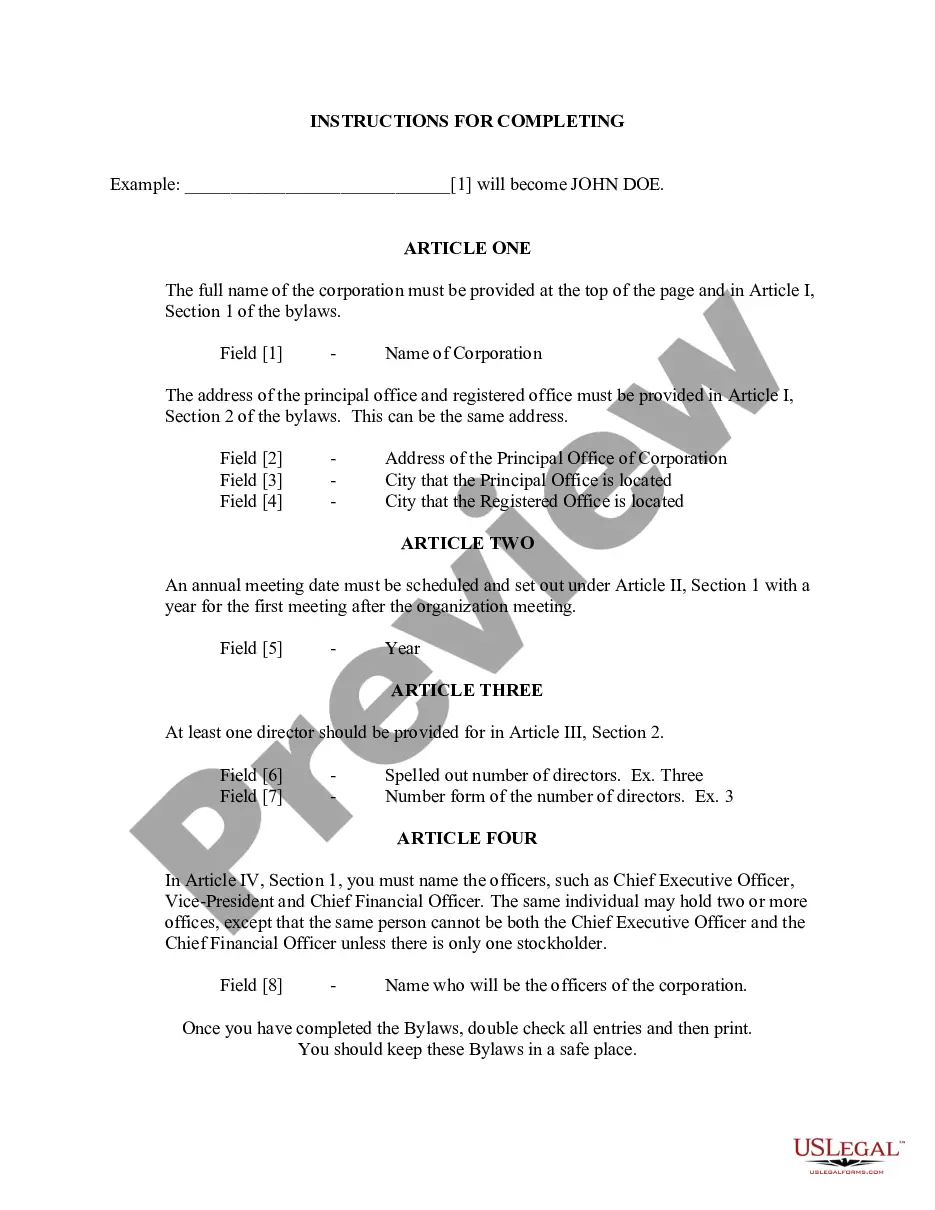

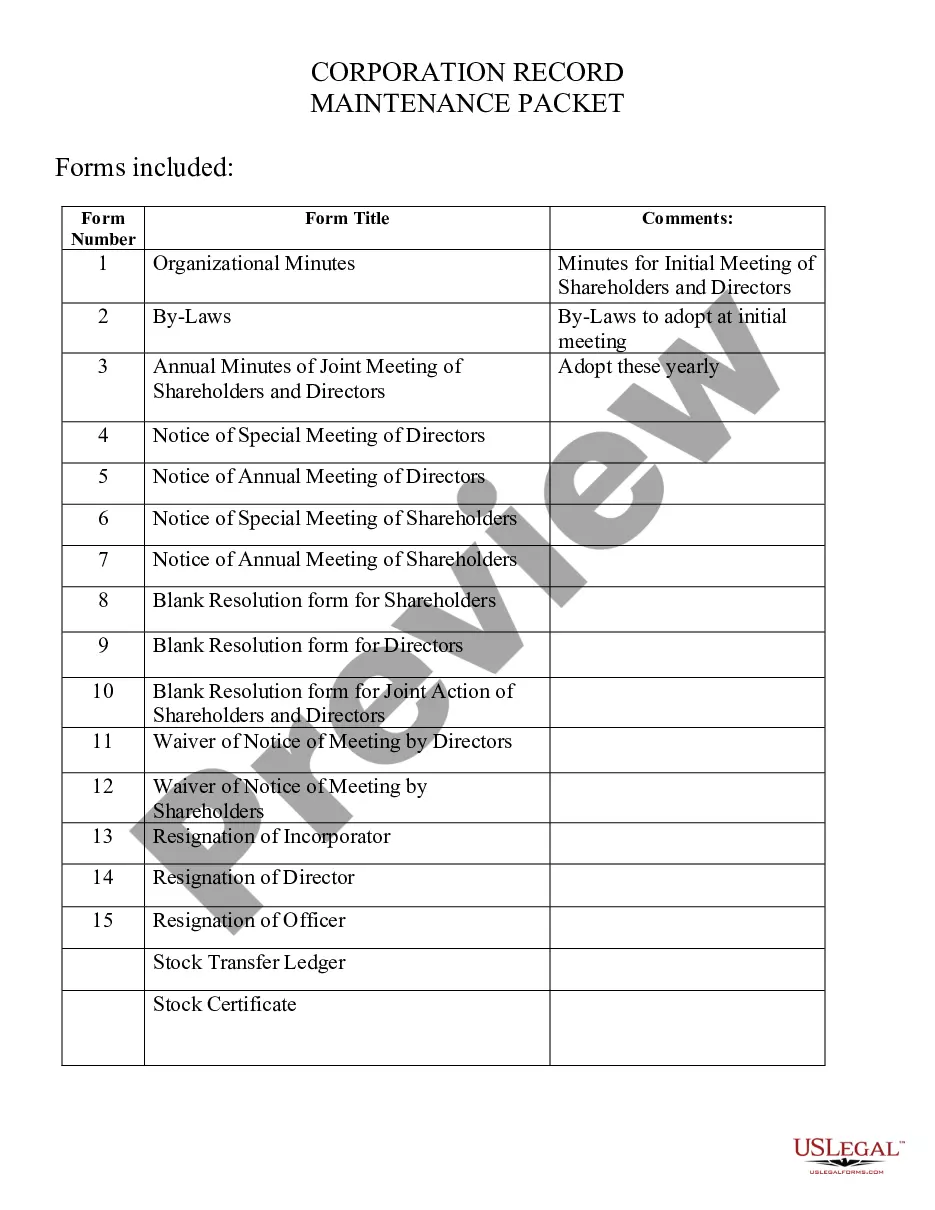

Title: Exploring Saint Paul Minnesota Articles of Incorporation for Domestic For-Profit Corporation Description: In this article, we will provide an in-depth overview of the Saint Paul Minnesota Articles of Incorporation for Domestic For-Profit Corporation. These legal documents are necessary for establishing a for-profit corporation in the city of Saint Paul, Minnesota. Keywords: Saint Paul Minnesota, Articles of Incorporation, Domestic For-Profit Corporation, legal documents, establishment, requirements, types 1. Understanding Saint Paul Minnesota Articles of Incorporation: The Saint Paul Minnesota Articles of Incorporation is a set of legal documents that are filed with the Secretary of State to establish a for-profit corporation. These articles serve as the foundational framework for the corporation and outline important information about its structure, purpose, and governance. 2. Key Requirements for the Articles of Incorporation: To ensure compliance with state laws, the Articles of Incorporation must include specific information. This typically includes the corporation's name, registered agent, registered office address, purpose, duration, business activities, shares authorized, and details about the initial directors and incorporates. 3. Naming Variations: While there are no specific types of Articles of Incorporation for Domestic For-Profit Corporations in Saint Paul, Minnesota, variations can arise based on specific business needs. Incorporates may need to consider additional provisions related to stock classes, shareholder rights, and managerial structure. 