The Shareholders Agreement is signed by the shareholders to agree on how the shares of a deceased shareholder may be purchased and how shares of a person who desires to sell their stock may be obtained by the other shareholders or the corporation. Restrictions on the Sale of stock are included to accomplish the goals of the shareholders to keep the corporation under the control of the existing shareholders.

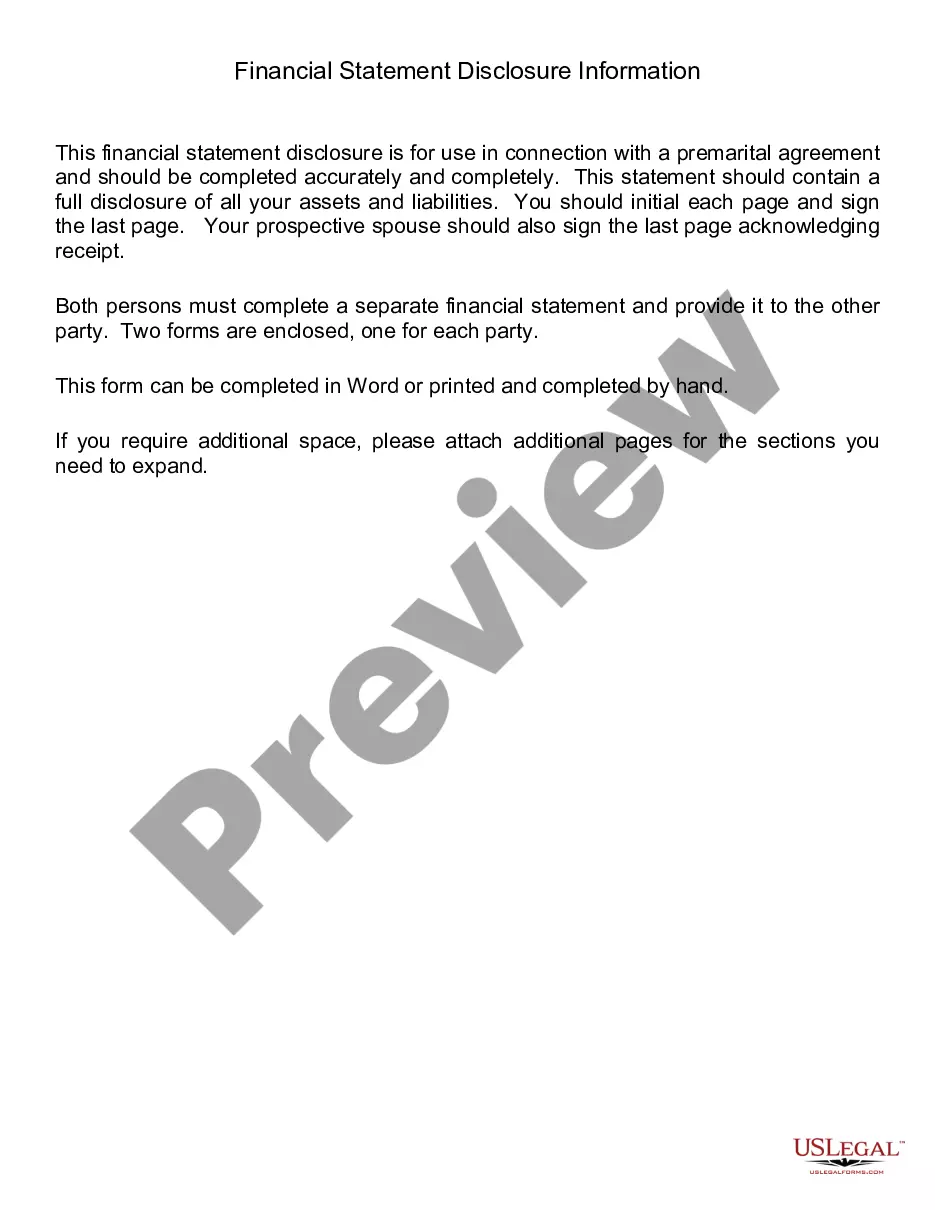

The Confidentiality Agreement is made between the shareholders wherein they agree to keep confidential certain corporate matters. The Saint Paul Minnesota Pre-Incorporation Agreement, Shareholders Agreement, and Confidentiality Agreement are essential legal documents that play a crucial role in business operations and relationships within the state. Let's delve into the details of each agreement and explore whether there are different types available. 1. Saint Paul Minnesota Pre-Incorporation Agreement: The Pre-Incorporation Agreement, also known as a Business Formation Agreement, is a legally binding contract that sets out the terms and conditions governing the establishment of a new business entity based in Saint Paul, Minnesota. This agreement is typically entered into by the founders or initial stakeholders before the official incorporation of the company. It helps structure the relationship between the individuals involved and outlines various corporate matters. Key provisions of a Pre-Incorporation Agreement may include the designation of initial shareholders, capital contributions, the division of ownership percentages, and the initial business plan. 2. Shareholders Agreement: The Shareholders Agreement is a crucial document that governs the relationship between the shareholders of a company based in Saint Paul, Minnesota. This agreement is designed to protect the rights, responsibilities, and interests of the shareholders, providing a framework for decision-making and dispute resolution. The agreement typically covers topics such as the transfer of shares, voting rights, decision-making processes, dividend distribution policies, restrictions on competition, and mechanisms for dispute