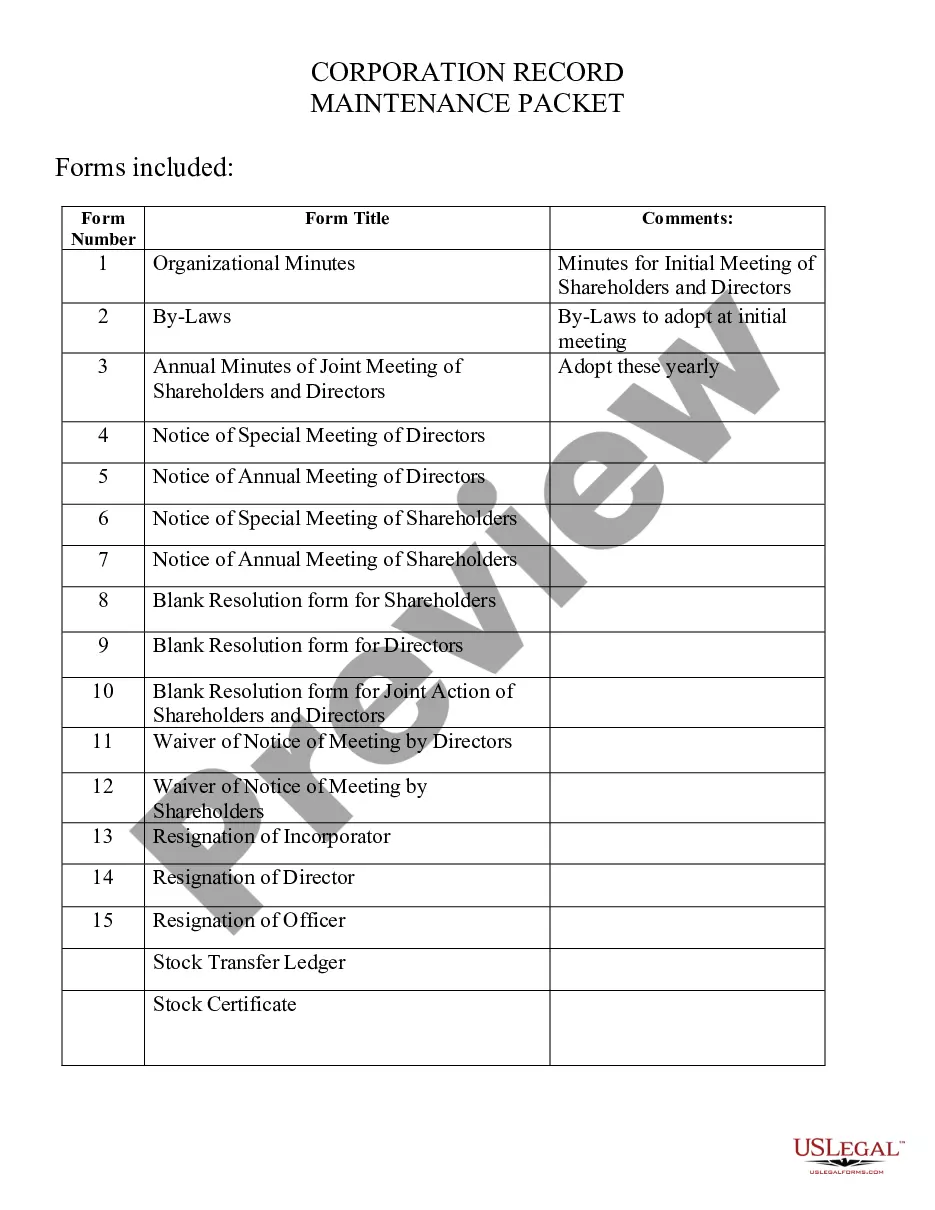

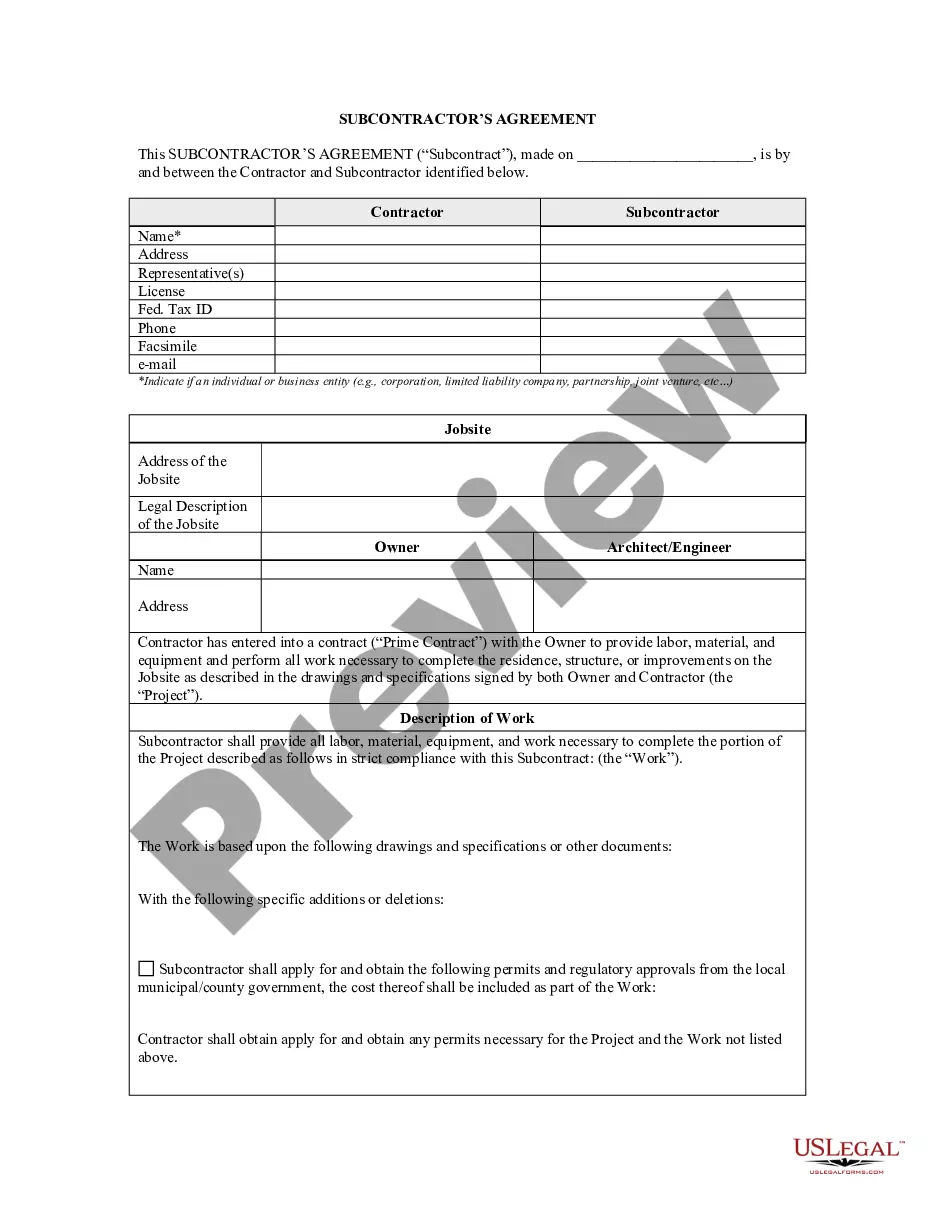

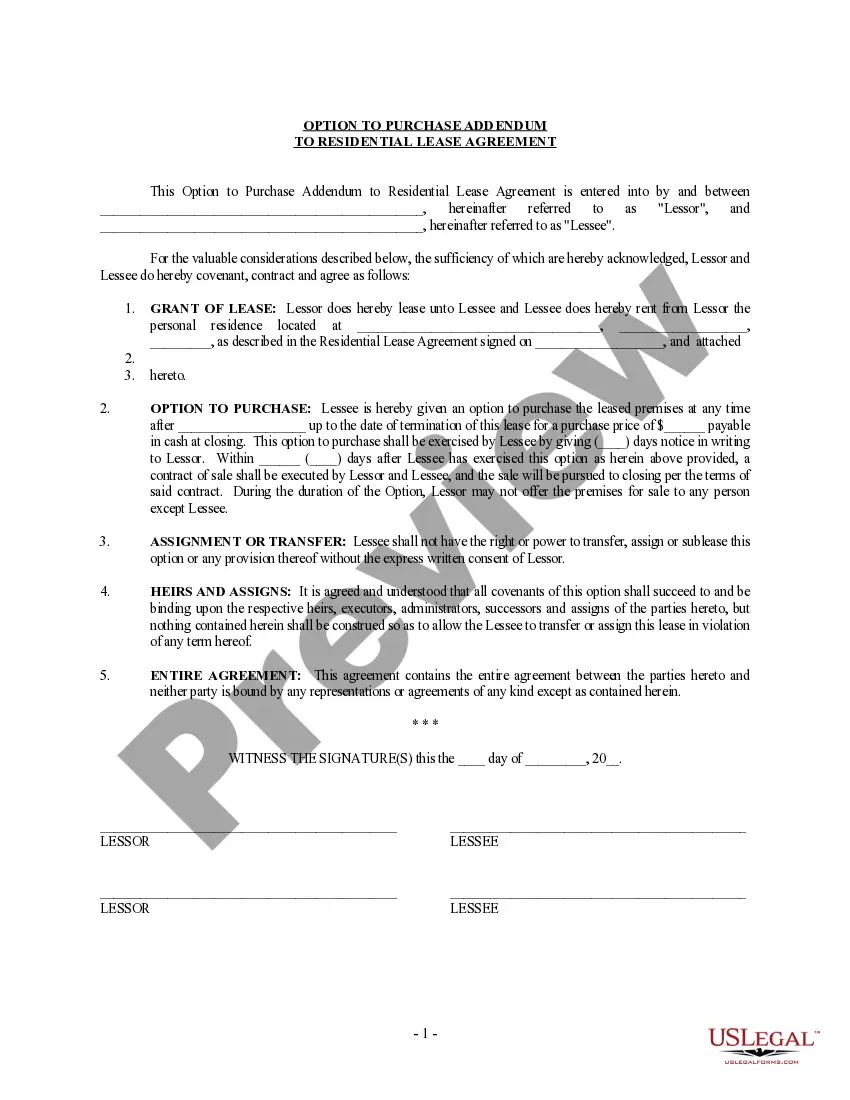

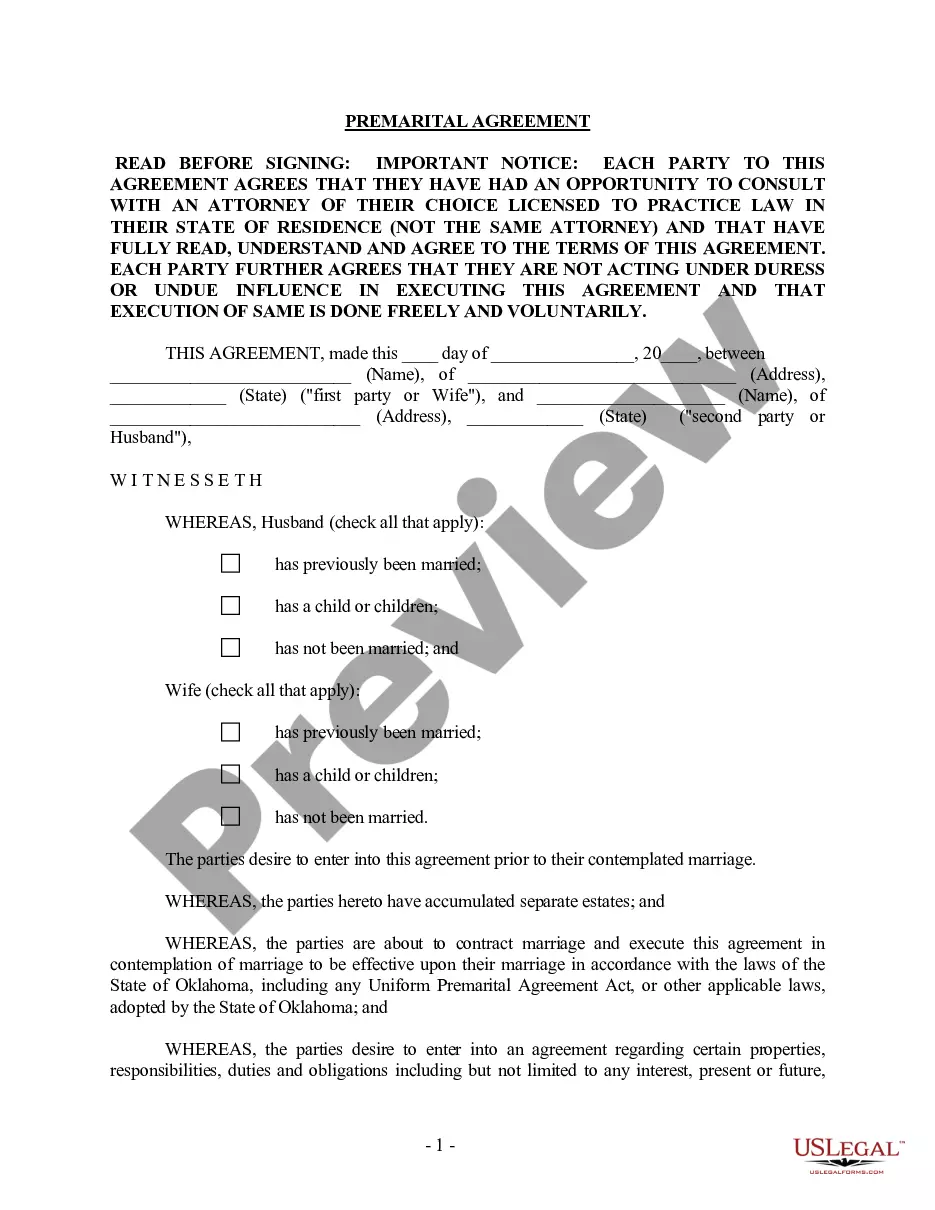

The Saint Paul Professional Corporation Package for Minnesota is a comprehensive, all-inclusive solution tailored specifically for professionals who are looking to establish or expand their practice in the state of Minnesota. This package encompasses a wide range of services and benefits, ensuring that professionals can set up their professional corporation efficiently and effectively. With a focus on compliance, legal structure, and overall business management, the package caters to the unique needs of professionals in various fields, such as doctors, lawyers, accountants, architects, engineers, and many others. Key components of the Saint Paul Professional Corporation Package for Minnesota include: 1. Incorporation Services: The package provides expert assistance in the process of incorporating the professional corporation in compliance with Minnesota state laws. This includes drafting and filing all necessary documents, such as Articles of Incorporation and Bylaws. 2. Legal Compliance: Ensuring compliance with state and federal regulations is crucial for professional corporations. The package offers ongoing support in maintaining proper legal structure, corporate governance, and compliance with professional licensing requirements. 