Saint Paul Minnesota Bylaws for Corporation serve as the guiding rules and regulations that govern the operations and management of corporations within the city. These bylaws outline the internal structure, procedures, and responsibilities of a corporation, ensuring smooth functioning and compliance with the law. In Saint Paul, there are several types of bylaws that corporations may adopt, including: 1. General Corporation Bylaws: These are the most common type of bylaws and provide a comprehensive framework for corporation operations. They typically define shareholder rights, board responsibilities, voting procedures, meeting requirements, and procedures for electing officers and directors. 2. Non-profit Corporation Bylaws: These bylaws are specific to nonprofit organizations and address particular issues related to their charitable mission, tax-exempt status, board composition, fundraising, and financial reporting requirements. 3. Close Corporation Bylaws: Close corporations are typically small, privately-held companies with a limited number of shareholders. The bylaws of a close corporation focus on shareholder agreements, restrictions on share transfers, and provisions for resolving shareholder disputes. 4. Professional Corporation Bylaws: Professional corporations are composed of licensed professionals, such as doctors or lawyers. The bylaws for professional corporations typically address specific requirements and regulations mandated by licensing boards or professional associations. 5. Benefit Corporation Bylaws: Benefit corporations, also known as B-corps, are corporate structures designed to prioritize social and environmental goals alongside financial objectives. The bylaws for benefit corporations may include guidelines for pursuing socially responsible activities, reporting on community and environmental impact, and balancing shareholder and stakeholder interests. In Saint Paul, these bylaws must comply with state laws related to corporations, including Minnesota Statutes Chapter 302A. Additionally, they should align with the city's specific regulations and ordinances regarding business operations, taxation, zoning, and employment practices. It is crucial for corporations in Saint Paul to draft comprehensive and well-structured bylaws to ensure legal compliance and effective governance. Seeking legal guidance from a qualified professional familiar with local laws and regulations is highly recommended during the drafting and adoption process.

Saint Paul Minnesota Bylaws for Corporation

Category:

State:

Minnesota

City:

Saint Paul

Control #:

MN-00INCE

Format:

Word;