resolution. Different types of Shareholders Agreements can include: a. Majority Voting Rights Agreement: This type of agreement allows a majority shareholder or group of shareholders to have greater decision-making power within the company. They may require the consent of a certain majority of shareholders to take significant actions like mergers, acquisitions, or changes in the company's bylaws. b. Drag-Along Agreement: This agreement grants certain shareholders the right to compel minority shareholders to sell their shares in the event of a sale or merger of the company. It ensures that the majority shareholders have the ability to facilitate a transaction even if a minority shareholder disagrees. c. Tag-Along Agreement: This agreement offers minority shareholders the right to join in a sale or transfer of shares by majority shareholders. It ensures that minority shareholders have the opportunity to participate in the financial benefits of the transaction. 3. Confidentiality Agreement: A Confidentiality Agreement, also known as a Non-Disclosure Agreement (NDA), is a critical legal contract that governs the sharing and protection of confidential information during business transactions or partnerships in Saint Paul, Minnesota. This agreement safeguards sensitive or proprietary information from unauthorized disclosure, ensuring that the parties involved maintain confidentiality. The agreement outlines the scope of information, the obligations to protect it, the permitted uses, and the consequences of breaching the agreement. Different types of Confidentiality Agreements can include: a. Unilateral NDA: This agreement is commonly used when one party (the disclosing party) wishes to share confidential information with another party (the receiving party). b. Mutual NDA: This agreement is utilized when both parties anticipate the exchange of confidential information. It provides equal protection to both the disclosing and receiving parties. c. Multilateral NDA: In situations involving multiple parties, a Multilateral NDA is employed. It establishes a framework for sharing confidential information among all parties involved while maintaining strict confidentiality. These agreements are crucial components of business operations and relationships in Saint Paul, Minnesota, protecting the interests of parties involved and setting a transparent and secure framework for conducting business activities.