3. Tax Planning and Preparation: Professionals often face complex tax regulations, and this package includes comprehensive tax planning and preparation services. Experts guide professionals through tax-saving strategies, deductions, and ensure they comply with all tax obligations. 4. Bookkeeping and Accounting: Proper financial management is essential for any professional corporation, and the package assists with bookkeeping, financial statement preparation, budgeting, and general accounting services to maintain accurate records and facilitate decision-making. 5. Annual Filings and Reporting: Professionals can rely on the package to handle all annual filings necessary to maintain their corporate status. This includes filing Annual Reports and coordinating necessary meetings and resolutions for compliance. Additionally, the Saint Paul Professional Corporation Package for Minnesota caters to different types of professionals by tailoring its services to the specific needs of each practice. Some variations may include packages designed for healthcare professionals, legal professionals, financial professionals, or other specialized fields within the professional realm. By leveraging the Saint Paul Professional Corporation Package for Minnesota, professionals can focus on their core expertise while ensuring their business operates within the legal framework. Whether professionals are just starting their practice or seeking to enhance their existing corporation, this package provides the necessary tools and support to establish a strong professional foundation in the state of Minnesota.

Saint Paul Professional Corporation Package for Minnesota

Description

How to fill out Saint Paul Professional Corporation Package For Minnesota?

If you are searching for a relevant form template, it’s impossible to choose a better platform than the US Legal Forms site – probably the most considerable libraries on the internet. Here you can get thousands of templates for company and personal purposes by types and regions, or key phrases. With our advanced search option, discovering the newest Saint Paul Professional Corporation Package for Minnesota is as elementary as 1-2-3. Additionally, the relevance of each and every document is verified by a team of expert attorneys that on a regular basis review the templates on our platform and revise them in accordance with the newest state and county regulations.

If you already know about our system and have a registered account, all you need to get the Saint Paul Professional Corporation Package for Minnesota is to log in to your account and click the Download option.

If you make use of US Legal Forms the very first time, just refer to the instructions listed below:

- Make sure you have chosen the form you need. Check its information and use the Preview feature to see its content. If it doesn’t meet your requirements, use the Search option near the top of the screen to discover the appropriate document.

- Confirm your selection. Choose the Buy now option. Following that, choose your preferred subscription plan and provide credentials to register an account.

- Process the purchase. Utilize your credit card or PayPal account to finish the registration procedure.

- Receive the template. Pick the file format and save it to your system.

- Make changes. Fill out, edit, print, and sign the acquired Saint Paul Professional Corporation Package for Minnesota.

Every single template you save in your account has no expiry date and is yours permanently. It is possible to access them via the My Forms menu, so if you want to receive an additional version for modifying or creating a hard copy, feel free to return and export it once again whenever you want.

Take advantage of the US Legal Forms extensive library to get access to the Saint Paul Professional Corporation Package for Minnesota you were seeking and thousands of other professional and state-specific templates in one place!