4. Role of Incorporates and Directors: The Articles of Incorporation also designate the initial directors and incorporates. Incorporates are responsible for filing the articles, while directors are individuals who oversee the management and decision-making within the corporation. 5. Filing Process and Fees: To establish a for-profit corporation, the Articles of Incorporation must be filed with the Minnesota Secretary of State. There may be submission fees involved, which vary based on the corporation's authorized shares or the use of expedited processing options. 6. Importance of Articles of Incorporation: The Articles of Incorporation act as a legally binding document that protects the corporation's rights and ensures compliance with state laws. This document provides clarity on the corporation's purpose, scope, and responsibilities, serving as a foundation for future operations. 7. Amending the Articles of Incorporation: In the future, a corporation may need to amend its Articles of Incorporation. This can be done to update its purpose, change the corporate name, modify the number of authorized shares, or make other necessary adjustments. Amendments typically require filing additional paperwork. 8. Seeking Legal Consultation: Given the significance of Articles of Incorporation in establishing a for-profit corporation, it is recommended to seek legal consultation. A professional attorney experienced in corporate law can provide guidance, review documents, and ensure compliance with all legal requirements. Conclusion: The Saint Paul Minnesota Articles of Incorporation for Domestic For-Profit Corporation play a pivotal role in establishing and governing the corporation's operations in the city. Understanding the requirements, filing process, and importance of these legal documents is crucial for entrepreneurs and business owners venturing into the corporate world of Saint Paul, Minnesota.