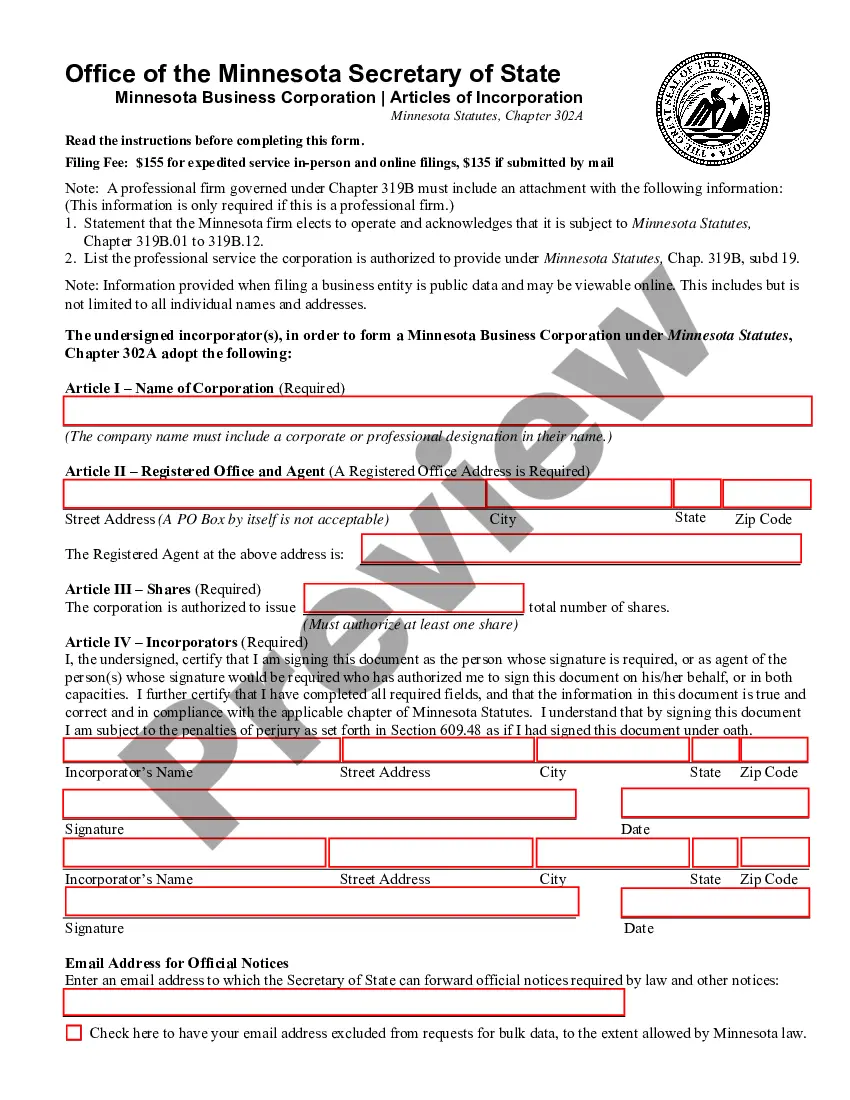

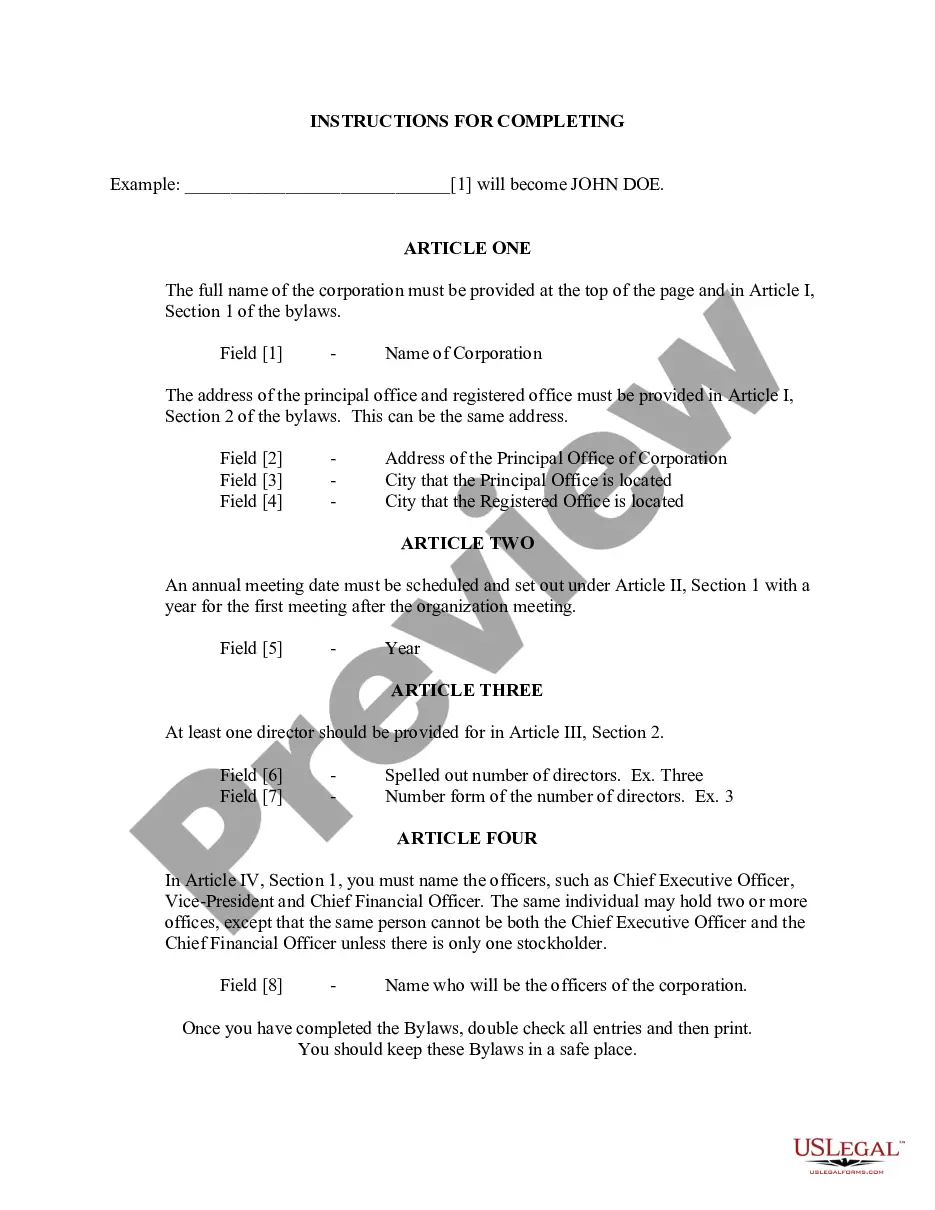

The Saint Paul Minnesota Pre-Incorporation Agreement, Shareholders Agreement, and Confidentiality Agreement are essential legal documents that play a crucial role in business operations and relationships within the state. Let's delve into the details of each agreement and explore whether there are different types available. 1. Saint Paul Minnesota Pre-Incorporation Agreement: The Pre-Incorporation Agreement, also known as a Business Formation Agreement, is a legally binding contract that sets out the terms and conditions governing the establishment of a new business entity based in Saint Paul, Minnesota. This agreement is typically entered into by the founders or initial stakeholders before the official incorporation of the company. It helps structure the relationship between the individuals involved and outlines various corporate matters. Key provisions of a Pre-Incorporation Agreement may include the designation of initial shareholders, capital contributions, the division of ownership percentages, and the initial business plan. 2. Shareholders Agreement: The Shareholders Agreement is a crucial document that governs the relationship between the shareholders of a company based in Saint Paul, Minnesota. This agreement is designed to protect the rights, responsibilities, and interests of the shareholders, providing a framework for decision-making and dispute resolution. The agreement typically covers topics such as the transfer of shares, voting rights, decision-making processes, dividend distribution policies, restrictions on competition, and mechanisms for dispute resolution. Different types of Shareholders Agreements can include: a. Majority Voting Rights Agreement: This type of agreement allows a majority shareholder or group of shareholders to have greater decision-making power within the company. They may