Rich Text

Instant download

Description

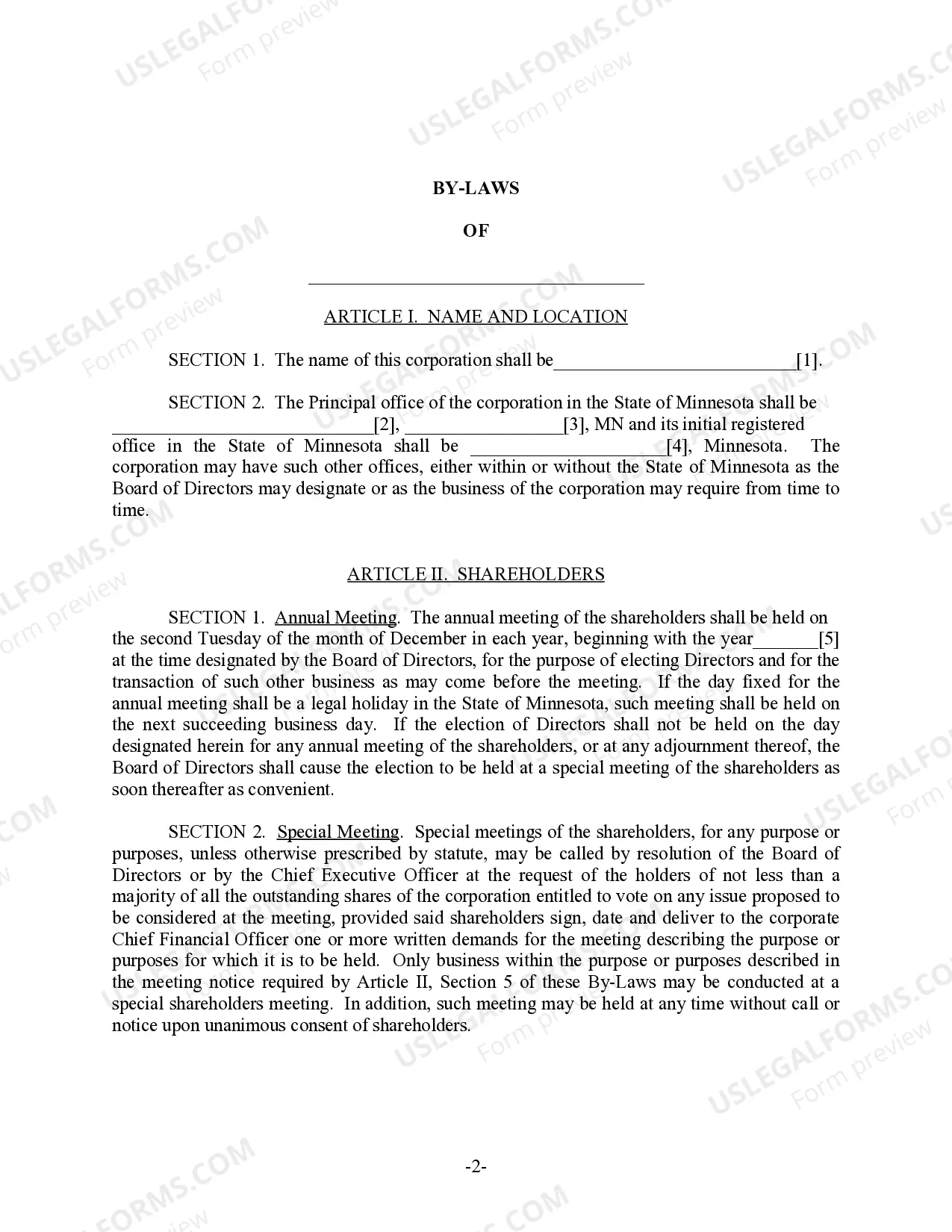

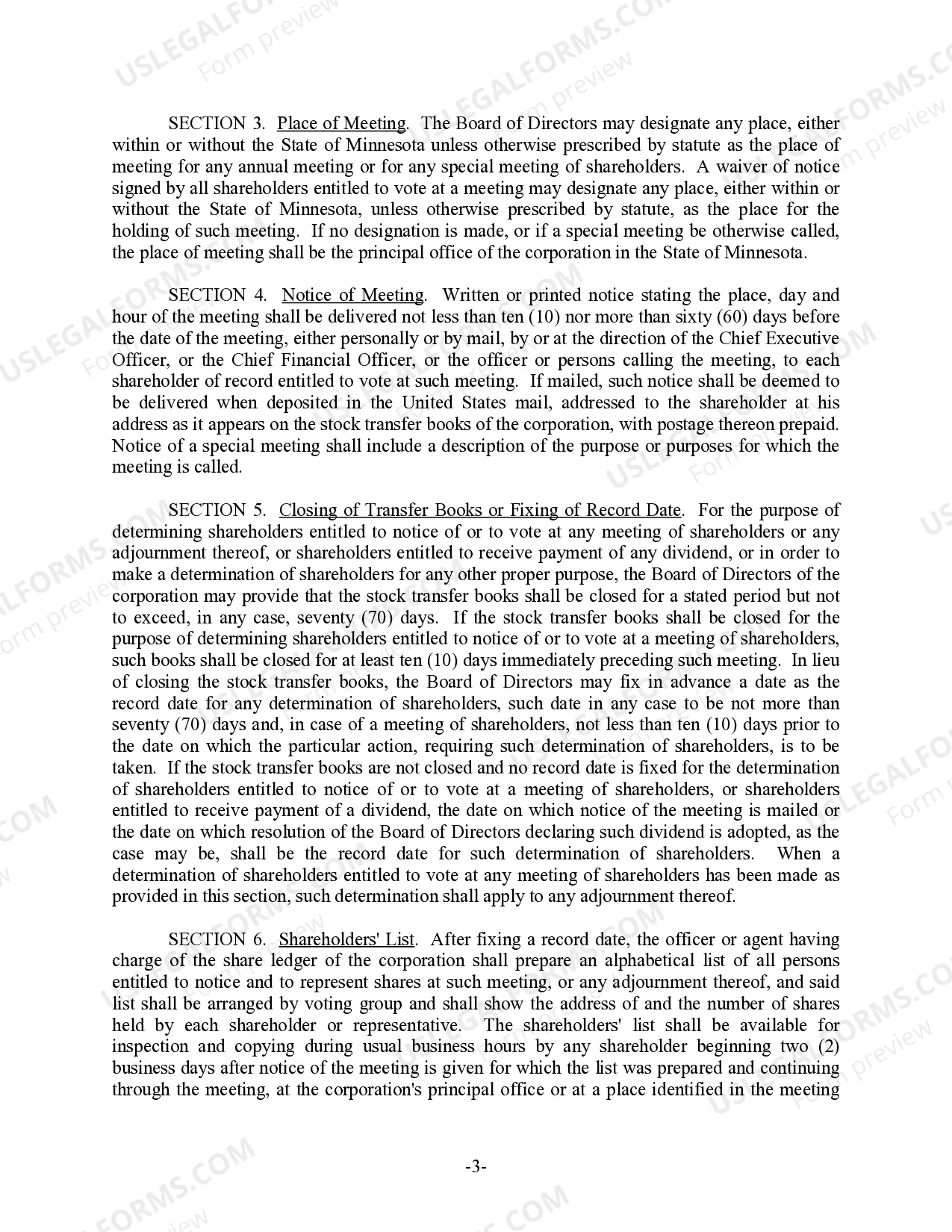

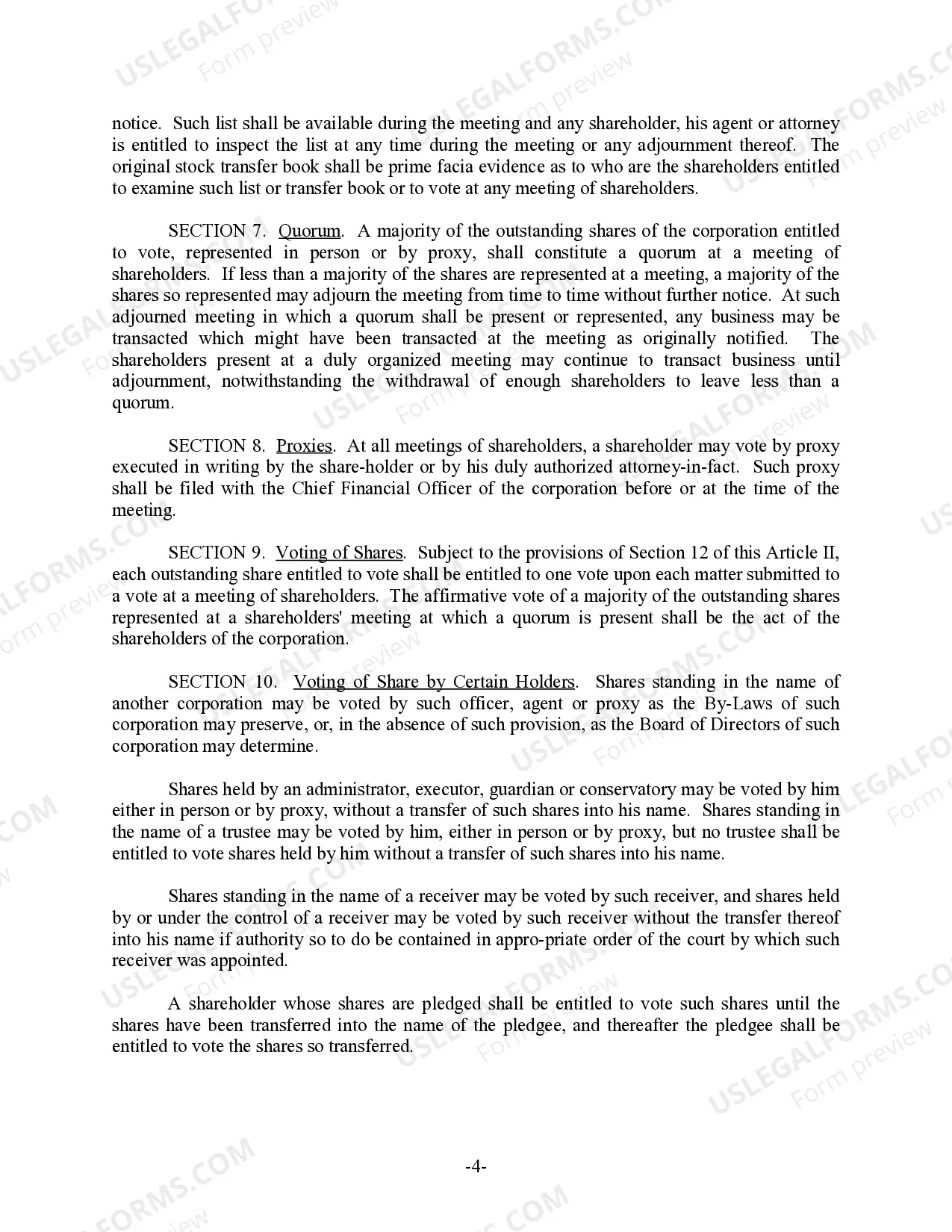

This form is By-Laws for a Business Corporation and contains provisons regarding how the corporation will be operated, as well as provisions governing shareholders meetings, officers, directors, voting of shares, stock records and more. Approximately 9 pages.

Saint Paul Minnesota Bylaws for Corporation serve as the guiding rules and regulations that govern the operations and management of corporations within the city. These bylaws outline the internal structure, procedures, and responsibilities of a corporation, ensuring smooth functioning and compliance with the law. In Saint Paul, there are several types of bylaws that corporations may adopt, including: 1. General Corporation Bylaws: These are the most common type of bylaws and provide a comprehensive framework for corporation operations. They