Saint Paul Minnesota Articles of Incorporation for Domestic For-Profit Corporation

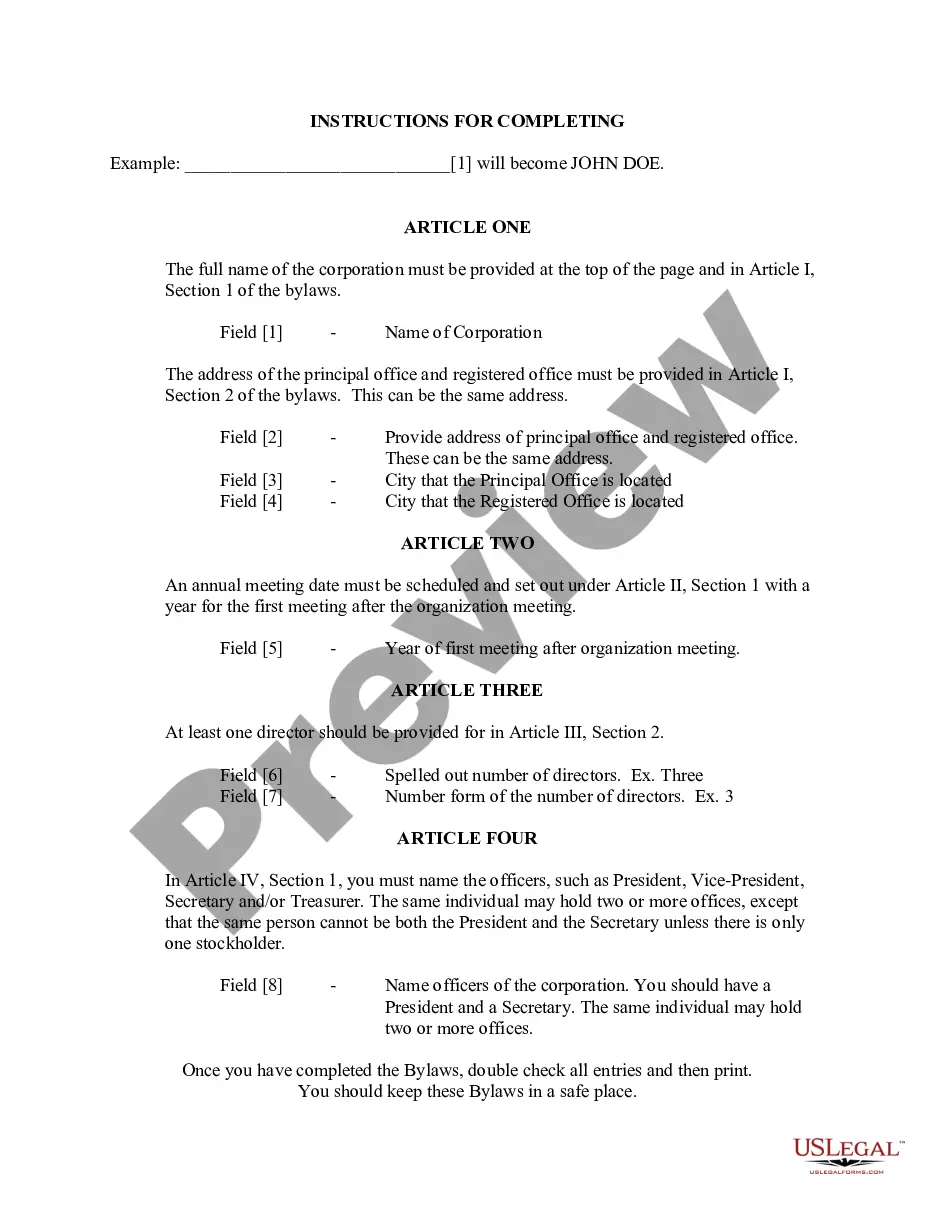

Description

How to fill out Saint Paul Minnesota Articles Of Incorporation For Domestic For-Profit Corporation?

Are you looking for a trustworthy and affordable legal forms provider to get the Saint Paul Minnesota Articles of Incorporation for Domestic For-Profit Corporation? US Legal Forms is your go-to choice.

No matter if you need a basic agreement to set regulations for cohabitating with your partner or a set of documents to move your separation or divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and framed based on the requirements of particular state and area.

To download the document, you need to log in account, find the needed form, and click the Download button next to it. Please keep in mind that you can download your previously purchased form templates at any time in the My Forms tab.

Are you new to our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Saint Paul Minnesota Articles of Incorporation for Domestic For-Profit Corporation conforms to the regulations of your state and local area.

- Go through the form’s description (if available) to learn who and what the document is good for.

- Restart the search in case the form isn’t suitable for your legal situation.

Now you can create your account. Then select the subscription option and proceed to payment. As soon as the payment is done, download the Saint Paul Minnesota Articles of Incorporation for Domestic For-Profit Corporation in any available file format. You can get back to the website when you need and redownload the document without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about wasting your valuable time researching legal paperwork online for good.