require the consent of a certain majority of shareholders to take significant actions like mergers, acquisitions, or changes in the company's bylaws. b. Drag-Along Agreement: This agreement grants certain shareholders the right to compel minority shareholders to sell their shares in the event of a sale or merger of the company. It ensures that the majority shareholders have the ability to facilitate a transaction even if a minority shareholder disagrees. c. Tag-Along Agreement: This agreement offers minority shareholders the right to join in a sale or transfer of shares by majority shareholders. It ensures that minority shareholders have the opportunity to participate in the financial benefits of the transaction. 3. Confidentiality Agreement: A Confidentiality Agreement, also known as a Non-Disclosure Agreement (NDA), is a critical legal contract that governs the sharing and protection of confidential information during business transactions or partnerships in Saint Paul, Minnesota. This agreement safeguards sensitive or proprietary information from unauthorized disclosure, ensuring that the parties involved maintain confidentiality. The agreement outlines the scope of information, the obligations to protect it, the permitted uses, and the consequences of breaching the agreement. Different types of Confidentiality Agreements can include: a. Unilateral NDA: This agreement is commonly used when one party (the disclosing party) wishes to share confidential information with another party (the receiving party). b. Mutual NDA: This agreement is utilized when both parties anticipate the exchange of confidential information. It provides equal protection to both the disclosing and receiving parties. c. Multilateral NDA: In situations involving multiple parties, a Multilateral NDA is employed. It establishes a framework for sharing confidential information among all parties involved while maintaining strict confidentiality. These agreements are crucial components of business operations and relationships in Saint Paul, Minnesota, protecting the interests of parties involved and setting a transparent and secure framework for conducting business activities.