typically define shareholder rights, board responsibilities, voting procedures, meeting requirements, and procedures for electing officers and directors. 2. Non-profit Corporation Bylaws: These bylaws are specific to nonprofit organizations and address particular issues related to their charitable mission, tax-exempt status, board composition, fundraising, and financial reporting requirements. 3. Close Corporation Bylaws: Close corporations are typically small, privately-held companies with a limited number of shareholders. The bylaws of a close corporation focus on shareholder agreements, restrictions on share transfers, and provisions for resolving shareholder disputes. 4. Professional Corporation Bylaws: Professional corporations are composed of licensed professionals, such as doctors or lawyers. The bylaws for professional corporations typically address specific requirements and regulations mandated by licensing boards or professional associations. 5. Benefit Corporation Bylaws: Benefit corporations, also known as B-corps, are corporate structures designed to prioritize social and environmental goals alongside financial objectives. The bylaws for benefit corporations may include guidelines for pursuing socially responsible activities, reporting on community and environmental impact, and balancing shareholder and stakeholder interests. In Saint Paul, these bylaws must comply with state laws related to corporations, including Minnesota Statutes Chapter 302A. Additionally, they should align with the city's specific regulations and ordinances regarding business operations, taxation, zoning, and employment practices. It is crucial for corporations in Saint Paul to draft comprehensive and well-structured bylaws to ensure legal compliance and effective governance. Seeking legal guidance from a qualified professional familiar with local laws and regulations is highly recommended during the drafting and adoption process.

Free preview

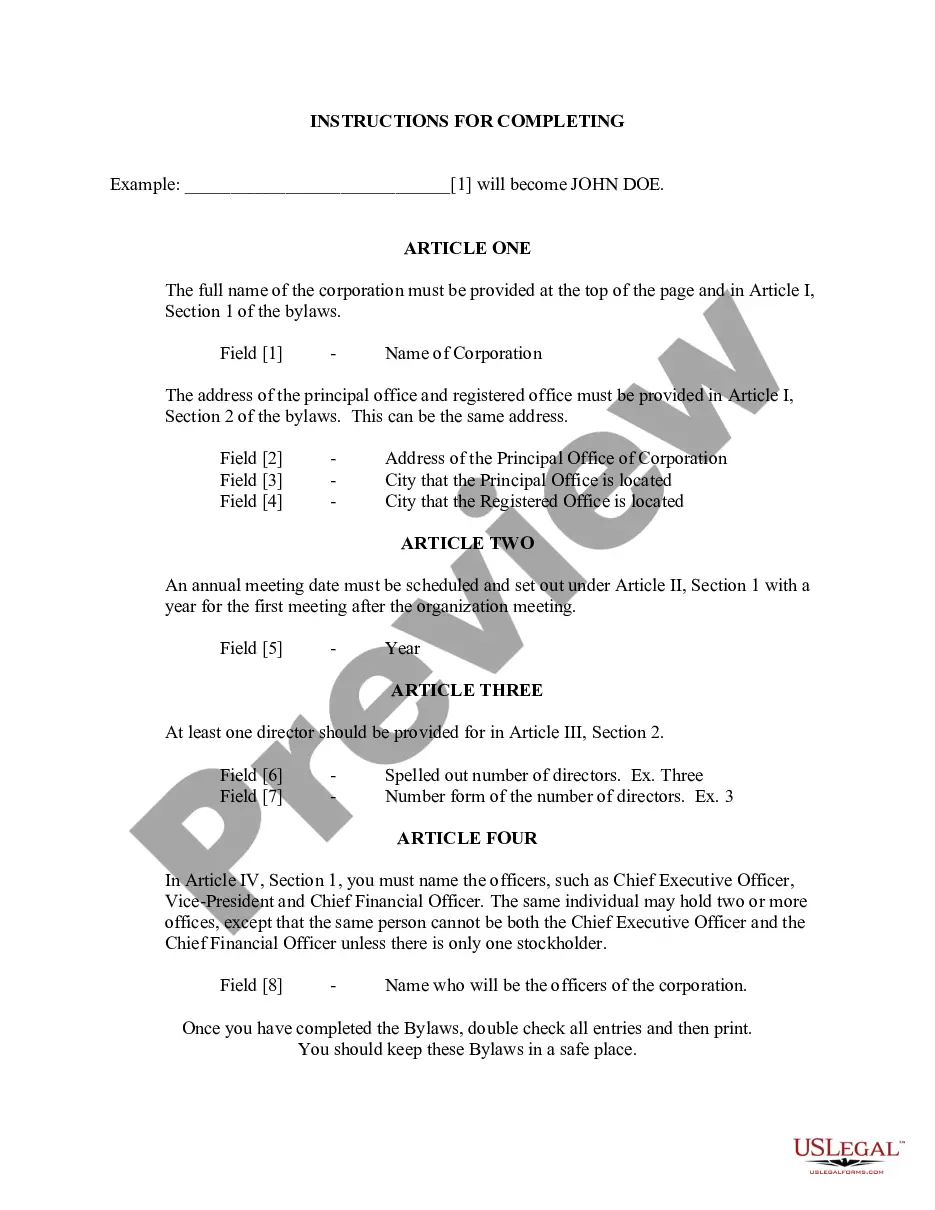

How to fill out Saint Paul Minnesota Bylaws For Corporation?

If you’ve already utilized our service before, log in to your account and download the Saint Paul Minnesota Bylaws for Corporation on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your file:

- Make certain you’ve found an appropriate document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Saint Paul Minnesota Bylaws for Corporation. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!